Income-Oriented Model Portfolios in 8 Charts

Focusing primarily on income often leads to subpar returns, but a few income-oriented models are Morningstar Medalists.

Investors' search for consistent income without exposure to higher volatility has only gotten harder over the past decade.

Stretching for yield has caused many investors to venture into riskier asset classes to make up for the income shortfall they would experience from safer assets. To damp the additional volatility while staying focused on the goal to maximize income, asset-allocation managers have been combining multiple higher-yielding asset classes, like dividend-paying stocks and high-yield bonds, into a single portfolio.

As of March 2022, asset managers reported over 100 of these income-oriented model portfolios to Morningstar. In our recently published "A Framework for Evaluating Income-Oriented Model Portfolios," we touch on those models' risk management, explore their income reliability, and share our top picks for income-oriented model portfolios.

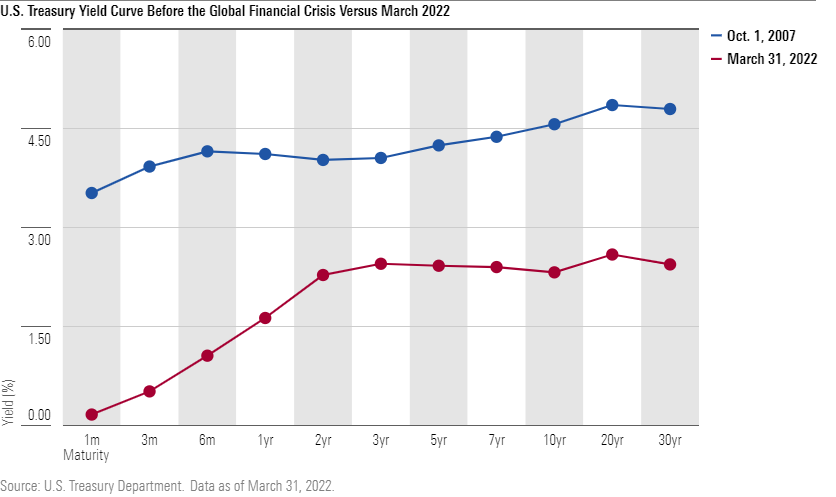

U.S. Treasury Yields Still Lag Those From Before the Financial Crisis

Safe-haven investments like certificates of deposit, money market funds, and U.S. Treasuries offer a fraction of the income they did prior to the 2007-09 global financial crisis. For example, the average money market fund had a yield above 4.00% in October 2007 but less than 0.04% in mid-March 2022.

Even with the prospect of the Federal Reserve hiking short-term interest rates several times this year, the chart below shows that yields across the U.S. Treasury curve, and other safe investments, are still well below their pre-financial-crisis levels.

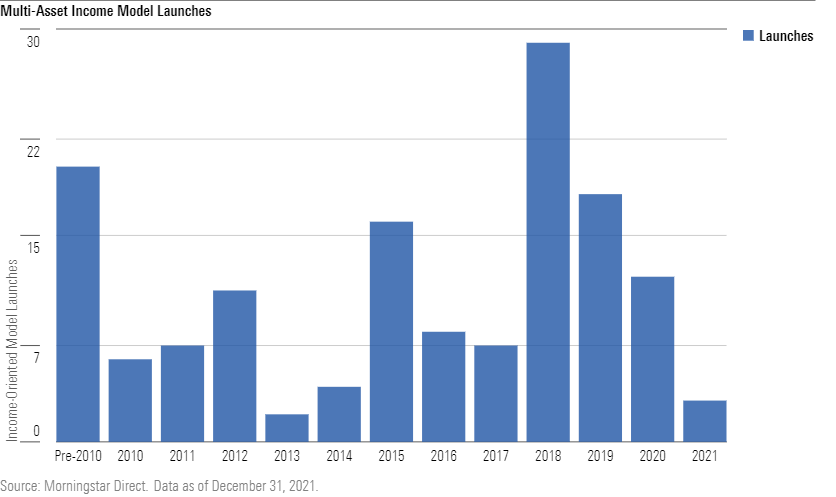

Income Model Portfolio Launches Surge in the 2010s

Over the past decade, there's been a sharp uptick in the number of income-oriented model portfolios launched and reported to Morningstar. (We note that model portfolios are voluntarily submitted, so our sample size may not be complete.)

