Cheap Stocks With Q1's Largest Fair Value Upgrades

Undervalued stocks in the financial, automobile, and semiconductor industries recently had major valuation increases.

In a tough quarter for stocks and rising uncertainty about the outlook for the global economy, Morningstar’s stock analysts slowed the pace of valuation increases among the companies on their coverage lists.

Still, investors can find undervalued stocks among the ranks of companies where Morningstar analysts upped their fair value estimates in the first three months of the year. Stocks with the largest boosts in fair value estimates include vaccine-maker Moderna MRNA, whose fair value rose to $232 from $159, followed by asset- management firm Ameriprise Financial AMP, to $338 from $236. The paint company Sherwin-Williams' SHW fair value was increased to $195 from $137.

They are among 119 out of the 866 U.S.-listed stocks in Morningstar’s coverage area that saw fair value increases of at least 10% who saw improving fundamentals despite the difficult environment. That compares with 130 upgrades in the fourth quarter and 249 from the same period last year, which was distorted by the emergence of the economy from the pandemic recession in late 2020.

The overall fair value estimate increase among all U.S.-listed companies covered by Morningstar analysts was 3.5%, down from 4.4% in the fourth quarter, and last year's quarterly average of 5.8%.

There may be opportunities for investors among those companies that saw super sized fair value increases and are trading below analysts’ valuations. So not only are these businesses worth more in the eyes of Morningstar’s stock analysts--they’re still trading at a discount.

To find these opportunities, we screened for companies with Morningstar Ratings of 5 or 4 stars. Only 20 stocks made the cut, with Moderna remaining at the top of that list and trading at a 27% discount to its fair value. The remaining stocks were primarily concentrated across the financial, automobiles, and semiconductor industries, including semiconductor manufacturer Onsemi ON and vehicle component manufacturer Aptiv APTV.

A list of the undervalued stocks with the largest fair value increases can be found at this end of the article.

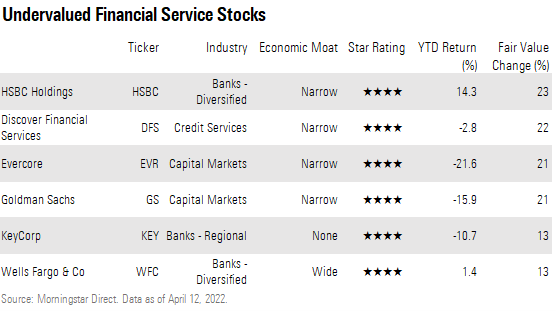

Financials:

Financial-services stocks represent more than a quarter of the undervalued stocks with the largest fair value upgrades picks in this article. At the top of the list are HSBC Holdings HSBC and Discover Financial Services DFS. Driving their fair value increases was an improved outlook for net interest margins (NIM).

Senior equity analyst Michael Wu increased HSBC’s fair value estimate to $48 per share from $39 after adjusting his model for the bank’s net interest margin to improve one year sooner than originally expected, and for it to grow more sharply in the medium term. HSBC now trades at a 30% discount to its fair value estimate.

Discover is among the best positioned credit card companies to benefit in the current rising-rate environment, says Michael Miller, Morningstar equity analyst. The company’s net interest income increased 4.5% year over year based on first-quarter results. The company's net interest margin also grew 1.06% in the last year. Miller raised Discover’s fair value to $135 from $113 with roughly $9 of the increase coming from higher loan growth expectations and an updated interest rate forecast. Shares trade at a 18% discount.

Bank stocks with fair value increases due to rising rates include KeyCorp KEY, at a 21% discount, and Wells Fargo WFC, 22% undervalued. Goldman Sachs GS and Evercore EVR also trade at steep discounts following their fair value increases.

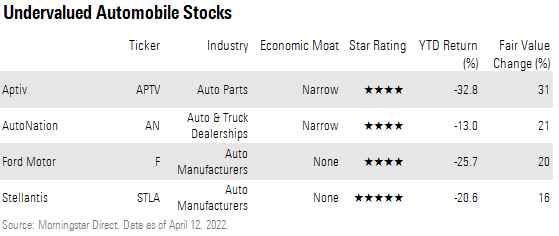

Automobiles:

Automobile companies dropped after Russia’s invasion of Ukraine further exacerbated concerns over supply shortages across the industry. While direct exposure to the crisis is limited for the auto industry, Morningstar senior equity analyst Richard Hilgert attests the selloff to the uncertainty around the indirect exposure the industry has to the conflict.

Hilgert suggests investors remain focused on intrinsic value and long-term value for stocks rather than near-term volatility. Auto companies that continued to impress Morningstar analysts despite near-term headwinds include Aptiv, AutoNation AN, Ford Motor F, and Stellantis STLA.

Significant drivers for each company’s fair value increase were updated models to account for improved revenue and profitability outlooks. The largest fair value increases were in Aptiv, to $139 from $106, and AutoNation, to $132 from $109.

The outlook for Aptiv improved after the company’s management set an annual revenue growth target to 8 to 10 percentage points ahead of the rest of the industry, up from its previous target of 6 to 8 percentage points, which Hilgert attributes to the company’s lifetime bookings backlog of $24 billion. In response, Hilgert raised his revenue growth assumptions, which rolled into Aptiv’s fair value increase, and left the company 22% undervalued.

Autonation’s fair value benefited from higher revenue expectations in the five-year forecast of David Whiston, Morningstar’s sector strategist for industrials. Whiston now sees revenue growing 11% on a compound annual basis for the next five years. Autonation trades 24% below its fair value estimate.

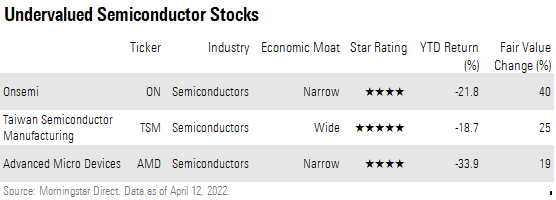

Semiconductors:

Following the tech selloff in the first quarter many companies saw their stock prices fall to levels Morningstar analysts now find attractive. For some stocks, the selloff left some shares at levels that Morningstar analysts find attractive. That group includes Advanced Micro Devices AMD, Taiwan Semiconductor Manufacturing TSM, and Onsemi.

Morningstar technology strategist Abhinav Davuluri raised AMD to $130 from $109 following the company’s acquisition of Xilinx, and it now trades at a 25% discount.

"We view this deal as a way for AMD to bolster its product portfolio with the leading field programmable gate array franchise to drive growth and better diversify its revenue,'' Davuluri says. ``Narrow-moat Xilinx boasts a stellar margin profile with gross margins near 70%, which is accretive to AMD's financials.'' Taiwan Semiconductor was raised to $179 from $143 by Morningstar equity analyst Phelix Lee. It is now 43% undervalued. Driving the move was increases in revenue growth and improvements in gross margin assumptions. "These changes mainly stem from MediaTek's entry into the premium chipset in 2022, a stronger pipeline of high-performance computing and demand and increasing certainty from autonomous driving," Lee says. Shares slumped after concerns about material availability rose following Russia's invasion of Ukraine, however Lee does not currently see these potential headwinds changing his valuation of the company. Morningstar equity analyst William Kerwin increased semiconductor manufacturer Onsemi to $67 from $48 after a strong fourth quarter. Management boosted its long-term gross margin target to 48% to 50% from 43% to 45%. While the company is capitalizing on the recent chip shortage to bolster its profits, Kerwin believes they are successfully executing on a strategy to align its portfolio toward more lucrative megatrends in industrial and automotive markets. Onsemi currently trades at a 19% discount.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)