Why There Is Good News in the Bad CPI Report

Despite a broad jump in inflation in March, the details are encouraging.

The latest inflation report showed costs hitting consumers where it hurts. But there are hints the skyrocketing cost of living may be easing.

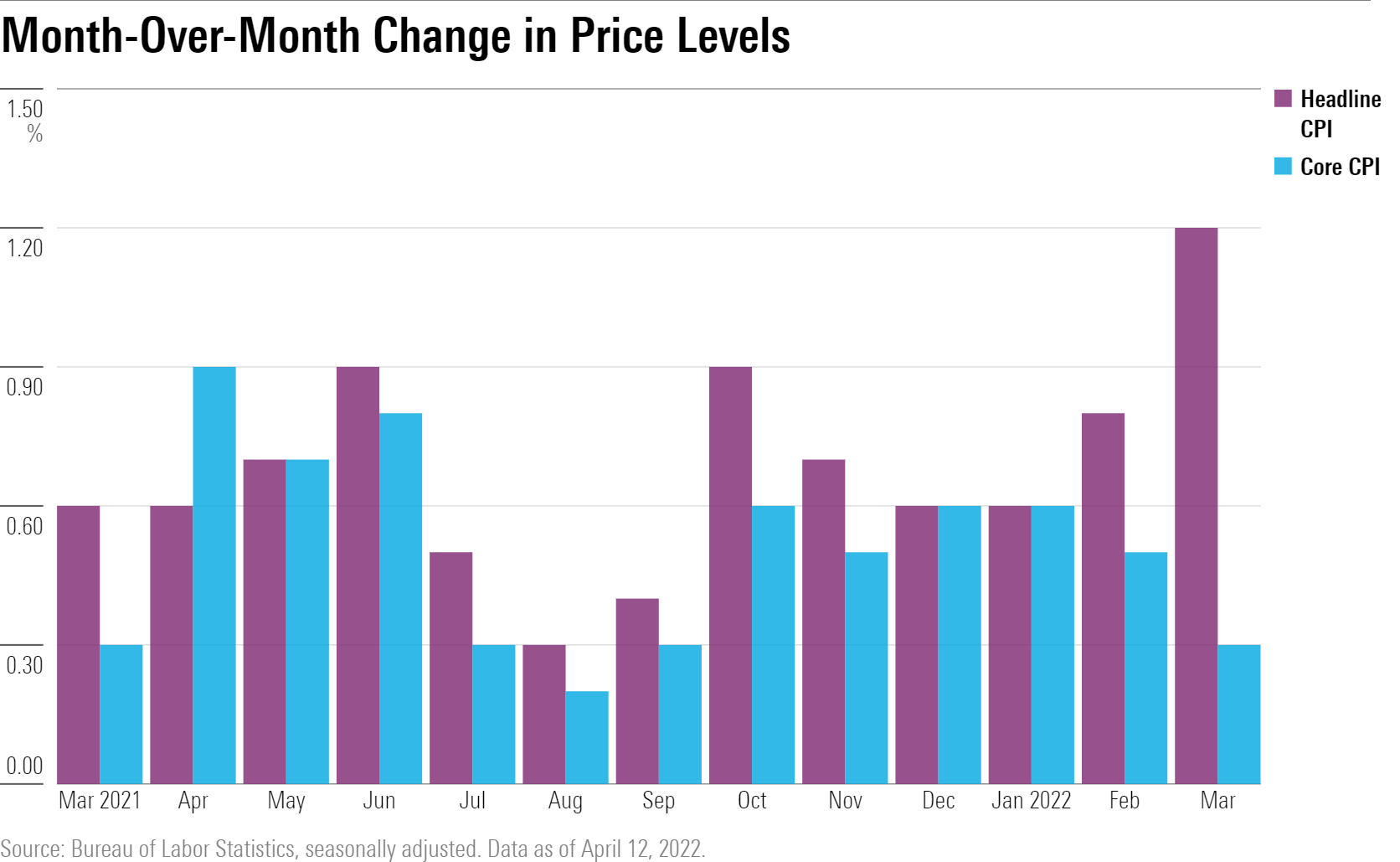

The U.S. Bureau of Labor Statistics reported that the Consumer Price Index jumped a stronger-than-expected 1.2% in March from the prior month after rising 0.8% in February. March's increase was led by gasoline, food, and shelter.