The chart below shows that more than 60 income-oriented models have been launched since 2018, which is more than 42% of the 143 income-oriented multi-asset models that now report to Morningstar. There is typically a 12- to 18-month lag between when models launch and when they are first reported to Morningstar, so there is the risk of selection bias in our sample group. That may partially explain why only three new models were reported in 2021.

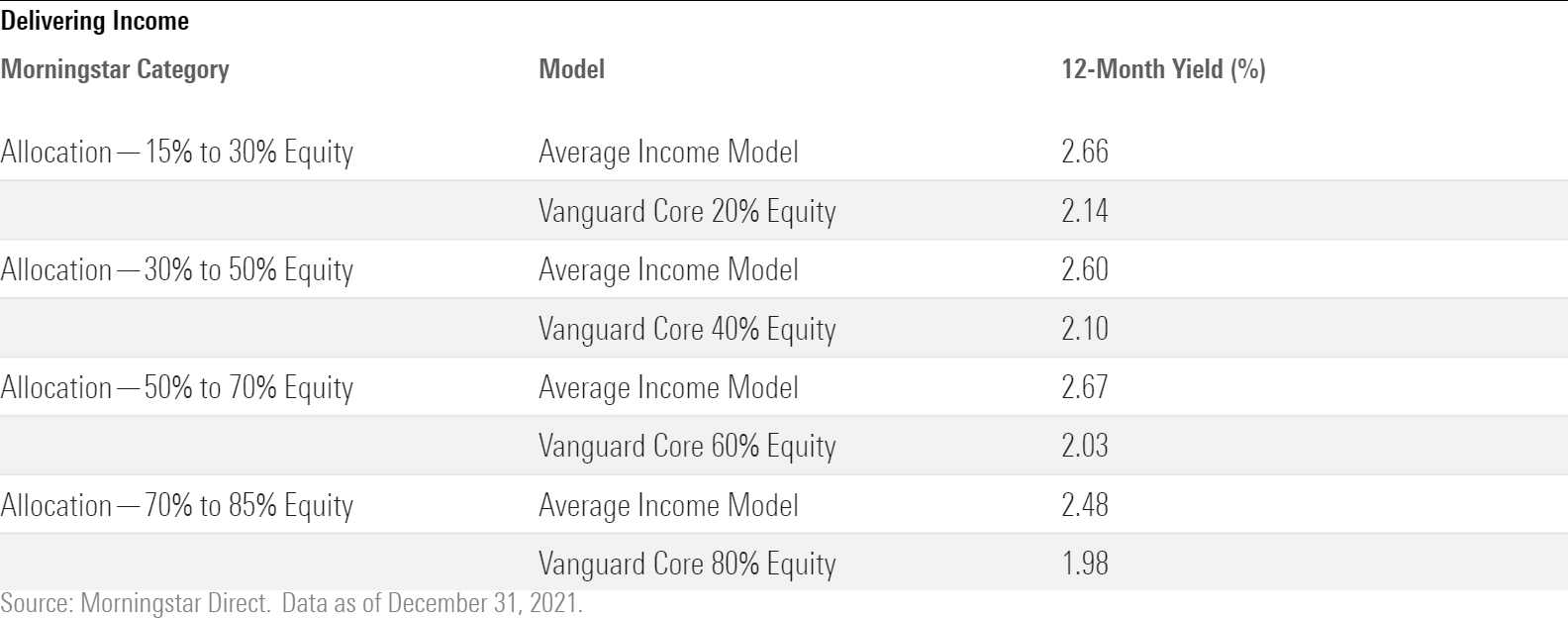

Finding Income Is the Easy Part, Diversification Is the Hard Part

Income-oriented model portfolios have stayed true to their name by providing high levels of income relative to the interest-rate environment. As you can see below, in most cases, the average income-oriented model portfolio outperformed its comparable Vanguard Core model portfolio by around 0.5%.

