It's Been a Rough Start to 2022 for Sustainable Investing Stock Strategies

As energy stocks surged and tech tumbled, sustainable portfolios had a tough quarter.

Sustainable investing strategies got hit with a one-two punch in the first quarter, largely missing out on the energy-stock rally and taking losses from their big weightings of sliding technology stocks.

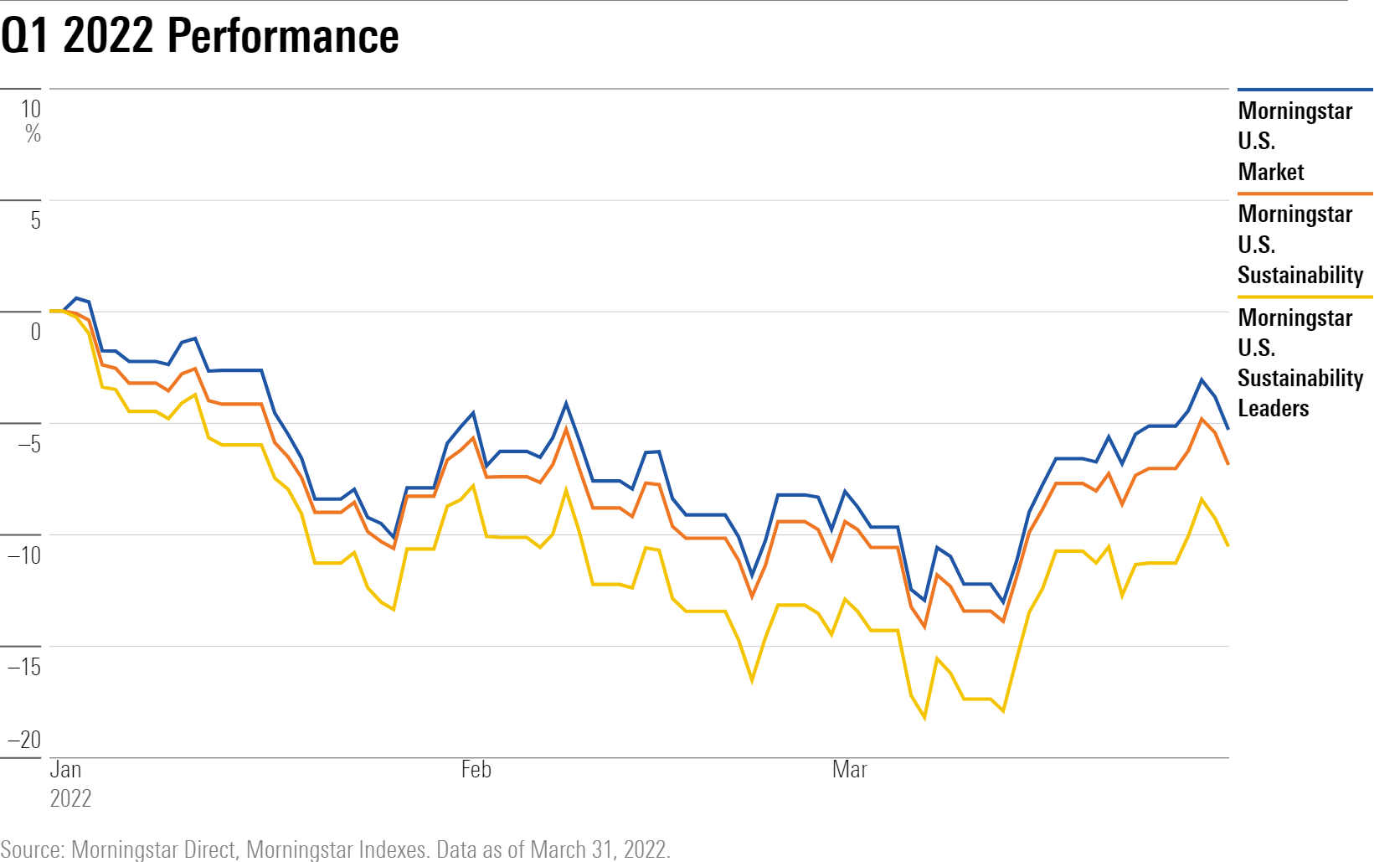

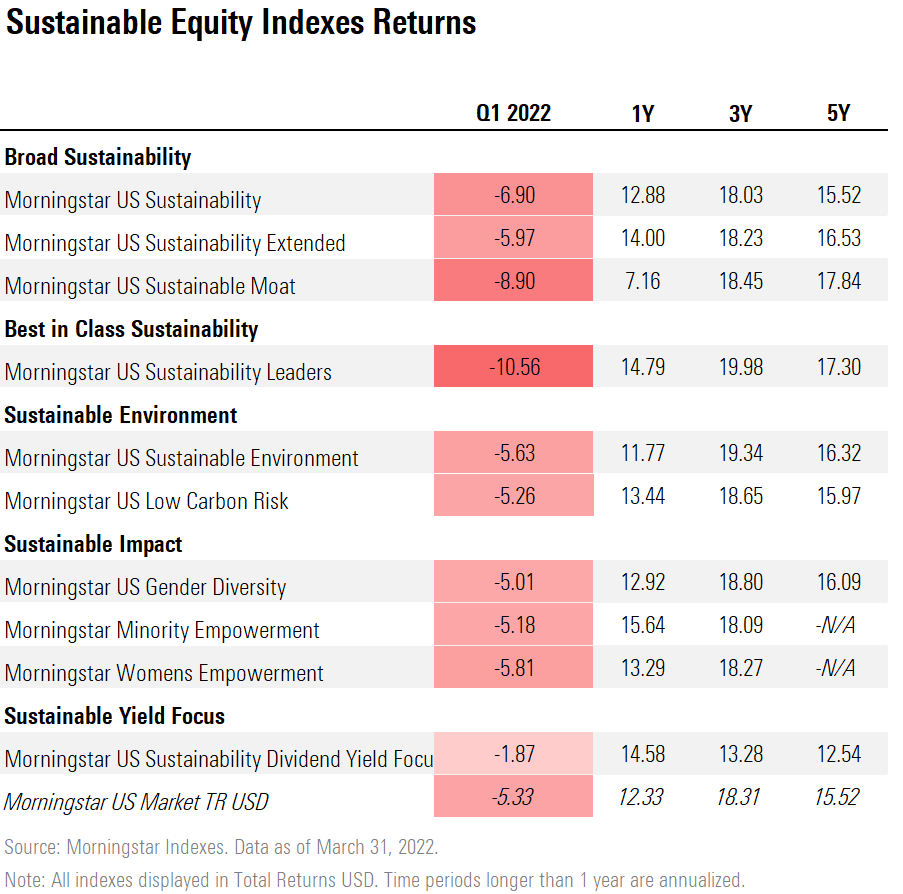

The Morningstar U.S. Sustainability Index lost 6.9% in the first quarter, trailing the Morningstar U.S. Market Index by about 1.5 percentage points. The Morningstar U.S. Sustainability Leaders Index—a collection of the 50 U.S. large-cap stocks with the best sustainability scores—fell even further, ending the quarter down 10.6%. Globally and across all markets, 13 of 66 Morningstar's sustainability-screened indexes beat their conventional market equivalents during the first quarter. That's down from 31 of 66 beating non-ESG indexes in 2021.

The biggest headwind came from the performance of energy stocks when it came to environmental, social, and governance, or ESG, strategies.

The Morningstar U.S. Energy index surged 38.5% in the first quarter, but because the energy sector carries more severe environmental, social, and governance risk than any other sector, sustainability strategies tend to be under-exposed to energy. At the same time, it’s common for these strategies to fill in much of the spare exposure with mega- and large-cap technology stocks.

“Large cap energy is up close to 40% year to date, and technology is down about 14%. Those combine into a headwind for ESG,” says Nicholas Colas, co-founder of market research firm DataTrek Research.

One exception to this was the Morningstar Low Carbon index family, which carries extra energy exposure compared to other sustainability indexes.

