The Best Robo-Advisors of 2022

These six providers receive high or above average scores from Morningstar.

Morningstar's first-ever Robo-Advisor landscape report identifies six providers as the best options for investors. Vanguard is the only one to receive a High overall assessment, while Betterment, Fidelity, Schwab, SigFig, and Wealthfront each come in at Above Average.

All six combine low costs with sound approaches to constructing portfolios and matching investors with them, responsible corporate parents, and a broad range of planning-related features. Here, we take a close look at these top robo-advisors, highlighting strengths as well as some weaknesses. You can also explore our assessments of all the leading providers in our guide to robo-investing.

Vanguard Digital Advisor/Vanguard Personal Advisor Services |High (4.5/5)

Vanguard Digital Advisor, or VDA, and its hybrid sibling Vanguard Personal Advisor Services, or PAS, which combines automation with human expertise, are not the best in every respect of the robo-advisors we surveyed, but they are the best overall.

Vanguard has been in the advice business since 1996, but it did not move into discretionary asset management until the respective May 2015 and May 2020 launches of PAS and VDA. Aiming to transform advice in the same way it revolutionized investment management with index funds, Vanguard continues to invest heavily in both services through adding capabilities and hiring personnel. In 2022, Vanguard plans to add environmental, social, and governance options to VDA and tax-loss harvesting to PAS. The two services at present otherwise have numerous features associated with top robo-advisors. VDA, for example, offers outside account aggregation, custom goal planning, debt planning, a rainy-day tool, and a next-dollar optimizer that helps investors choose between competing financial priorities.

VDA’s $3,000 minimum makes the service less accessible than some. But its 0.20% annual asset-based charge, including advisory and underlying ETF fees, is very competitive and is not reliant on waivers that might expire.

VDA’s approach to portfolio construction combines simplicity with customization. Using four broadly diversified exchange-traded funds focusing on U.S. and non-U.S. stocks and U.S. and non-U.S. bonds, VDA draws on the Vanguard Life-Cycle Model to create more than 300 glide paths based on an investor’s age, goal(s), and risk tolerance. The risk-tolerance assessment was not created in-house, however, but uses third-party Capital Preferences’ well-researched scenarios. VDA then evaluates portfolios daily and rebalances when any asset class is off target by more than 5 percentage points. The glide paths are updated annually as model inputs change.

The premium PAS offer has a $50,000 investment minimum and starts at a 0.30% annual advisory fee. Clients receive unlimited access to a pool of CFPs until their assets exceed $500,000, at which point Vanguard assigns them a dedicated CFP who touches base at least twice a year. PAS typically uses the same four total market ETFs to build portfolios; however, clients can also invest in Vanguard’s three new Advice Select active strategies, which are run by proven managers from two of Vanguard's most trusted subadvisors, as well as many other options not available within VDA.

As investors’ financial lives become more complicated, the ability to transition to PAS is a strength. In addition, PAS offers access to holistic, tailored financial planning advice at a cheaper price than any competing offering.

Betterment/Betterment Premium | Above Average (4.0/5)

Betterment’s transparency and value set it apart. Since its May 2010 launch, it has cut fees and added investment options and features to make investing and retirement planning easier for a retail audience. In October 2014, it also introduced a digital platform for financial advisors who want to manage client assets using Betterment’s tools and advice. These gradual improvements help explain its position as the largest and most successful stand-alone robo-advisor launched in the previous decade.

Betterment publicly documents on its blog how it builds and maintains various target risk portfolios while also attempting to maximize their tax efficiency. It is one of the few robo-providers that employs a glide path, which gradually adjusts the portfolio’s asset mix to become more conservative over time. Portfolio construction is sensible and well-thought-out: The main Core Portfolios series offers a mix of low-cost ETFs with exposure to several major asset classes, such as U.S. stocks, international stocks in both developed and emerging markets, investment-grade bonds, world bonds, and Treasury Inflation-Protected Securities. Within the U.S. equity allocation, Betterment tilts the portfolio toward value and smaller-cap stocks as part of an optimization process meant to generate higher expected returns. Beyond its core offering, Betterment offers smart-beta portfolios, target income portfolios, and sustainability-focused portfolios with specific investing styles. It also offers thematic versions of its sustainability-focused and, more recently, core portfolios through adding exposure to thematic ETFs.

