Markets Brief: Fed Minutes Could Set the Tone

Oil prices tumble and the yield curve inverts. Trip.com and airlines on the rise, while bank stocks take a hit.

In the early days of 2022, one of the first bits of news that sent stock and bond prices heading lower was release of the minutes from the Federal Reserve's policy-setting meeting in December. They depicted a Fed that was in the process of shifting towards raising interest rates and fighting inflation in a much more serious manner. This coming Wednesday, minutes from the March meeting will be released and they could provide important information about the Fed's monetary policy plans. In particular, the minutes may offer clues to the central bank's thinking about reducing its holdings of bonds that were purchased as way to keep yields low during the recession. Fed chair Jerome Powell has said the bank's balance sheet will be reduced--an action known as quantitative tightening or QT--but has given few details. The discussion in the minutes may shed some light on the expected timing of QT, and at what pace the Fed will roll down its holdings. QT will be of particular interest in the bond market. News on QT "could have the effect of encouraging rates to rise on Treasuries and mortgages, which would make future spending and growth more costly," Morningstar's chief economist Preston Caldwell says. "It's hard to tell what is already priced in [the market] versus what isn't. The bottom line is that it is just another piece of policy that is becoming less accommodative." The Fed raised the federal-funds rate by a quarter of a point last month as it attempts to get a grip on inflation that is now at a roughly 40-year high. Swings in expectations about the pace of Fed tightening have been a key factor in driving the bond market to some of its worst losses in years. After hawkish comments from Powell about boosting rates in mid-March, bonds sold off on expectations that the Fed would take more aggressive path for raising borrowing cost . The market is currently priced for a 75% chance that the Fed will raise by a half percent in May. The selloff in bonds took yields on the U.S. Treasury two-year note above that of the 10-year in the past week, a dynamic known as an inverted yield curve. An inverted yield curve is often viewed as a warning sign for a possible recession, and also cuts into bank profits. Among the events scheduled for next week:

- Tuesday: Analog Devices ADI Investor Day

- Wednesday: Federal Reserve Minutes

- Thursday: Swiss Re SSREY Investor Day; Atlassian TEAM Investor Day; Crowdstrike CRWD Investor Meeting

For the trading week ending April 1:

- The Morningstar US Market Index was up 0.2%.

- The best-performing sectors was real estate, up 3.74% and utilities 3.66%.

- The worst-performing sectors were energy, down 2.19%, and financial services 2.02%.

- Yields on the U.S. 10-year Treasury note fell to 2.38% from 2.49%.

- Oil ended the week down 12.8% to $99.27 per barrel.

- Of the 863 U.S.-listed companies covered by Morningstar 481, or 56%, rose while 382, or 44%, fell.

