Best- and Worst-Performing U.S. Equity Funds

Dividend funds and strategies with heavy energy stakes weathered the turmoil, while pandemic-high flyers took a beating.

The stock market may have been down modestly in the first quarter, but that doesn’t tell the whole story for fund investors.

As highlighted here, a major driver of performance was the degree to which funds were tilted toward either value or growth stocks. Dividend funds and those heavy in energy stocks carved out solid gains in the first three months of 2022. Invesco Small Cap Value VSCAX, which holds twice the energy weight as the average fund in its category, rose 8.8%, and WisdomTree U.S. High Dividend DHS gained 6.9%.

The heaviest losses came among funds with portfolios packed with stocks that had been high-priced, high-flyers in 2020. ARK Innovation ETF ARKK and Morgan Stanley Intuitional Discovery MPEGX both lost more than 20%, the largest quarterly drawdown for both funds since their inception.

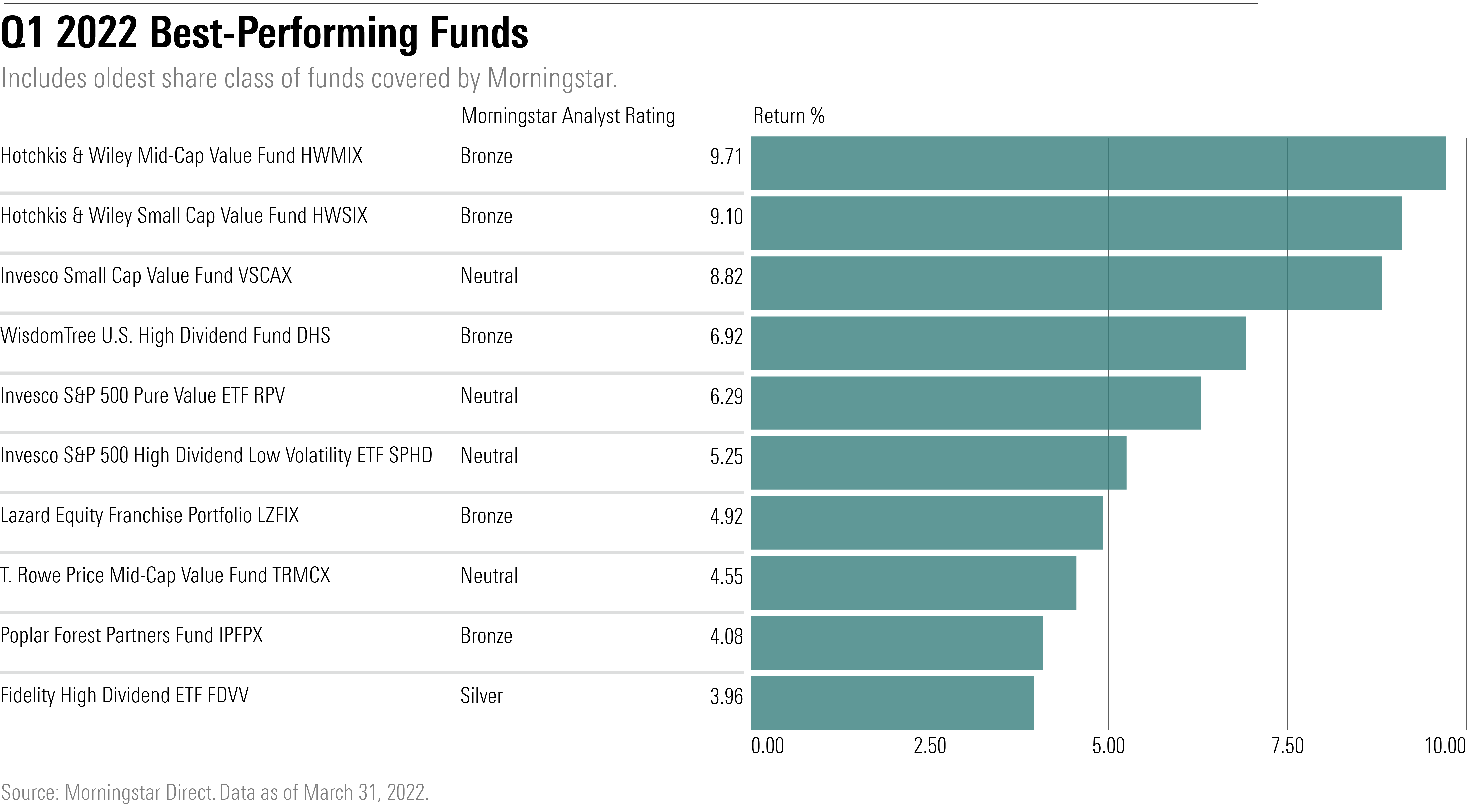

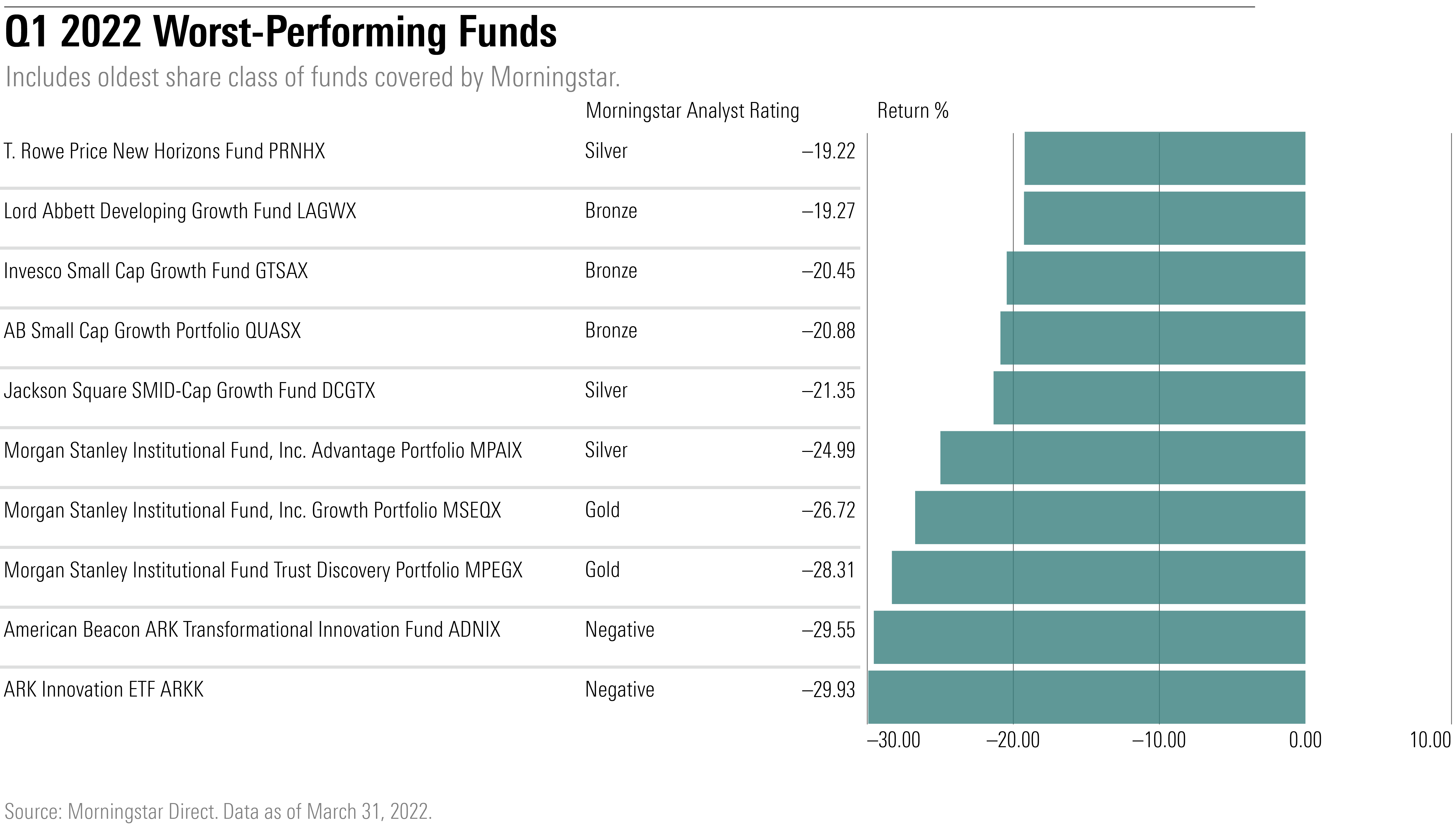

Here’s a look at the best– and worst-performing funds covered by Morningstar analysts, from among both actively-managed and index-tracking strategies:

Best-Performing Funds

Of the 568 U.S. equity funds covered by Morningstar analysts, Hotchkis & Wiley managed the two best performers. The Hotchkis & Wiley Mid-Cap Value HWMIX gained 9.71%, while the average mid-cap value fund lost 0.70%. The fund's large stake in energy companies--20% versus 5% for the category average as of December 31--helped boost returns. The managers have lightened their energy exposure given the sector's recent strong performance, but it remains a core part of the fund, Morningstar's associate director of equity strategies Christopher Franz wrote in a recent report.