Betterment bases its allocation guidance on a relatively simple risk-tolerance questionnaire. Unlike some firms, which attempt to quantify a client’s risk tolerance as a portfolio construction input, Betterment focuses on the amount and timing of the money a client needs when advising on allocation.

Betterment has a wide range of services, especially given its below-average price tag. It charges a 0.25% asset-based annual fee for automated portfolio management. Advice is part of the offer, too, and investors who aggregate their outside banking and investment accounts can get holistic help with retirement investing, goal planning, and prioritizing various accounts. Although on-demand access to an investment advisor is locked behind a steeper 0.40% fee for Betterment Premium, Betterment is one of the few robo-advisors that lets clients pay hourly for advice on specific situations, such as retirement planning, general financial advice, college savings, marriage planning, and other topics.

Schwab Intelligent Portfolios/Schwab Intelligent Portfolios Premium | Above Average (3.6/5)

Problematic cash allocations hold back Schwab's otherwise excellent robo-advisor program. The portfolio construction process has several strengths. It uses an extensive risk-tolerance questionnaire to match investors with portfolios from one of 12 different risk levels. The portfolios provide comprehensive asset-class exposure, including both U.S. and international large- and small-cap stocks, REITs, corporates, mortgages, high yield, muni bonds, world bonds, emerging-markets debt, Treasuries, TIPS, and gold. The underlying investments are solid, while Schwab’s approach to portfolio construction, rebalancing, and tax management is thoughtful.

Although Schwab Intelligent Portfolios does not charge an advisory fee, the underlying funds’ average expense ratio is slightly above average at 0.20%. In addition, the portfolios all include allocations to low-yielding in-house cash allocations that weigh down returns and diminish purchasing power amid resurgent inflation and low bond yields. Cash allocations range from 6% of assets for the most aggressive portfolios to 29.4% for the most conservative.

The transparency of those cash accounts in relation to Schwab’s fee model is a key issue, though. While the portfolios are nominally “free” for investors with at least $5,000, those enticed by getting digital investment management without paying for it may not realize that Schwab is using the cash portion of their assets to generate revenue. Schwab receives the spread (or difference) between the revenue it earns on asset balances in Schwab Bank and the yield it pays investors. The SEC is investigating Schwab’s previous disclosures related to its use of cash, and the company set aside $200 million in 2021’s second quarter to cover potential settlement costs.

Schwab Intelligent Portfolios Premium suffers from the same cash issue but otherwise has considerable merit. Investors with at least $25,000 have unlimited access to a financial planner holding the CFP designation. The service offers a range of online tools for advice on income, expenses, investments, college savings, retirement planning, and other issues. It is also one of the only robo-advisors to provide comprehensive retirement income advice.[1] The program helps investors determine how much they can afford to withdraw from their portfolios and schedule recurring withdrawals from both taxable and tax-deferred accounts, such as IRAs.

The premium service’s flat fee structure allows customers to benefit from economies of scale as their asset balances grow. Following a $300 planning fee for year one, investors pay just $360 annually thereafter. That’s pricey for smaller accounts, but individuals with balances of $90,000 or more would pay less than they would for similar offerings from Betterment and Fidelity.

