Liquid Alternatives Funds Belong on Most Investors' Too-Hard Pile

Their diversification benefits have mostly been a mirage.

A version of this article previously appeared in the February 2022 issue of Morningstar ETFInvestor. Click here to download a complimentary copy.

Markets ended 2021 on a high note. But not long after the ball dropped on New Year’s Eve, they fell out of bed. It has been a tough go thus far in 2022. The Morningstar Global Stock Market Index slumped 5.5% in the first quarter. Bond markets woke up with a hangover. After slipping 1.6% in 2021--its first calendar-year loss since 2013--the Morningstar U.S. Core Bond Index was down another 6% through the first three months of 2022.

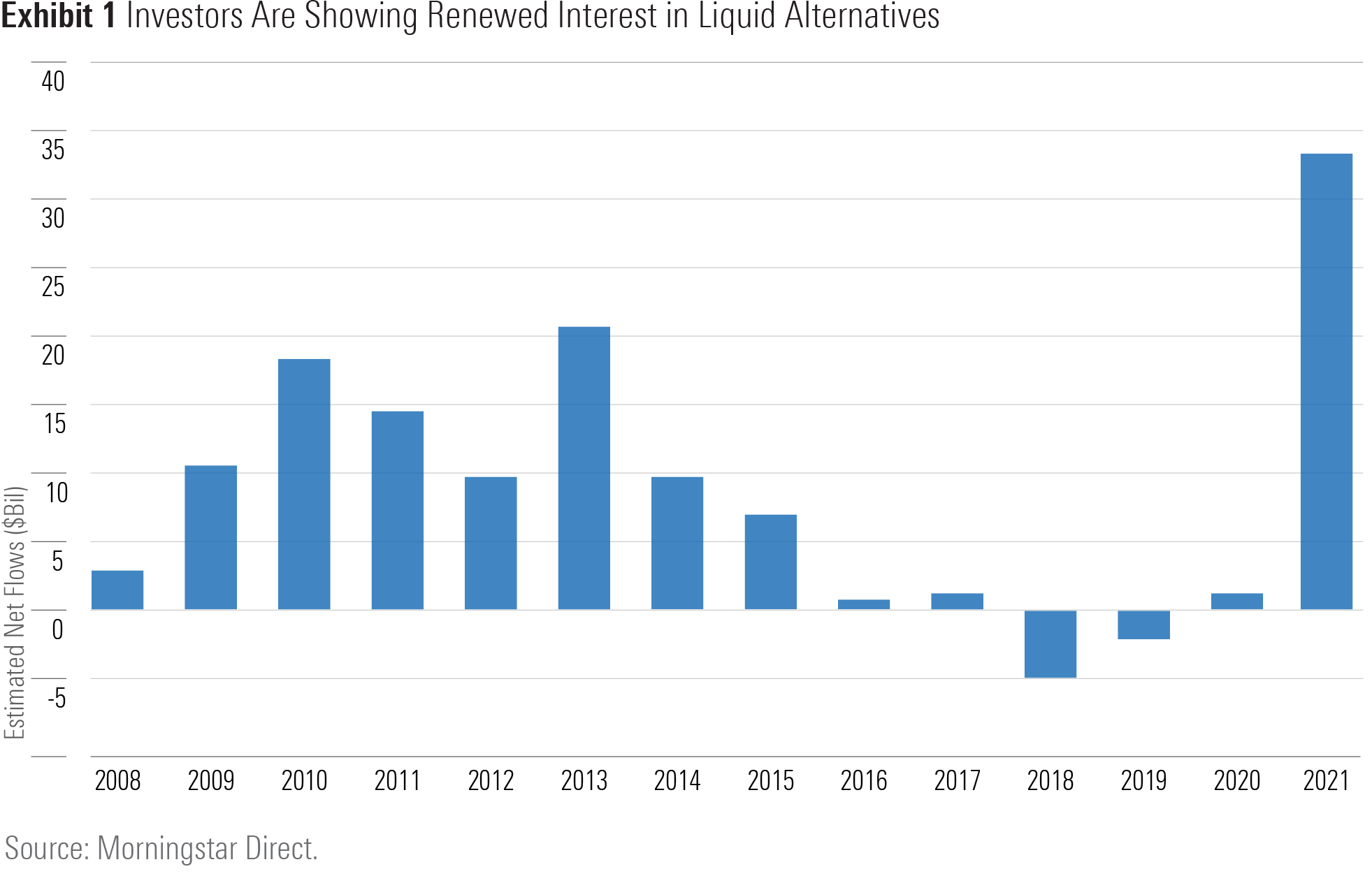

Rocky markets, still-lofty valuations, and low interest rates have sent investors in search of alternatives to the asset-class staples of any well-diversified portfolio: stocks, bonds, and cash. In 2021, investors allocated more to liquid alternatives funds in any year since 2013, pouring $33.4 billion into the category.

But what are liquid alternatives funds? Are they a good complement to traditional asset classes? And what are the odds that investors can succeed with these strategies? In this article, I’ll dig into each of these questions in turn.

What’s an Alternative?

Liquid alternatives funds trace their roots back to the global financial crisis. Many of the strategies these funds employ had previously been the exclusive domain of the well-heeled and were offered in hedge funds. Many of these funds used a heaping helping of leverage and locked up investors’ money, and some were hedge funds in name only. (They didn’t actually hedge anything!) Offering similar strategies in mutual funds ticked two important boxes in asset managers’ product development playbook. First, it offered the opportunity to “democratize” access to investment strategies that had previously been available only to a select few. Second, it was a way to fight the last war (a core competency of the industry). When the first liquid alternatives funds arrived on the scene, investors were still coping with the shock of the financial crisis and the impact it had on their portfolios. “Never again will I stand by and watch my portfolio sink as markets tumble and the correlations between stocks and bonds converge!,” said many. Liquid alternatives funds aimed to assure investors they’d not relive this experience.

Liquid alternatives encompass a broad array of investment strategies from arbitrage to trend-following. If there’s a common thread among them, it’s that they’re trying to rearrange different types of investment risk to deliver a pattern of returns different from what you’d get from meat-and-potatoes asset classes. Ideally, the end result of investing in them would be a meaningful improvement in your portfolio’s risk-adjusted returns.