Excluding food and energy, two categories that can be volatile, the news was better. The so-called core reading CPI rose 0.3% last month following a 0.5% increase for February.

“While the surge in energy prices made for an alarming headline inflation number, a closer look at the data suggests reason for optimism that high inflation will subside,” Morningstar’s chief economist Preston Caldwell says. With the recent decline in oil and gas prices, “it is encouraging that core inflation has already decelerated,” he says.

While the stubbornly high inflation has pinched consumers’ wallets, Caldwell believes the overall impact on economic growth has so far been muted.

“While consumer spending data isn't yet available for March, prior months' data shows that consumers have been bearing the hit of inflation without pulling back on spending,” he says. “Inflation-adjusted wages are still up since the start of the pandemic, and many consumers also have a cushion of excess savings accumulated during the pandemic.”

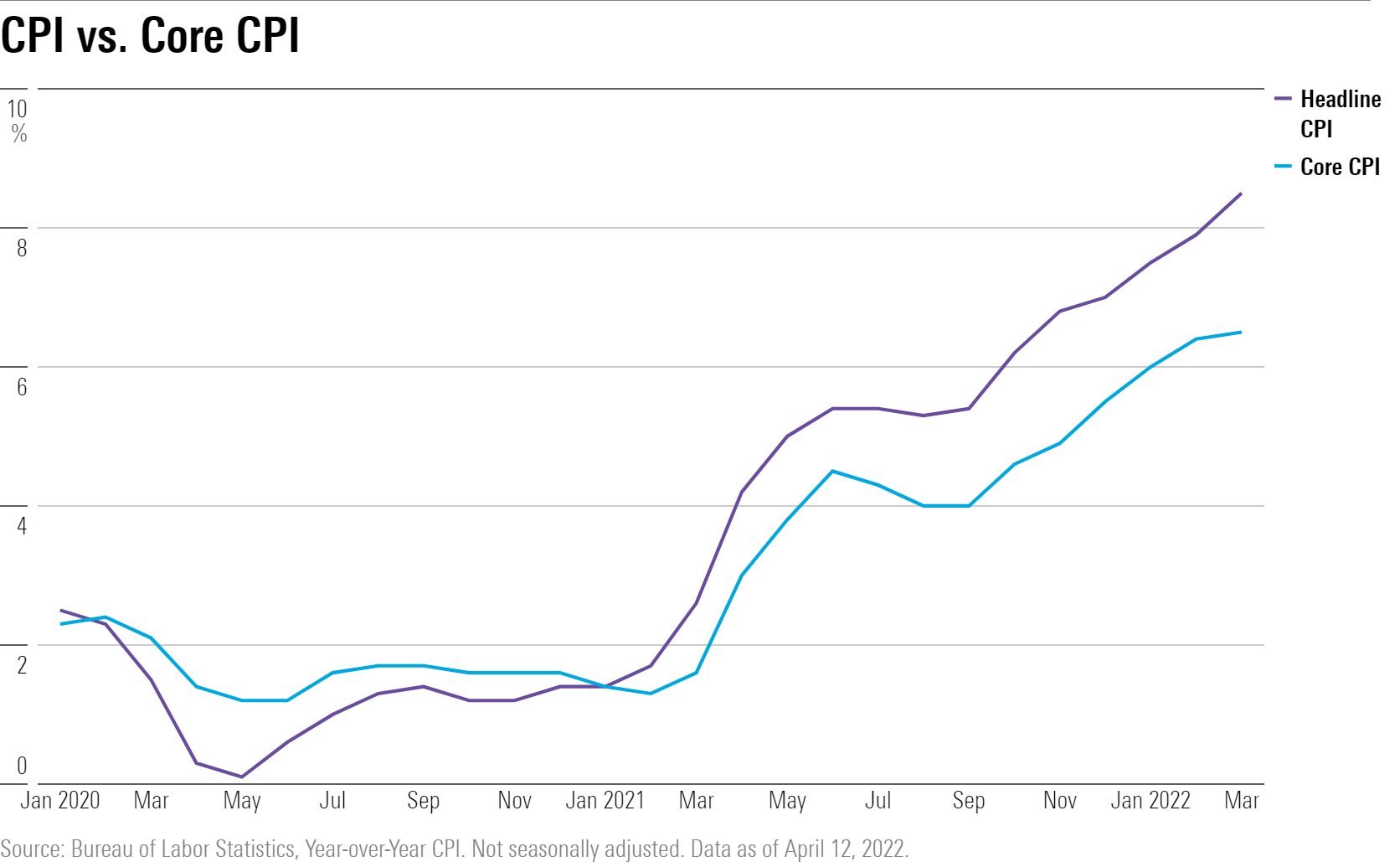

With the big monthly rise in March, CPI posted an increase for inflation that is measured on an annual basis. The March reading means that inflation hit 8.5% from the levels seen one-year, the largest increase since December 1981. The March reading followed a 7.9% rise in consumer inflation in February.

Excluding food and energy costs, CPI rose 6.5% in March from a year earlier, the largest 12-month change since August 1982.

