11 Newly Undervalued Wide-Moat Stocks

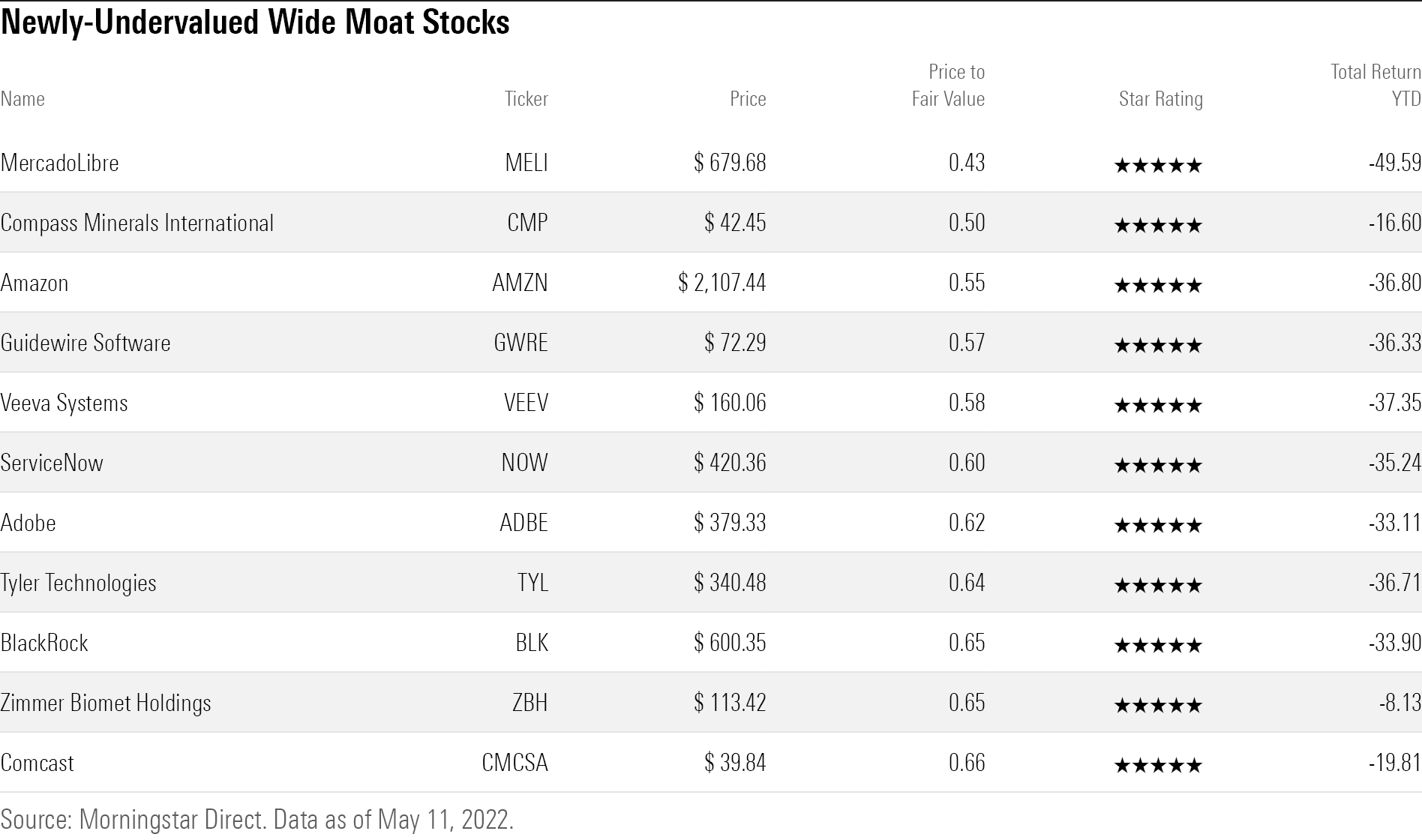

High-quality stocks, including Amazon, BlackRock, and Comcast, are now trading at steep discounts.

