These 4 Fund Managers Are Rising Stars

See what sets these fund managers apart.

A version of this article was published in the May 2022 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

Stock investors keep watch lists of names they might like to own only if there were a change to something like price, management, or maybe industry tailwinds. It’s not a bad idea for fund investors to do the same with promising funds they might own. Maybe you are waiting for the fees to come down or the manager to build a track record. Or you're waiting for something to go south at a comparable fund you own that will spur you to replace the fund.

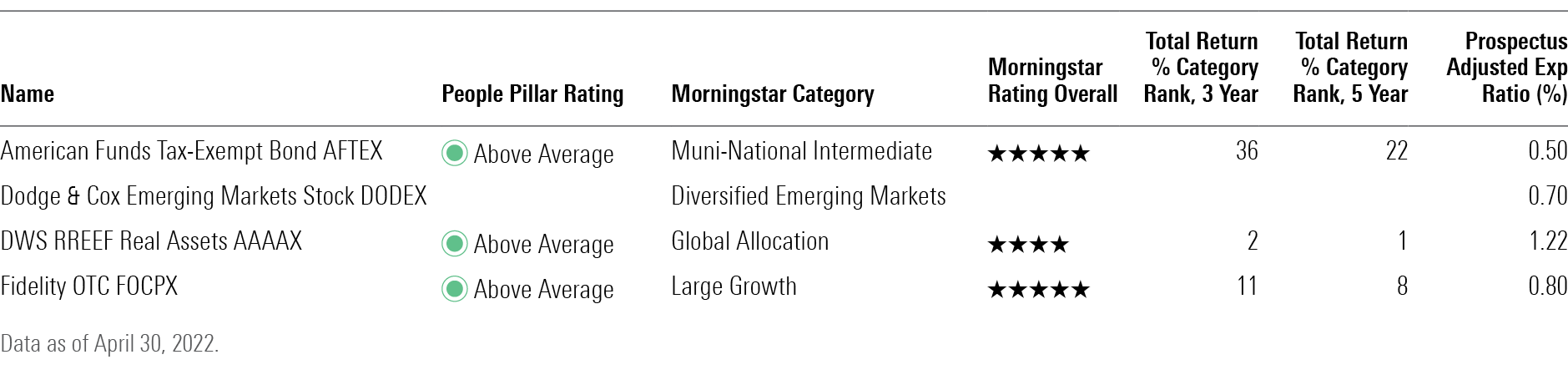

Chris Lin of Fidelity OTC FOCPX has done a fine job in four years at the fund. He joined Fidelity in 2003 and ran two tech funds from 2009 to 2018. He employs a classic bottom-up growth approach and limits his individual stock bets versus the Nasdaq to 4 percentage points. Running a $24 billion growth fund is certainly a challenge, but he’s impressed so far. The fund, which has a Morningstar Analyst Rating of Bronze, has outpaced the large-growth Morningstar Category since Lin was named manager in 2017.

Courtney Wolf was named a manager at American Funds Tax-Exempt Bond AFTEX in 2020, working alongside Karl Zeile and Chad Rach. We rate its People and Process Pillars at Above Average, giving the fund a range of Silver to Neutral overall ratings, depending upon fees. She served as research director from 2018 to 2020 and has 16 years overall experience with Capital Group. She maintains a foot in the analyst side by covering a few sectors. The fund has beaten its average peer in seven of the past eight years. It has also modestly outperformed the category benchmark over her short tenure. Wolf was also named a manager at American High-Income Municipal Bond AMHIX in October 2021.

Evan Rudy is the lead manager of DWS RREEF Real Assets AAAAX. He’s been with DWS since 2007 and a manager since 2016. Rudy pulls together work from multiple teams across DWS to arrive at the fund’s asset-class positioning. The team at DWS makes aggressive moves at times, such as a big equity overweighting in March 2021. We rate the fund Above Average for People and Process and a Bronze or Neutral rating overall, depending on the cost of the share class. The fund’s 10.1% annualized five-year returns were well ahead of peers and benchmark for the period ended April 2022.

Dodge & Cox isn’t normally associated with quantitative work, but quant analysis can serve fundamental strategies just as well as tactical trading strategies. Robert Turley, who holds a doctorate in business economics, has had a big impact on the firm’s quantitative and risk management work. He’s one of six named managers on Dodge & Cox Emerging Markets Stock DODEX. This fund has made quantitative research more central to the process than it is at other funds. We don’t rate the fund yet, but we are keeping an eye on it. The fund was launched in 2021. Its already low fees and Dodge & Cox’s team make it an intriguing fund.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)