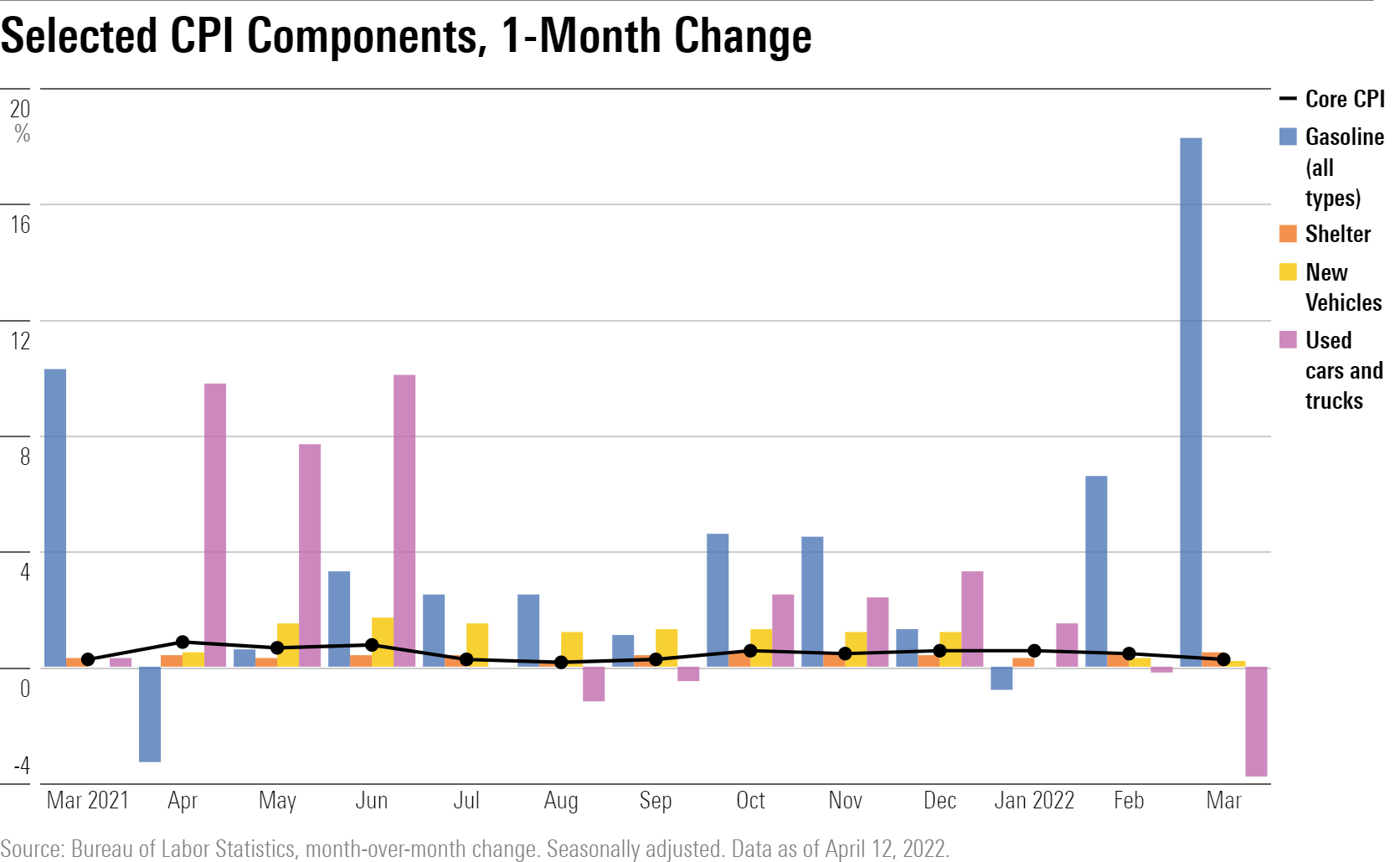

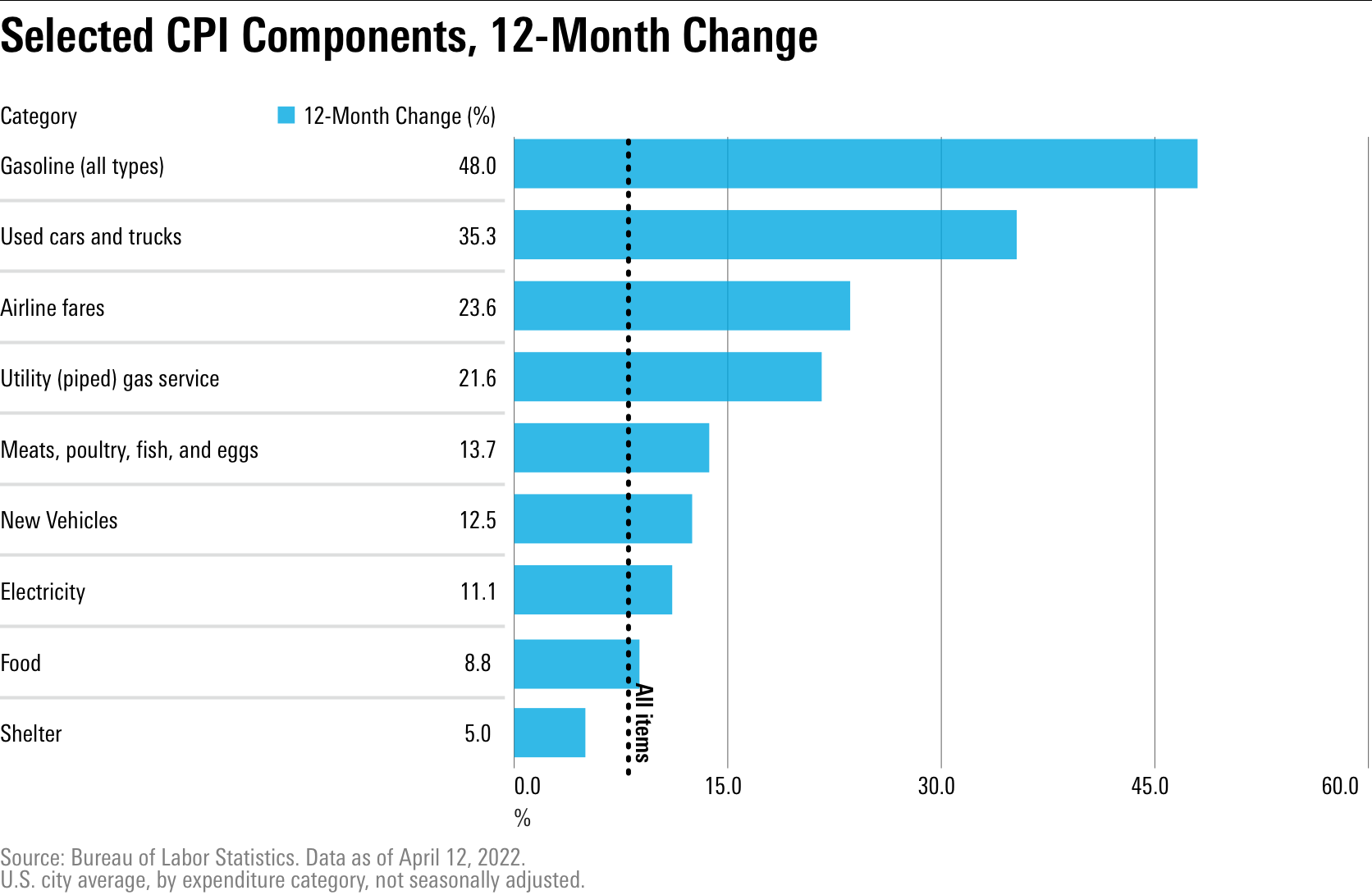

More than half the overall 1.2% rise in the CPI from March was due to an 18.3% jump in gasoline prices. Food costs rose 1% in March, with all six major grocery store food group indexes posting increases.

“While headline inflation jumped an alarming 1.2% month over month in March, most of the increase was driven by food and (especially) energy,” Caldwell says. “Core inflation--excluding food and energy--was up 0.3% month over month, only modestly above the monthly rate 0.2% consistent with 2% annual inflation.”

When food and energy were factored out, housing costs drove half the 0.3% increase in core CPI, with rental costs rising 0.4%. Other areas with notable price increases included airline fares, household furnishings and operations, medical care, and motor vehicle insurance, according to the BLS.