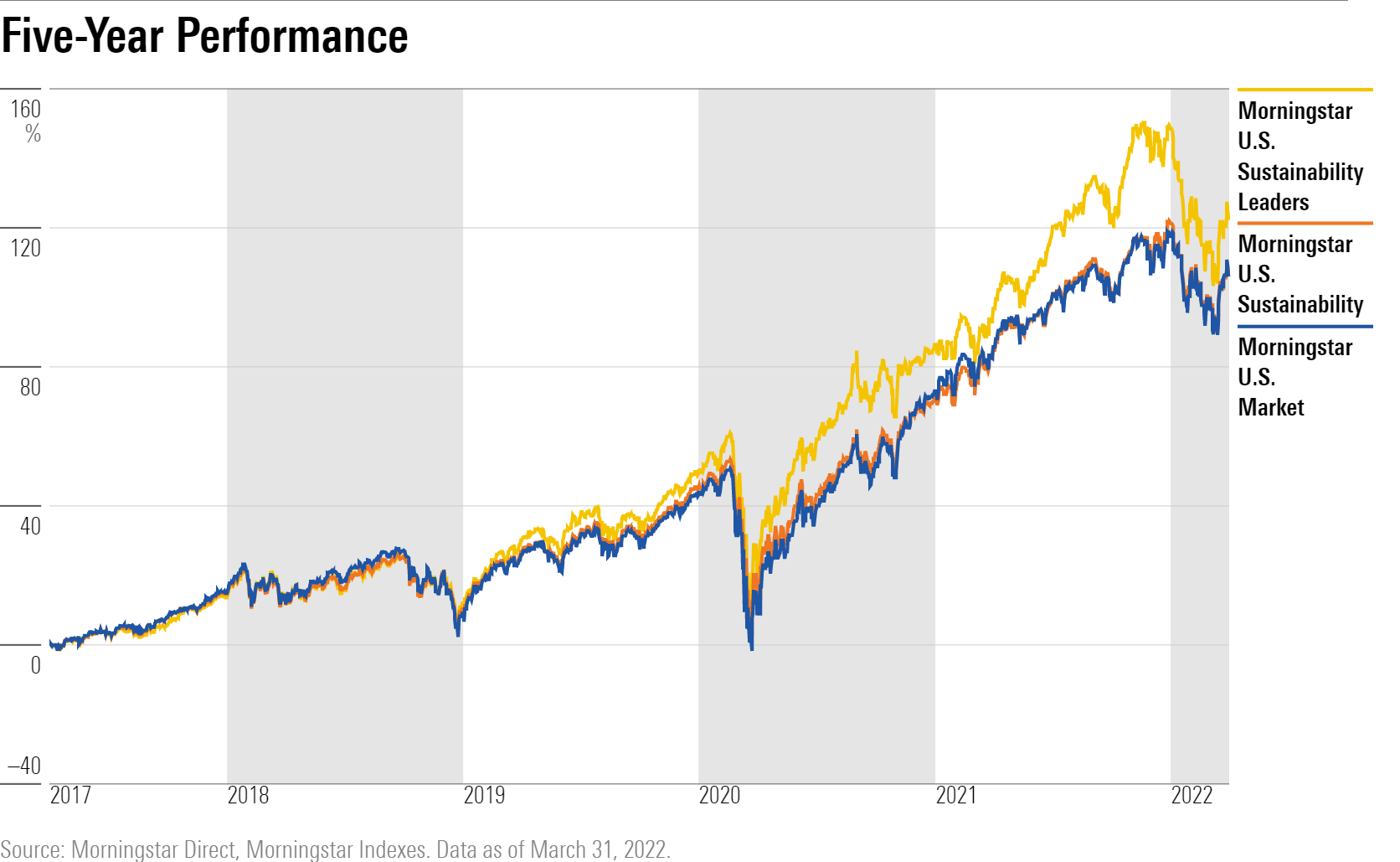

Longer-term results still show market-beating returns from many sustainable stock strategies. Over the past five years, the Morningstar U.S. Sustainability Index closely tracked the Morningstar U.S. Market Index—both grew 15.5%. And the sustainability leaders index saw gains of 17.3%.

Overall, 71.2% of Morningstar’s Sustainability indexes have outperformed their traditional market equivalents over the past five years. Of the 21 standard ESG indexes, 16 beat their benchmarks, and nine of 10 sustainability leaders indexes beat their non-ESG equivalents. Half of the low carbon indexes have edged out their broad market counterparts over the past five years.

