Risk-Management Concerns Ding These Two Equity Strategies

Highlights of the downgrades, upgrades, and strategies new to coverage.

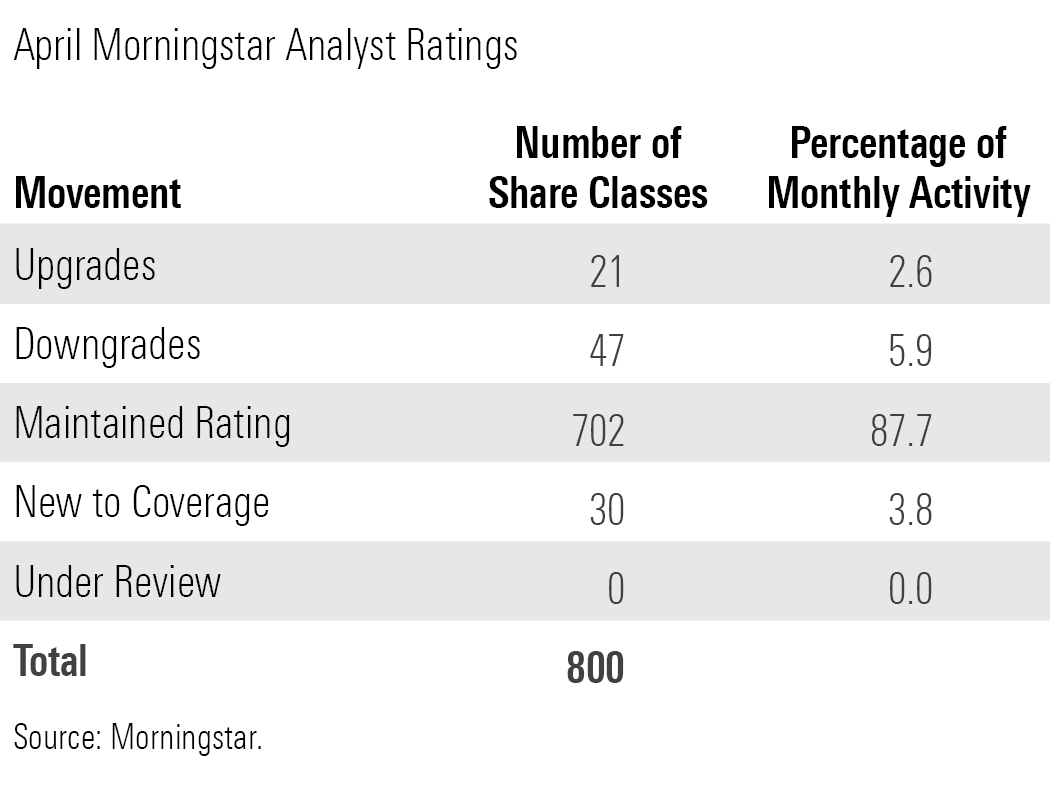

Morningstar updated the Analyst Ratings for 800 fund share classes, exchange-traded funds, separately managed accounts, collective investment trusts, and model portfolios in April 2022. Of these, 702 maintained their prior rating, 47 were downgraded, 21 were upgraded, and 30 were new to coverage.

Looking through share classes and vehicles to underlying strategies, Morningstar issued 180 Analyst Ratings during April. Of these, three were new to coverage, and the remainder had at least one investment vehicle that had been previously covered by a Morningstar analyst.

Below are some of the highlights of the downgrades, upgrades, and strategies new to coverage.

Upgrades

John Dance's sensible, growth-oriented investment approach at Fidelity Emerging Markets FKEMX earned a Process rating upgrade to Above Average from Average, and most of the share classes now receive Morningstar Analyst Ratings of Silver or Bronze, while one high-cost class stayed at Neutral. Dance honed his style as a regional strategy manager, seeking four types of stocks—consistent growth firms with superior business models, niche companies, firms with macroeconomic tailwinds, and special situations—holding them for three to five years. He spreads the portfolio out over 80-90 stocks, keeping the bulk of the portfolio in consistent growth names like Taiwan Semiconductor Manufacturing TSM. Since his October 2019 start as solo manager, Dance has delivered. Through April 2022, the fund's 7.2% annualized gain was more than the benchmark's 4.9% and average peer's 4.0%.

Manning & Napier Pro-Blend Moderate Term MNMWX and Manning & Napier Pro-Blend Conservative Term MNCWX received a People rating upgrades to Above Average from Average thanks to the fixed-income team's limited duration bets and avoidance of big missteps in security selection. The Analyst Ratings for the cheapest share classes were upgraded to Silver from Bronze, while the other share classes were raised to Bronze from Neutral, though there's limited access to the W shares. This has enabled the more conservative funds in the Pro-Blend series to beat their benchmarks on a risk-adjusted basis. The strategy's fixed-income team covers a lot of ground with just seven people, running core bond, unconstrained, high-yield, and municipal-bond portfolios. The core bond fund, which most resembles this series' fixed-income portfolios, has had some success on a risk-adjusted basis versus benchmarks, while the high-yield offering has excelled.

Downgrades

Lead manager Amy Zhang's unique approach at Alger Small Cap Focus AOFIX has strong points, but questions about risk management and trading dropped its Process rating to Above Average from High. The Analyst Ratings for most share classes drop to Bronze from Silver, while the cheaper shares remain at Silver. Portfolio-level risk management is modest—Zhang's bottom-up view lets significant sector concentration in technology and healthcare build up, for example. This isn't a new issue, but her recent busy trading is. Annual portfolio turnover hit 57% in 2021—not high by absolute standards but unusual given her prior patience and her training at Brown Capital Management, where managers trade reservedly. Zhang also takes on significant valuation risk at times: The portfolio's average price/projected earnings ratio was at least 50 (often twice as much as the index) in most months since late 2017, though it recently has dropped sharply.

Lessened confidence in the Artisan International ARTIX investment team's risk management warranted a Process rating downgrade to Average from Above Average, driving the most expensive share class to a Neutral rating from Bronze, while the cheaper shares remained at Bronze. Artisan doesn't have a centralized risk function, so risk management is left up to the individual investment teams. The lack of an independent voice to point out potential blind spots can lead this team to getting more comfortable with risks than perhaps is warranted. A few recent stock picks, including Amarin, Wirecard, Sberbank, and Norilsk Nickel, highlight this concern. Each stock was at least a 1.2% position at its peak and lost more than 60% through its exit, and in the case of the latter two Russian stocks, through April 2022.

New to Coverage

First Eagle Small Cap Opportunity FESCX might be young, but its team and approach are time-tested. Coverage was recently initiated on the fund, with its cheaper share classes receiving Silver ratings, while pricier shares earn Bronze ratings. Bill Hench leads this four-member team that joined First Eagle in April 2021 from Royce Investment Partners, where they managed Royce Opportunity RYPNX. While the team members have a new home, their deep-value approach hasn't changed. They look for statistically cheap micro- and small-cap stocks with overlooked catalysts for improvement. The portfolio often holds firms that appear to be struggling, so elevated volatility relative to the Russell 2000 Value Index is to be expected. Still, Hench and crew have tended to make up for lost ground by excelling in market rallies.

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)