The Best Core Stock Funds for 2022

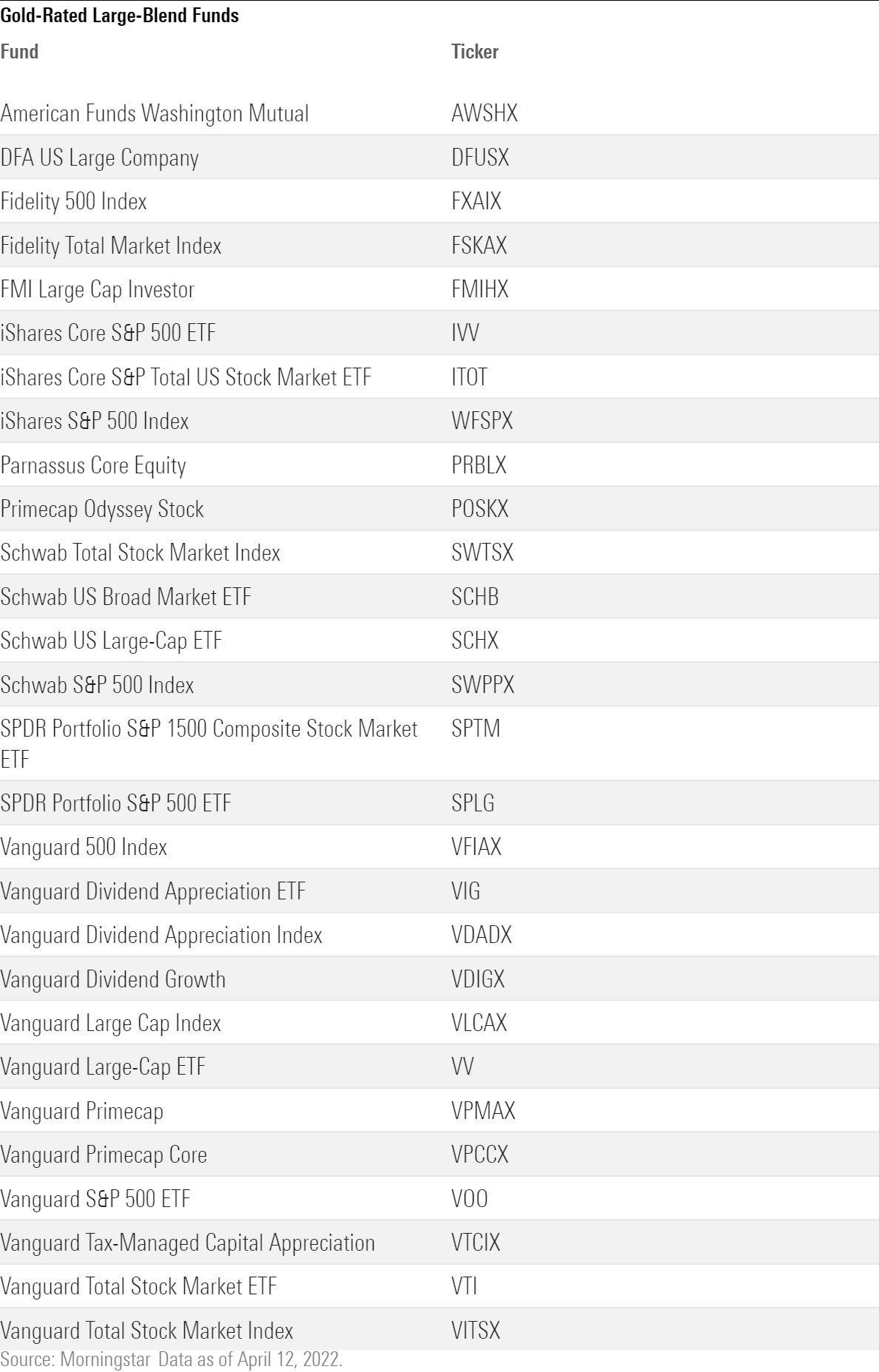

These large-company-focused mutual funds and ETFs blend growth stocks and value stocks and earn Morningstar Analyst Ratings of Gold.

A black dress (little or otherwise) is a versatile wardrobe staple for many women. Long-handled tongs and a good meat thermometer are must-owns for grilling enthusiasts. And The Joshua Tree and Slippery When Wet were essential albums for teenagers in the mid-1980s (well, at least they were for this teen in those days).

When it comes to long-term investing, U.S. large company stocks play a similar role: They are the essentials that investors build their portfolios around. Specifically, funds in the U.S. large-cap blend Morningstar Category are about as "core" as you can get, as they combine stocks with both growth and value characteristics. Indeed, these investments are the black dress of most long-term-focused portfolios.

There are many fine U.S. large-blend funds for investors to choose from. Today, we're focusing on those funds that have at least one share class that earns a Morningstar Analyst Rating of Gold. (We expect such highly rated mutual funds and exchange-traded funds to outperform over a full market cycle; learn more about our Analyst Ratings.) They're great starting points for your investment research.

Many of the top-rated mutual funds and ETFs in the Morningstar Category take a passive approach to investing. Passive funds aren't actively trying to beat the market through stock selection; instead, they're indexing the market in an effort to match its performance, minus their expenses. Why are so many of the best funds in the category index funds? Morningstar research has shown that in this part of the market, most active managers haven't added much value over their respective indexes. Low-cost index funds are therefore terrific options here.

There's some variety among passive strategies in the large-blend category. Some funds in the group--including Fidelity 500 Index FXAIX, iShares Core S&P 500 ETF IVV, and Vanguard S&P 500 VFIAX VOO--track the S&P 500. As a result, they provide access to large-cap stocks representing about 80% of the U.S. stock market. Meanwhile, Vanguard Large-Cap ETF VV focuses on the CRSP U.S. Large Cap Index, which includes more companies with smaller market capitalizations.

Other index funds on the list on the list--such as Schwab U.S. Broad Market ETF SCHB and Vanguard Total Stock Market VITSX VTI--follow much broader market indexes that include more stocks, some of which are smaller-cap names. While these funds also land in the large-blend category, they expose investors to a wider pool of stocks and market capitalizations.

Although managers who actively pick stocks as a group have struggled to add value in this part of the market, some have proven that they can in fact outperform. Our analysts believe that the Gold-rated active funds in the large-blend category have competitive advantages that will allow them to continue to outperform over a full market cycle.

When it comes to active managers on the list, strategies can vastly differ. The managers at FMI Large Cap FMIHX, for instance, maintain a compact portfolio of about 30 stocks that they deem undervalued; the team at American Funds Washington Mutual AWSHX, meanwhile, owns 6 times as many names and focuses on dividend-paying stocks.

To fully understand a fund's strategy, be sure to read its Morningstar Fund Analyst Report.

Those investors who would rather manage their allocations to growth stocks and value stocks--rather than combine both investment styles in one mutual fund or ETF--can find some of the top mutual funds and ETFs in The Best Growth Funds for 2022 and The Best Value Funds for 2022.

Start your free 14-day trial of Morningstar Premium. Rely on the gold standard for mutual fund and ETF research. Unlock our analysts' ratings to see which funds we think will outperform.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)