Why Sustainable Investors Should Stay the Course

Your portfolio may be struggling now, but it’s still helping generate positive ESG outcomes.

In late February I wrote that a long-term commitment to sustainability can help investors weather short-term market turmoil. Two months later, as we near bear-market territory, that message bears repeating.

At the end of April, the S&P 500 was down more than 13% for the year. Large-cap growth stocks had declined 29%. With many sustainable equity funds tilted in that stylistic direction, sustainable fund investors are bearing the brunt of this downturn. And because so many have only recently invested in sustainable funds, this is their first encounter with poor performance.

As a sustainable investor, what should you do now? Stay focused on why you are a sustainable investor. Your investments reflect a commitment to seek both competitive long-term returns and positive environmental, social, and corporate governance outcomes. Assuming you have a diversified portfolio designed to meet your long-term financial needs, you should remain invested for that reason alone. Trying to time the market is a crapshoot.

Meanwhile, take note of the fact that sustainable investors continue to successfully engage with companies on improving their sustainability performance and to support ESG-related shareholder questions at company meetings. Significant outcomes on climate-risk disclosure, racial audits, and plastics and packaging have occurred already in this year’s proxy season, for example. Whether directly pressured by investors or not, more and more public companies are embracing the idea of improving their ESG performance, if not the bigger idea of moving toward a business model that focuses on creating value for all stakeholders. This trend will continue despite current market conditions. Your investment returns may be struggling today, but your portfolio is still helping create positive ESG outcomes.

Keep this in mind, too: While sustainable investing includes a range of specific approaches, no sustainable fund is going to outperform all the time. The long-term thesis remains that, on balance, companies that embed sustainability into their operations, human capital, and governance will prosper more than those that don’t as we move through the first half of the century. So will companies that create actual products and services that are aligned with the transition to a more-sustainable low-carbon economy.

That’s a thesis—not a guarantee of superior investment performance. Some companies will prosper despite being ESG laggards or offering unsustainable products. And for investors, valuations come into play. A sustainable fund that buys a stock when it’s undervalued and sells before it gets too pricey will outperform one that pays no attention to valuations and focuses only on holding ESG leaders or the producers of sustainable products.

In the end, if you have a well-diversified portfolio, sustainable or not, and stay the course in difficult markets, it’s likely to generate competitive long-term returns for you. But having that additional sustainability connection with your portfolio should give you even more confidence to stay the course.

As Morningstar’s Don Phillips wrote recently, by forging that connection, sustainable investing is performing a “valuable social good—helping improve the long-term finances of a new generation of investors by not forcing a divide between their financial and social or environmental goals.”

