How the Largest Bond Funds Fared in the First Quarter

Amid a down quarter for bonds, there were few places for investors to hide among the biggest bond funds.

Many bond-fund investors are licking their wounds after the worst quarter in decades for some parts of the market.

Amid rising interest rates, there were few places for investors to hide in the opening months of 2022. Even the top-performing categories finished the first quarter in the red.

Among bond-fund strategies, the primary factor driving relative performance was sensitivity of a fund’s holdings to changes in interest rates. During a quarter that saw a significant jump in bond yields--as prices fell--funds with a greater sensitivity to rates generally fared worse.

The average core bond fund lost 5.89% in the first quarter, and the average core-plus fund dropped 5.72%, the worst declines for both categories since the 2008 financial crisis. Meanwhile, the average multisector bond fund finished with a 4.7% loss, the largest decline since the first quarter 2020, when markets were roiled by the onset of the pandemic. Funds focused on short-term securities fared better. Bank-loan funds lost 0.57%, and ultrashort bond funds fell 0.76%.

Here’s a look at how the oldest share class of the 10 largest actively-managed bond funds, and the 10 largest index-tracking bond funds, fared in the first quarter.

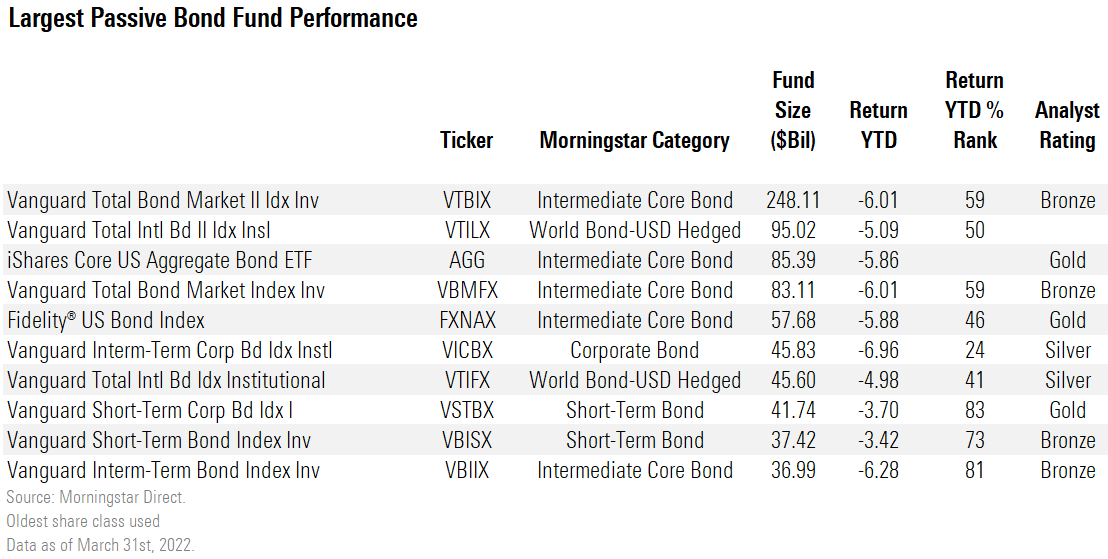

How Did the Largest Bond Index Funds Do?

Vanguard Total Bond Market II Index VTBIX, the largest index-tracking bond fund with $248.1 billion under management, tracks the broad Bloomberg U.S. Aggregate Float-Adjusted Index. The fund takes less credit risk but more interest-rate risk than its peers, according to a Morningstar report. That can be seen in the fund’s average effective duration--a measure of a funds’ sensitivity to changes in interest rates--which is 6.82 years, well above the 6.35 average for an intermediate core bond fund, and in its first-quarter performance. The fund finished in the 59th percentile, losing 6.01%.

Of the group, Vanguard Intermediate-Term Corporate Bond Index VICBX, which has a Morningstar Analyst Rating of Silver, was the top performer, finishing in the 24th percentile among corporate bond funds. The fund's credit risk exposure is mostly in line with peers, but it courts less interest-rate risk. It has lost 6.96% year to date.

