Discovering the Undiscovered: Hands-On Screening With Morningstar’s Quantitative Ratings

What the Fund Screener tool can do for you.

On the heels of the Morningstar Quantitative Rating’s five-year anniversary, let us take stock of a powerful fund screening tool used to uncover hidden gems. MQR is Morningstar’s quantitative version of the forward-looking Morningstar Analyst Ratings. It mimics the Analyst Ratings process using machine-learning methods, and it also applies Pillar Ratings when available. MQR employs the same tried-and-true three-pillar methodology (Parent, People, and Process) as the analysts do, and both systems assign Overall Ratings (Gold, Silver, Bronze, Neutral, and Negative) using the same framework—assigning a gross-of-fee, forward-looking alpha and then an Overall Rating after ranking each category’s expected alpha, after fees.

The screening tool can be used to identify analyst-rated and quantitatively rated funds; however, for the purpose of this exercise, the focus will be on MQR-rated funds since MQR covers approximately 10 times more funds than the analysts. To explore hidden gems, we narrow our search to smaller funds in less-efficient categories.

To complement the ratings process, last year we introduced MQR Analysis, which adds full-featured fund reports to all MQR-rated, open-end funds. Now, quantitative ratings are supplemented with quantitative reports, offering valuable insights into the ratings process and management of the fund. With MQR’s anniversary upon us, let us dive into the Fund Screener tool and see what we can uncover.

Harnessing the Power of MQR

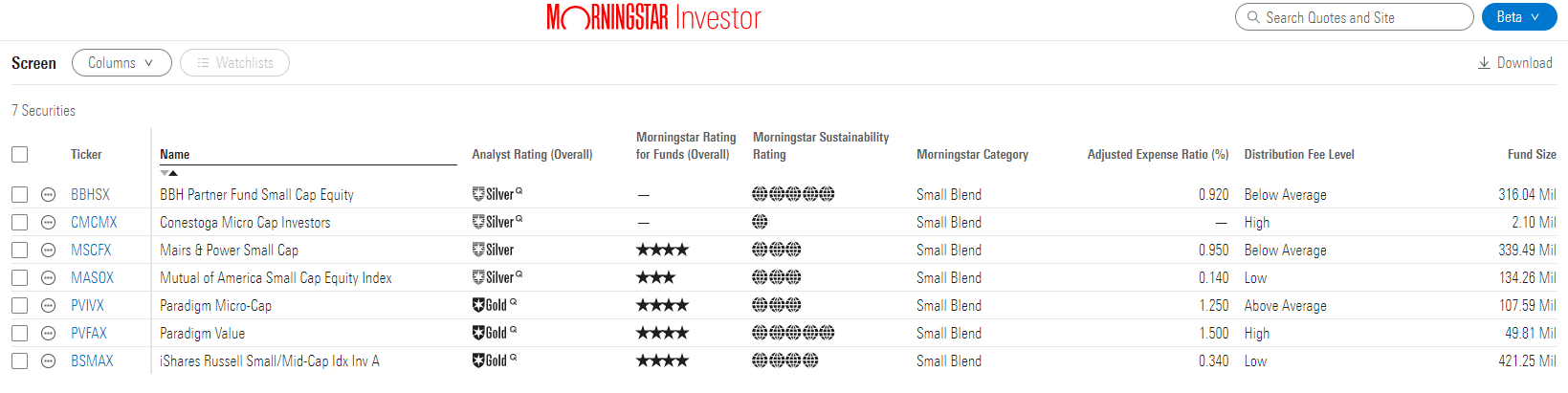

Using Morningstar Investor, click on the upper left-hand menu, and then Screen, under Tools. Morningstar's fund rating process is asset-class-agnostic—pinpointing investors to the very best funds within each category. In the screener, change the Investment Type to Mutual Funds. For this first example, we are looking for a US Equity fund in the Small Blend category, with No Loads, focusing on funds with less than USD 500 million in assets. We check to include MQR-rated funds.

Narrowing our search to only Gold- or Silver-rated funds, we arrive at six MQR-rated funds (as denoted by the superscript Q) and one analyst-rated fund. Although not purely small cap in nature, Gold-rated iShares Russell Small/Mid-Cap Index BSMAX appears to be an ideal cheap, passive option. Note that the Above Average Parent Pillar is covered by Dan Culloton; MQR inherits Analyst Pillar ratings and text when available. On the active front, Silver-rated BBH Partner Fund Small Cap Equity BBHSX sports below-average fees, with USD 350 million in assets. This relative newcomer does not have the necessary three years to support a Morningstar Rating, or "star rating," but the fund's MQR Analysis points to a few key drivers to its Overall Rating.

First, the fund was upgraded to a Silver rating from Bronze. Looking at the People section, the MQR Analysis points to the strength of BBH Partner’s portfolio managers (although the automated report indicates a lack of manager investment as a detractor). The MQR can leverage insights about management teams from Morningstar’s vast database, looking at prior and concurrent track records and experience data of each manager. Finally, David Kathman’s Above Average Parent Pillar rating and analysis further bolster this fund’s investment case.

