33 Undervalued Stocks for Second-Quarter 2022

Here are our analysts’ top stock ideas in each sector for the quarter.

For the new list of Morningstar’s top analyst picks, read our latest edition of “33 Undervalued Stocks.”

Inflation, fears about rising interest rates, and the Russia-Ukraine conflict rattled markets during 2022′s first quarter. U.S. stocks finished the quarter down about 5%, as measured by the Morningstar US Market Index. Heading into the second quarter, stocks were a tad undervalued according to our metrics: The median stock in Morningstar’s North American coverage universe traded at a 2% discount to our fair value estimate.

Expect more volatility ahead, says Morningstar chief U.S. market strategist Dave Sekera in his latest stock market outlook. "We suspect that volatility will remain high over the near term, especially until there is a resolution in the Ukraine conflict. Since the beginning of the year, our valuation has ranged from a 6% premium all the way down to an 11% discount."

Here are some specific stocks across sectors that are among our analysts' best ideas for the second quarter.

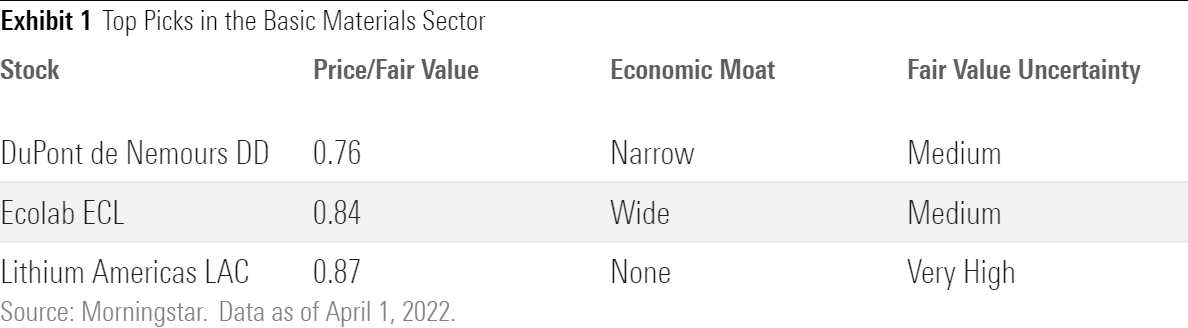

Top Basic-Materials Stocks

The basic materials sector outperformed the broader market during the first quarter by remaining essentially flat. We see more opportunities across the sector than we did last quarter, reports senior analyst Seth Goldstein. In fact, one third of the stocks we cover in the sector are trading at 4-star levels heading into the second quarter.

Goldstein argues that lithium is a smart way to play electric vehicle adoption; we expect prices to remain high over the next several years as demand outpaces new supply. We also expect solid long-term growth from specialty chemicals producers selling into the electronics and EV markets, he adds.

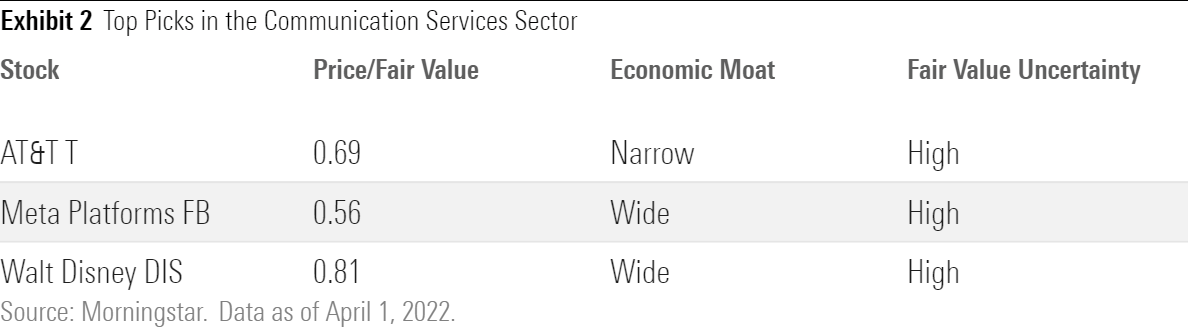

Top Communication-Services Stocks

The communications-services sector lost more than twice as much as the broader market during the first quarter, with Meta Platforms FB and Netflix NFLX driving most of the underperformance, explains director Mike Hodel.