The bottom performer of the group was the Vanguard Short-Term Corporate Bond Index VSTBX. The fund has lost 3.7% this year and was beat by 85% of its peers in the category. However, the fund’s long-term performance is strong, landing in the top third of the category for the last three years, top fourth for the past five years, and just shy of the top 10% for the past decade.

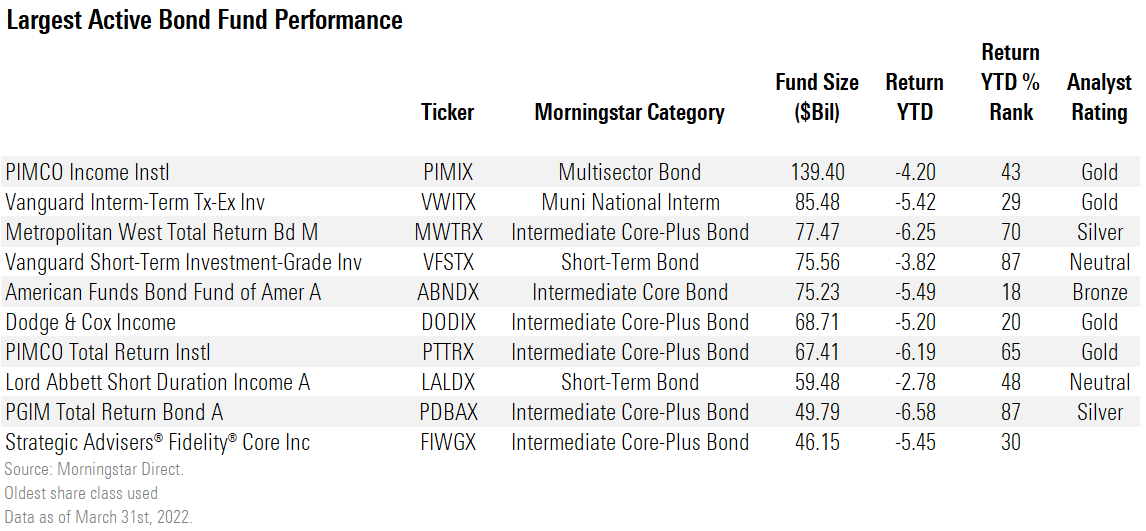

How Did the Largest Actively Managed Bond Funds Do?

Pimco Income PIMIX, the largest actively managed bond fund with $139.4 billion of assets, lost 4.2% in the quarter to finish in the 43rd percentile in the multisector bond category. The fund ranks near the middle of the pack for the last one- and three-year time frames, but over the last five years it is in the top fourth of category.

For the past decade, Gold-rated Pimco Income is in the first percentile. “The strategy has a broad palette and flexibility, though, and given Pimco's overall skill set, its optimism about beating the competition is well founded,” Morningstar strategist Eric Jacobson wrote in a report.

The second-largest actively managed fund, Vanguard Intermediate-Term Tax-Exempt VWITX, is also the largest active municipal fund. Along with long-term and emerging-markets, municipal funds are some of the worst-performing bond funds in 2022.

Vanguard Intermediate-Term Tax-Exempt lost 5.4% in the first quarter, landing it in the top third of its category. The fund also sports strong historical performance, finishing in the 26th and 20th percentiles over the last 10 and 15 years, respectively.

“The team’s strict emphasis on the higher-end of the credit-quality spectrum as well as a relatively moderate duration profile can cause the strategy to lag during exuberant markets, but these features have also kept the strategy out of trouble in (the) toughest stretches for muni bonds,” associate director Elizabeth Foos says in her analyst report.

The top-performing actively managed fund among the group is American Funds Bond Fund of America ABNDX. The Bronze-rated intermediate core bond fund has lost 5.49% so far this year but finished in the 18th percentile. Its rank was lifted by a strong March. Although the fund lost 2.53% in the month, it outperformed 85% of its peers.

During the past three years, which is when current manager Pramod Atluri took the reins, the fund is among the top 3% of its peers. Senior analyst Sam Kulahan notes the fund places an emphasis on downside protection.

The worst performers of the group were the Vanguard Short-Term Investment-Grade VFSTX and PGIM Total Return Bond PDBAX, as both funds finished in the 87th percentile year to date.

Correction: A previous version of this article failed to specify that the funds listed in the table and discussed in the story involve the oldest share class of each respective fund.

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)