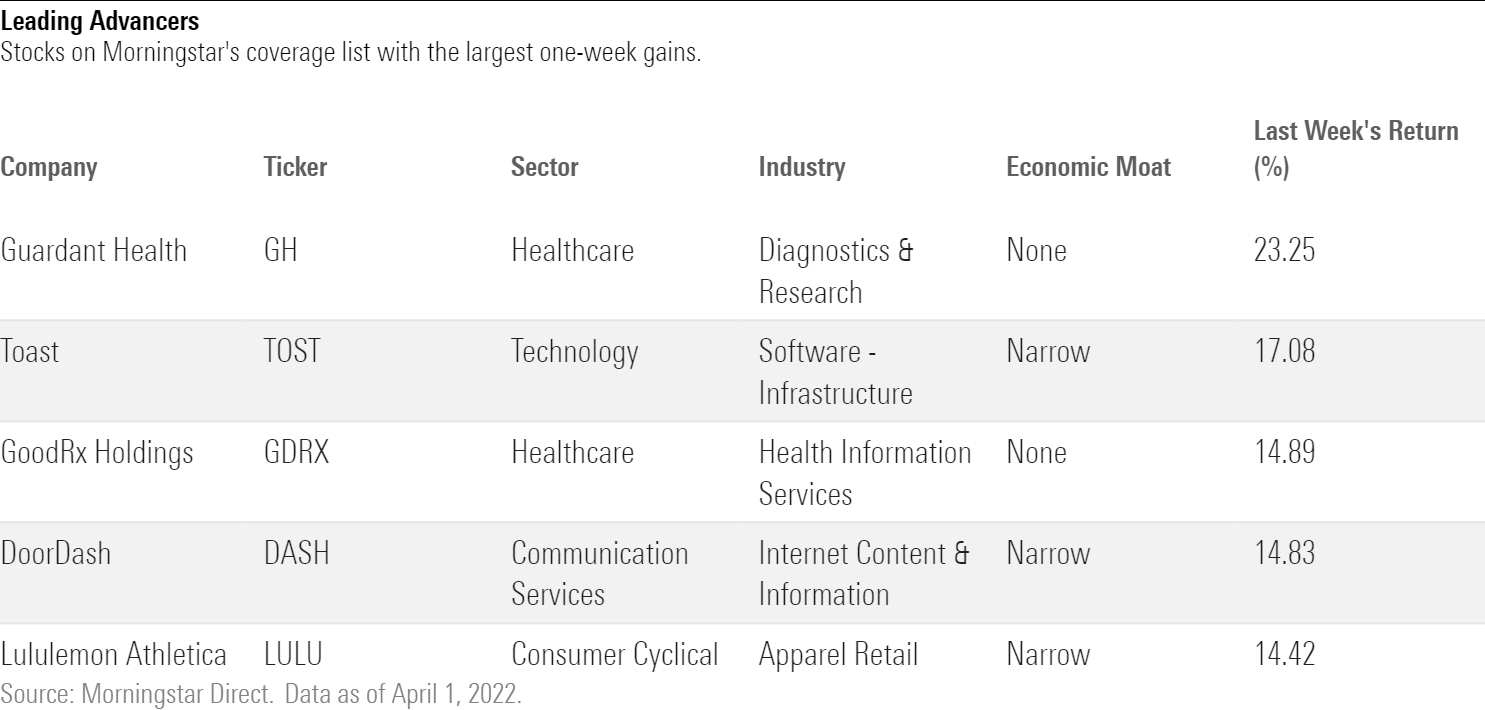

What Stocks Are Up?

The best performing stocks last week were Guardant Health GH, Toast TOST, GoodRX Holdings GDRX, DoorDash DASH, and Lululemon Athletica LULU.