Of the two, we think Meta is a far better opportunity today. “We don’t believe investors appreciate how thoroughly Meta dominates online social-media ad spending,” argues Hodel. So far, Meta has effectively countered features that other networks offer to keep users engaged, and we think the firm will continue to manage any regulatory challenges it faces.

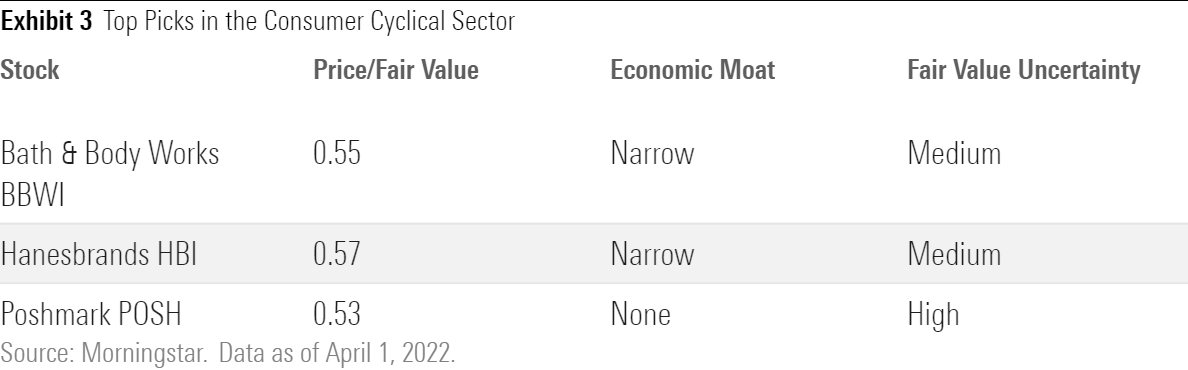

Top Consumer Cyclical Stocks

Consumer cyclical stocks struggled in the first quarter, lagging the broader market by 6 full percentage points. As such, the median consumer stock trades at a discount to our fair value estimate, with more than half of the names we cover trading in 4- and 5-star range, points out director Erin Lash. Travel and leisure stocks remain among the most significantly undervalued. While a volatile global political environment and rising prices may disrupt the travel industry's recovery short-term, we forecast a full recovery in the travel industry to prepandemic levels by 2023, she notes.

The pandemic’s impact on retailers may be longer-lived. “We believe retailers will need to continue to optimize e-commerce platforms to avoid losing sales in a quickly shifting marketplace and remain engaged with consumer trends,” concludes Lash.

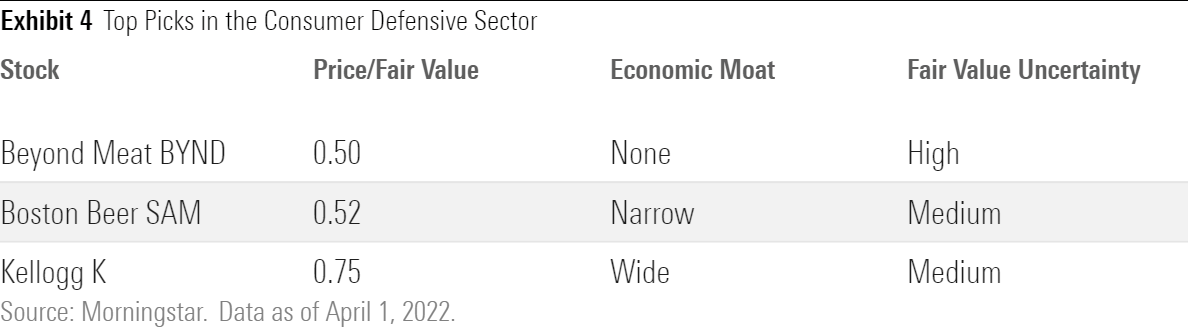

Top Consumer Defensive Stocks

Consumer defensive stocks outperformed the broader market during 2022’s first quarter. Though opportunities are scarce, we find them in the consumer products and beverage industries, notes Lash. “We suspect shares have been hampered by inflation and uncertainty about firms’ ability to withstand such pronounced margin pressure,” she argues.

Of course, inflation has posed a threat to the sector, but Lash expects companies with strong brands to be able to navigate relatively unscathed.

