4 Overpriced Utilities Stocks to Avoid

The rotation into defensive stocks has lifted utilities shares, but many are now overvalued and the outlook is risky.

Utilities stocks have been a safe haven for investors this year amid the market’s selloff, but now that security comes with an expensive price tag.

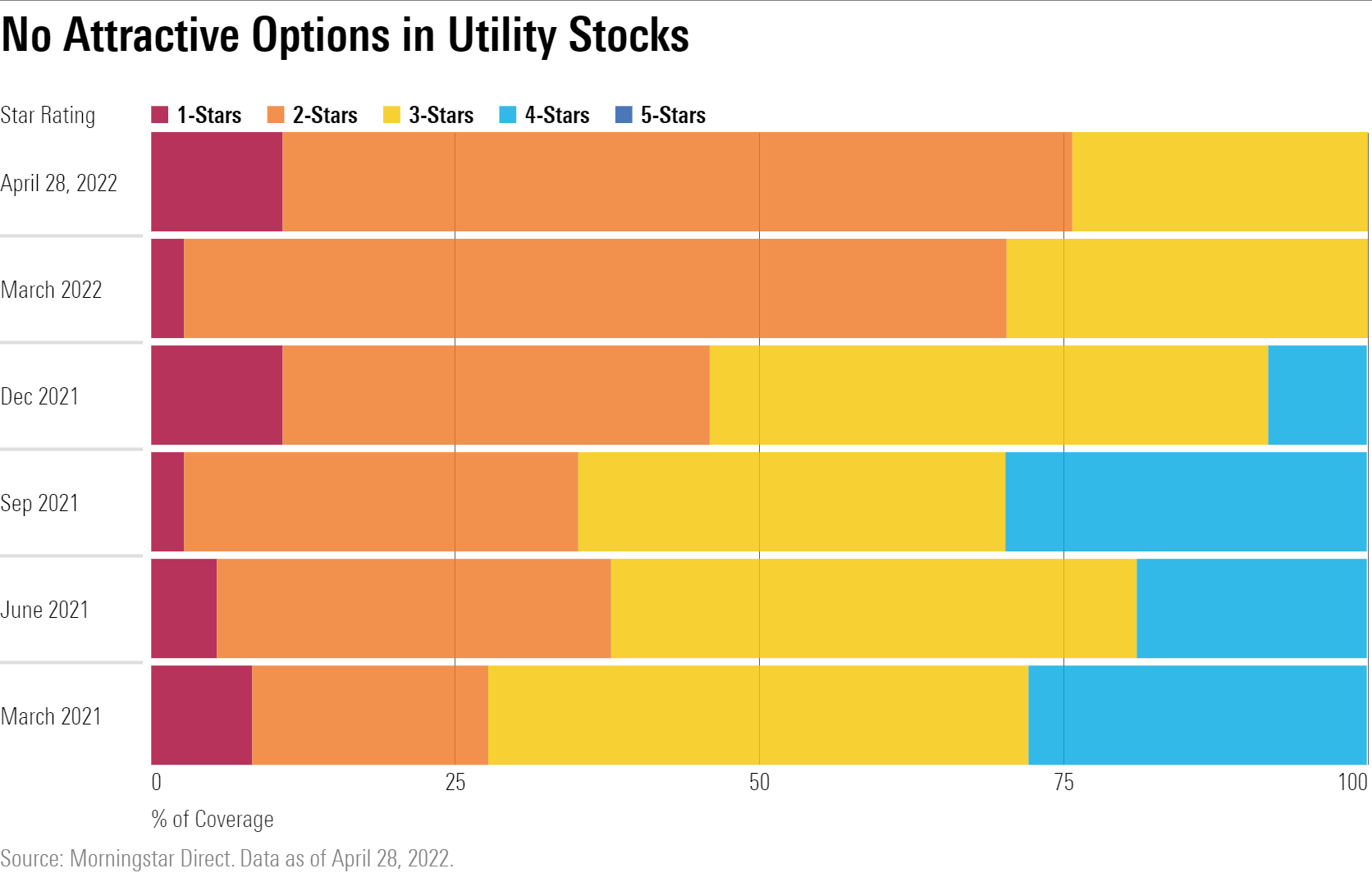

About 75% of U.S. utilities covered by Morningstar analysts are in overvalued territory. The rest are considered fairly priced. Meanwhile, higher inflation could threaten utilities company profits.

