29 Stock Funds That Flip-Flopped in the Rankings

These funds moved from best to worst, or from worst to best, amid the stock market's volatility.

The stock market in 2022 is a very different one than this time a year ago.

Stock funds that rode the rally in high-flying technology names, especially pandemic-driven winners, have seen returns deflated. Meanwhile, value stock funds have performed strongly, but within that group, dividend strategies and low-volatility funds have seen their fortunes shift.

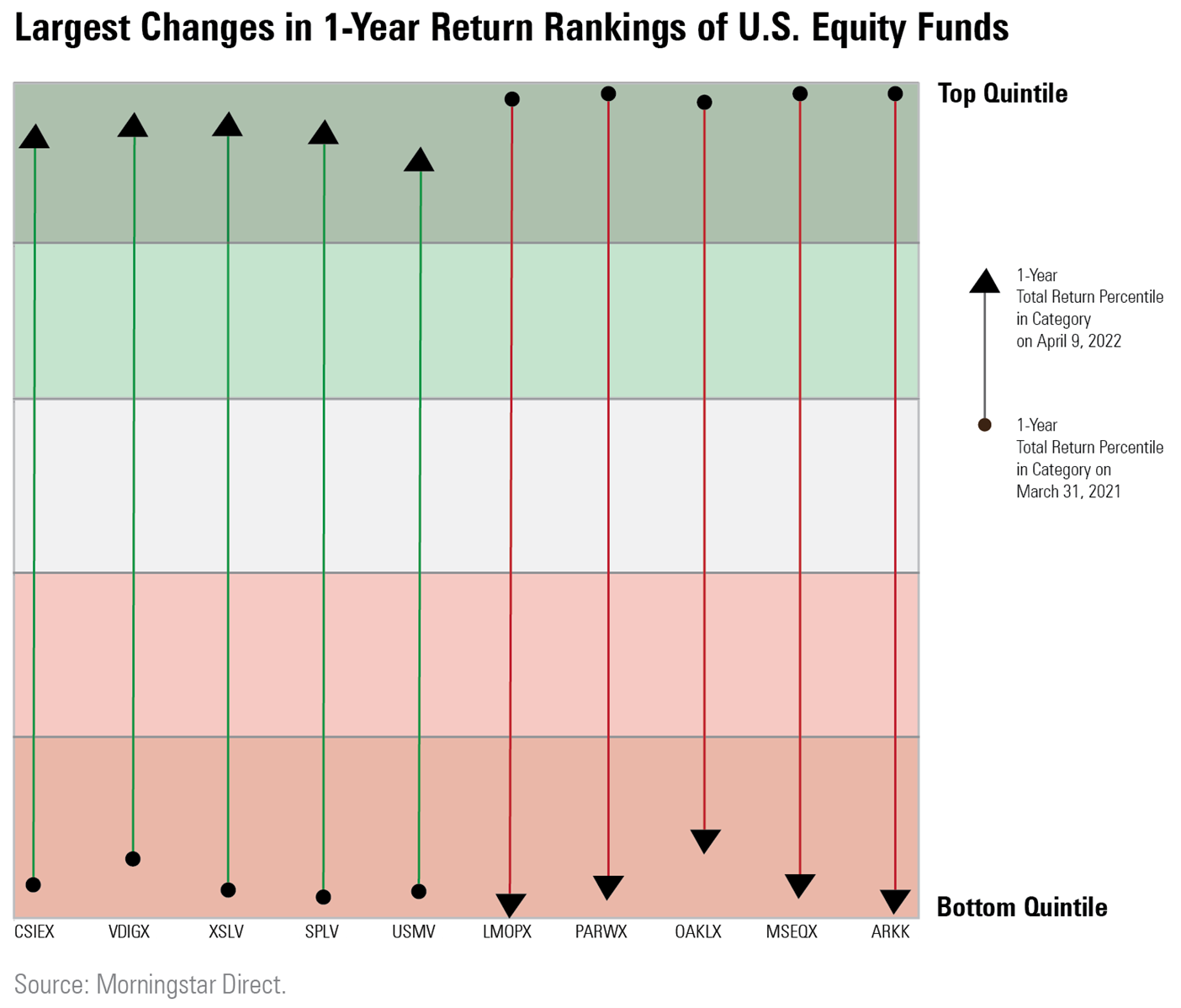

The result was that some funds that were big winners a year ago, such as Morgan Stanley Institutional Growth MSEQX and Miller Opportunity LMOPX, have sunk to the bottom of their category rankings. At the same time, some former laggards such as Invesco’s low-volatility exchange-traded funds, including its S&P 500 Low Volatility ETF SPLV and Vanguard Dividend Growth VDIGX now clock in at the top. That volatility also produced big swings in performance that don’t fit the narrative: Value-investing stalwarts Oakmark Select OAKLX and Longleaf Partners LLPFX both sank compared with other value funds.

We drilled down into Morningstar’s U.S. stock fund categories to look for funds that had significant swings higher or lower in their category rankings. To do so, we compared funds' one-year return rankings as of April 9, 2021, with their rankings a year later.