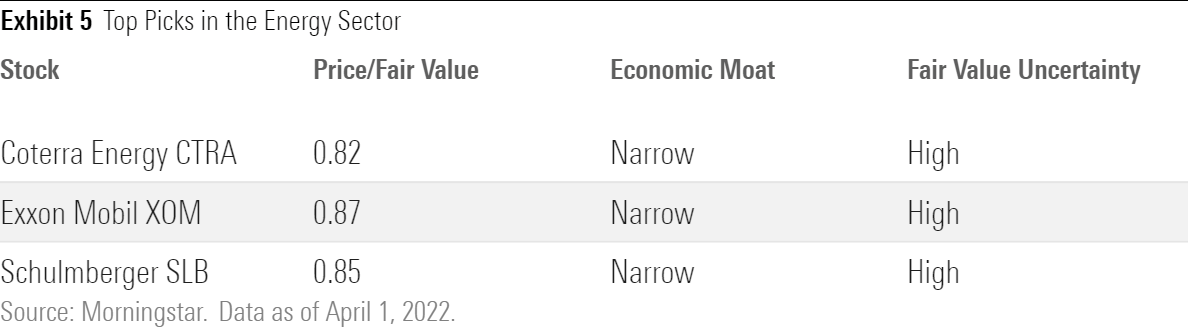

Top Energy Stocks

Energy stocks trounced the broader market during the first quarter, rising more than 40%. Given the surge, we now think the energy sector is overvalued, trading at an 11% premium to our fair value estimate entering the second quarter, reports director Dave Meats. The oil-services industry is a pocket of opportunity, with those names trading at an average discount of 7%.

The Russia-Ukraine conflict drove up crude and natural gas prices--and we expect them to remain well above our midcycle estimates this year as a result. “The disruption is likely to upend trade flows, with more Russian crude heading east, while volumes previously bound for Asia are diverted to Europe,” explains Meats. “But that increases frictions, including higher shipping costs, inefficient pipeline utilization, and quality mismatches at refineries.”

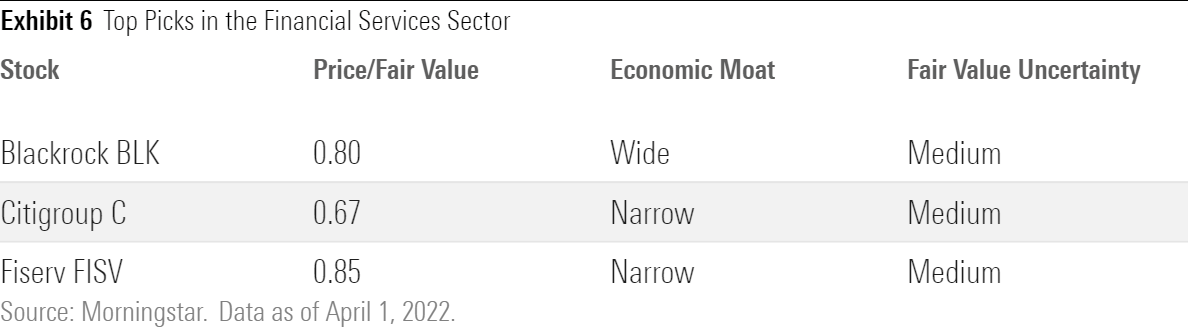

Top Financial-Services Stocks

Financial-services stocks bested the broader market during the first quarter. The sector appears to be about 1% undervalued according to our metrics, reports director Michael Wong.

Wong attributes the relative outperformance to an increase in interest-rate expectations during the quarter. “Higher interest rates are a positive driver of earnings across much of the financials sector from banks that charge more for loans to insurers that earn more on their investable float,” he explains. “The positive effect of higher interest rates on financials contrasts with many other sectors where higher interest rates increase their cost of funding or could limit their ability to finance new projects.”