One area where costs fell was in a category that was a source of significant price increases in 2021: used cars and trucks. They fell 3.8% in March, declining for a second consecutive month.

The slowdown in core inflation was helped by lower vehicle prices. Those prices are still up by 22% since the start of the pandemic due to the semiconductor shortage and other supply issues--one of the main contributors to the swelling of inflation.

"We expect this spike in vehicle prices (along with other goods affected by similar issues) to further unwind as supply issues eventually resolve,'' Caldwell says. "In the near-term, however, global supply chains could see adverse impact from China's ongoing lockdowns, as the country doggedly persists with its "zero-COVID" strategy.''

There has been good news on the energy front, with prices for both oil and gas coming down.

“For energy prices, it appears that the worst is now over,” Caldwell says.

“We shouldn't rule out a short-term worsening of the situation, given the unpredictability of the war in Ukraine and its consequences for Russian oil supply. Nonetheless, in the long-run we expect the surge in oil prices to recede as global oil suppliers ramp up production. Our energy team projects oil prices to reach $55 per barrel by 2025.”

On a year-over-year basis, the 8.5% increase in the CPI was led by the jump in gasoline prices and saw meaningful increases elsewhere. Electricity costs were up 11.1%, food at home costs rose 10%, and food away from home rose 6.9%, all for the 12-month period ended in March.

Housing costs rose by 5% on an annual basis, the largest such increase since May 1991, and household furnishings and operations costs increased 10.1% over the past year, its largest 12-month increase since July 1975.

