The Growth of Managed Products and the Need for Scalable Tools

What’s new, and how Morningstar is pitching into it.

Editor’s Note: A version of this article appeared in May 2022.

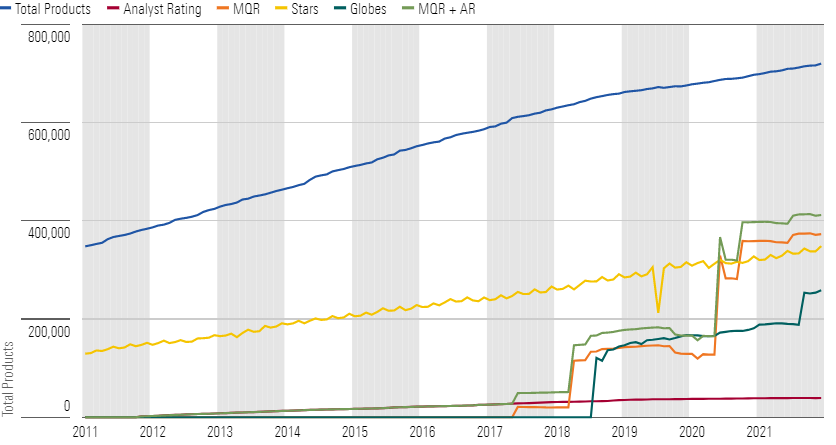

Product innovation in the managed products industry is roaring. Since 2002, more than 3,000 share classes are incepted each month. Product supply continues to expand. Total managed products outstanding crossed 700,000 in 2021. With a 10-year annual growth rate of 11%, the industry is on pace to surpass 1 million products in three years and 2 million products in 10 years.

Growth drivers come from three groups: innovations in distribution, long-term secular trends, and recent disruptions. As a ratings provider, Morningstar has evolved and extended its methodologies to meet these challenges.

Innovations in Distribution: The Types of Vehicles Launched Are Growing

Product innovation is shifting away from traditional open-end fund vehicles. In the clash between open-end funds and exchange-traded funds, new product launches are favoring ETFs. Open-end launches have been relatively flat in the United States over the last five years, but ETFs have more than doubled to 459 in 2021.

In the target-date space, collective investment trusts are becoming the plan sponsor’s preferred vehicle. CITs are on pace to overtake mutual funds by assets under management in the coming years. In 2021, CITs accounted for 86% of target-date strategy net inflows and now make up 45% of total target-date strategy assets, up from 32% five years ago.

Finally, model portfolios are surging in availability. The number of model portfolios reported to Morningstar has more than doubled since 2020, with now more than 2,100 models reported by asset managers and third-party strategists. Allocation models have multiplied so fast they now outnumber allocation mutual funds.

Long-Term Secular Trends: Sustainable Funds

Between fund launches and repurposed funds, a large number of new sustainable funds—those that seek to deliver competitive financial results, while also driving positive environmental, social, and corporate governance outcomes—came to market, and these funds offered greater variety than seen before in terms of their approaches to sustainable investing.

Product development remained strong through 2021, with more than 200 new sustainable fund launches globally each quarter. The number of sustainable open-end and exchange-traded funds available to U.S. investors increased to 534 in 2021, up 36% from 2020. Matching the high set in 2020, 26 existing funds in the U.S. adopted sustainable mandates in 2021. At the end of the year, repurposed funds accounted for 12% of assets in sustainable funds.

Recent Disruptions: Thematic Funds

Investor interest in thematic funds—those that harness secular growth themes such as artificial intelligence—has increased in recent years. In the trailing two years to the end of 2021, assets under management in these funds grew nearly threefold to USD 806 billion worldwide. This represented 2.7% of all assets invested in equity funds globally, up from 0.8% 10 years ago. The number of thematic funds has multiplied: 589 new thematic funds debuted globally in 2021, more than double the previous record of 271 new launches in 2020. Europe is the largest market for thematic funds, accounting for 55% of global thematic fund assets. From digital economy to Generation Z, thematic funds have a wide range and so provide variation in a portfolio. New themes launch each year, or existing themes morph focus. To stay on top of these trends, our research department and ratings need to be nimble.

Evolving Our Ratings

For ratings providers like Morningstar, the three trends create two pressure points: scale and nimbleness. Our challenge is to rate products quickly to keep up with the pace of the industry’s growth, ensure breadth of coverage, and maintain the ability to rate products with more-varied anatomies.

Scalable Ratings Approaches Needed to Keep Pace

Morningstar’s forward-looking ratings have expanded to meet the need. Over the past five years, their coverage has grown 63% annually. Today, 57% of total products outstanding receive a forward-looking rating, which represents 89% of AUM.

With the consolidation of our forward-looking ratings systems, the Morningstar Analyst Rating and the Morningstar Quantitative Rating, into the Morningstar Medalist Rating in 2023, Morningstar now provides a forward-looking assessment on every fund in our coverage universe after one month of history. Investors don’t have to wait for a fund to rack up a three-year track record to earn a star rating or accumulate enough assets to warrant attention. Morningstar provides an objective measure almost immediately upon fund launch. The Medalist Rating now surpasses the coverage of the past-performance-based, quantitatively derived Morningstar Rating for funds—the star rating.

There is a gap to close in terms of total products with forward-looking ratings, and Morningstar is prioritizing the remaining markets for coverage.

- Source: Morningstar Analysts

Nimbleness: Algorithms Complement the Analyst Process

Morningstar uses algorithms and humans where they add the most value—in line with behavioral research on humans and algorithms. All of our forward-looking ratings will be a hybrid of human and machine to produce the best ratings possible.

Morningstar’s Medalist Rating system is built to learn how analysts rate their funds. In many cases, the algorithm does not have to learn or think—it is told the answer. The system leverages what our analysts know and applies their decisions to uncovered products through extensive mapping logic. For example, if our manager research team has a view about a firm’s Parent Pillar, it is extended to all products at that firm. Our system applies similar mappings through information about management teams, strategy mappings, or passive benchmarks. An analyst covering one fund does not make an isolated decision; their People, Process, and Parent assessments are leveraged and extended to cover a larger universe.

As a result, we can deploy analysts to cover funds with the largest impact where they can add the most value—and leave the algorithm to cover the rest.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/6f447f02-a11d-4e4f-90b0-42fa39383198.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6f447f02-a11d-4e4f-90b0-42fa39383198.jpg)