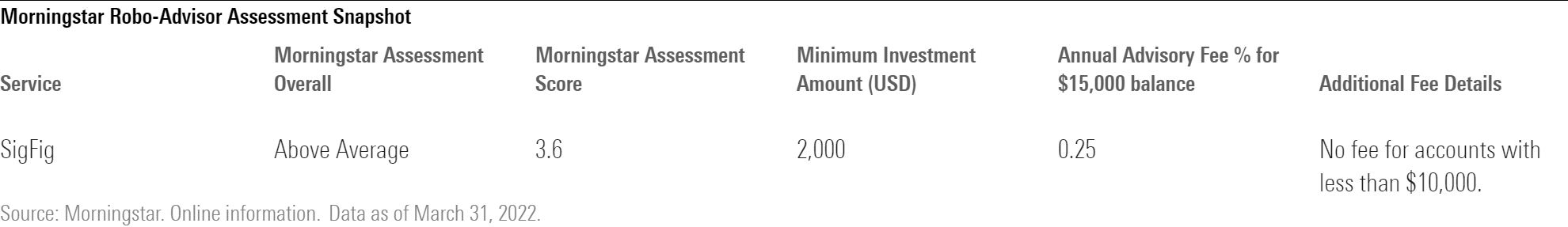

SigFig | Above Average (3.6/5)

SigFig is a lean offering that doesn’t sport the same scale of resources as some of its competitors, but it checks all the right boxes for a robo-advisor.

SigFig’s evolution since its 2006 start as Wikinvest, an online forum for sharing investment ideas, has helped it develop capabilities that still put it ahead of most peers. After pivoting toward automated investment advice in 2011, the firm curated a group of financial advisors to provide in-person consultations. It also introduced tax-advantaged and taxable portfolios as well as tax-loss harvesting.

SigFig’s overall fee is below the median of robo-advisors we surveyed. The program is free for accounts less than $10,000 and charges 0.25% for accounts at and above that size. It uses a suite of low-cost ETFs for its portfolios (the ETFs differ depending on which custodian the customer chooses for the account) but does not waive or return fees on these holdings.

SigFig’s portfolio construction approach is simple but sensible. Allocations are strategic and updated periodically depending on the market environment and SigFig’s capital markets assumptions. They are generally reasonable, with equity allocations for taxable portfolios ranging from 26% to 90% of assets, depending on the risk level, and 13% to 85% for retirement portfolios. Regardless of risk tolerance, however, all the tax-deferred portfolios allocate at least 7% of assets to emerging-markets debt (which could be considered slightly aggressive) as well as 5% to REITs. In addition, the portfolios rely on one broad index for U.S. stock exposure, with no granularity for separate allocations by style or market cap.

The firm’s executive team appears well-resourced, although a few senior leaders have left in recent years. The CEO and chief technology officer have both been with the firm since 2011. Chief investment officer Terry Banet, who also joined the firm in 2011, has extensive experience in investment research and asset-allocation roles at J.P. Morgan and other firms. The firm’s size peaked in 2019, however, and appears to have shrunk significantly since.

The service has some weaknesses. It does not provide advice for multiple investment goals and lacks more dedicated educational resources that could help clients make SigFig their “one-stop shop.” In addition, the privately held firm’s focus on partnering with larger corporations like UBS and Wells Fargo raises questions about whether it will remain a stand-alone robo-advisor. Many stand-alone robo-advisor firms have been acquired (witness Wealthfront’s recent agreement to join forces with UBS), and SigFig’s small size and limited revenue base could make it a more likely acquisition target than some of its peers.

Fidelity Go/Fidelity Personalized Planning & Advice | Above Average (3.5/5)

Fidelity Go stands out for its simple, straightforward approach that draws on Fidelity’s strong global research and asset-allocation team. Many key executives within the Fidelity Strategic Advisors unit overseeing this program have spent at least 15 to 20 years with the firm. Fidelity Go is free for accounts with balances up to $10,000 and charges $3 per month for accounts between $10,000 and $50,000. Investors with balances above $50,000 pay 0.35% per year.

The program starts with a relatively thorough risk-tolerance questionnaire. Questions cover the investor’s investment goals, time horizon, household income, risk tolerance, investment experience, investment knowledge, reaction to falling markets, emergency fund, spending as a percentage of income, likelihood of unexpected future expenses, household financial situation including job security, and value of total assets. Fidelity then uses this information to map investors to a taxable or retirement-focused portfolio, with each spanning seven different risk levels. The portfolios all focus on a short list of core asset classes, such as U.S. stocks, international stocks, and intermediate core bonds; esoteric asset classes or ESG-focused strategies aren’t part of the offer.

