The Best Small-Cap Funds of 2022

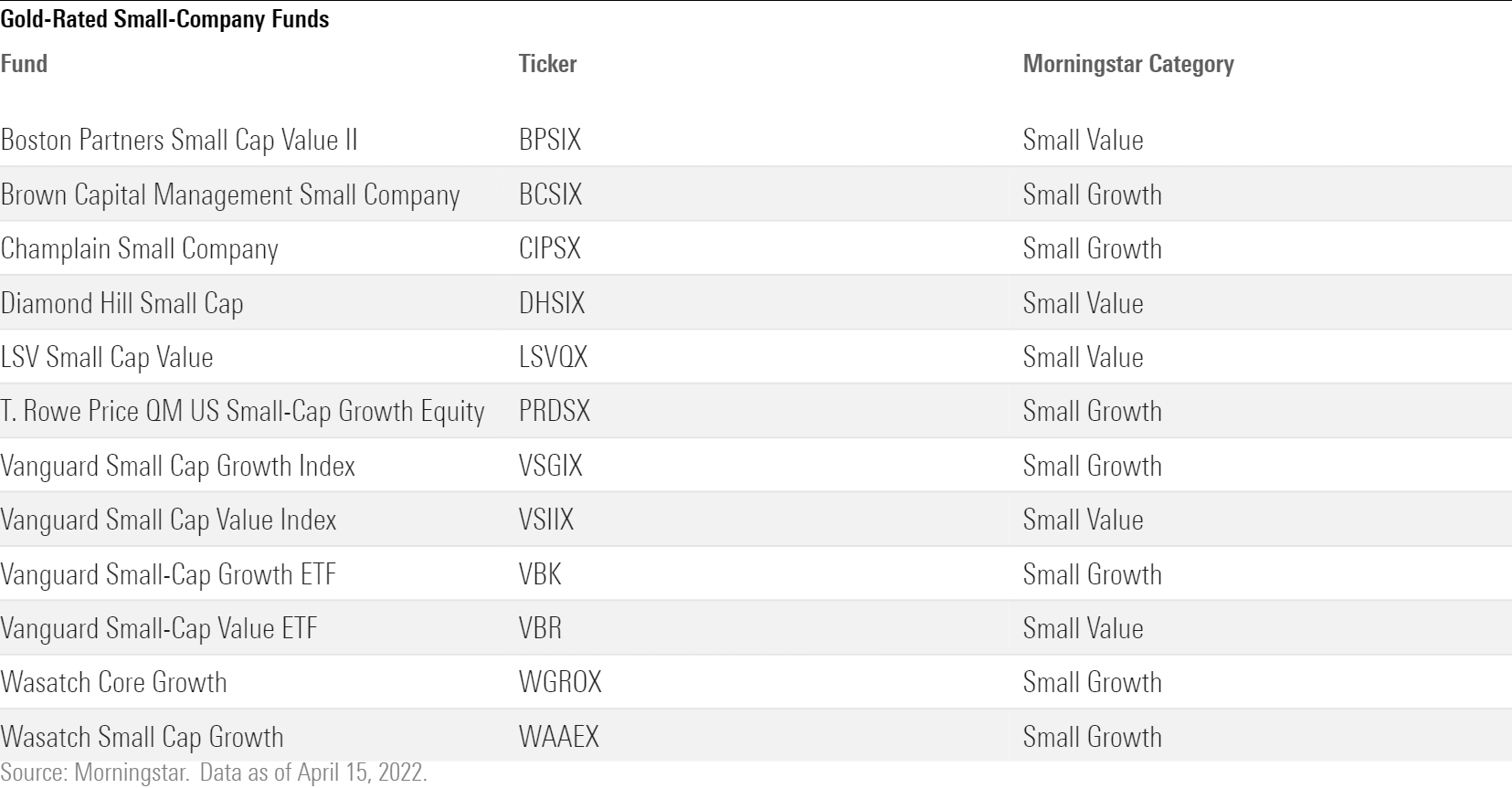

These mutual funds and ETFs focus on small-company stocks and earn Morningstar Analyst Ratings of Gold.

Investors gravitate to small-company stocks for a couple of reasons. Some want a small dose of small companies in their portfolios to round out their exposure to the large-company stocks that dominate the market. Other investors may want to tilt their portfolios toward small caps after a period of large-cap outperformance, such as we've seen during the past several years.

Before adding a small-company stock fund to your portfolio mix, though, make sure you don't already have plenty of exposure to small-company stocks through your core stock funds; Morningstar's Instant X-Ray feature can help you determine your portfolio's current small-cap stock stake. While there's no "right" allocation to small-company stocks, the Morningstar Lifetime Allocation Indexes (which you can use to benchmark your asset allocation) suggest up to a 12% position in domestic small caps, depending on your life stage.

If you find you are, in fact, lighter in small-company stocks than you'd like, you can turn to our shortlist of the best small-cap mutual funds and exchange-traded funds—those funds with at least one share class earning a Morningstar Analyst Rating of Gold—for ideas to investigate further.

You'll find both passive funds and active funds on our list of Gold-rated small-company funds. Passive strategies have several things going for them. First, of course, is their cost advantage: All of our Gold-rated index funds carry below-average expense ratios, which give them a lower hurdle to jump over to generate returns. Moreover, index funds tend to be more tax-efficient than active funds, which is a benefit for investors in taxable accounts. Finally, index funds are less threatened by asset growth than active funds.

That being said, the small-cap part of the market is an area where some active managers have been able to add value versus their respective indexes. But investors who are considering active funds, take note: Several of the active funds on the list are closed to new investors. It's not surprising that some of the active Gold-rated funds are closed: Capacity is critical for many small-cap funds to maintain their approaches. As such, the best small-cap funds may close or otherwise limit new investment on occasion to keep their focus intact. You can find out whether a fund is limiting new investment by taking a look at its report on Morningstar.com; check the "Status" data point on a fund's Quote page.

Dig deeper: Why a Fund Closes and Reopens (and Why It Matters to You)

Whether you favor an index fund or an active fund, the Gold-rated funds on our list focus either on growth stocks or value stocks. There's not a single Gold-rated fund that blends both styles. So what can investors do if they want broad-based exposure to both small-growth stocks and small-value stocks? One option would be to combine one of the active or index funds from the small-growth Morningstar Category with one of the active or index options from the small-value category. Investors who prefer to invest in just one fund that covers the small-company stock waterfront, however, can delve into Silver- and Bronze-rated small-cap funds. Premium Members of Morningstar.com can access a full list of all small-cap mutual fund Morningstar Medalists here and ETF medalists here.

Start your free 14-day trial of Morningstar Premium. Rely on the gold standard for mutual fund and ETF research. Unlock our analysts' ratings to see which funds we think will outperform.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)