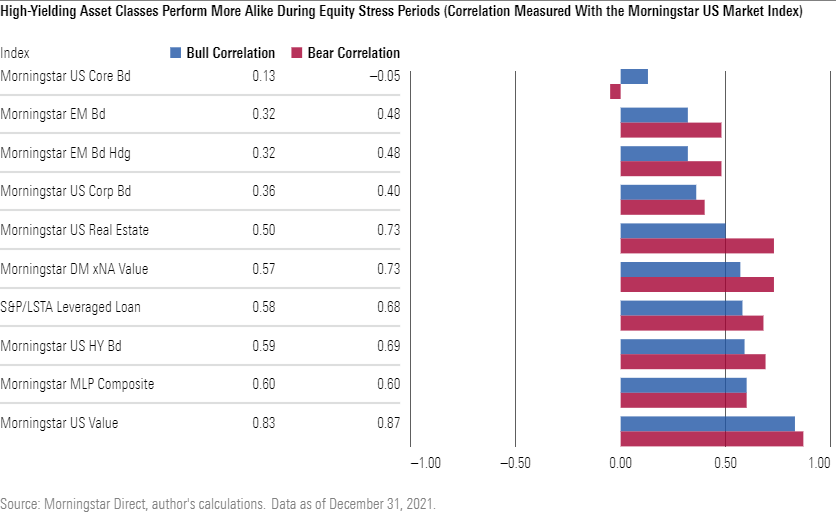

Yet, as economic uncertainty has become more global than local in nature, the correlations of high-yield corporate bonds, emerging-markets debt, and other common high-income asset classes to equities have often increased during stock market selloffs. The table below illustrates that this phenomenon, "contagion" risk, is more common in income-based portfolios than traditional asset-allocation portfolios.

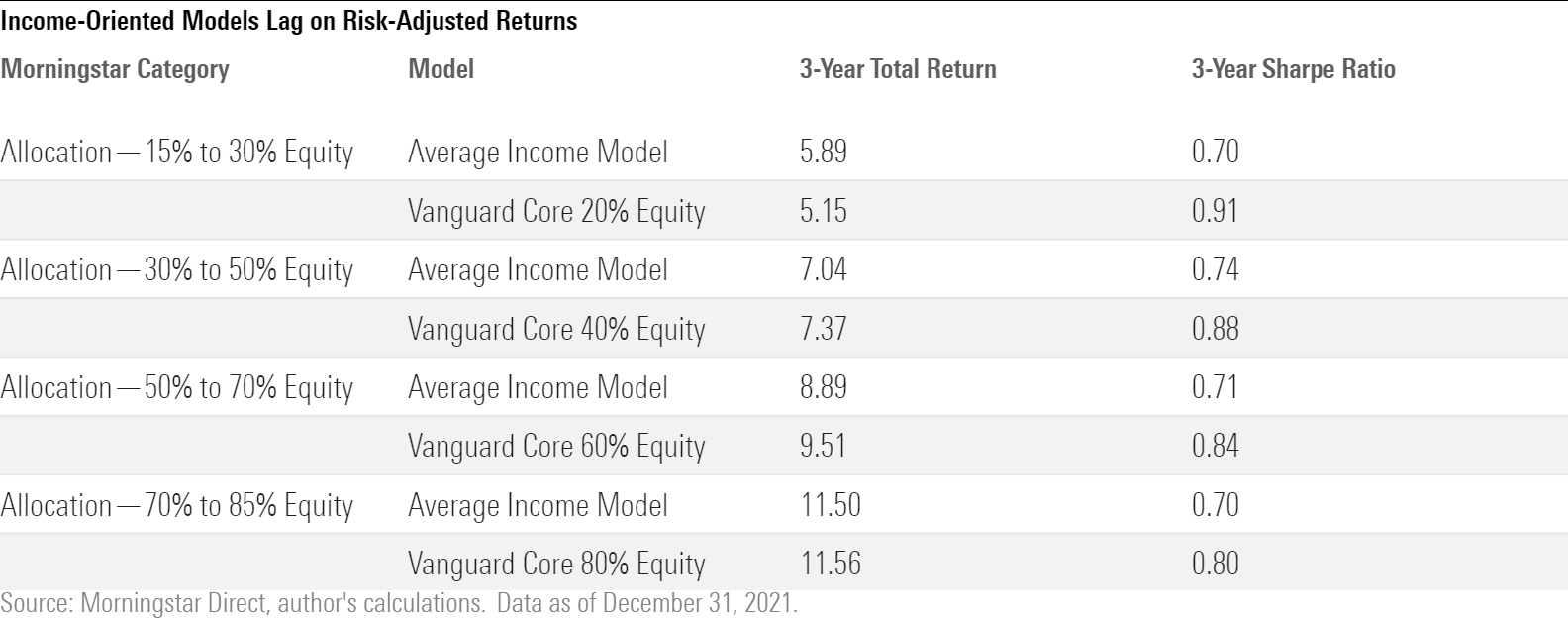

Income Funds Have Had Worse Risk-Adjusted Returns

Outside of equities, the other asset classes lacked the resilience of U.S. Treasuries during stock market turbulence.