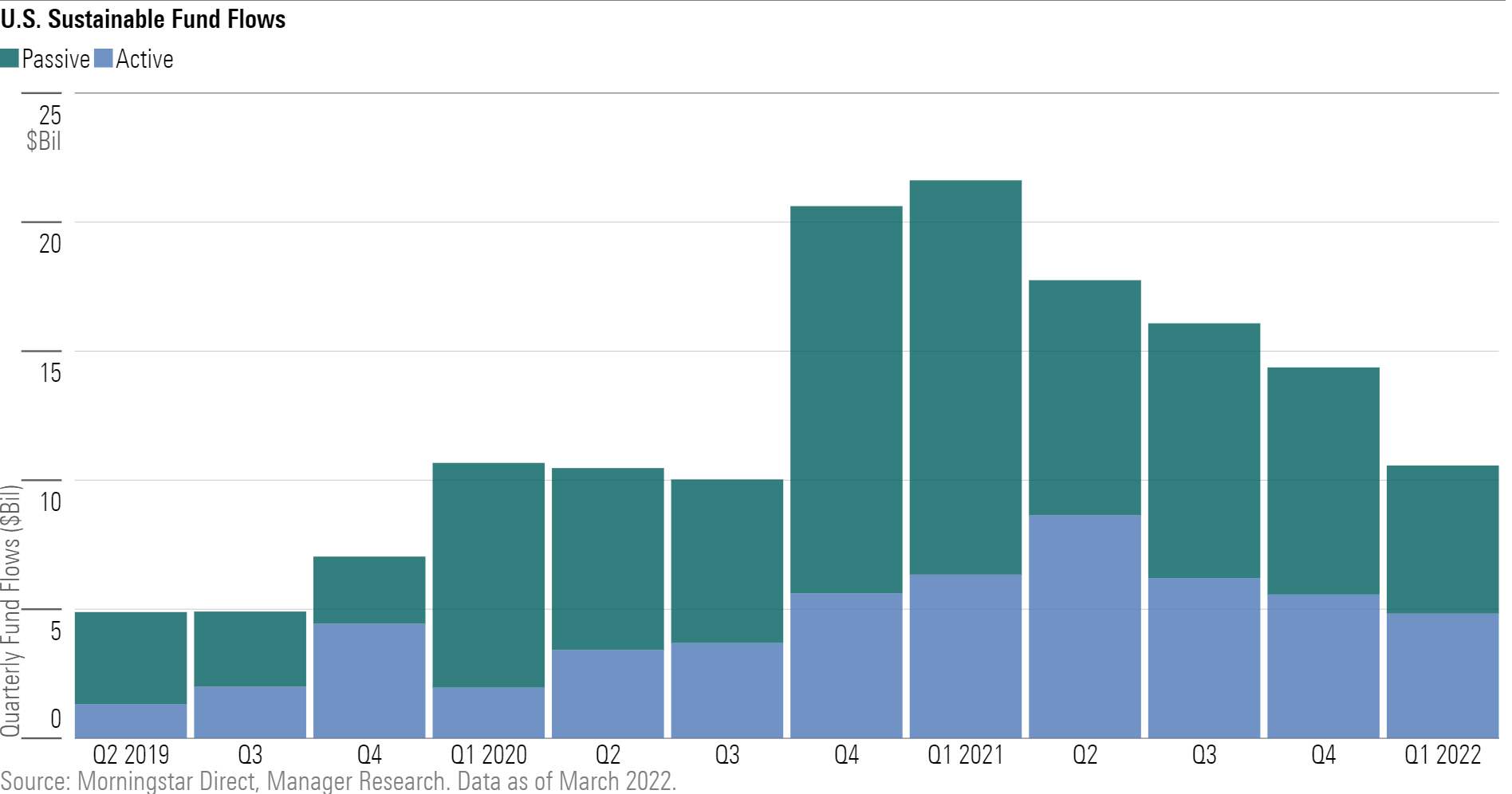

Fund Flows Suggest Sustainable Investors Stayed the Course During the First Quarter

Are sustainable investors staying the course? The macro-level answer appears to be yes, based on our fund-flows data. For the ninth consecutive quarter, U.S. sustainable fund flows topped $10 billion in 2022′s first quarter. While that was a 26% decline compared with the fourth quarter of 2021, flows into the overall U.S. funds market dipped by 65%. Total assets in sustainable funds declined 4% in the first quarter, but total assets in the overall U.S. funds market dropped 6%. Sustainable funds thus showed greater resilience compared with the overall U.S funds market.

Investors Continue to Vote in Favor of ESG-Related Questions at Company Meetings

Here are some of the successes sustainable investors have achieved so far in this year’s proxy season:

- At Jack in the Box JACK, 95% of shares were voted against management in favor of the company accelerating its move to sustainable packaging.

- At Costco COST, 70% of shares were voted against management in favor of asking the company to disclose short-, medium-, and long-term plans for reducing emissions across its entire value chain.

- At Disney DIS, 59% of shares were voted to request a report on racial and gender pay gaps.

- At Apple AAPL, a majority of shares were voted to request a third-party audit of the firm’s civil rights impact.

- At Microsoft MSFT, nearly 80% of shares were voted in favor of a review of the firm’s sexual harassment policies.

- At Berkshire Hathaway BRK.A, where management owns most of the shares, three shareholder proposals were favored by nearly half of independent shares voted at the company’s annual meeting last week—two of them climate-related and one about diversity, equity, and inclusion.

For more on this year’s proxy season, see Leslie Norton’s interview with the stewardship director of Sustainalytics (a Morningstar Company), Jackie Cook.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)