The Worst Robo-Advisors of 2022

These six providers receive Low or Below Average scores from Morningstar.

Morningstar's first Robo-Advisor landscape report doesn't just identify the best options for investors; it also warns them against the worst ones.

Titan is the only provider to receive a Low overall assessment, while UBS Advice Advantage, Morgan Stanley Access Investing, E-Trade Core Portfolios, Merrill Edge Guided Investing, and Wells Fargo Intuitive Investor all come in at Below Average.

Although each of these robo-advisors has strengths, weaknesses overshadow. Steep fees are a problem for four of the six, insufficient portfolio disclosures afflict three of them, and three are navigating acquisitions that create uncertainty. Here, we take a close look at each to help investors understand why these offers score poorly in our assessment. You can also explore our assessments of all the leading providers in our guide to robo-investing.

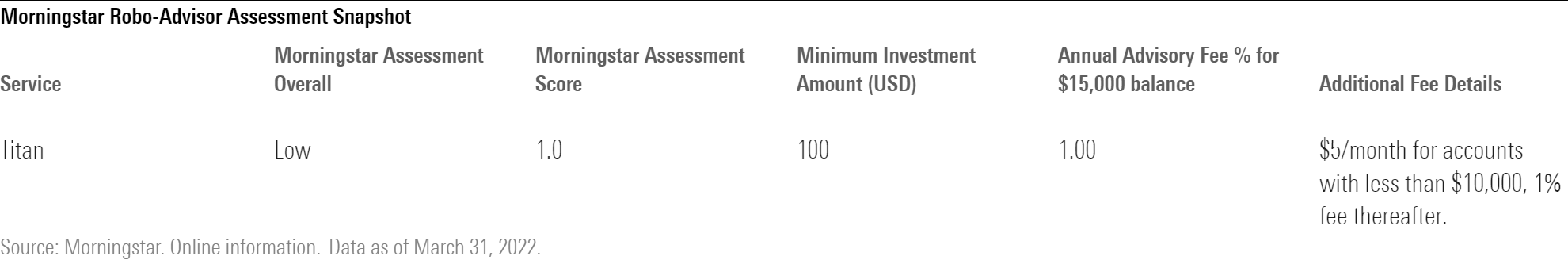

Titan | Low (1.0/5)

Titan’s aggressive investment platform, narrow focus, and relatively unproven management render it the least attractive robo-advisor among those we surveyed.

Titan is defined as much by what it isn’t as by what it is. It is not a holistic financial planner, nor does it intend to be. It does not provide tax advice, nor does it typically manage its portfolios with regard for tax consequences, which means rebalancing portfolio allocations among its volatile equity and cryptocurrency strategies can result in big tax bills for clients investing in taxable accounts.

To the extent Titan proffers advice, it is in using client information to place them in aggressive, moderate, or conservative stock portfolios, distinguished only by the percentage of assets each hedges: 0%, 5%, and 10%, respectively, when not in a market downturn, and 5%, 10%, and 20% during one. It is not clear how Titan differentiates a hedge-worthy downturn from normal volatility or avoids selling at a low to increase the hedge when it should be buying. The notorious challenge of market-timing—an approach that often fails—only raises further questions.

Titan portfolios’ long exposure comes from four concentrated, actively managed options. Its three equity strategies invest in 15 to 25 stocks each, with Flagship focusing on U.S. large caps, Opportunities on U.S. small- and mid-caps, and Offshore on non-U.S. companies. Crypto, which holds five to 10 digital currencies, rounds out the offer.

Titan doesn’t disclose much detail about its investment team, but depth of investment management experience seems wanting. The two cofounders with investing experience each have less than five years of experience as long-short generalists for hedge funds, and the third cofounder has worked at early-stage growth companies for the past decade. Only in July 2022 will CIO Clayton Gardner hit a decade in the industry.

Investors could do worse than Titan. Compared with the long-short equity Morningstar Category's 1.73% median expense ratio, it is cheap: charging $60 per year for accounts with less than $10,000 and 1% of assets for accounts with more. But compared against robo-advisors, the latter fee is the highest in our survey.