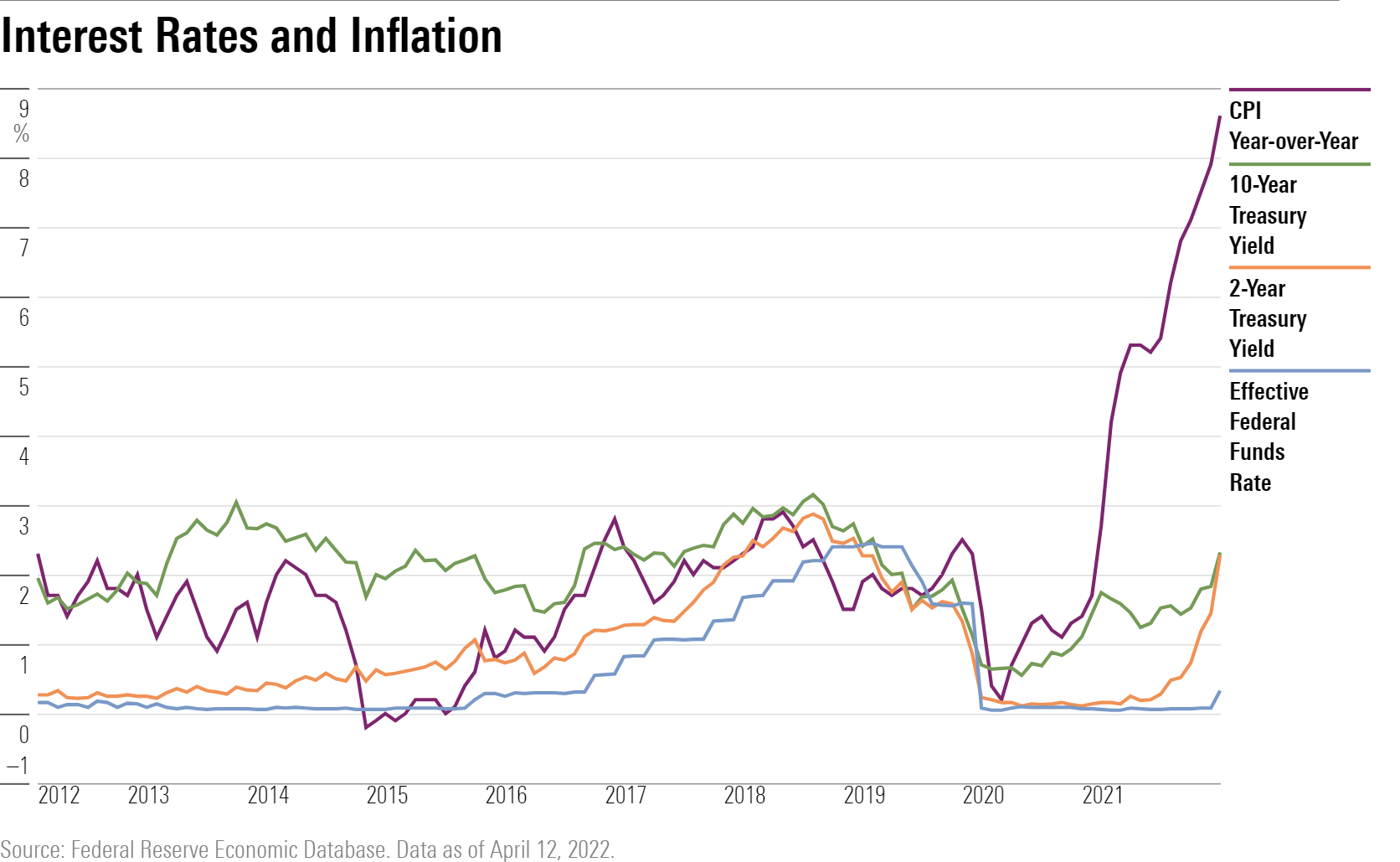

“Today's data doesn't likely change the plan for the Federal Reserve to hike interest rates aggressively over the next several meetings” Caldwell says. While the fall in core inflation offers some light at the end of the tunnel, “the Fed can't take it for granted that high inflation will come down on its own.” In March, the Fed announced a 25-basis-point increase in the federal-funds rate and projected to raise rates seven more times in 2022 alone.