“A quarter of underperformance doesn’t a story tell,” says Thomas Kuh, head of Morningstar’s ESG indexes strategy. “The real question is, on a longer term basis, do these differences systematically help or harm performance?”

“Taking a bad quarter along the way is part of the commitment,” he says.

Within the Morningstar Sustainability Index family, a set of indexes designed to target stocks with low ESG risk ratings, only 2 of 21 indexes outperformed during the first quarter. Last year, 14 of the 21 sustainability indexes beat their conventional market benchmarks. For the Morningstar Sustainability Leaders series—indexes that provide exposure to only the lowest-risk companies from an environmental, social, and governance risk standpoint—2 of 10 beat their benchmarks during the quarter.

Sustainable Investing Strategies Hold Few Energy Stocks

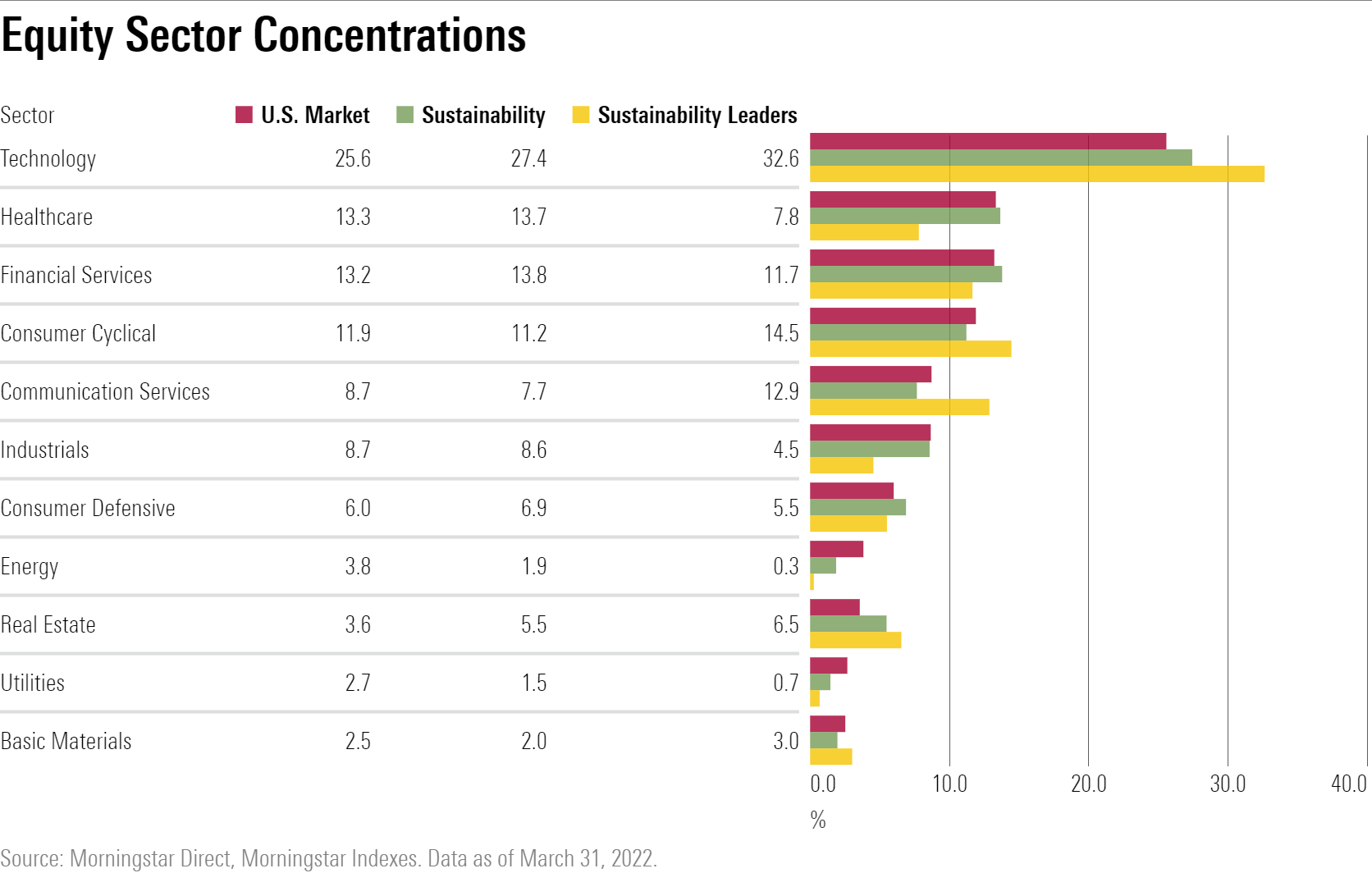

As a result of stock screens that avoid companies with high levels of ESG risk and instead bias toward stocks with low ESG risks, the Morningstar U.S. Sustainability and Sustainability Leaders indexes carry extra exposure to the technology sector while shying away from energy. When compared to the U.S. Market index, the standard Morningstar U.S. Sustainability index cuts out 50% of the broader market’s energy exposure and carries two extra percentage points in technology stocks.

The difference is even more extreme for best-in-class sustainability stocks. Just 0.3% of the Morningstar U.S. Sustainability Leaders Index is made up of companies from the energy sector: that’s less than one twelfth of the broader market’s exposure. And over 30% of the Sustainability Leaders Index’s total weight is in technology stocks—seven percentage points more than the Morningstar U.S. Market Index.

“There have been criticisms of some of the broad-market ESG funds that they track very closely to the market,” Kuh says. “It’s an interesting challenge, you can’t be different from the market and the same as the market at the same time.”