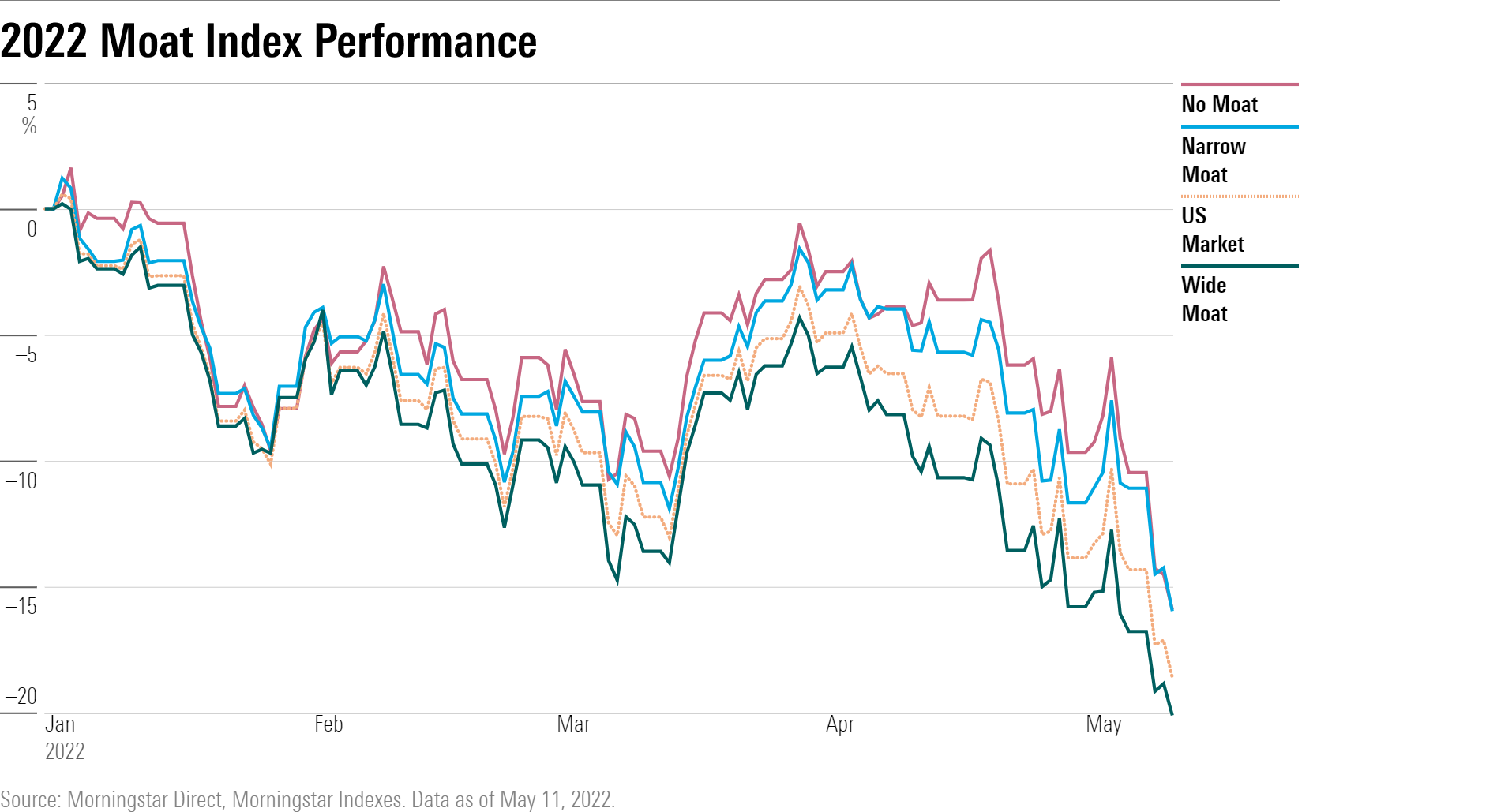

When stocks hit a downdraft like the current one, the highest quality stocks are often a safe haven for investors. Not this time. In fact, companies with some of the strongest competitive advantages are getting hit much harder than the overall market.

Big share price declines are creating opportunities for long-term investors to scoop up high-quality stocks at low prices. That list of undervalued names includes Comcast CMCSA, Amazon.com AMZN, Adobe ADBE, and BlackRock BLK.

These are companies that earn wide Morningstar Economic Moat Ratings, meaning they have strong competitive advantages that should help them outperform their peers over the next 20-plus years. Less than one fourth of all stocks covered by Morningstar are considered wide moat.

As a group, wide-moat stocks have outperformed stocks without economic moats in four of the past five calendar years. Especially in periods of a market downturn, wide-moat investing strategies tend to hold up better than the market.

This year, wide-moat stocks are taking it on the chin, with many having finished 2021 at lofty valuations. The Morningstar Wide Moat Composite Index (a collection of all the wide-moat companies in the Morningstar US Market Index) has lost 20%, while the narrow-moat and no-moat indexes each fell 15.9%.