They exhibited a higher correlation to stocks during months with negative stock returns than during months with positive returns. These increased correlations, in turn, reduce the diversification benefits of combining multiple high-income asset classes in a single portfolio during periods of stock market stress, particularly compared with traditional portfolios that hold core bond funds with U.S. Treasuries.

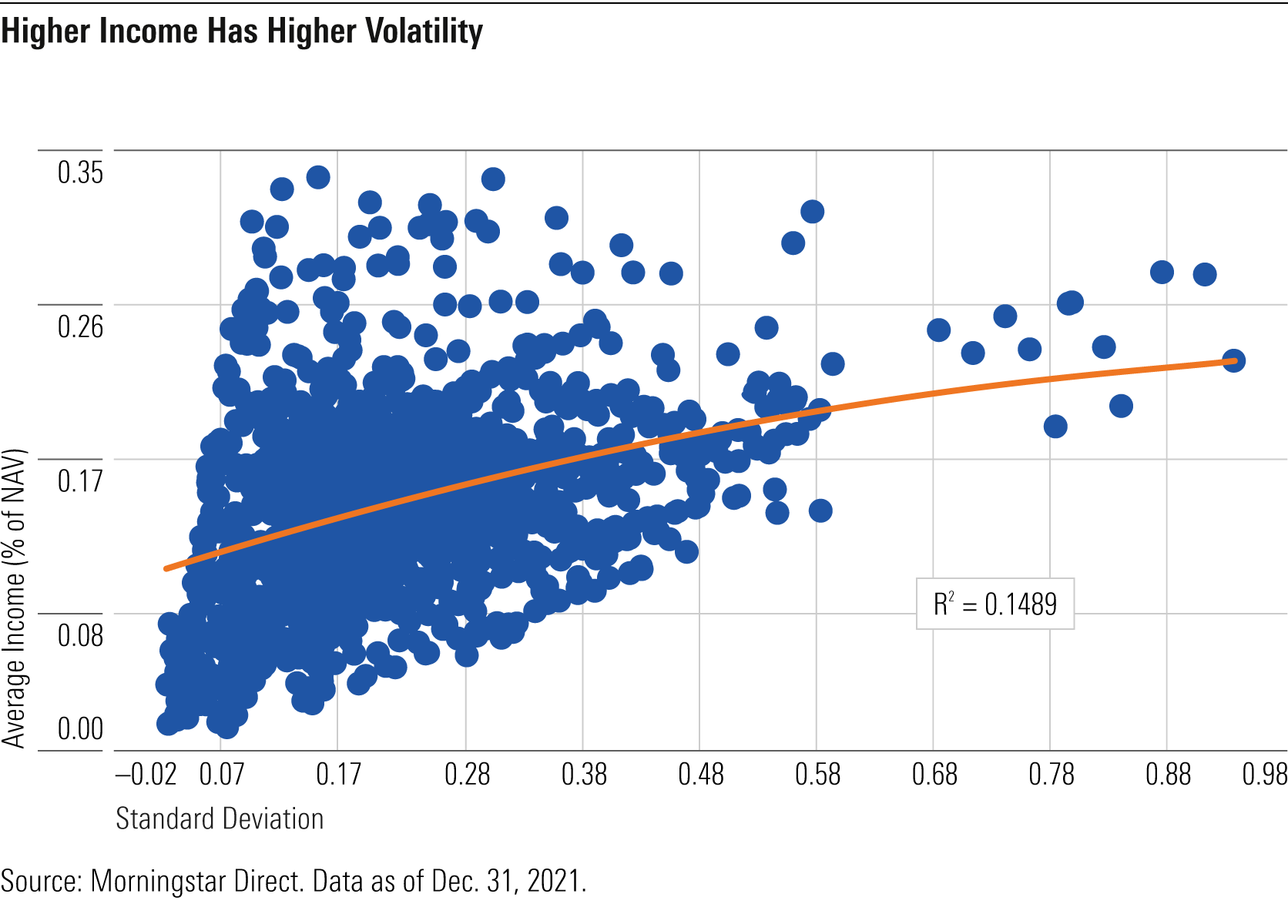

Higher Potential Income Means Less Consistent Income

Just as higher average returns are often more volatile, income payouts from these model portfolios show a positive relationship between the average income distribution size and the volatility of those income distributions.