Titan’s problematic marketing also stands out. Some aspects, such as daily investing insights, are helpful. Others, like branding itself as a pocket hedge fund and likening mutual funds to VHS, obscure Titan’s lack of innovation: It offers little more than aggressive, concentrated portfolios, which are not new and tend to be difficult to use well.

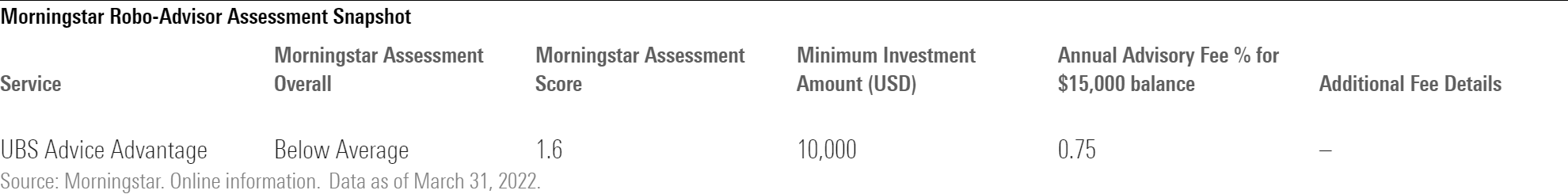

UBS Advice Advantage | Below Average (1.6/5)

Hefty costs, steep account minimums, and poor transparency are significant negatives for UBS Advice Advantage.

The program’s 0.75% annual fee makes this offering among the priciest robo-advisors we evaluated. Those fees are in addition to the expense ratios for the portfolios’ underlying funds, which are difficult to determine because UBS does not disclose them. A high account minimum of $10,000 also makes this program less accessible to entry-level investors.

UBS Advice Advantage debuted in 2018 as a standard robo-advisor that provides access to a financial advisor and leverages SigFig’s algorithm. The program offers investment advice, custody, trading/execution, and performance reporting. Investors can choose from five different portfolio risk levels based on a standard risk-tolerance questionnaire. UBS is responsible for the development and maintenance of the model portfolios and uses the algorithm for ongoing monitoring, rebalancing, and tax-loss harvesting. Portfolio allocations are based on UBS’ capital market assumptions, strategic asset allocations, and covariance estimates. However, key executives listed in a recent regulatory filing are all part of UBS’ larger Wealth Management platform, so it is unclear whether this program has a dedicated investment management team. That’s on top of UBS’ failure to disclose publicly its program’s asset classes or underlying funds.

On the positive side, UBS Advice Advantage includes access to financial advisors as well as portfolio diagnostics that incorporate outside holdings. However, the access and diagnostics seem to play a secondary role within the larger UBS universe and serve partly as a funnel for higher-cost advisory services. With a disappointing amount of available public information, little credit can be given to this offering. Its future is also now uncertain with UBS Group’s UBS early 2022 agreement to acquire the well-respected robo-advisor Wealthfront.

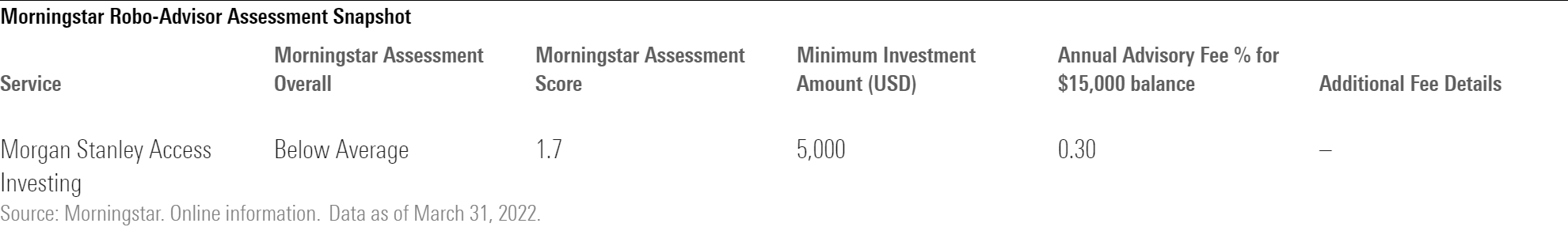

Morgan Stanley Access Investing | Below Average (1.7/5)

Morgan Stanley Access Investing is a complicated service with an uncertain future.