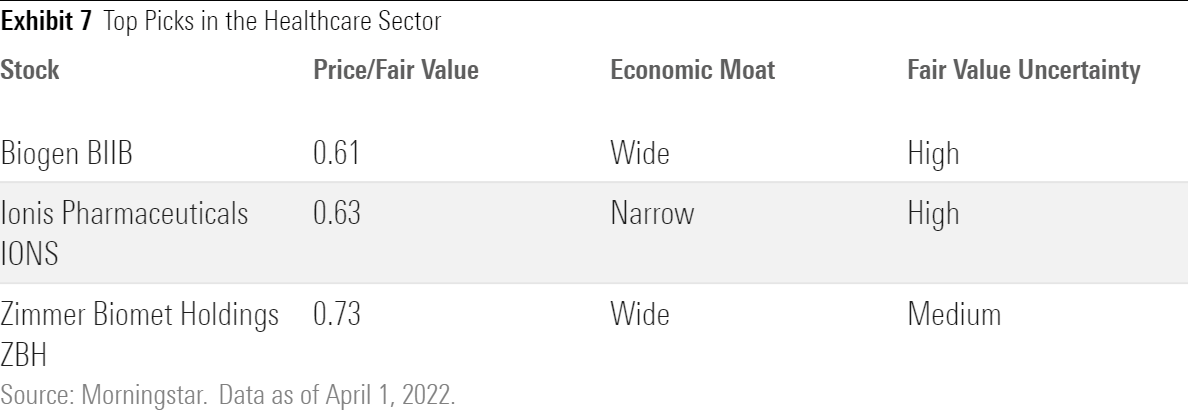

Top Healthcare Stocks

Healthcare stocks have slightly outperformed the broader market during the past 12 months. Though about one third of the names we cover are undervalued, the sector overall appears overvalued according to our metrics, reports sector director Damien Conover.

The Russia-Ukraine conflict has had little direct impact on the sector: Most healthcare companies generate less than 2% of sales in the two countries, he says. Inflation doesn’t pose much threat to the sector, either, he adds, as many of the wide-moat companies in the sector will be able to pass along price increases given the pricing power that their patents and high switching costs provide. “As the war in Ukraine and inflation have shifted the focus of the Biden administration and Congress, we don’t expect near-term movement on major U.S. healthcare policy, which should ease some pricing pressure risk on the Big Biopharma group,” concludes Conover.

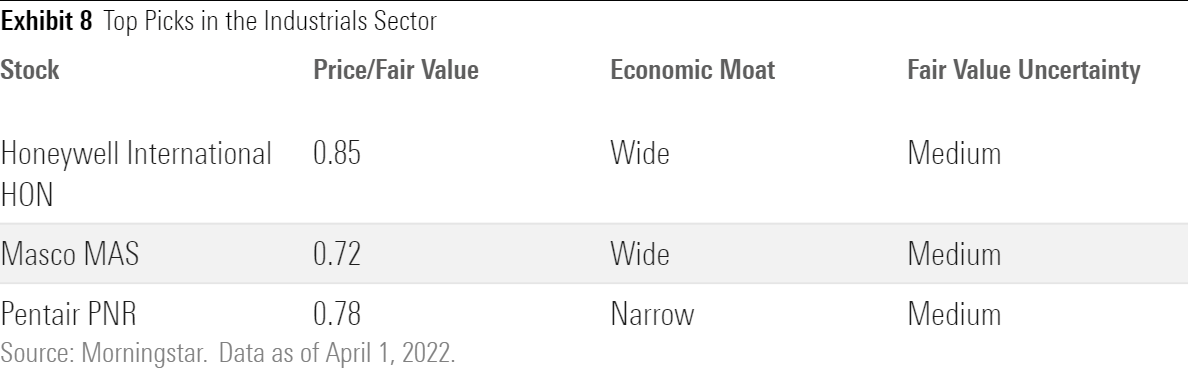

Top Industrials Stocks

The industrials sector outlegged the broader market during the first quarter, driven by aerospace and defense and farm and heavy construction machinery, says sector director Brian Bernard. "Given heightened geopolitical tension, we think inflation-adjusted growth in the defense budget seems plausible, which would be significant relative to our previous assumption of a flattening U.S. defense budget," he adds.

Dogged by economic uncertainty and supply chain/inflationary challenges, industrial products stocks lagged last quarter, presenting long-term investors with a few opportunities, says Bernard.

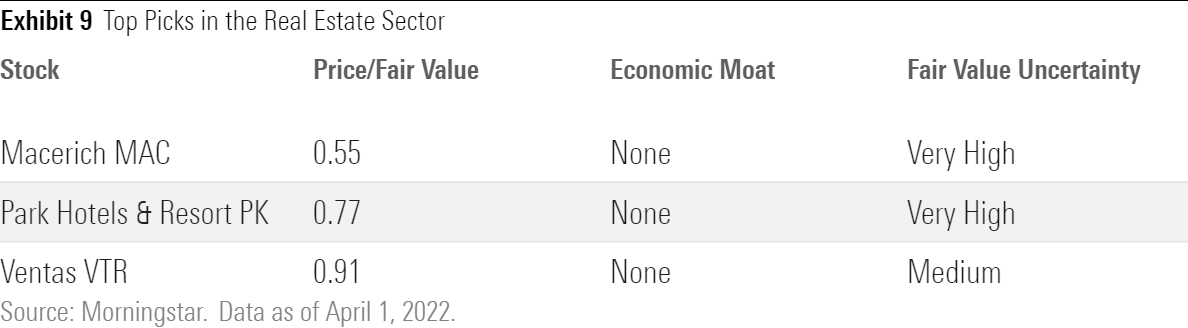

Top Real Estate Stocks

The real estate sector has outperformed the broader market by a significant margin during the past 12 months. The sector is slightly overvalued coming into 2022's second quarter, reports analyst Kevin Brown.

