What If Stagflation Arrives?

Many now foretell its return, after a 40-year absence.

3 Visits

The timing of today's headline is ironic, as only this past Friday I disparaged prophecies of economic doom. Consider, therefore, this article not as a prediction—indeed, the current forecasts of stagflation strike me as overstated—but instead as a form of investment preparation. In the unlikely event that the scourge of stagflation does appear, this column should provide some advance guidance.

By my reckoning, the United States has suffered three episodes of stagflation, which I defined as: 1) recession plus 2) an annual inflation rate that exceeds 7%. (Formal descriptions of stagflation all include economic contraction, but they do not stipulate a minimum inflation rate). The first instance of stagflation occurred from late 1973 through early 1975, the second during the first half of 1980, and the third from summer 1981 through late 1982.

Because the markets anticipate future economic developments, assessing investment results during the actual periods of stagflation is misleading. Security prices decline before the recession starts, then recover before it finishes. Thus, for this column, I have measured investment performance during stagflation from six months prior to a recession’s beginning to six months prior to its end.

The Big Bad

Stagflation first appeared when the Organization of Petroleum Exporting Countries imposed an oil embargo on the U.S., as the economy was already slowing. The twin shocks violated the tenets of the Phillips Curve, triggering both an unemployment rate that reached 9% and an inflationary surge, as well as gasoline lines that require a certain age to remember.

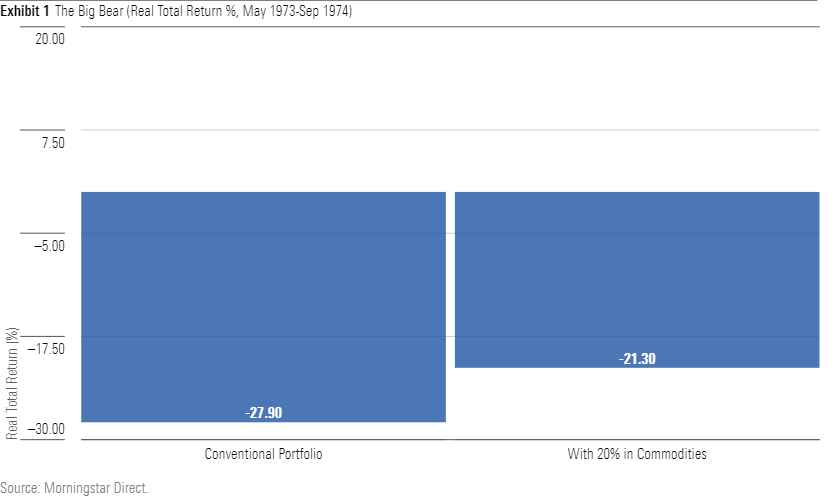

Traditional investments were caught out. Not only were equities shredded, but the usual haven during a recession—Treasuries—also lost value. (In contrast, although stocks fell even further during the Great Depression, Treasuries rallied.) The following chart depicts the after-inflation return over that period for: 1) a conventional portfolio, containing 50% large-company U.S. stocks and 50% intermediate-term Treasuries; and 2) a portfolio with a 20% commodities stake. Specifically, the latter invested 40% of its monies in large U.S. stocks, 40% in intermediate-term Treasuries, 10% in spot crude oil, and 10% in spot gold.

(The commodities positions aren’t realistic, as there were no commodities exchange-traded funds during the 1970s. Also, most current ETFs buy commodities futures, so they don’t precisely track spot prices. Thus, one shouldn’t treat these performances as correct to the final decimal point. They are, however, directionally accurate.)

Ouch! In less than two years, a staid portfolio that held half its assets in Treasury notes lost almost 28% of its real value. Now that was an unpleasant surprise. Replacing 20% of those securities with commodities eased the problem, but the strategy didn't come close to eliminating it. The stock-market losses were too large for the commodities to overcome, particularly as gold stagnated. Only energy generated an after-inflation gain.