That has helped the fund bounce back from a prolonged period of underperformance, he adds. The fund trailed in the category from 2017-2019, but ranks in the top 1% of the mid-cap value category over the last year.

Invesco Small Cap Value VSCAX outperformed in the quarter, gaining 8.82%, but has also shined over longer time periods. The fund ranks in the top 5% of small value funds over the past three-, five-, and 10-year periods. The strategy’s strong quarter can be attributed to excellent stock selection, with industrials doing particularly well, says Morningstar analyst Nicholas Goralka. The managers like industrials, allocating 39% versus 15% for the fund's benchmark, the Russell 2000 Value Index, so they look much better than their peers when those picks outperform the broader market, he says.

Many divided-focused funds posted strong returns amid rising interest rates and strong performance from dividend-gushing energy stocks. WisdomTree U.S. High Dividend was the top-performer, gaining 6.92%, while the average large value fund lost 0.24%. Nearly 20% of the portfolio was invested in energy companies and despite its high-yield mandate, the fund also has a greater focus on profitable companies with solid economic moats than the category average index, writes analyst Lan Anh Tran. The fund also benefited from top-holding AbbVie ABBV, which gained 21% in the quarter.

Worst-Performing Funds

Ark Innovation ETF was down the most among all U.S. equity funds falling 30% in the quarter, compared with the average mid-cap growth fund's decline of 12.5%. Morningstar's Robby Greengold recently downgraded the fund to negative, citing its poor risk management.