While both the hotel and retail subsectors have improved since coronavirus vaccines were introduced, they still remain well below the rest of the real estate subsectors, with many still trading below their prepandemic prices, he says.

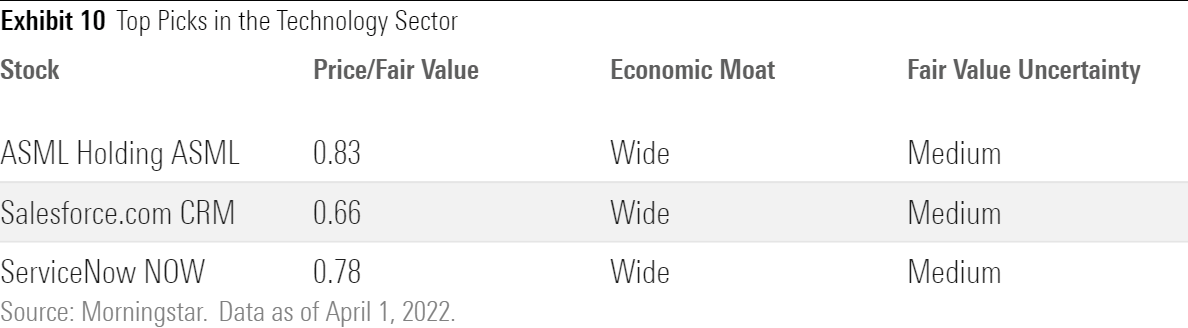

Top Technology Stocks

The technology sector lost about twice as much as the overall market during the first quarter. We think the sector overall is undervalued, with the median stock in our coverage universe trading at a 6% discount to intrinsic value at quarter's end, a stark reversal from a quarter ago. Software remains an attractive subsector, reports director Brian Colello.

“We foresee enterprises using software to modernize all types of business processes, in turn leading to software industry growth at a low-double-digit compound annual growth rate,” he says. We also think an ongoing data boom bodes well for cloud computing and database management systems.

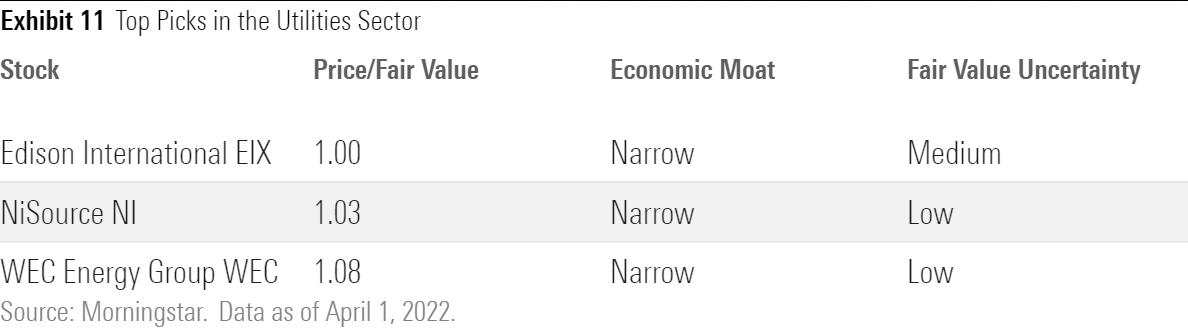

Top Utilities Stocks

Utilities enter the second quarter of 2022 at robust valuations, suggests strategist Travis Miller: We think the sector is about 11% overvalued today, with valuation multiples well above 20-year averages.

"Another quarter or two of elevated inflation, including higher energy price, could hit utilities’ earnings and growth prospects," he adds. “Utilities haven’t experienced this inflationary punch in several decades.” Even with the sector enjoying the benefits of a push to clean energy, we think utilities investors should prepare for lower returns ahead.

Start your free 14-day trial of Morningstar Premium. Understand the difference between a good company and a great opportunity. Unlock our analysts’ fair value estimates and get continuous research and analysis to help you make the best decisions.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)