At first glance, the program looks reasonable enough. The 0.30% investment advisory fee is in line with its typical rival, but the firm tarnishes its offering by providing access to high-cost mutual funds without waiving their underlying fees. The Market Tracking ETF portfolios use a standard mix of low-cost exchange-traded funds for their portfolios, but both the Impact and especially the Performance Seeking portfolios include higher-cost options. The Frontier Markets theme, for example, invests in a mix of funds with a steep 0.57% average expense ratio, thanks in part to a heavy investment in Harding Loevner Frontier Emerging Markets HLFMX at the cost of 1.62%.

The program’s portfolio options may also be too complex for investors to use effectively. The firm provides three types: Market Tracking portfolios are made up of low-cost, passively managed ETFs; Impact are composed of slightly more expensive funds and ETFs branded with an environmental, social, and governance focus; and Performance Seeking consist of a mix of active and passive funds across sectors. Investors who opt for the Impact and Performance Seeking portfolios can choose niche funds focusing on certain themes, such as data, artificial intelligence, and clean water. Such funds have been in vogue lately but have questionable utility for long-term investors.

The program’s five risk tiers (aggressive to conservative) are standard, but portfolio allocations can be counterintuitive for investors who opt for various themes. Inflation-conscious investors, as one example, get high Treasury Inflation-Protected Securities allocations for more-aggressive portfolio risk levels and smaller allocations for conservative risk levels. Further, there doesn’t appear at first glance to be a separate taxable or tax-free allocation; all portfolios default to options that appear, in some cases, subject to potentially high capital gains.

Morgan Stanley’s investment management resources are substantial, but it is not apparent if they are applied well here; the firm declined to provide details about this offering. More important, the firm purchased E-Trade in February 2020, which has its own suite of brokerage and robo-advisor services. It is not clear how this service may change as the two firms continue to integrate their operations.

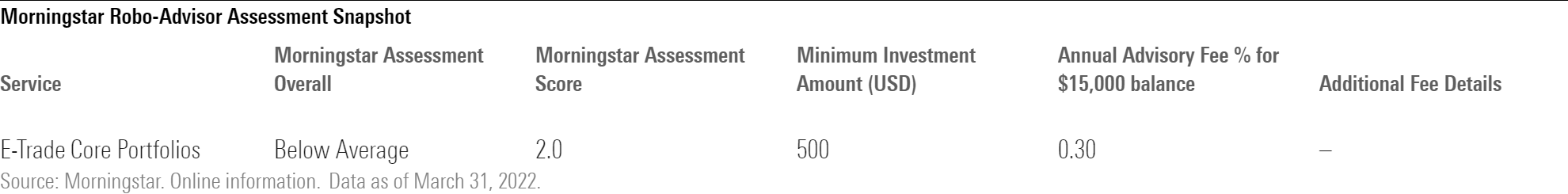

E-Trade Core Portfolios | Below Average (2.0/5)

E-Trade Core Portfolios meets industry standards in some respects, but a lack of transparency renders it inferior to most robo-advisors.

The program’s 0.30% annual asset-based advisory fee is in line with most competitors’, but it does not include the underlying ETFs’ expense ratios. Because the firm doesn’t divulge which ones it uses or their relative weightings, it is impossible to calculate total costs. Those could add another 5 to 25 basis points of fees, depending on whether investors choose a standard, sustainable, or smart-beta portfolio.

Insight into portfolio construction could be better. There is little public information about what the program invests in or the rationale for the portfolios’ allocations and investment selections. The portfolios currently use third-party ETFs exclusively, although the wrap fee program brochure notes that E-Trade reserves the right to expand the universe of portfolio managers to include products affiliated with Morgan Stanley, which acquired E-Trade in October 2020. ETFs are selected based on a quantitative screening methodology that incorporates historical performance, expenses, tracking error, and liquidity.

The program offers both retirement-focused portfolios and tax-sensitive portfolios that invest in municipal-bond ETFs. In addition, investors can opt into smart-beta or ESG-focused portfolios. E-Trade uses a standard drift rebalancing methodology, which involves making portfolio shifts whenever the portfolio floats away from its target allocation. It also employs a calendar rebalancing feature whereby accounts enrolled for at least six months are automatically rebalanced semiannually.