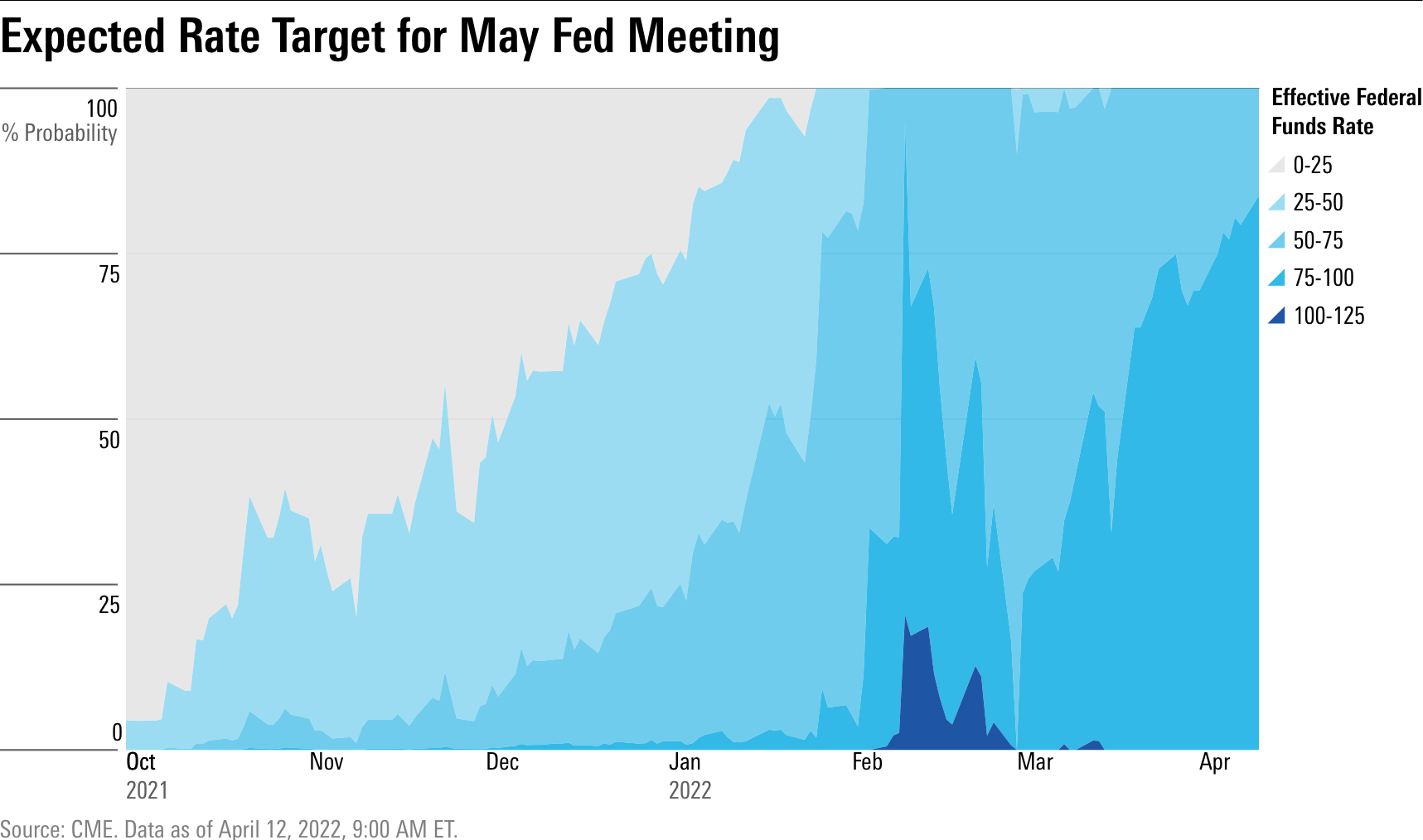

Official minutes from the March meeting reveal that the Fed is weighing options to raise rates twice as fast (half a percentage point instead of 0.25) at its next meeting in May. Over 75% of the market (as measured by futures contracts) expects rates to rise by 75-100 basis points at the May meeting, according to the CME FedWatch tool.

Meanwhile, the bond market has taken a hit by the stubborn inflation as Treasury yields have risen across the board. The U.S. Treasury two-year note soared to 2.28% at the end of March, up from 0.73% at the end of 2021. The yield on the 10-year treasury note also rose to 2.3%, up from 1.5% at the end of 2021.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)