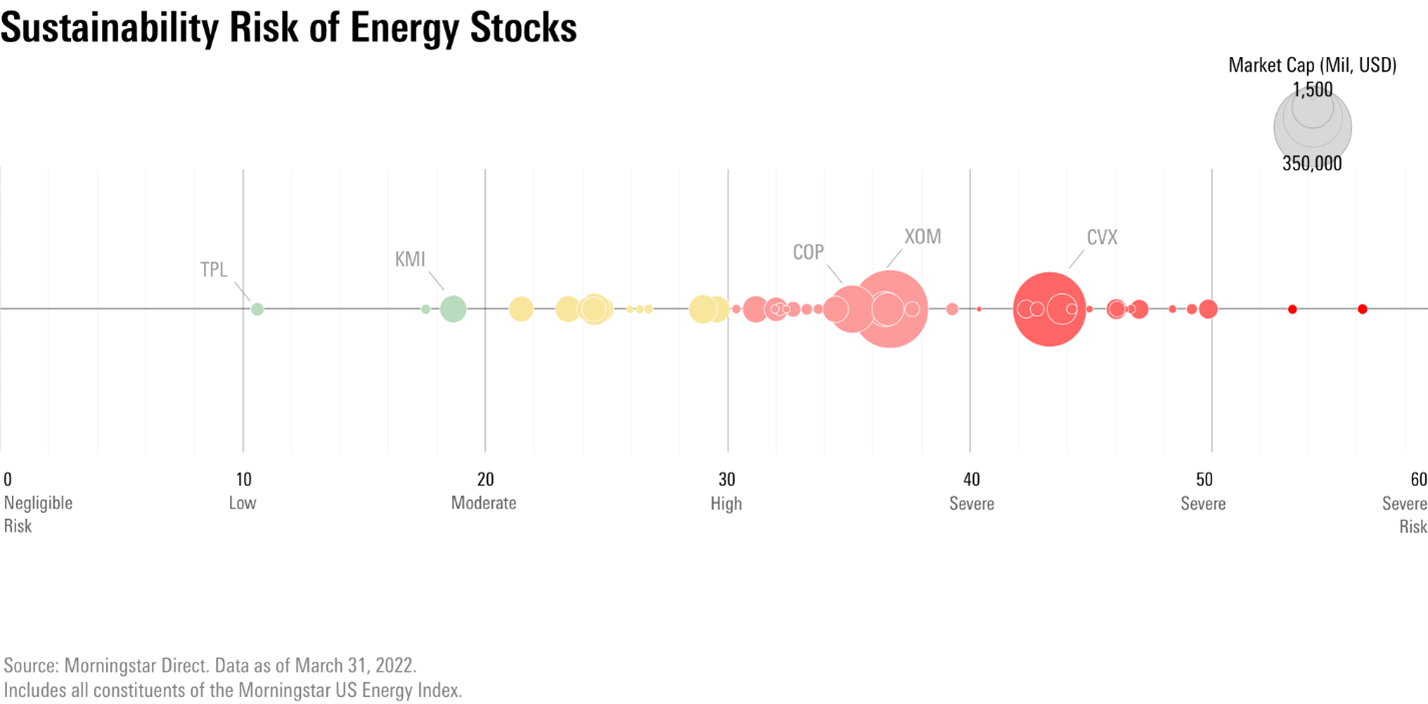

Exposure to energy is rare in sustainability-focused strategies. Overall, energy has a higher Sustainability Risk Rating than any other sector. The Morningstar Energy Index carries a risk score of 35.6, placing it squarely in the "high" risk category. That's far ahead of utilities, the sector with the second-highest risk, at 28.6 in the "moderate" risk category.

A handful of companies in the Morningstar U.S. Energy Index carry low to moderate sustainability risk. But by both market cap and company count, the majority of energy companies fall into the high- or severe-risk category from an ESG standpoint.

Over 50% of the sustainability risk within the energy sector comes from the environmental sleeve—the rest is split about equally between social and governance risk. Sustainalytics' notable material issues for the sector involve carbon use in the company's own operations, high-carbon products and services, and emissions, effluents, and waste.

Sustainable Investing Strategies Make Big Bets on Tech Stocks

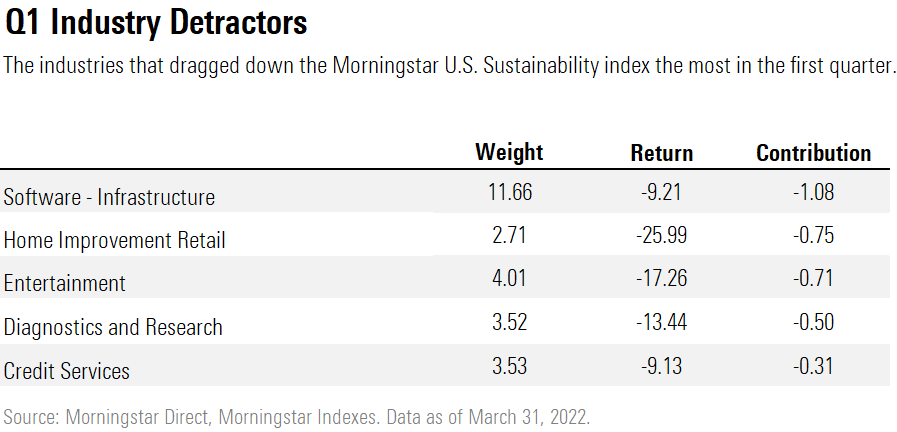

In addition to missing out on the energy rally, sustainable portfolios took a hit from their high exposure to the tech sector. With many big-name tech stocks starting off the year with high valuations, the group suffered a significant selloff in the first quarter in response to rising interest rates in the bond market. While the tech sector rebounded from its worst levels by the end of the quarter, the Morningstar U.S. Technology Index was down 9.7%.

In particular, the software infrastructure industry was down 9.2% for the quarter, contributing to the decline of the Morningstar U.S. Sustainability Index.

Why Low Carbon Strategies Hold Energy Stocks

The exception to the low-energy-stake rule can be found in low carbon strategies. That's because they're designed to provide exposure to companies aligned with the transition to a low-carbon economy, which includes traditional energy companies that invest in or generate revenue from renewables.

“The exposure that you’re benefitting from may not be the reason you’re investing,” says Lan Anh Tran, associate manager research analyst for passive funds at Morningstar. “Low carbon portfolios can still benefit from profits garnered by traditional energy, because the energy companies investing in renewables can sometimes be the same ones providing fossil fuels to the global economy.”

With that tailwind, seven of the 10 Morningstar Low Carbon Risk Indexes beat their conventional market equivalents.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)