Deja Vu

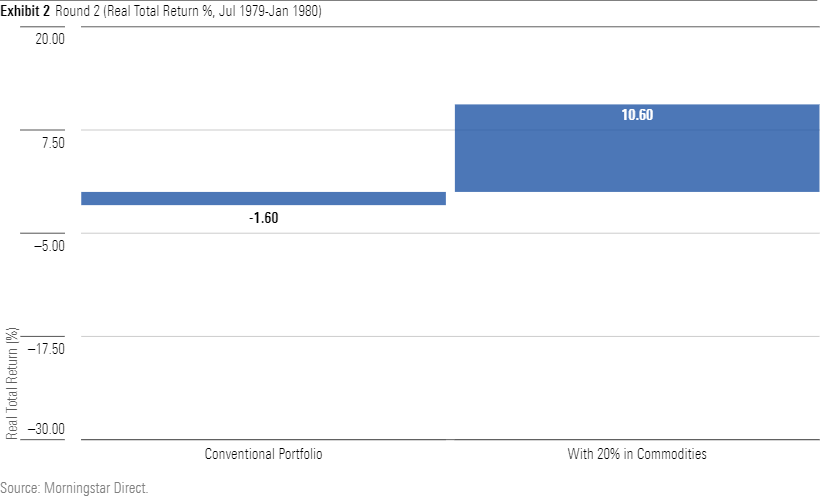

Six years later, history largely repeated itself. This time the culprit was the Iranian Revolution rather than an embargo, but either way, a drop in Middle Eastern oil production, coinciding with U.S. economic weakness, sparked stagflation’s return. Once again, gas lines formed.

This time, gold shone (so to speak), outgaining even energy. The stock market also thrived, presumably because investors recognized the recession would be short-lived. Nevertheless, because of both bond weakness and the damage caused by rampant inflation, the conventional portfolio declined slightly. In contrast, the alternative portfolio posted a solid gain, thanks to its commodities.

Once More, With Feeling

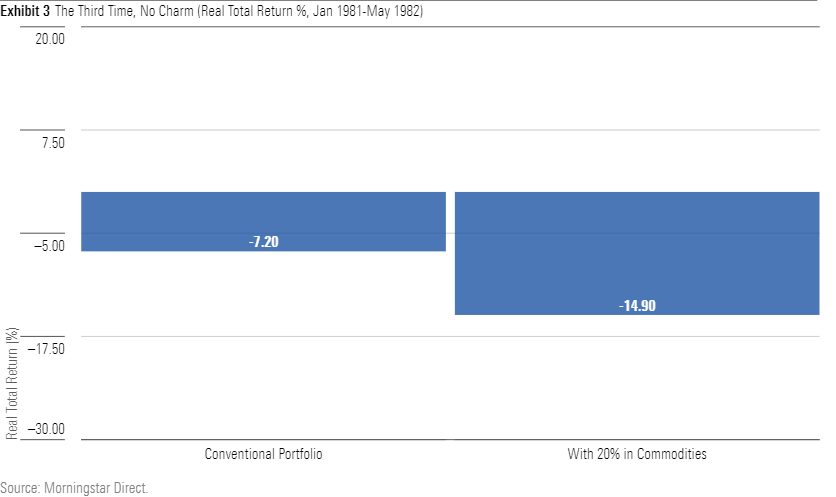

The respite was brief. Eighteen months later, the economy re-entered recession, this time with no investment refuge. Not only did the stock/bond portfolio shed 7% of its purchasing power, but the alternative version fared considerably worse. Gold and energy slumped, and so did almost every other commodity: silver, corn, wheat, and so forth. (Admittedly, I did not research orange juice futures.)

In hindsight, the reason commodities failed during this session was straightforward. Although the inflation rate remained high, it had begun to slide, thanks to the Federal Reserve’s resolve. Consequently, bonds rallied. Even as stocks and commodities headed south, Treasuries eked out a modest real profit. Once again, investors had correctly anticipated future events. No longer would stagflation be a concern. Treasuries would therefore be in, and commodities out.

Lessons for Today

As these incidents have shown, no two investment markets are exactly alike. Even if their conditions seem very similar—as with 1973-74 and 1979, each of which featured an oil shock and economic slump, rising unemployment, and spiking inflation, the details vary. Why did soybean prices increase in the first instance and decline in the second? The answer escapes not only me, but I suspect also contemporary economists. They could explain why after the fact, but not before.

However, history does offer a suggestion. If the economy slows while inflation is high, both components of a traditional portfolio will likely struggle. Stocks typically decline when recessions approach, for the simple and obvious reason that corporate earnings suffer. And bonds are ill-equipped to combat inflation. During such occasions, portfolios that hold commodities may either escape losses altogether, as with the second example, or soften the blow, as with the first.

This benefit, though, comes with a qualification. As the final period illustrates, commodities prices behave differently when inflation is on the rise than after it has peaked. Consequently, the critical investment issue is not, “Will stagflation occur?” but instead “If stagflation does arrive, will this be its only appearance?” How aggressively one should pursue commodities depends upon the answer to that question.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)