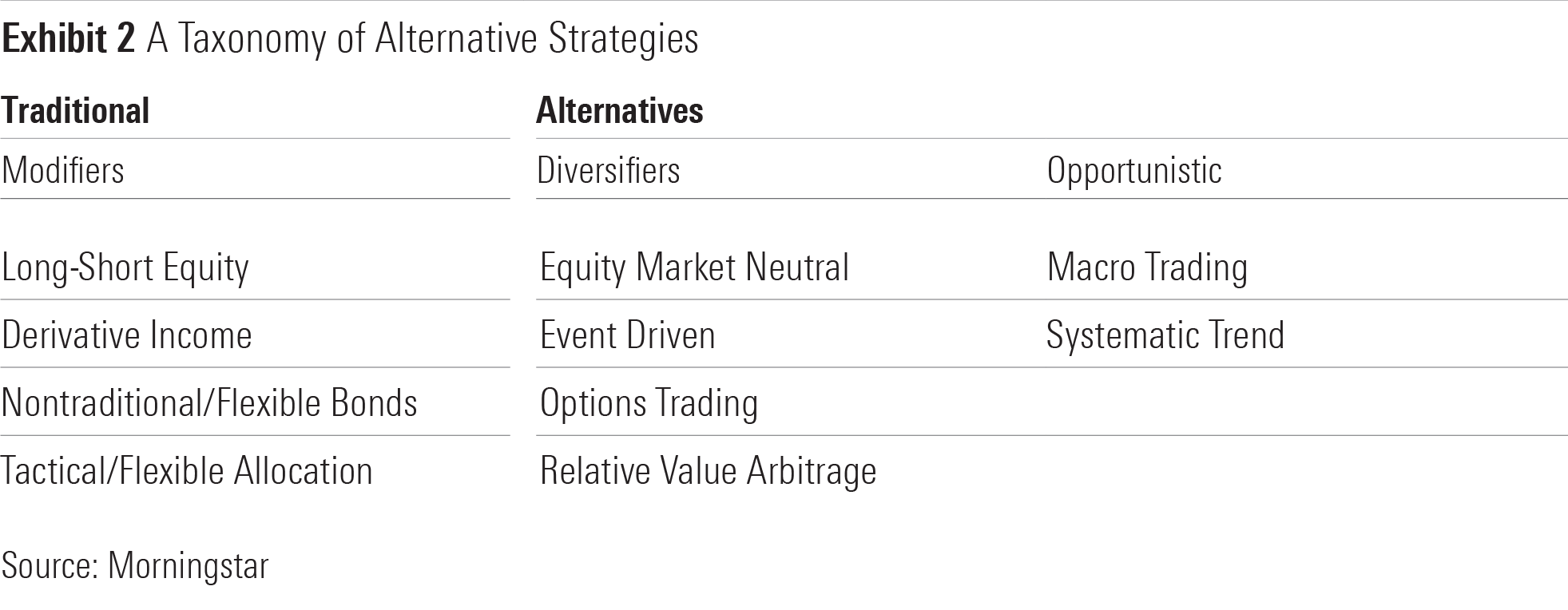

Some liquid alternatives strategies represent a modification to long-only stock or bond exposure, like long-short equity and nontraditional bond funds. Others look to diversify stock and bond risk, like equity market-neutral funds. There are also liquid alternatives strategies that are strictly opportunistic, such as trend-following. Exhibit 2 provides a taxonomy of the different objectives of the panoply of liquid alternatives strategies.

Are They a Good Complement?

A good litmus test for liquid alternatives funds is whether an investment in them improves the risk-adjusted returns of a diversified portfolio. In an August 2018 analysis, my Morningstar colleagues Jason Kephart and Maciej Kowara put these funds to the test.[1] Their analysis used a simple 60% stock/40% bond index portfolio as their benchmark. Each alternative fund included in the analysis received an allocation that maximized the portfolio’s risk-adjusted returns, as measured by Sharpe ratio. Over the five years through 2017, they found that the majority of alternatives funds that lived from the beginning of the period to its end failed to improve the Sharpe ratio of the simple 60/40 index portfolio. Just eight of the 134 funds (6% of them) improved the 60/40 portfolio’s Sharpe ratio by more than 10%. If funds that were merged or closed during this five-year stretch were included, the results would have been even worse.

But 2013–17 was a great stretch for stocks and a mostly good one for bonds, and it was marked by rising correlations between the two. What if we look at a different period? In a follow-up to their original work, Kephart and Kowara replicated their analysis for the period spanning from the pre-financial crisis peak in October 2007 through March 2012. [2] Their sample was much smaller (remember, these funds’ popularity peaked only after the markets cratered), including just 65 funds. Of those 65, 45 survived, and 17 (26% of the original 65) improved the 60/40 portfolio’s Sharpe ratio by more than 10%.

The data doesn't paint a pretty picture. Most liquid alternatives funds haven’t proved they have what it takes to improve investors’ portfolios. But that’s not to say that none of them can. It’s just that investors hoping to succeed with these funds face a Herculean effort.

The 10 Labors of Liquid Alternatives Fund Investors

Morningstar’s 2021 Global Liquid Alternatives Landscape outlines 10 key challenges facing liquid alternatives investors in their quest for better risk-adjusted returns.[3]

1) Lineup Churn. Liquid alternatives funds have tended to live fast and die young. Among the 797 funds that have ever belonged to the broad alternative Morningstar Category group, 450 (56%) have been liquidated or merged away. The median age of these funds at the time they expired was four years. As of June 2021, less than 10% of liquid alternatives funds had lived through the 2008 global financial crisis.