The sector is the second-best performer in the market since Russia invaded Ukraine on Feb. 24, rising 13.4%. Prior to that, it was down 9.1% this year.

The rally is a result of investors rotating into defensive stocks after the war kicked off a new wave of economic uncertainty, says Travis Miller, Morningstar’s strategist for energy and utilities. Companies posting the biggest gains since then are Sempra SRE, Vistra VST, and Edison International EIX, all of which rose 21% or more.

Investors should be wary of their utilities holdings, Miller says. Rising inflation dragged the sector lower in January and February--and it is still a major risk. While utilities are able to pass along rising energy, materials, and labor costs to customers, their ability to do so is limited, he says.

“We think the market does not fully appreciate the regulatory risk that these utilities face. If inflation remains high, regulators where these utilities operate might force them to limit customer bill increases, thus slowing earnings growth more than the market expects,” Miller says.

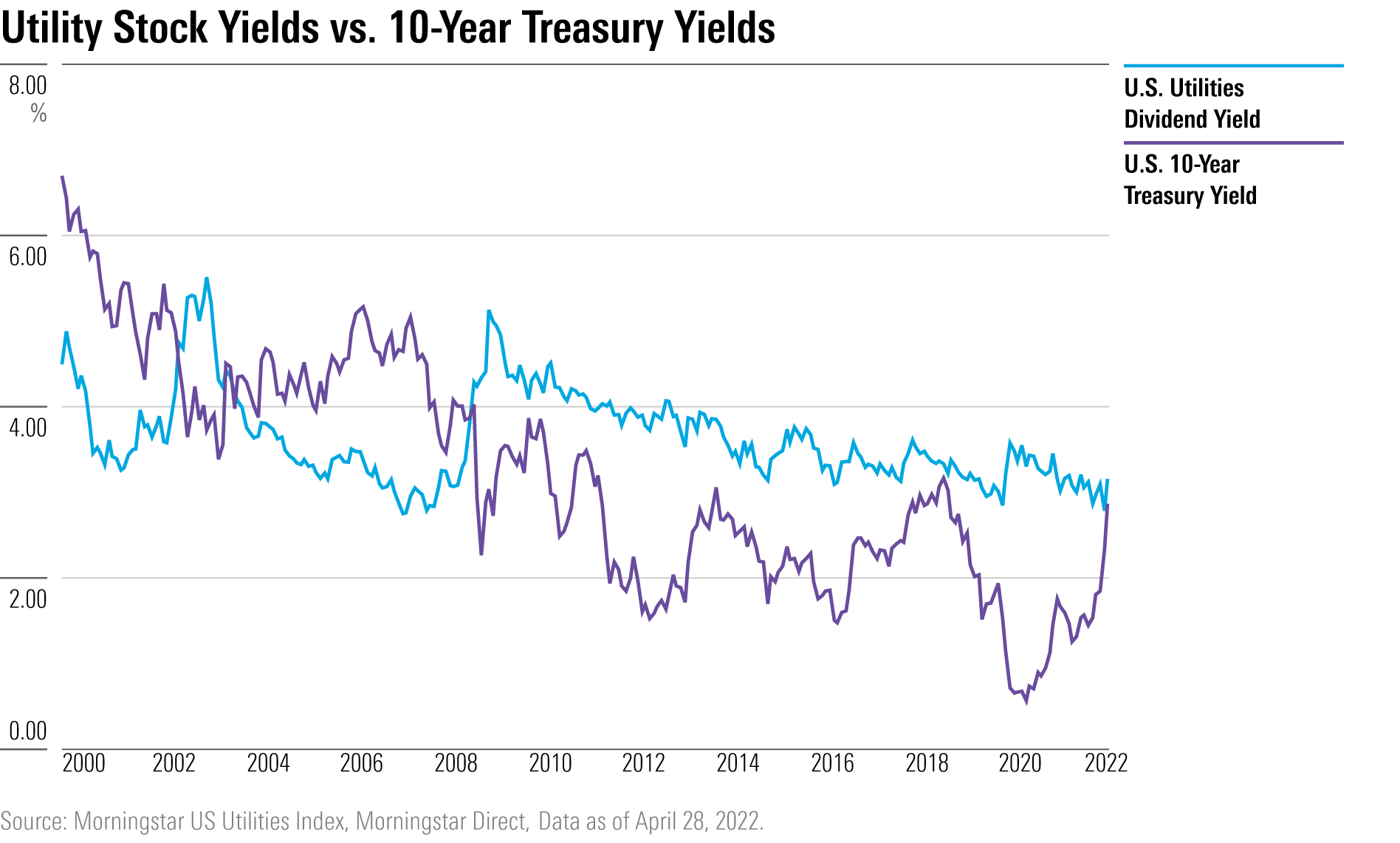

Inflation has also started to erode the competitiveness of the sector's dividends. “For the first time in at least 30 years, utilities' inflation-adjusted dividend yield has turned negative.’’

While yields are still attractive at a median of 3.1% compared with the rest of the market, the sector’s yield premium is dissipating, Miller says. Utility yields had as much as a 200-basis-point premium to the 10-year U.S. Treasury in August 2021. That has fallen to 29 basis points as of April 28, the smallest since November 2018.

Utilities Stocks Valuations

At current prices, not one of the 37 U.S.-listed utilities stocks covered by Morningstar analysts are considered undervalued. Nine are in fair value territory and 28 are considered overvalued.