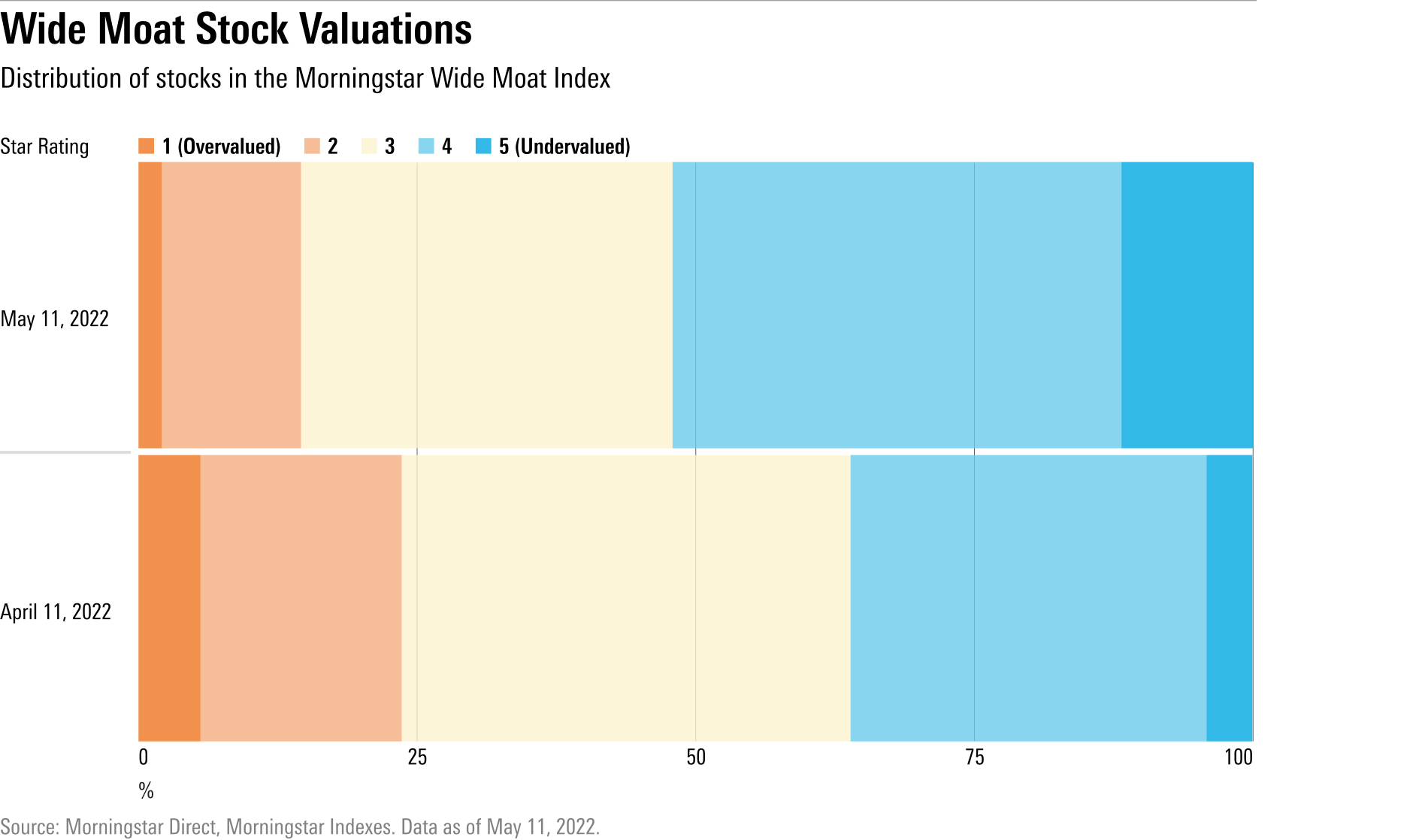

On the bright side, companies with Morningstar Ratings of 5 stars—stocks trading at the steepest discount to their analyst-assessed fair market value—that also carry wide moat ratings are popping up in droves. Seventeen companies in the wide-moat index are currently trading at 5-star prices: That’s 12% of the index. On average, just 1% of the companies in the index were ever rated as a 5-star stock in the last five years.