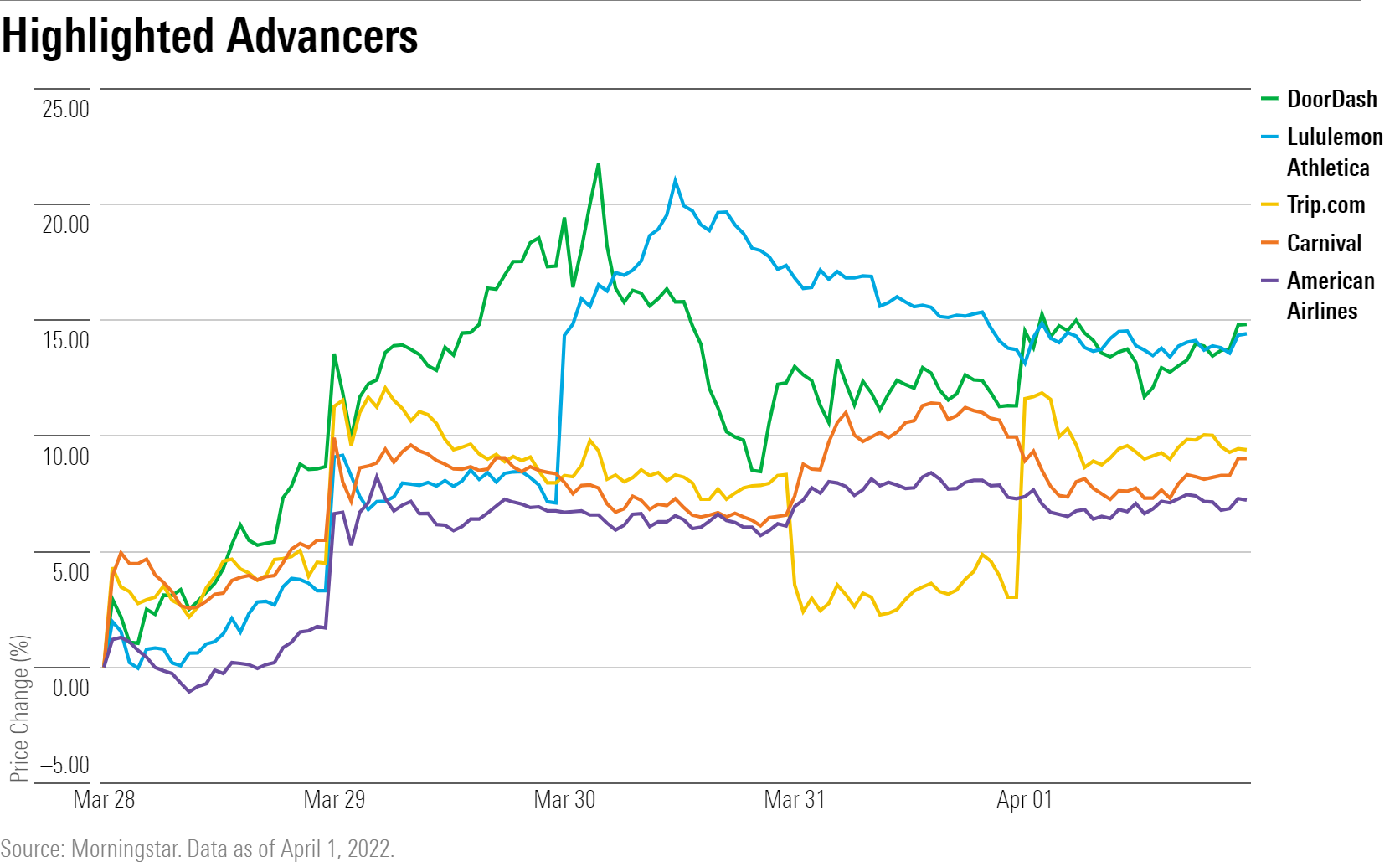

Lululemon Athletica LULU shares rallied after posting earnings and guidance that beat Wall Street’s estimates. DoorDash DASH also jumped after confirming a partnership with BJ’s Wholesale Club BJ for grocery deliveries.

Travel stocks rebounded this week after oil prices fell more than 10%. Trip.com TRIP, Norwegian Cruise Line NCLH, Carnival Corporation CCL, and Royal Caribbean RCL gained. Oil-sensitive airline stocks American Airlines AAL, United Airlines UAL, and Delta Air Lines DAL also closed higher.