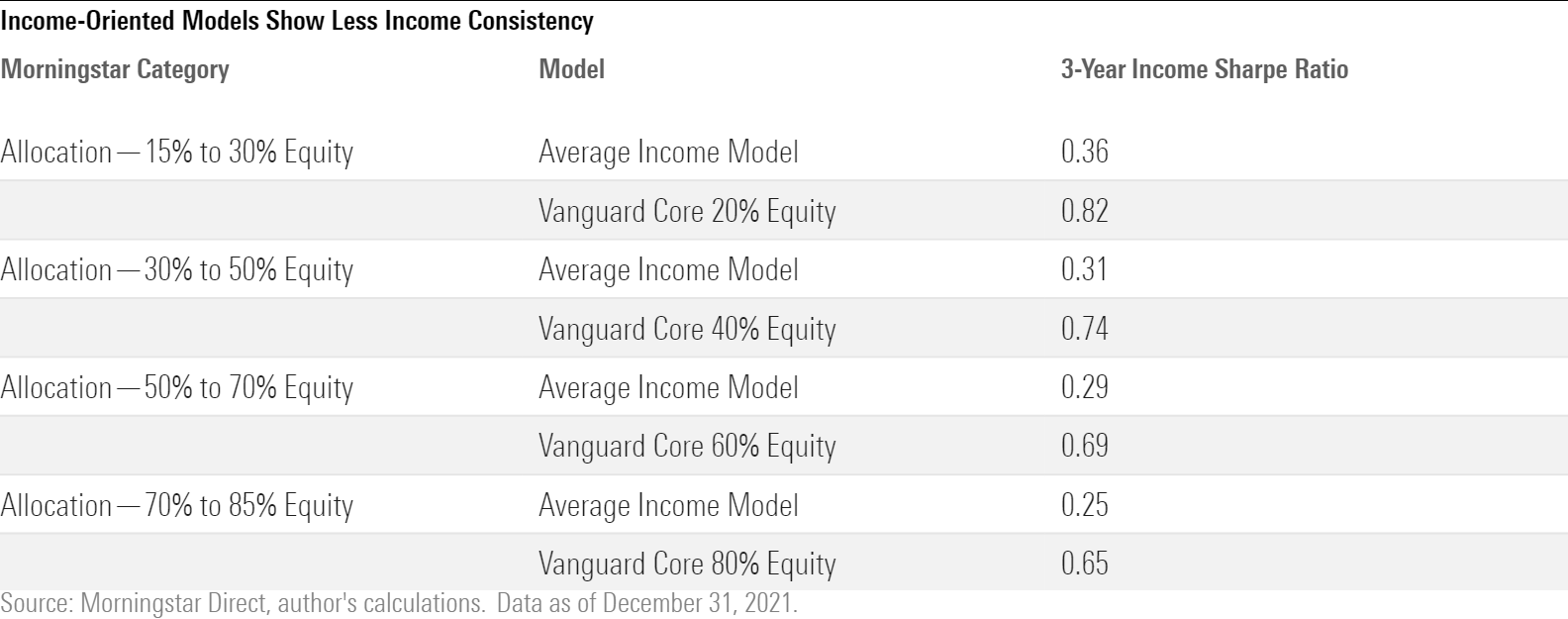

A Better Way to Evaluate Income Consistency

Higher potential income comes with higher income volatility, on average, but that income volatility appears only minimally correlated with overall returns and return volatility.

At the same time, as shown in the previous chart, income distributions and income volatility have a positively convex relationship with one another, like returns.

We can use some of the same performance metrics in the income space as we do in the returns space to capture risk-adjusted performance. In this spirit, we calculated a "raw income Sharpe ratio." In the way that a higher Sharpe ratio indicates better returns relative to its risk, a higher raw income Sharpe ratio indicates better income consistency relative to risk.

Although the Vanguard Core models have lower overall income, as we highlighted earlier, the table below shows that their distributions have been more consistent than the average income model over the period evaluated. Consistent income gives investors confidence they will be able to set and maintain regular spending habits.