A group of 11 funds rose to the top of their Morningstar Category based on one-year returns from the bottom 10% for the period ended April 9, 2022. At the same time, 18 funds took the opposite route and fell into bottom 10% of returns after ranking in the top 10% during the previous year.

The performance flip-flops among mutual funds shouldn't come as too much of a surprise. Morningstar analysts evaluate funds over a full market cycle, so short-term swings aren't necessarily a cause of concern. In many cases, funds' long-term rankings remain intact, and their Morningstar Analyst Ratings stay unchanged. However, tracking these kinds of swings can provide helpful information about biases within funds' strategies and how these funds can fit into a portfolio.

From Worst to Best

After struggling in early 2020, low-volatility funds across the market-cap spectrum made a comeback. Invesco S&P SmallCap Low Volatility ETF XSLV, Invesco S&P 500 Low Volatility ETF, and iShares MSCI USA Min Vol Factor ETF USMV all went from the bottom 10% in their category to the top.

Vanguard Dividend Growth also made a comeback from a slump to beat its benchmark, Morningstar strategist Alec Lucas wrote.

“Thanks to picks like UnitedHealth Group UNH and Accenture ACN, the fund’s 24.8% calendar-year gain outpaced the Nasdaq U.S. Dividend Achievers Select and S&P U.S. Dividend Growers Indexes by 1.3 and 0.6 percentage points, respectively,” Lucas says.

One notable fund going from worst to best was Calvert Equity CSIEX. Many sustainable investing strategies have struggled lately, largely missing out on the rally in energy stocks and suffering from their big weightings in sliding technology stocks.

Calvert lands in the large-growth category, but its focus on companies with strong environment, social, and governance standards means it missed out on big losses in Meta Platforms FB, Facebook’s parent company. Meta lost 28.85% during the 12-month period. As a top holding in many growth funds, having a zero weighting in Meta was a considerable tailwind for Calvert Equity.

The stock was dropped from the Calvert's approved list in 2018, Morningstar associate director Tony Thomas wrote.

“The strategy's tendency to be relatively light on mega-cap and technology stocks weighed on returns in 2020, but the managers' patience with existing holdings paid off in 2021,'' Thomas says.

Healthcare companies helped also helped propel the fund ahead of its peers, fueled by investments in Thermo Fisher Sciences TMO and Danaher DHR, according to Morningstar Direct.

From Best to Worst

One of the biggest winners during the stock market’s recovery from the pandemic was Morgan Stanley Institutional Growth.

“The fund has taken a sharp turn since posting triple-digit gains in 2020,” writes Morningstar’s director of equity strategies Katie Rushkewicz Reichart in the latest fund report. In 2020 the fund was bolstered by several pandemic winners including Zoom ZM, Shopify SHOP, and Square SQ, according to Morningstar Direct. But now concerns about rising interest rates have clobbered growth stocks that the portfolio prefers, she notes. “Apple’s privacy guidelines change also weighed on several advertising-dependent holdings, including Pinterest PINS, Snap SNAP, and Twitter TWTR.”

Veteran fund manager Bill Miller has also had tough ride in the past year. Miller Opportunity sits at the bottom of the mid-cap blend category on a return basis for the past year. It lost 33.9% while the average mid-cap blend fund lost 14.3%. The fund’s cyclical holdings have suffered, and a 2.94% weight in Alibaba BABA also hurt performance, according to Morningstar Direct.

For the prior one-year period the fund was among the best performers in its category with a gain of 163%. That was 90 percentage points higher than the average fund in the category, bolstered by consumer cyclical holdings that included Farfetch FTCH, Peloton PTON, and Stitch Fix SFIX, all of which gained more than 200% in that period.

Miller Opportunity's flip-flop shouldn’t come as a huge surprise to investors. The fund can outperform at times, but its highly volatile nature limits its appeal, says associate director of equity strategies Andrew Daniels. It has a Morningstar Analyst Rating of Neutral.

In a rally that has lifted most value funds, Parnassus Endeavor PARWX fell behind in the large value category. The fund doesn’t invest in fossil fuels due to its ESG focus and has underperformed as energy stocks have rallied over the past year. This underperformance is not surprising since as almost 6% of the index is allocated to those companies, Morningstar analyst Stephen Welch says.

“The strategy’s technology overweighting has also weighed on results as growthier fare has come under pressure to start the year as investors ponder the effects of the Federal Reserve’s looming monetary policy tightening,” Welch says.

A healthy investment in energy companies didn’t prevent another large value fund from underperforming. Oakmark Select was weighed down by some stock picks over the past year, including Netflix NFLX and Meta, according to Morningstar Direct. The team considers nontraditional value stocks and has holdings in just 23 companies as of March 2021, Morningstar’s Katie Rushkewicz Reichart wrote.

Perhaps the biggest fund flip-flopper on the downside has been ARK Innovation ETF ARKK. Its woes have been well chronicled as the fund went from 180% return in the 12-month period ended March 30, 2021, to a 59.9% loss for the past year.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)