Is Now the Time to Buy Netflix Stock?

Netflix shares plunge, with subscriber losses set to continue as competition for the streaming pioneer from Disney and others intensifies.

Where did all of Netflix’s NFLX subscribers go?

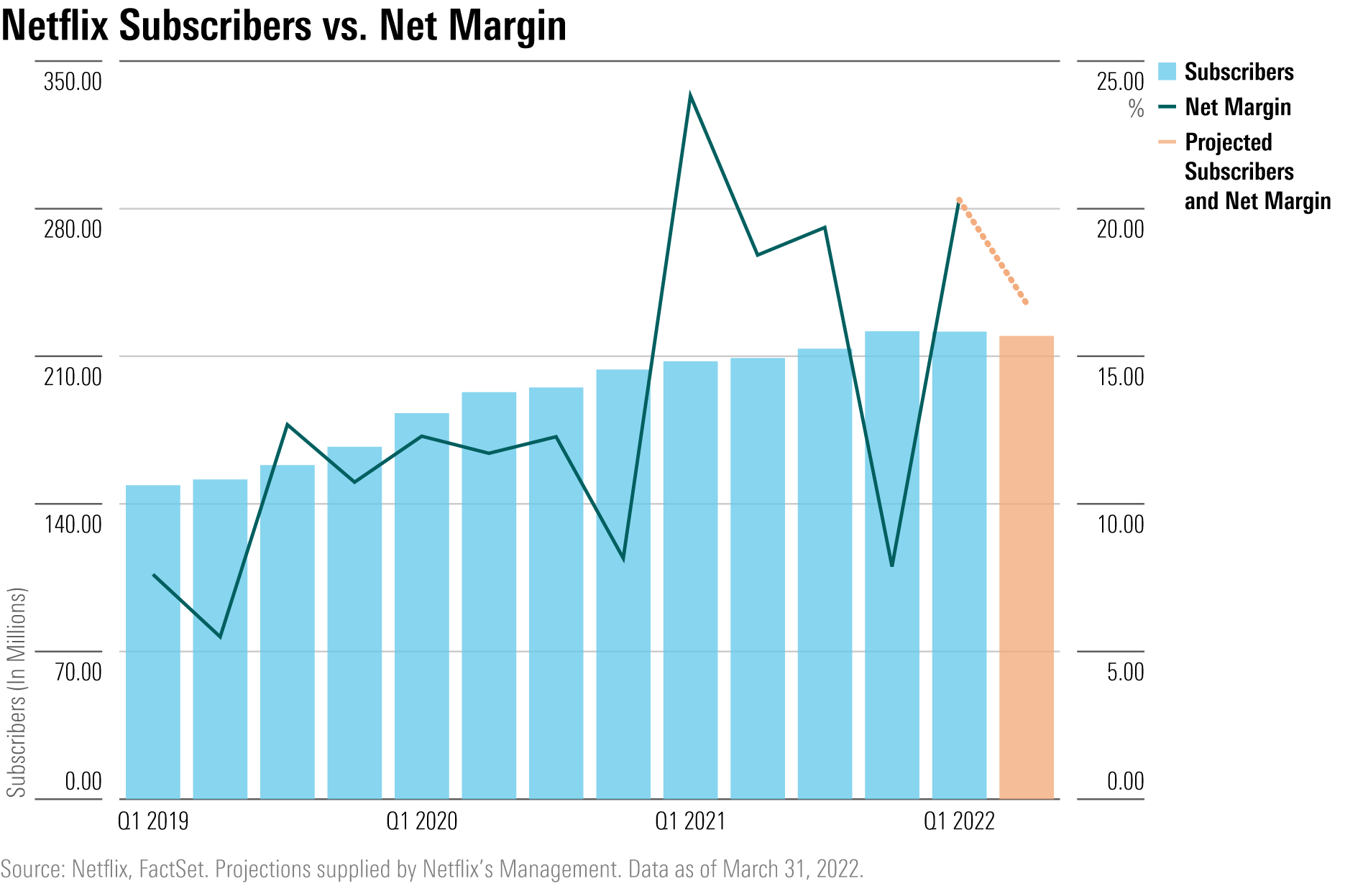

The leader in streaming video on demand services reported a loss of 200,000 subscribers in its first-quarter earnings report, well off its projections of a gain of 2.5 million. It was the first quarterly loss of subscribers since 2011 when it moved to separate its streaming service from its DVD service.

Worse, the company said it expects to lose another 2 million subscribers in the current quarter.

