Profiting From Lower Volatility

Reducing risk isn’t only about avoiding losses.

Changing Perspective

Investment risk is real for retirees, but it's largely psychological for workers. When spending from a portfolio that has declined in value, retirees cement their losses. Workers face no such jeopardy—quite the contrary. If they contribute steadily to their retirement plans, they will buy during slumps rather than sell into them.

This logic is imperfect, as it relies on the assumption that the financial markets will recover. That premise may not hold for older workers who are approaching retirement. Also, while it has yet to occur in modern history, it’s possible that security prices could remain depressed for an entire generation. Nevertheless, the claim is largely accurate. The greatest investment fear for workers is fear itself.

There is, however, another reason to prize low-risk securities: profits. Holding the safest issues within an asset class can potentially lead to stronger gains, because doing so permits investors to alter to their allocations. They can invest more heavily in lucrative but volatile asset classes while not increasing their portfolio’s risk level. At least in theory, doing so might give them a free investment lunch.

Two Portfolios

Here is an example. Friday's column discussed Morningstar's "moat" stocks. The company's equity analysts categorize companies as possessing: 1) wide economic moats, which shield them well from competition; 2) narrow moats, which provide some protection, and 3) no moats, which offer no shelter. Since October 2002, when the moat ratings began, indexes of the narrow- and no-moat stocks have outgained the wide-moat index. (That said, the Morningstar Wide Moat Focus Index, which owns a subset of the broader benchmark, has posted higher returns yet.)

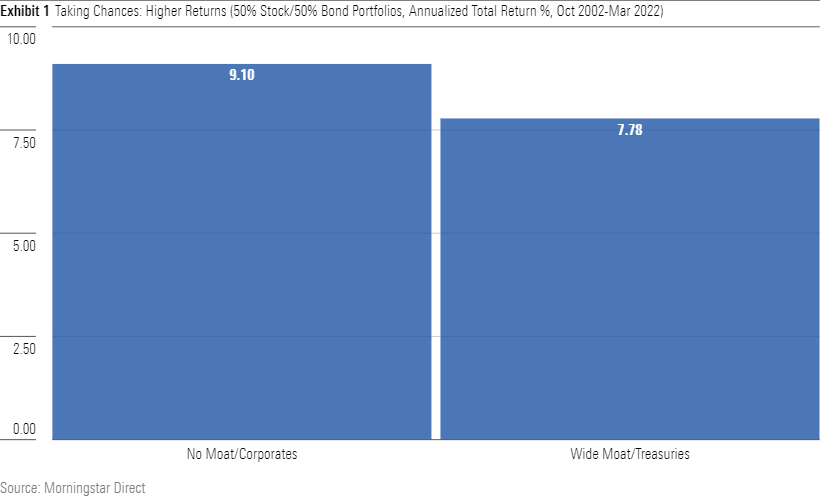

During that same period, corporate bonds have also handily beaten U.S. Treasuries. Consequently, one would expect a portfolio that invests half its assets in no-moat stocks and half in corporate bonds to have outgained a portfolio that that split its monies between wide-moat stocks and Treasuries. After all, each segment in the first portfolio outpaced each segment in the second.

That indeed is what happened. (It would have been unusual had it not, although such things are possible, depending upon how the assets are correlated.)

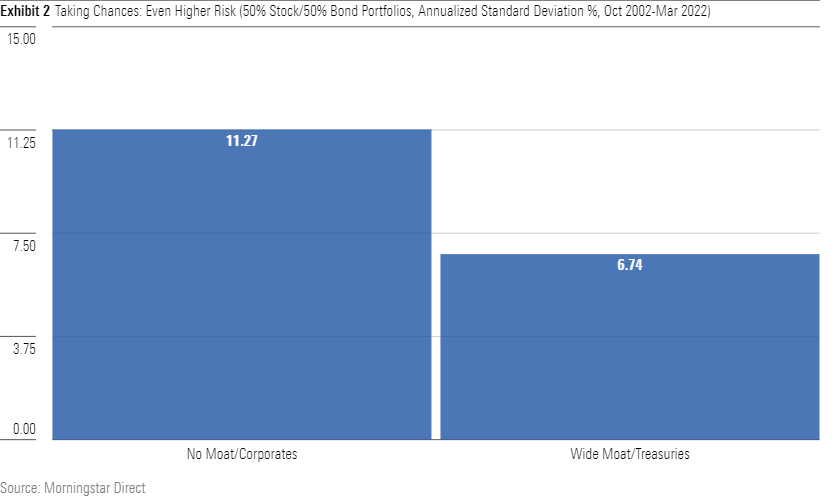

The no moat/corporate bonds portfolio, however, paid handsomely for its relative success. Unsurprisingly, companies that lack moats are more volatile than firms that maintain wide moats. Similarly, for notes of a given duration, corporate bonds are riskier than Treasuries. Thus, the no-moat/corporate portfolio was by a wide margin (so to speak) the more volatile of the two.

More Stocks, Please

If 50% stocks/50% bonds were the sole asset allocation, our evaluation would be complete. Investors could pursue higher potential returns through a blend of no-moat stocks and corporate bonds, or they could select a steadier route. Further analysis is moot. True, the Sharpe ratio for the wide-moat/Treasury portfolio is well above its rival's, but that information is purely academic. To earn more money, investors must swallow hard and accept additional risk.