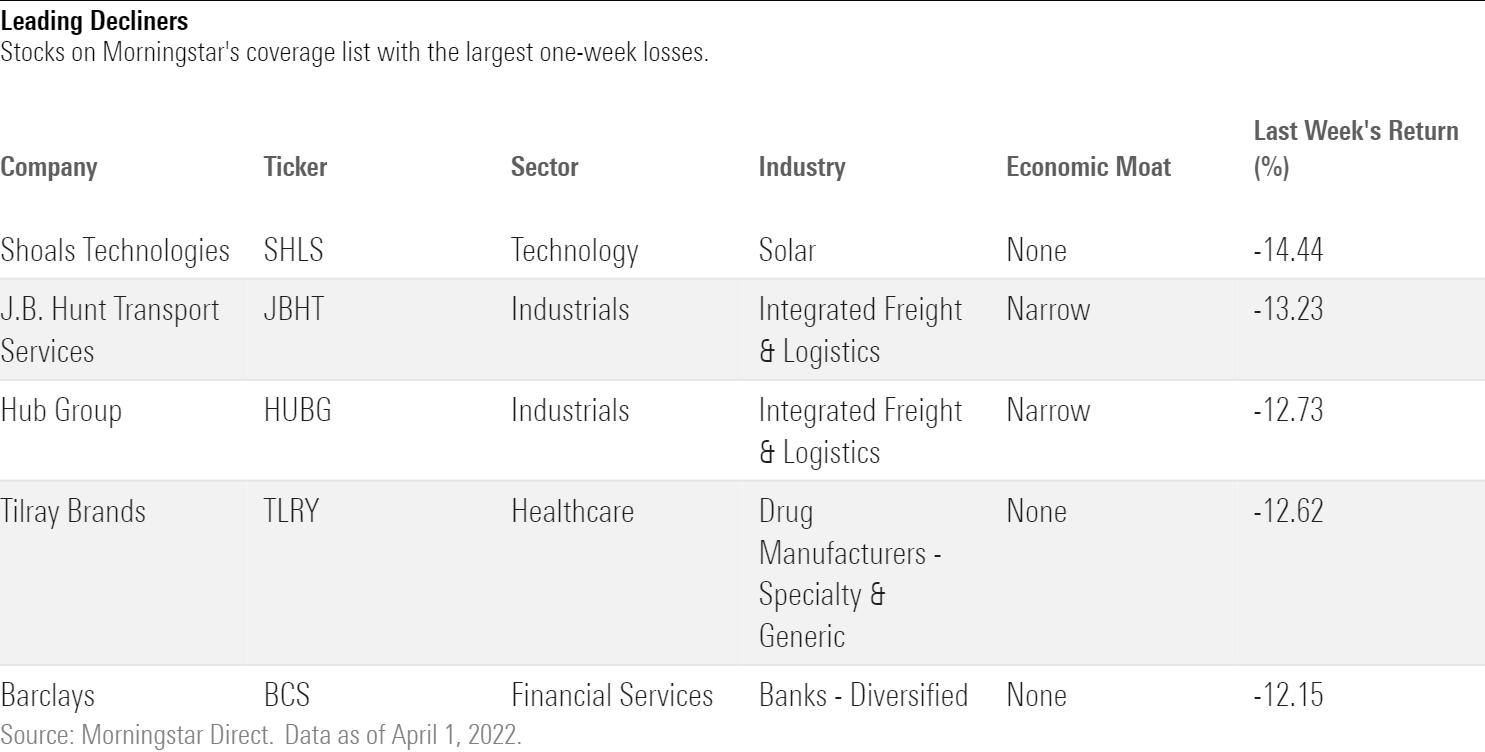

What Stocks Are Down?

The worst performing stocks last week were Shoals Technologies SHLS, J.B. Hunt Transport Services JBHT, Hub Group HUBG, Tilray Brands TLRY, and Barclays BCS.

Among the worst-performing stocks was Barclays, which slid after the bank had to buy back shares of exchange-traded-notes at a loss of nearly $600 million due to issuing past its share limit in error.

Stocks across various industries were down as a flattening yield curve raised concerns about a possible recession.