Although Fidelity Go’s investment advisory fees are slightly above the peer median for higher account balances, it invests in a streamlined list of zero-expense ratio Fidelity Flex funds, which keeps total costs slightly below average.

The program also offers ongoing support. Text alerts and other communications let customers know how they are progressing with their goals, as well as provide behavioral nudges to encourage long-term investing. Like VDA, however, Fidelity Go does not currently offer tax-loss harvesting.

Fidelity’s premium Personalized Planning & Advice service (available for accounts with at least $25,000) charges 0.50% of assets and offers additional financial planning services. Participants have access to unlimited advice and planning calls and can choose from a menu of coaching solutions focused on different topics, including retirement planning, budgeting, and debt management. In contrast to Betterment and Schwab, though, not all its financial advisors hold the CFP designation, which makes its 0.50% price tag comparatively steep.

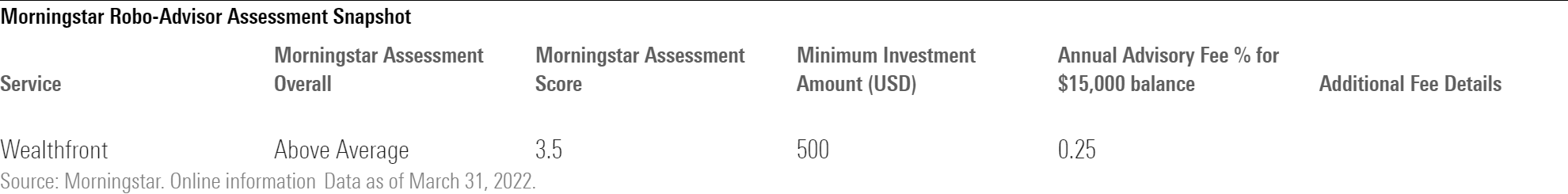

Wealthfront | Above Average (3.5/5)

Wealthfront has considerable merits, although some strategic shifts and questionable allocations hold it back.

The merits start with attractive fees. Its 0.25% annual advisory charge is cheaper than most, and expense ratios are reasonable for most of the underlying funds used in the portfolios. The quality of the underlying funds is also generally strong; the majority used in Wealthfront’s portfolios receive Morningstar Analyst Ratings of Gold or Silver. The program includes a thorough questionnaire that incorporates behavioral economics research to evaluate both risk tolerance (an investor’s subjective willingness to take risk) and risk capacity (their objective ability to take risk given their financial assets and other resources).

Wealthfront uses the responses to slot investors into a portfolio matching one of 20 risk levels spanning three account types: taxable, retirement, and socially responsible investing. Customers also have access to financial planning tools (though not to human financial advisors) for spending, savings, income growth, inflation, Social Security, taxes, college planning, and home equity. The website provides information on a wide range of planning-related questions, as well as numerous methodology papers and transparent performance disclosures.

Still, some of Wealthfront’s strategic pivots seem driven by popular but not necessarily prudent investment trends. Many of its portfolios are on the aggressive side; for example, its retirement portfolios allocate up to 14% to emerging-markets stocks, 15% to real estate, and 10% to emerging-markets debt. It previously opted investors into a risk parity strategy that has consistently disappointed; Wealthfront now lets them invest up to 10% of their assets in cryptocurrency through Grayscale Bitcoin Trust (BTC) GBTC and/or Grayscale Ethereum Trust (ETH) ETHE, which are high-cost vehicles whose grantor trust structure leads to significant tracking error.

Its early 2022 agreement to be acquired by UBS is ironic given that this Swiss banking giant is the kind of firm Wealthfront originally sought to disrupt. However, Wealthfront says UBS has committed to letting Wealthfront continue to operate under its own brand as a stand-alone business.

[1] Capital One Investing also offers advice on retirement drawdown strategies but is much smaller. Morningstar was previously a minority owner of Capital One Investing predecessor United Income, which Capital One acquired in 2019.

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)