When Momentum Fails

The momentum factor has been a pretty unstoppable force, but nothing lasts forever.

Momentum—which measures the tendency of stocks with strong performance over the past 12 months to continue outperforming[1]—has been one of the most persistent forces in investing. Academic research has found that it often leads to above-average returns. Further, stocks with weaker returns over the past year tend to continue falling behind. This type of thing should not happen in an efficient market; as a result, famed academics Eugene Fama and Kenneth French have described momentum as the premier market anomaly.[2]

Investors who latched onto momentum-oriented stocks have often been richly rewarded. But the momentum factor has shown signs of faltering over the past few months, and it has had some jarring drawdowns in the past. The key lesson: Handle the power of momentum with care.

An Unstoppable Force?

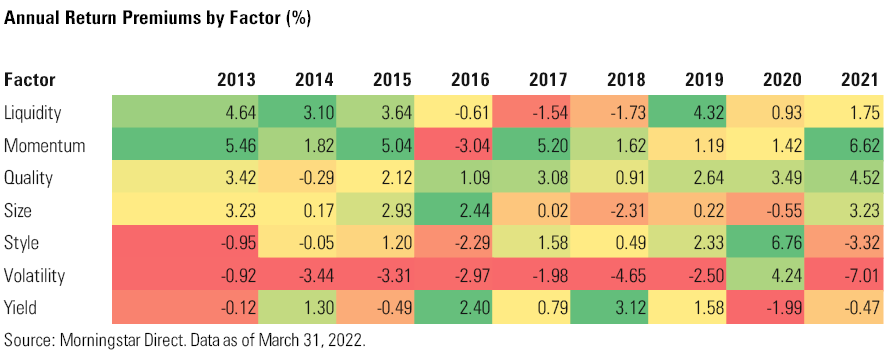

As shown in the table below, momentum has been one of the best-performing market factors over the past 10 years, delivering a return advantage in seven of the past 10 calendar years. Momentum stocks dropped slightly less than the overall market in the coronavirus-driven downturn in early 2020, followed by a strong rebound as the market recovered. Momentum generated an even more robust return premium in 2021’s bullish market.

These results reflect the long string of double-digit returns for momentum-oriented stocks such as Tesla TSLA, Microsoft MSFT, and Nvidia NVDA. In addition, the momentum factor overlaps somewhat with the growth investment style, which enjoyed a long-running winning streak until the recent market rout. Most major momentum indexes are also moderately overweight in technology stocks, which helped shore up performance during the market correction in early 2020.

These strong performance trends have led to rich rewards for momentum investors. Over the nearly 20-year period from January 2003 through March 31, 2022, momentum stocks have enjoyed a significant return advantage—better than any other factor in Morningstar's standard factor model. Low-volatility stocks, which in some ways can be considered the opposite of momentum plays, showed the opposite performance trend with lagging returns. Value stocks, which have been widely studied as another investment factor that can lead to above-average long-term returns, also fell behind, albeit by a smaller amount.

Just as in physics (where a body in motion tends to stay in motion), momentum builds on itself. Stocks with robust returns over the past 12 months often go from strength to strength. It’s not obvious why this is the case, though. The strength of the momentum factor probably partly reflects herding behavior: Investors tend to pile into stocks that have posted high returns in the recent past. It could also reflect the market’s tendency to underreact to new information or reluctance to sell stocks at a loss.

When Momentum Screeches to a Halt

Unlike the laws of physics, though, investment momentum is not a completely unstoppable force. The war in Ukraine, stubbornly high inflation, market expectations for continued interest-rate hikes, and worries about a potential recession have all weighed on the market in recent months. As a result, the momentum factor lagged the broader market by about 5 percentage points for the year-to-date period through April 30, 2022. Leading momentum funds such as iShares MSCI USA Momentum Factor MTUM have shed about 18% of their value over the same period.

Actively managed funds with heavy exposure to momentum stocks have fared even worse. ARK Innovation ETF ARKK, which previously had one of the most extreme momentum profiles of any domestic-equity fund, has shed more than half of its value for the year to date through May 6, 2022. Other high-profile momentum funds such as Morgan Stanley Institutional Discovery MPEGX and Zevenbergen Growth Investor ZVNBX have also posted painful losses.

This saga highlights another danger of high-momentum stocks: The roster of stocks with the highest momentum is constantly changing. During periods of market decline, previously high-flying momentum issues can quickly screech to a halt. Former market darlings like Moderna MRNA, Nvidia, and Intuit INTU have dropped sharply so far this year.

Despite its overall strength, the momentum factor has also suffered in some previous periods. It held up relatively well during the 2008 bear market but went on to lag by about 17 percentage points in 2009. It also fell behind (albeit by smaller margins) in 2000, 2001, and 2016. These were all periods when growth stocks were out of favor, which also probably explains part of the momentum crunch so far in 2022.

Conclusion

The most important lesson from momentum’s reversal: Nothing lasts forever. Momentum is a powerful force, but so is reversion to the mean. That means investors who want to bet on momentum should do so carefully and remember that it’s not a guaranteed route to success.

[1] Most researchers and index providers exclude the most recent month from momentum calculations because of another market anomaly (the reversal effect).

[2] Fama, E.F., & French, K.R. 2008. "Dissecting Anomalies." J. Finance, Vol. 63, P. 1653 https://doi.org/10.1111/j.1540-6261.2008.01371.x

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)