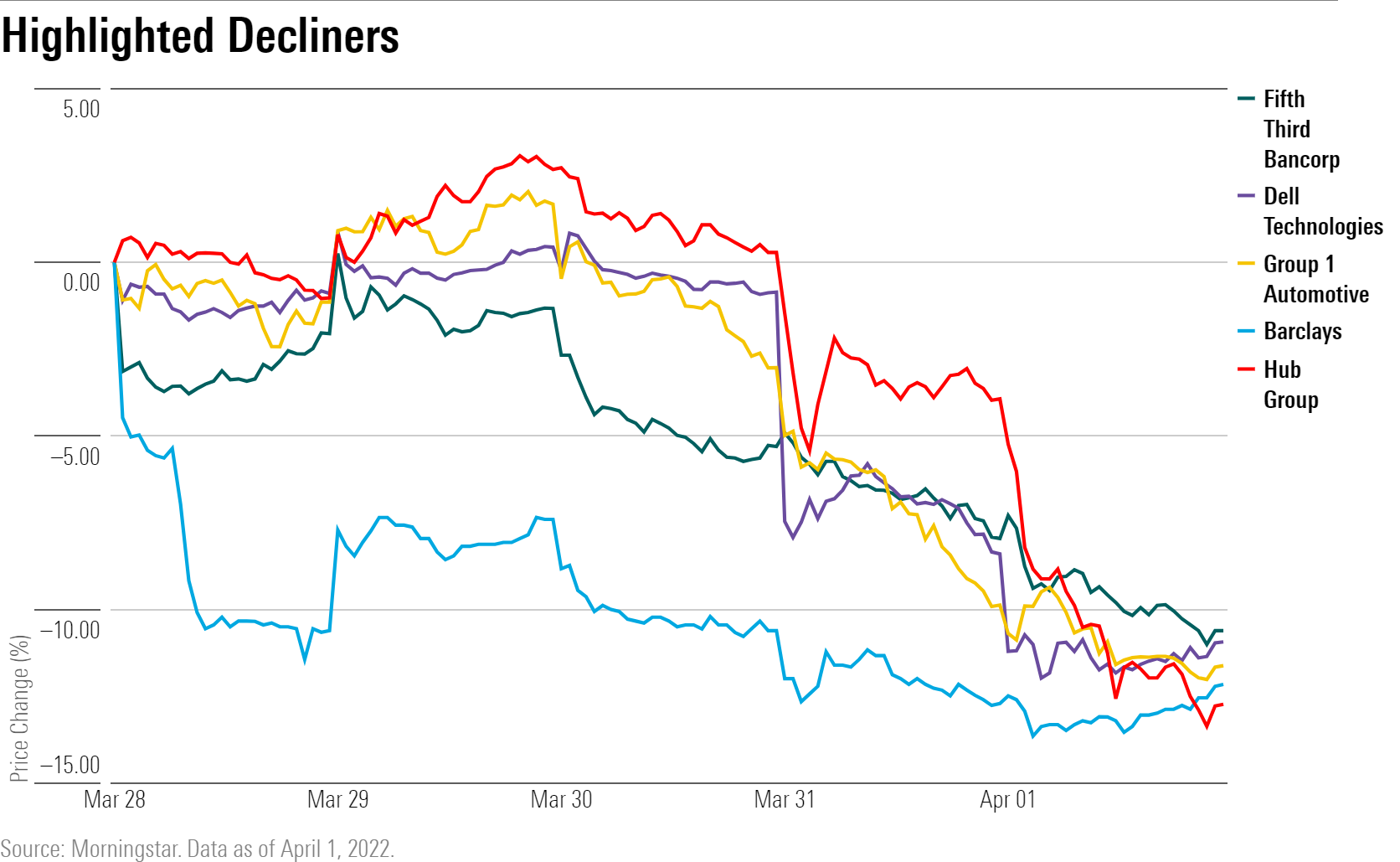

Bank stocks were hit by the flattening yield curve. A flattening yield curve can crimp bank profits by limiting their ability to borrow at low-interest rates and then lend to customers at a higher rate. Fifth Third Bancorp FITB, KeyCorp KEY, M&T Bank MTB, and Wells Fargo WFC were among bank stocks sliding in the past week.

Other cyclical stocks were lower as Autonation AN, Group 1 Automotive GPI, and Sonic Automotive SAH fell. Logistics firms Hub Group and J.B. Hunt Transport Services also finished lower.

Concerns over wavering personal computer demand led to declines for Dell Technologies DELL, HP HPQ, and Advanced Micro Devices AMD.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)