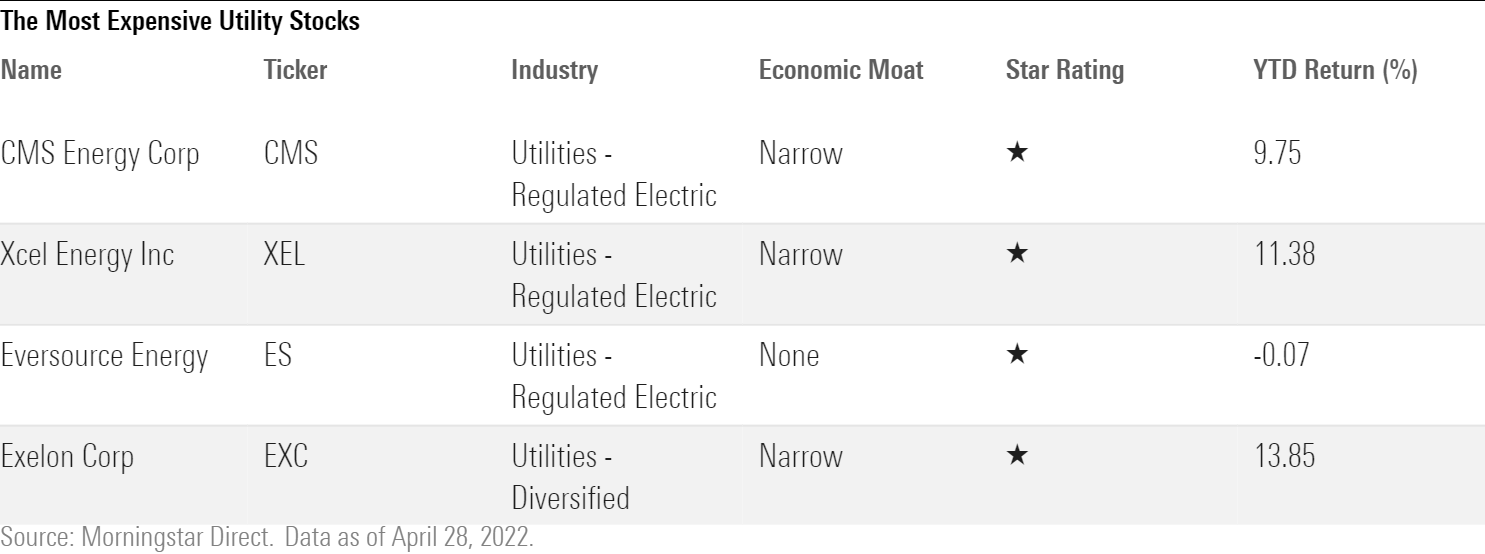

Which stocks are the most overvalued? Four utilities companies are rated as 1 star, which means they are viewed as expensive at current prices by Morningstar’s analysts.

CMS Energy CMS

CMS Energy shares are 36% overvalued.

“The biggest threat to CMS' future earnings is capricious state regulation. Regulators may choose to disallow recovery of CMS' investments in rates or place political expediency above the interests of CMS' investors by maintaining or lowering rates.

Regular gas and electric rate cases provide a real-time indicator of regulators' appetite for rate increases to support large capital investments. The outcome of its 2021 electric rate case was mostly constructive but pushed out some of CMS' wish list of investments. CMS used cost savings in 2020-21 to offset impacts from COVID-19 and the economic slowdown. This will help mitigate future customer rate increases.

CMS' earnings growth and value creation depend on regulatory support for its capital investment, operating cost recovery, and a fair return on capital. New legislation and regulatory mechanisms have reduced regulatory uncertainty. Large capital investment programs also require good execution to keep projects on time and on budget.”

--Travis Miller, strategist

Xcel Energy XEL

Xcel’s shares are shares are 31% overvalued.

“Xcel's key risk is its ability to win favorable regulatory decisions, particularly in its largest service territories, Minnesota and Colorado.

Given Xcel's large capital investment plans, we expect its utilities to continue to be active in front of regulators asking for customer rate increases. If customers' utility bills start rising too quickly, regulators might push back on rate increases, slowing Xcel's growth.

In Minnesota, Xcel has been able to use one-year rate adjustments in 2020 and 2021 to avoid large often contentious rate cases. The outcome of its three-year, $677 million rate increase request in Minnesota in 2022 will be critical to achieve management's growth target. In Colorado, Xcel has received political support for its long-term investments to replace coal generation with renewable energy. But regulators have been stingy with rate increases, potentially slowing the pace of clean energy investment. Regulatory activity in Texas and New Mexico supports Xcel's earnings growth outlook.”