- source: Morningstar Analysts

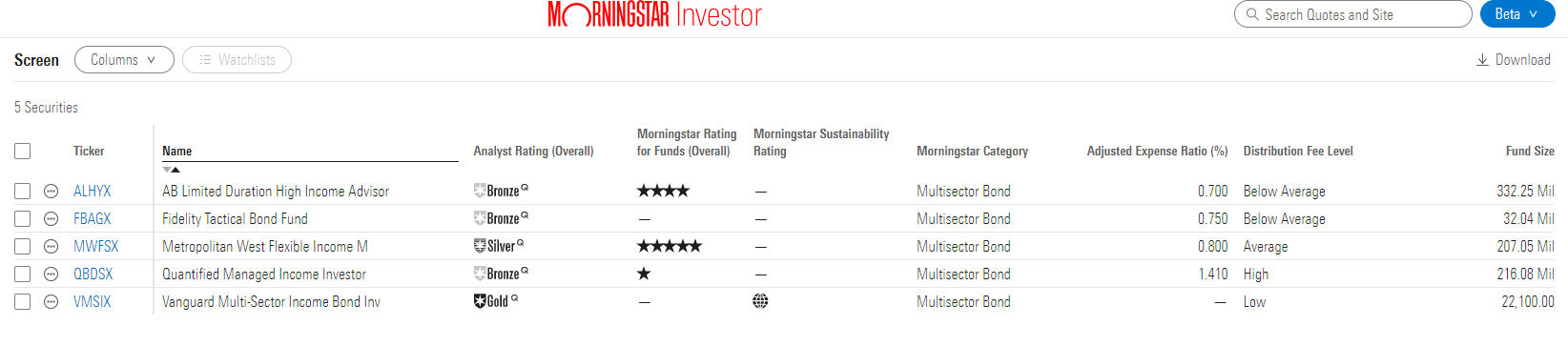

Beyond Equity Analysis

Uncovering hidden gems in the fixed-income world is another strong use case for MQR. This analysis may be especially pertinent given the rising-rate backdrop. Also, fixed income has historically been an area where active management and manager selection can really shine, in part because of more inefficiencies (compared with equities) and sector tilts. Here, we look at the Multisector Bond category in the Taxable Bond asset class. We look at funds with under USD 1 billion in assets and any fund rated Gold, Silver, or Bronze.

While new, Gold-rated Vanguard Multi-Sector Income Bond VMSIX looks promising. The MQR Analysis points out that the team boosts an impressive level of experience and track record—the portfolio managers support an impressive average Morningstar Rating of 4.5 stars. And like many Vanguard funds, low fees are a big plus. Metropolitan West Flexible Income MWFSX is another contender, given its longer track record and USD 200 million in assets. The fund has landed within the top few performance percentiles for its category in 2019 and 2020, and perhaps more impressive, it is down slightly less (0.43%) than the category average for the year to date (through May 2, 2022).

- source: Morningstar Analysts

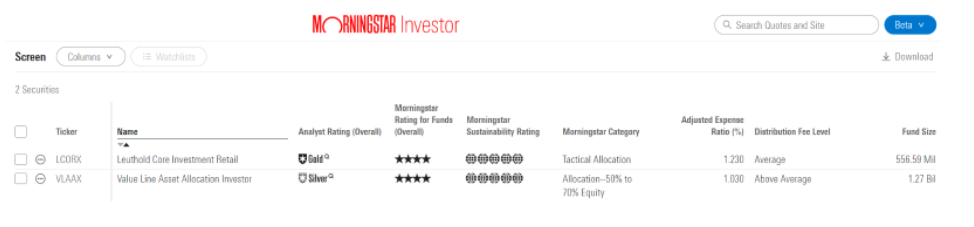

MQR for Niche Searches

For our last example, we combine multiple aspects of the screening tool to showcase its true potential. Looking at every category in the Allocation asset class, we focus our search on funds with less than USD 25 billion, at least a Silver rating, at least 4 stars, and a Morningstar Sustainability Rating of 5 globes.

Gold-rated Leuthold Core Investment LCORX looks appealing. The strategy boasts USD 555 million in assets and has been around since 1995. Notably, its management team is experienced, with at least one manager investing USD 1 million in the fund. Silver-rated Value Asset Allocation VLAAX is another viable option, with a nearly 30-year track record under its belt. Here, all three pillars are covered by MQR, and the Parent section of the report points to the firm’s relatively successful lineup (67% success ratio), but firmwide fees are on the higher end.

- source: Morningstar Analysts

These examples help showcase MQR's prowess as a powerful fund selection tool. In terms of efficacy, the results of MQR look very promising, with Gold-rated funds besting their category averages by a cumulative 0.77% since inception five years ago and Negative-rated funds falling short of their category averages by a cumulative 0.51% since inception.

/s3.amazonaws.com/arc-authors/morningstar/d71f7d0c-3ecd-4473-9a14-3aa8da05a4fc.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d71f7d0c-3ecd-4473-9a14-3aa8da05a4fc.jpg)