2) Liquidity. Some liquid alternatives funds dabble in less-liquid fare. This can create a liquidity mismatch in funds that are meant to provide their investors with liquidity on a daily basis. When too many investors come calling for their assets and managers have to raise cash in a pinch, the pressure applied to the prices of less-liquid holdings can punish fundholders.

3) Complexity. Some of these strategies can come across as gibberish, even to astute investors. Complexity is rarely a positive trait in most investment settings; the less investors understand what they own, the less likely they are to succeed.

4) Leverage. The use of leverage is common among liquid alternatives funds. While leverage can give investors a boost on the upside, it more commonly makes headlines for its devastating impact on the downside.

5) Constraints. Liquid alternatives funds face far more constraints than similar strategies plied in hedge funds. These constraints can apply to the use of liquid alternatives leverage, liquidity, levels of portfolio concentration, and more. While it isn’t clear whether this is beneficial or detrimental, on average, it is all but certain that investors in these funds are getting something very different from what’s on offer in hedge funds.

6) Instability. There are real live people managing these portfolios, and personnel turnover has been a fixture of liquid alternatives funds. This sort of disruption is rarely (if ever) beneficial for fund investors.

7) Fees. The less investors pay, the more they get. In the case of liquid alternatives funds, they generally pay more--a lot more. In 2020, the asset-weighted average fee across all actively managed alternative funds was 1.20%, nearly double the 0.62% asset-weighted average fee for all actively managed funds.

8) Style. The winds have not been blowing in many liquid alternatives funds’ favor. Value stocks have struggled, so funds that try to harness the value premium have languished. High correlations among asset classes have made it tough sledding for trend-following strategies, and many of them couldn’t act quickly enough to capitalize on the early-2020 market meltdown and subsequent melt-up. If a liquid alternatives fund hasn’t got wind in its sails, it may leave investors with a case of cabin fever.