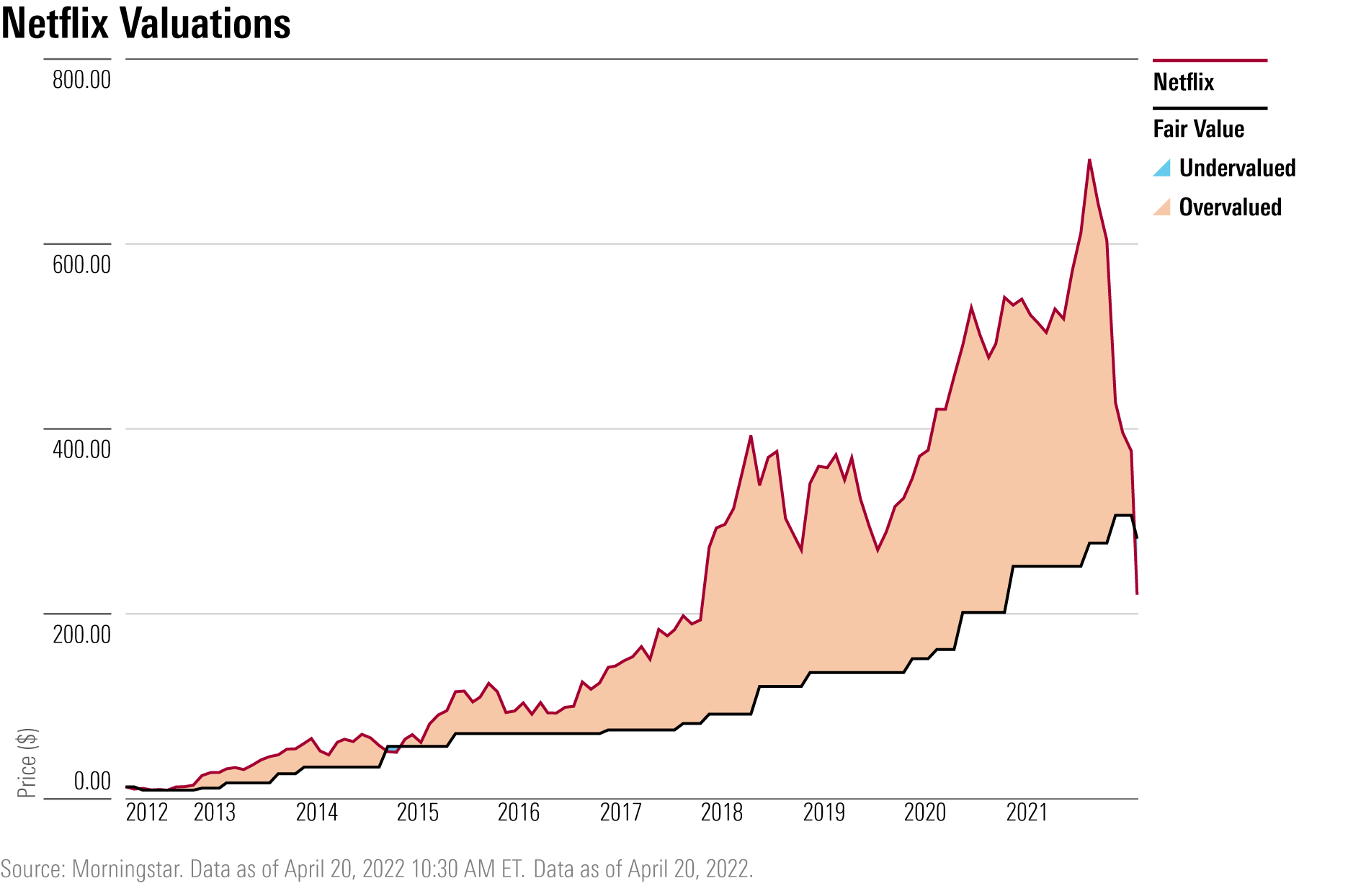

The company's shares plummeted as much as 36% to a new 52-week low. The stock is off 62.5% so far this year and 59% in the past year. That compares with a drop of 12.95% this year and a loss of 2.12% for the past year in the Nasdaq Composite. The Morningstar US Market Index is off 7.15% in 2022 but is up 4.25% in the past year.

“Our forecast assumes our current trends persist (such as slow acquisition and the near-term impact of price changes) plus typical seasonality (Q2 paid net adds are usually less than Q1 paid net adds),” Netflix's chief executive Reed Hastings wrote in a letter to shareholders. “We project revenue to grow approximately 10% year over year in Q2, assuming roughly a mid-to-high single digit year over year increase in ARM (average revenue per membership) on a F/X neutral basis. We still target a 19%-20% operating margin for the full year 2022, assuming no material swings in F/X rates from when we set this goal in January of 2022.”

Morningstar senior equity analyst Neil Macker has been cautioning investors that Netflix shares looked pricey based on slowing subscriber growth. He sees higher spending on original content leading to slower margin expansion. Macker lowered his fair value estimate on the stock to $280 a share in the wake of the first-quarter report.

Amid the decline following earnings, Netflix's shares entered the territory of a Morningstar Rating of 4 stars and are now the most undervalued they have been since 2014. Walt Disney DIS and Warner Bros. Discovery WBD both represent better investment opportunities than buying Netflix's stock because of their more diversified business models and their sources of revenue and cash flow, Macker says.

