Do You Need an Annuity for Retirement Income?

Some guidelines to figure out whether an annuity makes sense for you, and if so, how much to allocate.

A version of this article previously appeared on Sept. 3, 2021.

We’ve recently published a few articles in favor of broader usage of annuities, which allow investors to convert a lump-sum investment to a guaranteed income stream. Like most insurance products, annuities are a form of risk transfer. Because the insurance company spreads risk across a broader pool, it’s able to manage longevity risk and provide income payments that are not only higher than investors could generate on their own but also guaranteed for life (assuming the insurance company is financially sound).

Annuities can be confusing because they come in so many different varieties--from immediate to deferred and fixed to variable. Even within the same broad type, there’s a long list of potential features, benefits, and costs that can be tough to make sense of. In this article, I’ll focus specifically on immediate fixed annuities, which provide a predetermined income stream that starts paying out right away (technically within 12 months of when you first sign the contract). I’ll also explain how to decide if one of these annuities makes sense for you and how much you might want to allocate to one.

Background

Investors often think of annuities as overly complex, high-cost products peddled by aggressive salespeople. In some cases, that reputation is well deserved. (Variable annuities, I'm lookin' at you.) But fixed annuities are relatively plain-vanilla products that can add significant value by filling gaps in retirement income. Thanks to the long-term decline in interest rates (which affects how much insurance companies can earn on their portfolios), payout rates aren't as high as they used to be. Based on data from Schwab's Income Annuity Estimator, a 65-year-old man could currently expect to receive monthly payments of about $540 in exchange for purchasing a $100,000 annuity. That's down from average payouts of more than $700 in 2001 based on data from the Center for Retirement Research at Boston College.

Even so, that translates into an effective income rate (which includes both interest payments and return of principal) of about 6.5%, which is higher than the cash flows generated by most investments. And in contrast to an investment portfolio, which runs the risk of depletion from unexpected longevity, market downturns, or a bad sequence of returns, an annuity won’t run out during the investor’s lifetime (or payout period). That makes annuities especially valuable for retirees who fear running out of money.

Note: It’s important to emphasize that while annuities are often described as a way to generate income, they’re not an investment asset. An annuity purchase immediately removes money from your portfolio, and the monthly payout includes principal from the amount you originally paid in.

Running Through the Numbers

If you think an annuity might be right for you, here are a few steps to take to figure out the specifics.

- Determine your monthly spending needs. The most conservative approach would be to base this spending analysis only on essential items, such as housing, utilities, food, medical costs, and insurance.

- Subtract any monthly income, such as payments from a pension or Social Security, and then multiply the result by 12 to get an annual number for your net spending needs.

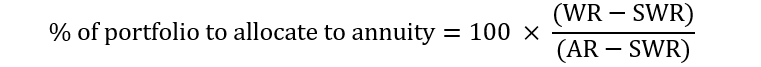

- Take the result and divide it by your portfolio's total value. This is your required withdrawal rate, or WR in the formulas below.

- Decide on a figure to use for the safe withdrawal rate, or SWR, which is the percentage of your portfolio's value you can safely withdraw each year. (Retirees typically use this percentage to calculate the starting withdrawal amount and then increase subsequent withdrawals for inflation each year.) Many investors rely on the 4% figure originally tested by Bill Bengen in 1994, but a lower number (such as 3.5%) may be more prudent in an era of lower bond yields and potentially lower stock returns. On the other hand, investors willing to allocate a larger portion of their asset to stocks can use that as a lever to allow for higher withdrawal rates.

- Find out the effective income rate you can earn on an annuity, or AR. For example, if you expect to receive monthly income payments of about $559 in exchange for purchasing a $100,000 annuity, that would translate into an effective income rate of 6.7% per year.

- Plug the numbers into the following formula.

Source: Adapted from Otar, J. 2006. "Lifelong Retirement Income: How to Quantify and Eliminate Luck." In Evensky, H. & Katz, D., Retirement Income Redesigned: Master Plans for Distribution P. 94. (New York: Bloomberg Press.)

Here are a few examples of how this might work in practice. I’ll use the same assumptions for the annuity rate and safe withdrawal rate, and test out some different portfolio values and required withdrawal rates to show how annuities could fill a bigger or smaller role depending on an individual’s circumstances.

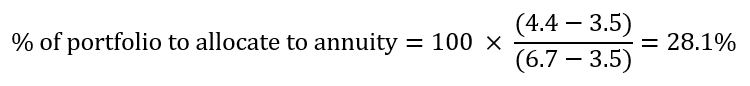

Case 1: Annuity Can Help Fill the Gap

Let’s say Arturo figures out that he needs to spend $44,000 per year. The starting value of his portfolio is $1 million, so that’s a withdrawal rate of 4.4%. Plugging the numbers into the formula yields the following result:

Case 2: Bigger Need for Annuity

Arturo’s friend Bernard also plans to spend $44,000 per year and has been able to save $850,000 for retirement. His starting withdrawal rate would be 5.2%. That leads to a higher potential annuity allocation, as shown below:

Case 3: No Need for Annuity

Arturo and Bernard’s friend Chad plans to spend $80,000 per year and has been fortunate enough to amass a $3 million portfolio, which translates into a withdrawal rate of only 2.7%. The formula below yields a negative number, which means his portfolio is large enough to support his planned withdrawal rate with an extra cushion he could use for bequests, charitable giving, or additional spending. There’s no need for him to fill in any income gaps with an annuity.

Other Considerations

Of course, the formula above is just a starting point. Investors will want to carefully think through the pros and cons of shifting assets to an annuity before making any decisions. Most important, once you purchase an annuity contract, the decision is irrevocable--meaning that you typically can’t get the money back. Purchasing an annuity means you’re giving up the value of your current assets in exchange for a guaranteed future income stream. Many people also hesitate to give up assets for an annuity because if the annuity owner dies earlier than expected, the money stays with the insurance company instead of going to heirs. (People can get around this issue by purchasing an annuity with survivor benefits or a guaranteed benefit period).

As mentioned above, the financial strength of the insurer is another important consideration. However, most state insurance guaranty associations will cover at least $250,000 in annuity benefits in the event that the annuity provider becomes insolvent.

In addition, certain types of annuities come with limits on the amount of assets you can convert. For example, a qualified longevity annuity contract is a type of deferred annuity funded with assets from retirement accounts, such as a 401(k) or IRA. The IRS limits the amount of money you can convert to a QLAC to up to $135,000 or 25% of the account value, whichever is less.

Before committing to an annuity, it’s also worth thinking through other options for creating maintainable cash flows in retirement. Reducing spending is the easiest way to do that, but retirees can also boost their portfolios’ odds of success by employing a more-flexible withdrawal strategy, such as forgoing inflation adjustments in years when the portfolio decreases in value, or limiting withdrawals to a certain percentage of the portfolio’s value. More-flexible withdrawal strategies can significantly increase the starting withdrawal rate. Finally, some retirees may be comfortable with a higher level of uncertainty. Withdrawal-rate guidelines (including the 3.5% number used above) are typically based on stress-testing the withdrawals so they meet a 90% threshold for the odds of success. But investors who are willing to accept lower odds--and adjust spending if needed--may be comfortable with a higher starting withdrawal rate.

That said, fixed annuities are a critical--and arguably underused--piece of the retirement-income puzzle. They can play a valuable role in filling retirement-income gaps for retirees who worry about running out of money, value certainty over flexibility, or still find themselves short on retirement assets even after cutting down planned spending.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)