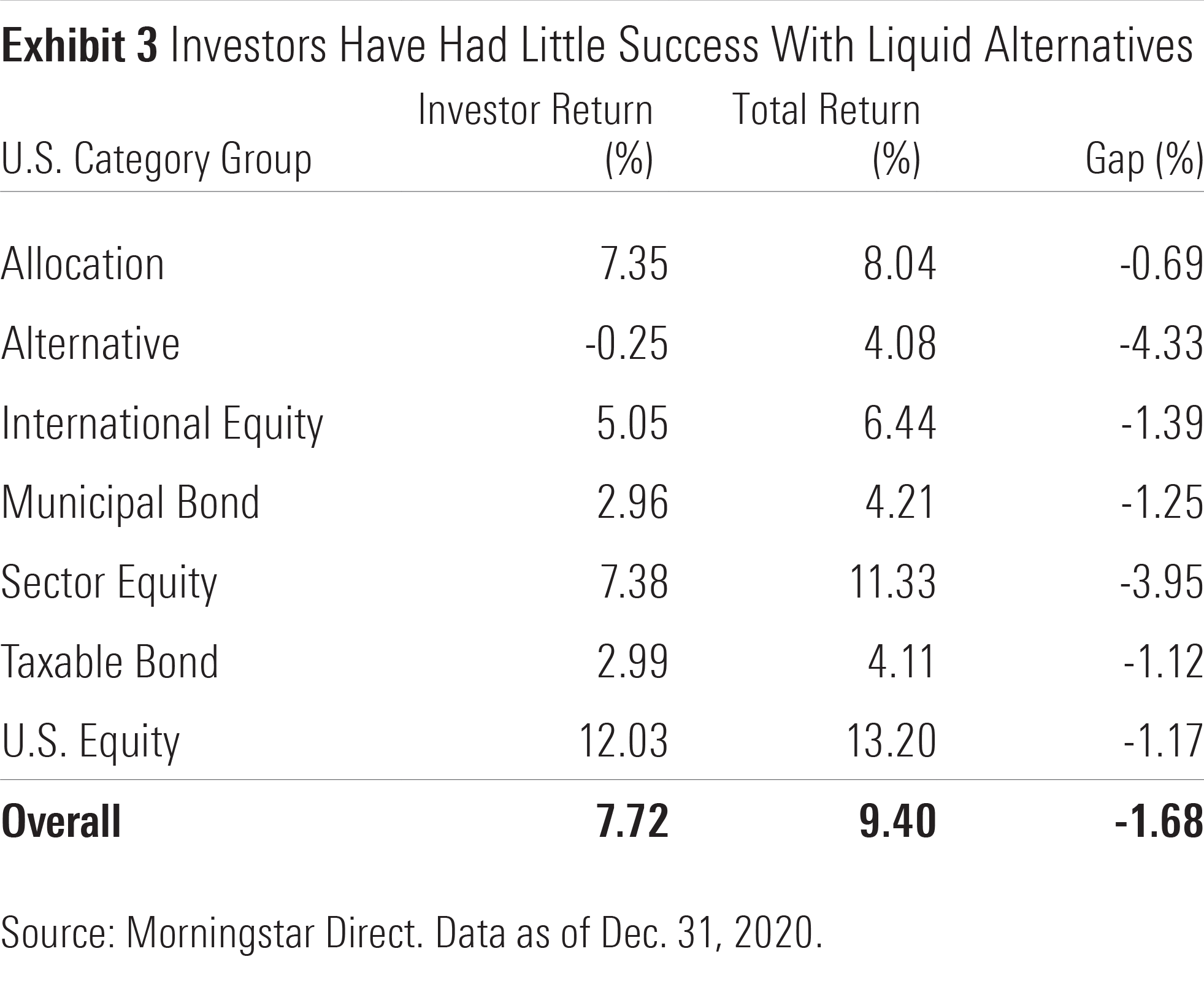

9) Investor Gap. Investors have generally had little success with liquid alternatives funds. This is evidenced by the gap between these funds’ time and dollar-weighted returns. The former measures the returns the funds produce, the latter measures the returns investors earn--accounting for the timing of their purchases and sales. Exhibit 3 shows that over the 10 years through Dec. 31, 2020, investors in liquid alternatives funds have made particularly poor timing decisions with these funds, often buying after stretches of stellar performance and bailing near the bottom.

10) “Diworsification.” Most liquid alternatives funds haven’t been good diversifiers. In many cases, they’ve not only failed to improve the risk-adjusted returns of a diversified portfolio, they’ve made them worse. Granted, the market environment hasn’t been conducive to the success of many of these strategies, but many investors have missed out on the chance for better risk-adjusted returns elsewhere as they bide their time waiting for the tide to turn.

Alternate Ending

I personally think liquid alternatives belong on most investors’ “too hard” pile. While there are a handful of standouts among their ranks, I think it will be difficult for many to invest an amount that could yield the desired diversification benefits and to stick with these strategies long enough to reap those rewards.

[1] Kephart, J., & Kowara, M. 2018. “Liquid Alternatives Have Yet to Prove They Belong in Portfolios.” https://www.morningstar.com/articles/878584/liquid-alternatives-have-yet-to-prove-they-belong-in-portfolios

[2] Kephart, J., & Kowara, M. 2018. “What If? The Liquid Alternatives Edition.” https://www.morningstar.com/articles/883541/what-if-the-liquid-alternativesedition

[3] Alitovski, E., Mottola, M., Paganelli, F., & Scott, S. 2021. “2021 Global Liquid Alternatives Landscape.” https://www.morningstar.com/lp/alt-landscape

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)