Steep losses for high-quality companies have pushed the index closer to undervalued territory. Eighty percent of the newly minted 5-star stocks in the Morningstar Wide Moat Composite Index have lost more in 2022 than any other calendar year over the past decade. MercadoLibre MELI and Compass Minerals CMP are now more undervalued than they’ve been at any point in the past five years.

We screened the Morningstar Wide Moat Composite Index for a list of high-quality companies that moved newly into 5-star range over the past month. Here are the 11 stocks now trading well below their fair value estimates:

Adobe ADBE

“For Adobe overall we assign a wide moat, arising from switching costs and network effects. Based on the company's segments, we believe digital media has a wide moat from switching costs and network effects, digital experience has a narrow moat arising from switching costs, and publishing has a narrow moat from switching costs.

"Digital media represents approximately 70% to 75% of revenue. This segment contains Creative Cloud, which is nearly 50% of revenue, and Document Cloud, which is approximately 10% of revenue. While both product groups generate strong revenue growth, growth in Creative Cloud is materially higher. Creative Cloud is composed of the iconic products Photoshop, Premiere, Illustrator, InDesign, After Effects, Fireworks, XD, and Dreamweaver, among others, and a variety of mobile versions of these products and additional discrete mobile solutions. Document Cloud consists of the Acrobat family of products, including Scan and Sign."

—Dan Romanoff, senior equity analyst

Comcast

"We believe Comcast possesses a wide moat, resulting from the strength of its core cable business. The majority of U.S. homes today can receive fixed-line internet access service from only two providers: traditional cable or phone companies. Across nearly half of the United States, that cable company is Comcast. The cost to enter this market is enormous. While technological developments have made it possible to build more efficient and reliable networks than legacy providers possess, deploying these technologies still requires heavy construction spending, while also overcoming the regulatory hurdles that municipalities often impose. Assuming successful network construction, entrants then face steep customer acquisition costs and startup losses as they attempt to gain share, typically with a modestly differentiated product in a rapidly maturing market. Several firms have attempted to enter the fixed-line market over the years, but failures far outnumber successes. Most notably, Alphabet (GOOGL) sharply curtailed its Google Fiber plans in 2016 after six years of effort ended with likely less than 1% of the U.S. connected, despite the firm's deep pockets.”

—Michael Hodel, director of equity research, media and telecom

Compass Minerals International CMP

“We think Compass possesses a wide economic moat. It holds unique assets with geological advantages that are nearly impossible to replicate, which gives the firm a maintainable cost advantage over other producers of both salt and sulfate of potash.

"The company's rock salt mine in Goderich, Ontario, is the world's largest active salt mine. At Goderich, Compass mines deposits that are 100 feet thick, compared with many competing mines whose seams are only 20 to 30 feet thick. This allows Compass to use more efficient mining techniques and remove more salt for each foot advanced in the mine.

"Further, Goderich is located on a deep-water port on Lake Huron, giving Compass easy water-based access to the snowy markets near the Great Lakes. Because of its low value/weight ratio, salt can only be shipped economically by land over very short distances—roughly 150 miles. In its regions, Compass estimates that shipping by water is about half the cost of rail and one fifth the cost of trucking, leading to a shipping cost advantage for wintry markets from Minnesota to western New York.”

—Seth Goldstein, senior equity analyst

Guidewire Software GWRE

“Our wide moat rating for Guidewire Software is driven by higher customer switching costs and, to a lesser extent, intangible assets. Our position is that switching costs for software are driven by several factors. The most obvious would be the direct time and expense of implementing a new software platform. Additionally, there are indirect costs along those same lines, mainly lost productivity as employees move up a learning curve on the new system and the distraction of employees involved with the function where the change is occurring. Perhaps most important, there is operational risk, including loss of data during the changeover, project execution, and potential business disruption. The more critical the function and the more touch points across an organization a software vendor has, the higher the switching costs will be.

"Given that Guidewire provides core systems that enable policy production, billings management, and claims processing, coupled with a lower-than-average risk tolerance among insurers and the typically long-tail investment in core software systems, we believe excess returns are more likely than not to remain for at least 20 years. Critically, software companies tend to have low capital intensity and generate high free cash flow margins, which supports our contention for excess returns over a prolonged period. Further, high perceived friction from changing core systems is not just a theory, it is reality, as Guidewire has not lost a customer to a competitor since it was founded in 2003. The company enjoys the highest retention in the entire software industry.”