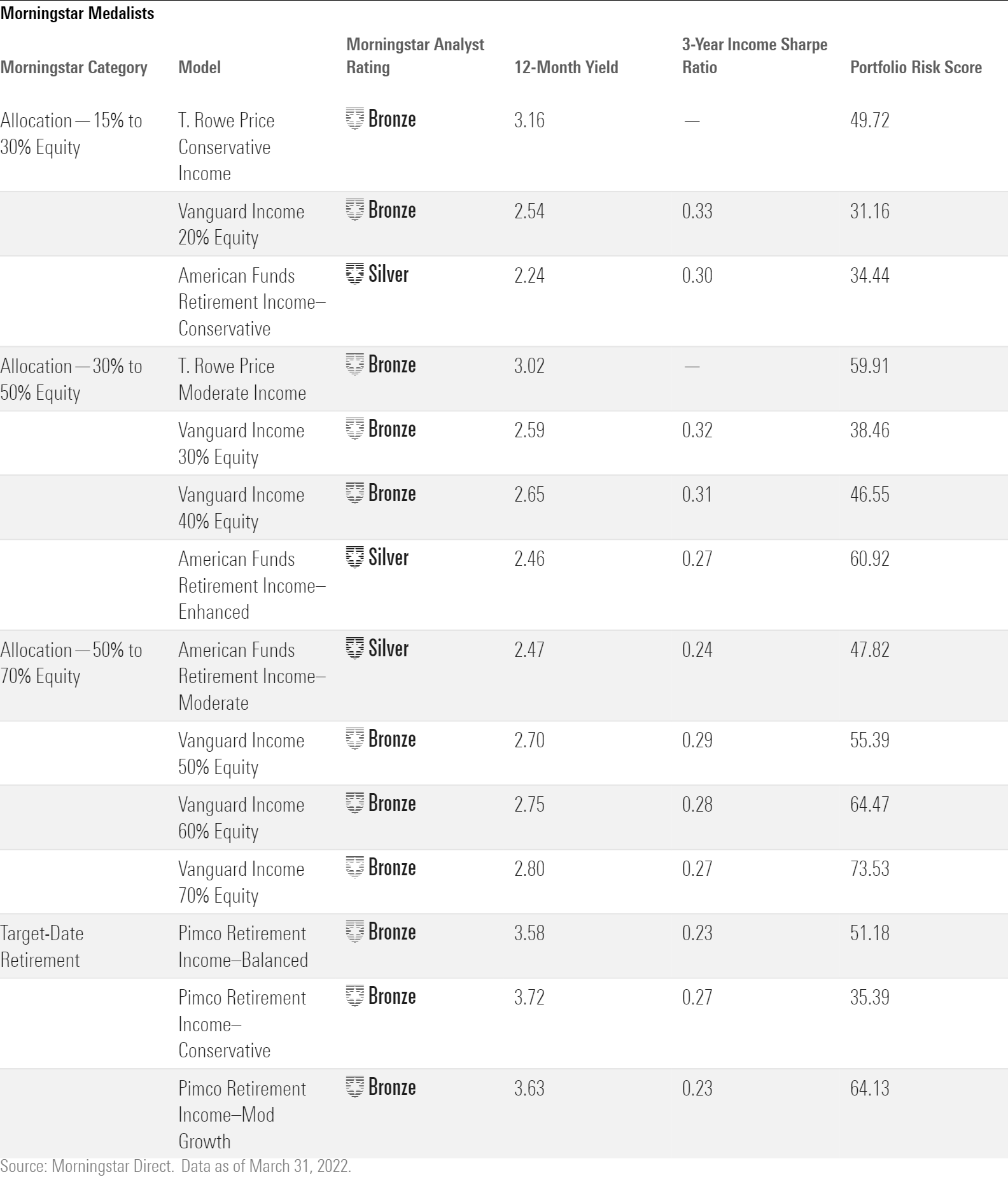

Morningstar's Picks for the Best Multi-Asset Income-Oriented Model Portfolios

Morningstar Analyst Ratings reflect our view of a model portfolio's likelihood of outperforming its Morningstar Category index on a risk-adjusted basis over a full market cycle. We do not specifically consider income other than as a component of a portfolio's total returns. As we've highlighted here, focusing primarily on income often leads to subpar risk-adjusted returns. As a result, few income-oriented model portfolios are Morningstar Medalists.

Below, we've mapped out each model's most recent asset-weighted 12-month yield and income Sharpe ratio. For models with at least a three-year track record, we've also included each model's Morningstar Portfolio Risk Score. The higher the Morningstar Portfolio Risk Score, the higher a model's level of risky assets as compared with its average category peer. This score can offer a better sense of a portfolio's expected risk than the allocation to stocks alone.

/s3.amazonaws.com/arc-authors/morningstar/31069962-a596-4b9a-abf7-079fbbeb77ed.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a9934929-bc1b-4947-9568-208bd9d6ba90.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/31069962-a596-4b9a-abf7-079fbbeb77ed.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a9934929-bc1b-4947-9568-208bd9d6ba90.png)