Funds That Buy Like Buffett, 2022

Our annual review of funds that own the same stocks as the Oracle of Omaha.

Warren Buffett and Charlie Munger will host Berkshire Hathaway's BRK.B annual shareholder meeting in Omaha, Nebraska on Saturday. It will be the first in-person Berkshire meeting in three years, after the coronavirus pandemic forced Buffett to cancel the in-person meetings in 2020 and 2021. Proof of COVID-19 vaccination will be required this year for entry to the meeting venue, but otherwise it should be a return to some kind of normal. Buffett, Munger, and Berkshire vice-chairmen Ajit Jain and Greg Abel will spend most of the day answering questions submitted online and in person before the formal business meeting starts at 3:45 p.m. CDT. CNBC will webcast the meeting this year.

For the 13th consecutive year, we're marking the upcoming Berkshire Hathaway meeting by looking at "Funds That Buy Like Buffett"--mutual funds with the highest percentage of stocks in common with Berkshire's investment portfolio, as listed in Buffett's annual letter to shareholders and in Berkshire's annual report. Morningstar's Lewis Jackson discussed the letter after it came out in February. (You can find last year's "Funds That Buy Like Buffett" here, with links to previous articles.)

Berkshire Hathaway's top 15 stock holdings by market value as of Dec. 31, 2021, were Apple AAPL, Bank of America BAC, American Express AXP, Coca-Cola KO, Moody's MCO, Verizon VZ, U.S. Bancorp USB, BYD, Chevron CVX, Bank of New York Mellon BK, General Motors GM, Itochu, Mitsubishi, Charter Communications CHTR, and Mitsui. Thirteen of these names were the same as the previous year, with the only newcomers being Japanese conglomerates Mitsubishi and Mitsui, which replaced healthcare firms AbbVie ABBV and Merck MRK.

