Introducing the New Digital Assets Morningstar Category

Responding to growth in new products, Morningstar will launch a Digital Assets Morningstar Category in April 2022.

Digital assets are still in their early stages, yet the investment universe is ripe with innovation. Morningstar is taking steps to provide tools for tracking and analyzing the group of funds more uniformly. At the onset, the new category will act as a holding pen for the wide variety of digital-assets funds. As the category grows and asset managers become more specialized in their approaches, we expect that the category will evolve. Given that, the category will not be rated or ranked and will only capture U.S.-domiciled vehicles. It will feature several funds that invest in digital assets via the spectrum of access points—exchange-traded funds, mutual funds, hedge funds and trusts.

What Are Digital Assets?

To qualify for inclusion, funds in this category must have a material portion of risk coming from digital assets. Our definition purposely is not limited to alt coins but rather seeks to ensure we capture more of the investment universe.

Digital assets that utilize blockchain technology can be described as an immutable, permissionless, and often decentralized digital database. Digital-asset portfolios will invest the majority of their assets in, and risk will arise from, one or more broadly classified areas, including decentralized finance assets, stable coins, currency assets, smart contracts platforms, exchange assets, privacy assets, yield farming, and nonfungible tokens, or NFTs, among others. Digital assets are often characterized by two risk style factors: momentum and volatility. Portfolios may gain access to digital assets through physical or derivative exposures and incorporate both long-only investments and other hedging techniques.

Category Constituents

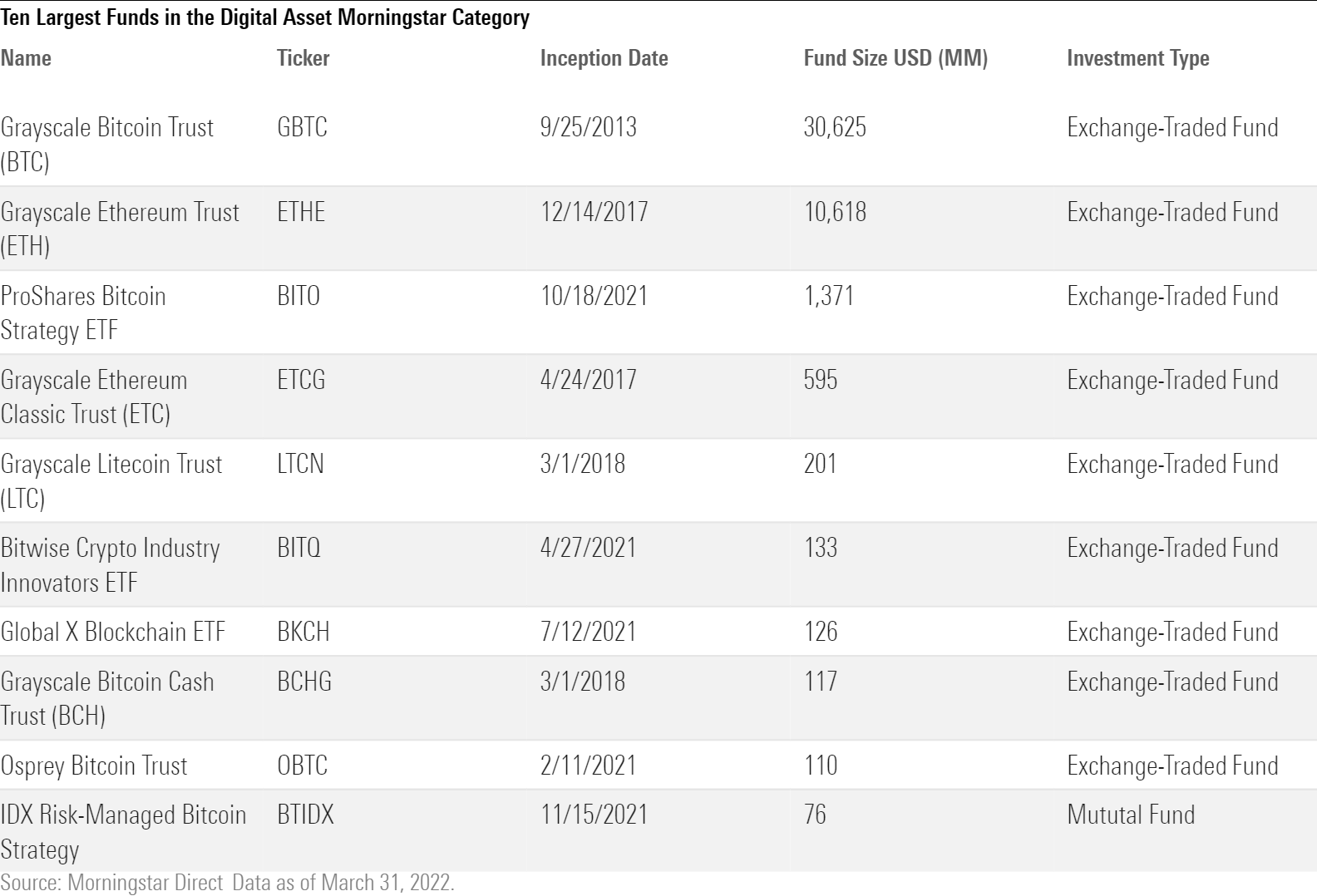

The category will be made up of 20 to 25 trusts and ETFs, about 10 hedge funds, and a handful of models and separate accounts. Most of these funds are simple buy-and-hold cryptocurrency coin strategies. There are also a handful of thematic strategies that invest more broadly across the digital-asset spectrum in areas such as crypto-mining-related holdings and other blockchain-related technology.

Open-end vehicles and trusts provide the most robust data, but the constituents, perhaps less aware of data capture provisions, offer far less clarity than the open-end vehicles at this stage. Grayscale currently dominates in asset terms; its Bitcoin Trust GBTC and Ethereum Trust ETHE are by far the largest strategies within the new category at over $25.5 billion and $9.2 billion, respectively, at March 31. The next largest fund is ProShares Bitcoin ETF BITO at over $1 billion. We’ve previously highlighted the challenges with Grayscale’s structure, and we’ll continue to keep a close eye on this strategy’s performance relative to its new category peers.

Future Expectations

By grouping these funds within the new category, we aim to allow investors to track fund launches, strategy closures, fund flows, fee trends, and general performance by way of a category average. We expect further product issuance will offer a higher degree of active trading across multiple digital-asset types rather than those that simply buy-and-hold single digital assets such as a specific coin and that this new issuance will comprise the bulk of the category’s assets over time.

At present, the United States will be the only region with a Digital Assets category. Both Canada and Australia have 10 or more products that would fit the criteria but sit within “Other” in their respective Alternative categories at this stage. Canada has a much higher quality of data.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)