--Travis Miller, strategist

Eversource Energy ES

Eversource’s shares are 27% overvalued.

“Regulatory risk remains the key uncertainty for Eversource. The storm-related penalties in Connecticut are the latest example of how regulatory decisions can impair shareholder value.

Eversource wrapped up major regulatory proceedings in its primary jurisdictions in 2020 and 2021, so we expect a light year of regulatory activity in 2022. However, Eversource's large planned capital investment budget will require continued regulatory support during the next five years to produce earnings growth.

Eversource has derisked its capital investment budget by finding smaller distribution projects to offset the loss of large projects it has proposed, notably Northern Pass. Eversource is eyeing several large offshore wind projects as a way to boost earnings growth. These projects come with higher execution risk than its regulated utility investments.

Eversource faces continued regulatory uncertainty at its transmission business, based on rate challenges at FERC.”

--Travis Miller, strategist

Exelon EXC

Exelon shares are 24% overvalued.

“Exelon's ability to earn regulatory approval for rate increases depends on maintaining constructive relations with regulators. If regulatory relations sour, regulators could cut the utility's allowed return, resulting in earnings and cash flow pressure.

Illinois and Maryland are two historically tough regulatory environments, and punitive rate decisions could have a material impact on earnings and growth. However, Exelon has done a solid job developing good regulatory relationships in the Northeast. New legislation in Illinois also helps mitigate some of Exelon's regulatory risk. We expect Exelon will be able to earn returns near its average allowed regulatory returns at its regulated utilities.”

--Andrew Bischof, senior equity analyst

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)