“High exposure to money-losing companies amplifies the strategy’s volatility and downside risks. They recently consumed 60% of the strategy’s assets, more than double the index’s share,” Greengold says.

Another high-flying fund from 2020, Morgan Stanley Institutional Discovery, tumbled 28%. The fund’s fortunes have reversed due to a drop in many of its technology-related holdings, says Katie Rushkewicz Reichart, Morningstar director of equity strategies. Concerns about rising

, Apple’s privacy changes, and stock-specific bumps contributed to those declines.

"The fund's concentrated, high-growth style lends itself to boom-and-bust returns over short time periods, though long-term investors have come out ahead,’’ Rushkewicz Reichart wrote. The fund ranks in the top 2% of performers in in the mid-cap growth category over the past five years.

Large-cap offerings from Morgan Stanley, the Institutional Growth MSEQX and Institutional Advantage MPAIX funds also made the worst-performers list.

Small growth funds also had losses. Lord Abbett Developing Growth Fund LAGWX dropped 19.3% versus the average small growth fund fall of 12%. The strategy's holdings in technology and consumer discretionary stocks, which pumped up gain in the past, drove losses for the year-to-date period, Morningstar analyst Drew Carter says in a report.

"A large overweighting in tech stocks hurt somewhat, but its picks in the sector also weight on results, particularly cloud and software platform provider Calix CALX and semiconductor chip designer Ambarella AMBA,’’ Carter says.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)