—Dan Romanoff, senior equity analyst

MercadoLibre

“In our view, MercadoLibre has built a wide economic moat around its Latin American e-commerce ecosystem (implying excess returns over 20 years), benefiting from a quickly growing network of buyers and sellers on its platform, privileged access to consumer transaction data, and switching costs as sellers and buyers increasingly depend on the firm’s broadening suite of services (including the core marketplace, shipping solutions, classified ads, mobile payments, and digital advertisements). Our average goodwill-adjusted ROIC forecast of 43% through 2031 embodies this view, handily outpacing our weighted average cost of capital estimate of 12.8% for the firm.

"We view a network effect as MercadoLibre’s principal moat source, and the key advantage underpinning its commerce segment (representing roughly 72% of 2021 consolidated revenue). In our view, the platform grows stronger as new users are onboarded to both sides of the marketplace, with sellers benefiting from quicker inventory turnover and access to a larger pool of potential customers, while buyers benefit from better search engine optimization, breadth of selection, and lower shipping costs. Consequently, more buyers on the platform encourages further seller participation, while a deeper pool of sellers adds stock-keeping units, lowers search costs for customers, and entices more buyers to join the platform in a positive feedback loop.”

—Sean Dunlop, equity analyst

ServiceNow NOW

“We assign a wide moat rating to ServiceNow, driven by high customer switching costs. Our position is that switching costs for software are driven by several factors. The most obvious of these would be the direct time and expense of implementing a new software platform. Additionally, there are indirect costs along those same lines, mainly lost productivity as employees move up a learning curve on the new system, and the distraction of employees involved in the function where the change is occurring. Lastly, and perhaps most importantly, there is the operational risk, including loss of data during the changeover, project execution, and potential business disruption. The more critical the function and the more touch points across an organization a software vendor has, the higher the switching costs will be.

"While ServiceNow positions itself as a workflow solution, it is more easily understood as a provider of software for information technology service management and information technology operations management. That said, the workflow element of ITSM has been critical in driving adoption for use cases outside of the IT function. The broad appeal of automating processes across the enterprise has opened up a larger array of use cases for the company’s solutions. These factors have allowed ServiceNow to initially bore deeply into the IT function and then to expand to other non-IT functions. Both of these sales dynamics have allowed ServiceNow to become deeply entrenched in an organization across a variety of critical functions. Since the software sales process across the enterprise will regularly touch the IT department, ServiceNow adopted a stance early on that it would let the internal IT function sell the platform to other areas of the customer. This process has clearly been successful.”

—Dan Romanoff, senior equity analyst

T. Rowe Price TROW

“In our view, the asset-management business can be conducive to economic moats, with switching costs and intangible assets the most durable sources of competitive advantage for firms operating in the industry. Although the switching costs might not be explicitly large, inertia and the uncertainty of achieving better results by moving from one asset manager to another tend to keep many investors invested with the same funds for extended periods of time. As a result, money that flows into asset-management firms tends to stay there. For the industry as a whole, the average narrow redemption (retention) rate, which does not include exchange redemptions, has been 25% or less (75% or greater) annually during the past five-, 10-, 15-, 20-, 25-, and 30-year time frames. Including exchange redemptions, the rate has been less than 30% (greater than 70%).

"Because T. Rowe Price does not break out its net flows (which are gross sales less investor redemptions) we assume that, based on its historical record of positive organic growth, the company's average annual redemption rate has been at its worst no worse than the industrywide rate, especially given the tailwinds that have been provided at times by defined contribution plans the past couple of decades—noting that redemptions have outpaced inflows into 401(k) plans since the baby boomer retirement phase started in 2011. During the past five (10) calendar years, T. Rowe Price's organic growth rate has averaged 0.6% (0.4%) with a standard deviation of 1.5% (1.7%), which meant that the firm was in most years compensating for investor redemptions with new flows into its products.”

—Greggory Warren, equity sector strategist

Veeva Systems VEEV

“We assign a wide moat rating to Veeva, stemming from switching costs and to a lesser extent intangible assets. The company provides mission-critical software for the life sciences industry. The high degree of specification behind Veeva’s software is an asset to its clients (in improving workflow and ease of adherence to regulations) and Veeva itself (clients have their complex workflow entrenched in its software). Once integrated into a company’s operating activities, the direct time and expense of switching to a competing software solution is high and comes with substantial operating risks. The downside operational risk of switching is expansive and could result in loss of data in the migration process, temporary disruption to sales activities, or even ultimately delay product launches and put the company at risk of exposure to unnecessary regulatory risk.”

—Dylan Finley, equity analyst

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)