Breadth of services is lacking. Investors can only invest toward a single goal, and there is no tax-loss harvesting feature or tax location guidance. Investors also do not have access to advisors or benefit from account aggregation. Proactive client communication seems to be limited to monthly email updates, though clients do have access to other E-Trade communications and educational materials.

It is not clear what Morgan Stanley’s October 2020 acquisition of E-Trade means for this service. So far, though, E-Trade’s offering does not stand out.

Merrill Edge Guided Investing | Below Average (2.3/5)

Launched in 2017, Merrill Edge Guided Investing is a pricey bridge between Bank of America’s legacy self-directed investing platform and Merrill Lynch’s full-service financial advisors. It also offers a limited feature set, and there are cheaper and better options elsewhere, in our view.

Clients with total assets of $20,000 or less can expect to pay the offering’s full 0.45% advisory fee, which is 15 basis points more than the median of robo-advisors we surveyed. Those in the bank’s Preferred Rewards program pay less as they accrue assets, but fees only level off at the 0.30% median for balances of $100,000 or more.

Portfolio construction appears fairly standard, but there are a few sticking points. The firm offers five levels of risk tolerance, with tax-aware and tax-free options as well as an ESG suite for each of these risk levels. However, the firm’s risk-tolerance questionnaire is less detailed than most. Indeed, time horizon and starting/ending money goals appear to be one of the major inputs to determine an investor’s target risk portfolio, which can’t be overridden.

Merrill Edge tilts its portfolios—composed almost exclusively of low-cost ETFs—toward certain asset classes, such as value stocks, and away from others based on firmwide capital market assumptions. These active asset-class decisions add uncertainty as they could help or hurt in any given year. In addition, riskier high-yield munis are used as a supporting allocation, and the Impact/Sustainability portfolios do not have a tax-aware version, making their suitability for a taxable portfolio questionable.

Service breadth is also an issue. While Merrill Edge’s broader brokerage platform allows for integrating external accounts for portfolio analysis, this data isn’t aggregated into the robo-advisor itself and must be manually inputted. More-complicated features like tax-loss harvesting aren’t available, and access to an advisor is locked behind a significantly more expensive premium tier, which starts at 0.85% per year and drops to 0.70% for accounts with at least $100,000.

Ultimately, this robo-advisor seems like an afterthought within Merrill Lynch’s wealth-management empire. The firm’s self-directed brokerage platform offers educational resources (ranging from college savings calculators to in-depth market reports from Bank of America Global Research), but these aren’t directly available in the robo-advisor area of the site, which has only a few basic articles about saving and investing. Worse still, features that are available elsewhere within Merrill’s purview are not available here: Merrill offers its self-directed clients the option to open a 529 account, for example, but not through its robo-advisor program.

Wells Fargo Intuitive Investor | Below Average (2.4/5)

With uncompetitive fees, limited disclosure on underlying portfolio holdings, and an average breadth of services, Wells Fargo Intuitive Investor is not compelling.

Designed for customers who are already banking clients, the program’s 0.35% asset-based fee is 5 basis points higher than the median for robo-advisors we surveyed. The $5,000 investment minimum, while in line with traditional brokerage robo-offerings, is also a bit higher than most. Because Wells Fargo does not provide details about the underlying ETFs used, it is difficult to assess the total costs associated with the program.

Like UBS, Wells Fargo uses the proprietary portfolio management algorithm from SigFig for ongoing monitoring, rebalancing, and tax-loss harvesting. Investors can choose from Wells Fargo’s nine investment portfolios based on their answers to a risk-tolerance questionnaire. The suggested asset-allocation strategies are proprietary to Wells Fargo and include a series of nine portfolio risk levels, with each composed of seven to 11 ETFs. Portfolio allocations look reasonable, with minimal cash allocations and adequate exposure to major asset classes.

Access to a financial advisor at no cost seems to be the only feature that stands out as a clear advantage. The offering seems to play a strategic role within the larger Wells Fargo universe to bring in new investors for other opportunities. Although information provided about the program’s approach to portfolio construction has improved in recent months, the service remains anything but intuitive, with no information available on the underlying funds or holdings prior to enrolling.

Correction: This article was updated to remove an incorrect advisor for E-Trade Core Portfolios.

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)