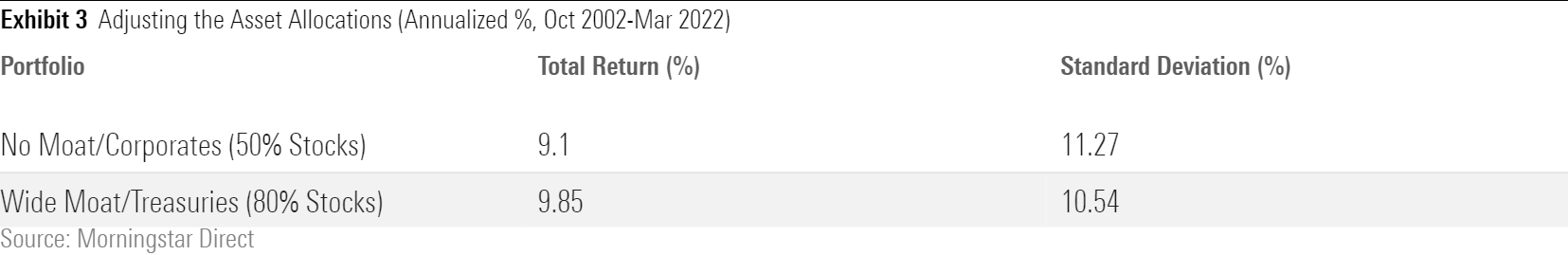

Happily, the real world offers the option of choosing the more-conservative assets while adjusting their allocation. The standard deviation for the wide-moat/Treasury portfolio is far below that of the alternative. If one were to increase its stock weighting so that the two options became equally risky, might the wide-moat/Treasury portfolio also boast higher expected returns?

It very well might. Boosting the wide-moat/Treasury portfolio’s stock percentage to 80%, with the final 20% remaining in Treasury notes, creates an investment that has not only remained less risky than its competitor, but which, thanks to its now-higher equity position, also recorded stronger total returns.

When the Bear Arrives

It may be difficult to believe that a portfolio that places 80% of its assets into equities is safer than one that holds only 50%. Perhaps those standard deviation figures are misleading, capturing insignificant market shifts but missing what truly bothers investors. After all, dropping 2% in a month instead of 4% is immaterial. What matters is how the portfolios perform during outright bear markets.

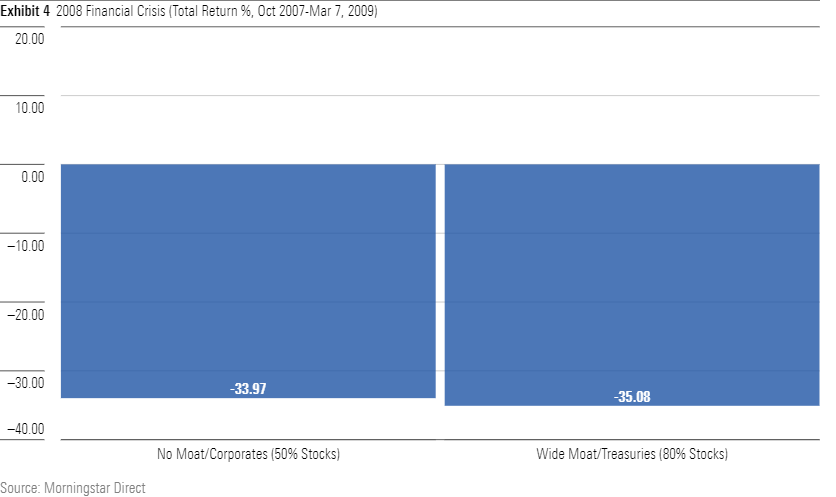

There have been two such events since October 2002. The first commenced in late 2007, accompanied by plunging real estate prices and a sharp recession. During that selloff, the 80/20 portfolio would in fact have dropped further than the 50/50 portfolio, but only modestly. Few investors would have been bothered by the difference.

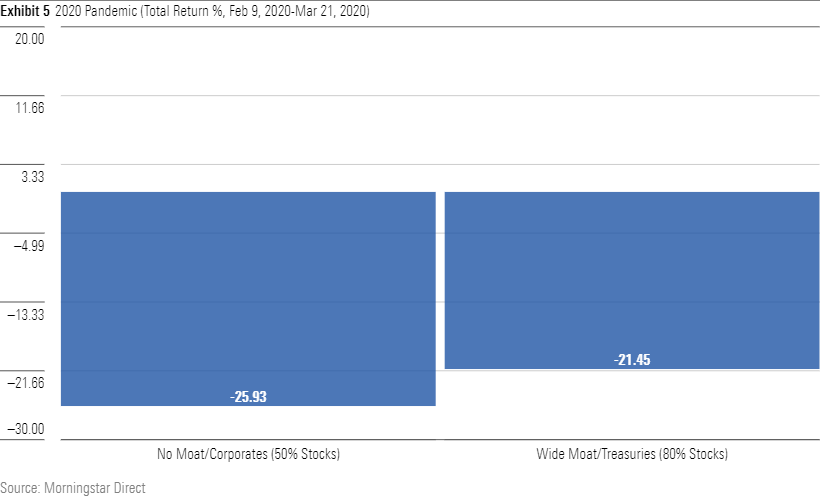

The reverse occurred during the second bear market, which coincided with the coronavirus pandemic's arrival, and which also sparked a recession. This time, the wide-moat/Treasury strategy would have fared better. Once again, though, the margin of victory was slight. For practical purposes, the 80/20 portfolio matched the bear-market performances of the 50/50 portfolio.

Investment Lessons

The times, of course, may change. Although wide-moat companies will almost surely remain the stock market’s steadiest performers, their relative returns may slip, thereby eliminating the benefit of heavily buying wide-moat stocks. That is not the way I would bet, as I believe that the tactic will remain successful, but it certainly is possible. My suggestion is therefore no more than that.

However, the general principle deserves serious consideration. Investing by market cap, as indexers customarily do, is certainly sound. There is nothing wrong with such an approach. But for those who are willing to do the work, an even better strategy may be to favor the safest securities within an asset class while adopting a more aggressive allocation. Use less to achieve more.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)