The growth in Netflix subscribers during pandemic-related lockdowns masked some underlying trends that are now being laid bare. Recent price hikes for Netflix’s video services amid increasing options, including Disney+ and Hulu, are to blame for some of the loss in subscribers.

The practice of password-sharing within household accounts could account for an estimated 100 million in potential, missed subscribers. Hastings said that fewer purchases of so-called smart televisions factored into the loss of subscribers as most of its viewers watch on TVs rather than mobile devices. Moreover, about 700,000 accounts were lost when the company shuttered its service in Russia following the Ukraine invasion.

Netflix is testing ways to monetize the “sharing” and reduce the amount of freeloading. And for the first time, Netflix is considering a lower-priced service that would include advertising, which would support revenue growth while providing consumers with more choice.

It will continue to spend heavily on content development.

“Our plan is to reaccelerate our viewing and revenue growth by continuing to improve all aspects of Netflix--in particular the quality of our programming and recommendations, which is what our members value most,” Hastings told shareholders. “We’re doubling down on story development and creative excellence.”

In the future, expect more of its growth to come from overseas, where it is focused on developing local programming along the lines of its popular South Korean production Squid Game.

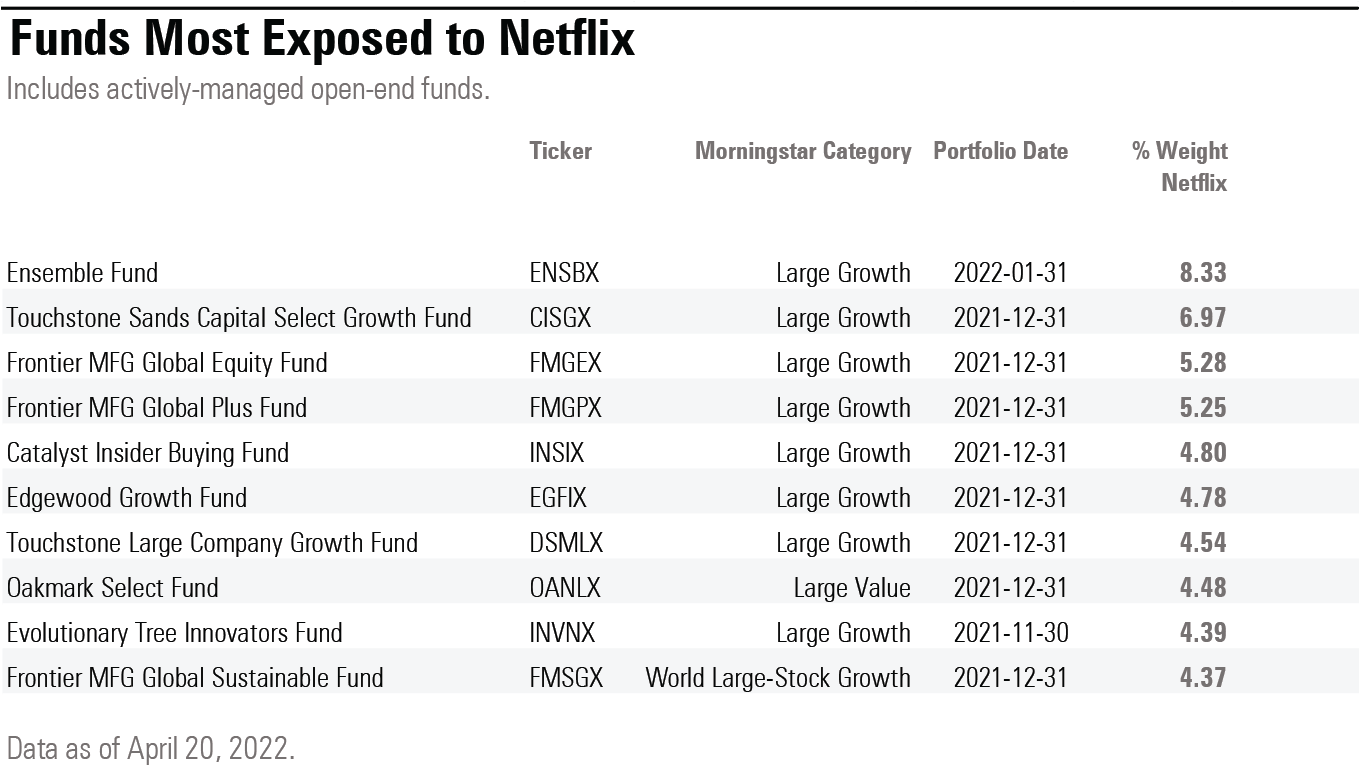

Bill Nygren, manager of the Oakmark Fund OAKMX and Oakmark Select OAKLX offerings from Harris Associates, was disappointed in the quarterly results but is still a fan of the company.

“With a market multiple of 20 times trailing earnings per share, it looks reasonable,” Nygren says. “The market is pricing it as if it will never grow again. The stock looks cheap against all its peer group. It’s dominant in the industry, well managed, with a strong moat, and its management is excellent.”

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)