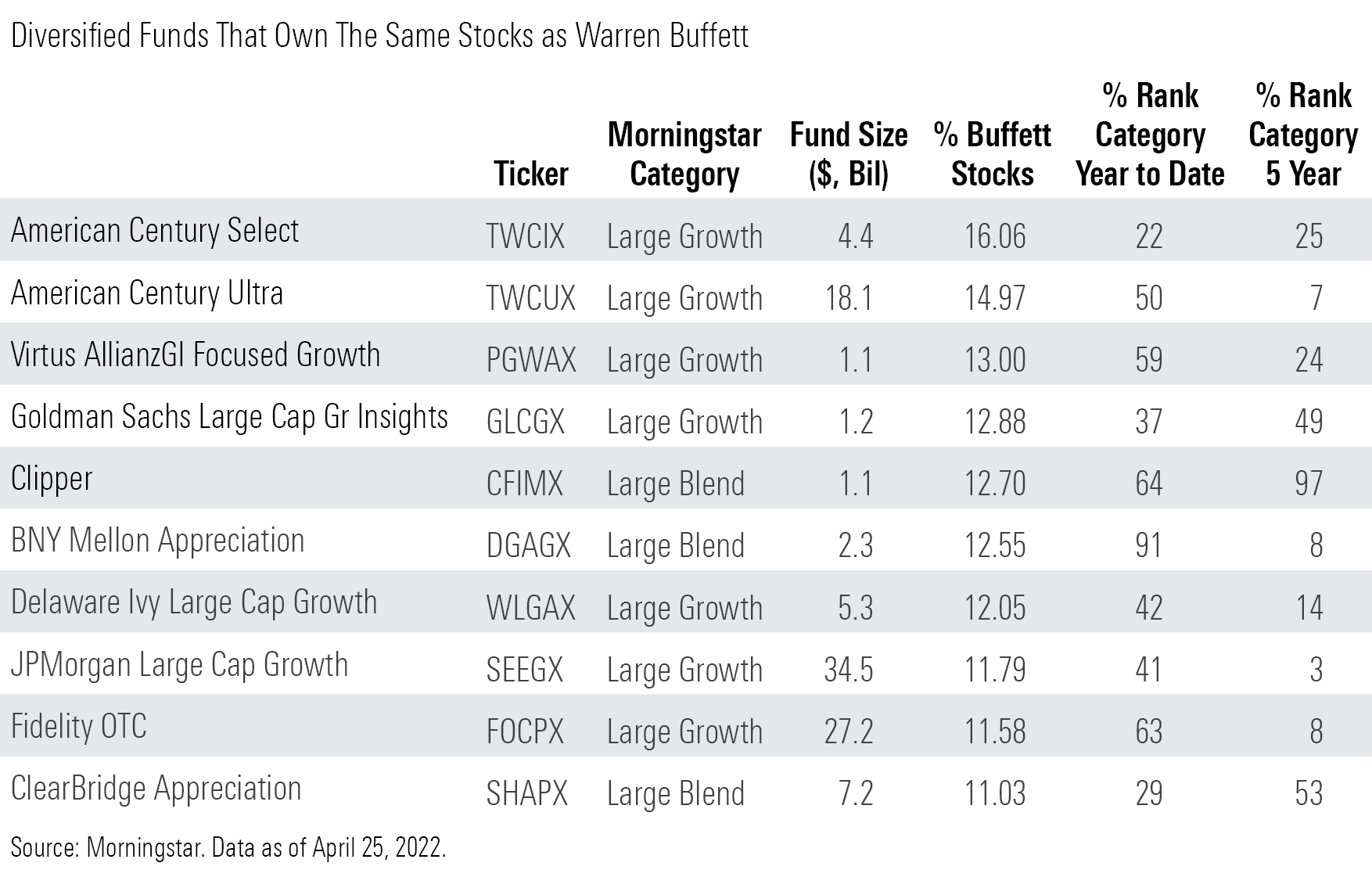

The table below shows the open-end mutual funds with the largest combined weightings in those 15 "Buffett stocks," as of their most recent portfolios. We left out funds without at least $1 billion in assets or a five-year track record; those not covered by Morningstar analysts; and sector funds such as banking and financial-services funds. With those constraints, the following table shows the 10 funds with the most Buffett-like taste in stocks. We show each fund's Morningstar Category, size, and percentile rank in its category for the year to date and for the trailing five years (through April 25, 2022):

The top two funds on the list, American Century Select TWCIX and American Century Ultra TWCUX, also made the list last year. They are both run by veteran portfolio managers Keith Lee and Michael Li, whose Buffett-like approach to picking growth stocks focuses on companies with histories of high profits, and competitive advantages that help maintain those profits over time. These funds' presence atop this list is due to one stock: Apple, a Buffett favorite that is far and away both funds' largest holding, taking up around 15% of each portfolio's assets. (American Century Select also has a small position in Moody's.) Both funds have put up pretty good performance numbers in recent years, though each only earns a Morningstar Analyst Rating of Neutral for the investor shares, because of portfolio constraints that make it hard to stand out in the crowded large-growth space.

The other fund on this list that's a holdover from last year is Clipper CFIMX, managed by Chris Davis and Danton Goei of Davis Selected Advisors. Davis is a longtime Buffett fan whose value-investing approach often favors big financial stocks and other blue chips that Buffett likes. Berkshire Hathaway was this fund's top holding as of Dec. 31, with "Buffett stocks" Bank of New York Mellon and U.S. Bancorp among the top 10, and Bank of America and American Express in the top 20. The fund's positions in Chinese companies New Oriental Education and Technology Group EDU, Didi Global DIDI, and Alibaba Group Holding BABA have hurt it in recent years, resulting in returns that rank near the bottom of the large-blend category over the trailing five years. Despite those struggles, the fund earns an Analyst Rating of Bronze, thanks to the managers' bold strategy and talent for picking good businesses.

The largest fund here is $35 billion JPMorgan Large Cap Growth SEEGX, managed by veteran Giri Devulapally and three comanagers. They use a strategy that's similar to the two American Century funds and many others in the large-growth category, with an emphasis on companies having solid growth prospects and competitive advantages. It's not a particularly distinctive approach, but strong stock-picking by Devulapally and his team has helped the fund achieve top-decile returns in the category over the past 15 years. As with the American Century funds, Apple is the top holding here, taking up about 10% of the Feb. 28, 2022, portfolio, with Coca-Cola being the other Buffett stock present.

Fidelity OTC FOCPX is the other giant among these 10 funds, with $27 billion in assets under management. The manager is Chris Lin, a Fidelity veteran who used to run technology sector funds, so it's no surprise that tech has a heavy presence here. Lin's approach to finding growth stocks is Buffett-like only in the very broadest sense; he is focused on finding competitively advantaged firms that have pricing power but don't require a lot of capital investment. However, he does share one characteristic with Buffett and many of the other managers on this list: He's a big fan of Apple, which took up nearly 12% of the Feb. 28 portfolio. The prominence of Apple among this year's "Buffett stocks" is a stark illustration of how much that company and other tech giants like Microsoft MSFT and Amazon.com AMZN now influence the U.S. stock market and market indexes.

Morningstar senior analyst Jack Shannon assisted with the data for this article.

/s3.amazonaws.com/arc-authors/morningstar/1ec055c4-13ba-4cb0-bbe5-607ba591d202.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1ec055c4-13ba-4cb0-bbe5-607ba591d202.jpg)