The First Quarter’s Top and Bottom Non-U.S. Equity Funds

Russia’s invasion of Ukraine and inflation fears spark growth selloff and commodity rally.

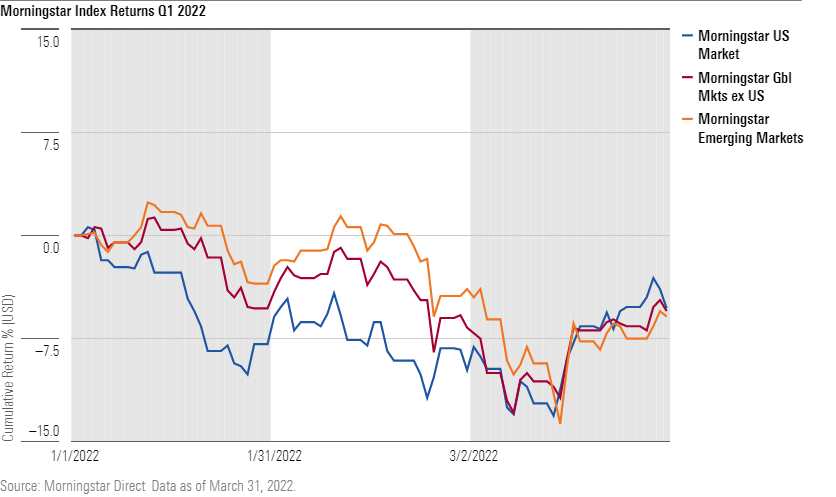

Non-U.S. growth funds crumpled while value funds proved resilient in 2022’s first quarter amidst Russia’s invasion of Ukraine and inflation fears. The Morningstar Global Markets ex-U.S. Index was down about 13% at its low point on March 8, 2022, but subsequently recouped some of its losses. Overall, the Morningstar Global Markets ex-U.S. Index and the Morningstar Emerging Markets Index ended the quarter down a respective 5.5% and 5.9%, slightly underperforming the Morningstar U.S. Market Index’s 5.3% loss.

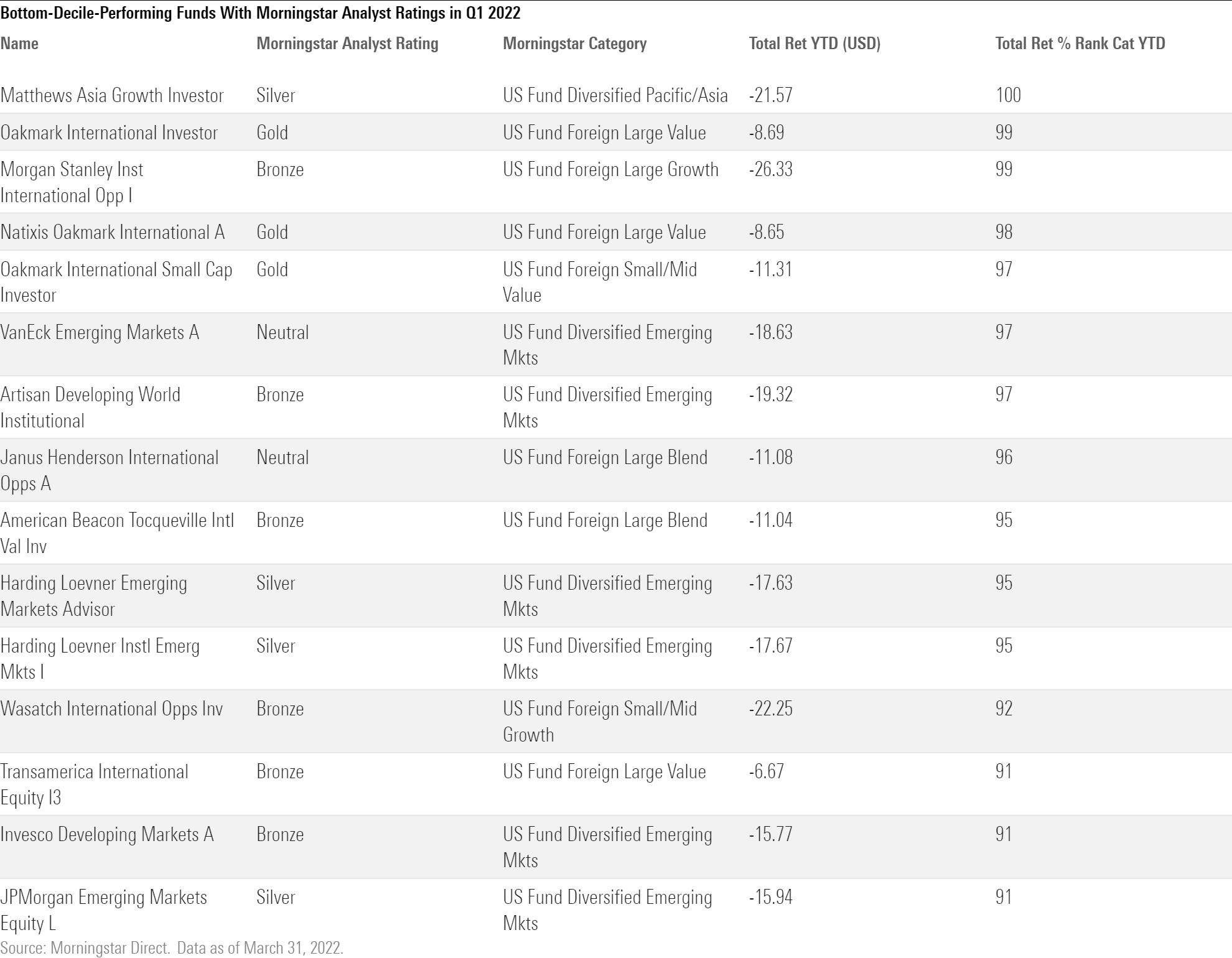

Russia was by far the worst-performing market in the first quarter. Not only did the United States and its allies place severe economic sanctions on Russia, but several index providers also deleted Russian stocks from their benchmarks and wrote their prices down to zero. Naturally, emerging-markets funds with sizable Russia exposure coming into 2022 struggled, including Harding Loevner Emerging Markets HLMEX, which has a Morningstar Analyst Rating of Silver but fell 17.7% for the quarter, trailing 95% of its diversified emerging-markets Morningstar Category peers. The team maintained stakes in its four Russian holdings--Lukoil LUKOY, Novatek NOVKY, Sberbank of Russia SBRCY, and Yandex YNDX--but discounted their values to zero given the trading halt. Bronze-rated Invesco Developing Markets ODMAX also fell 15.8% and placed in the peer group’s bottom decile as its Russian picks detracted. Manager Justin Leverenz continues to hold a few Russian names in the portfolio, including Yandex and Novatek, though they also carry values of zero. More information on how Morningstar Medalist managers navigated their Russian holdings post-invasion can be found here, while potential lessons learned can be found here.

Inflation and interest-rate concerns continued to spook investors, contributing to a sharp selloff in pricey, growth-oriented stocks. Indeed, the typical foreign large-growth and foreign small/mid-growth offerings fell 13.4% and 16.3%, respectively. Bronze-rated Morgan Stanley Institutional International Opportunity MIOIX was among the worst-performing foreign equity funds in the first quarter, falling 26.3% and lagging 99% of its foreign large-growth peers. While the portfolio does not own any Russian stocks, its technology picks, including Shopify SHOP, EPAM Systems EPAM, and Keyence, pummeled it as they each lost more than one fourth of their value in the year to date. The same stocks also brought down Silver-rated WCM Focused International Growth WCMIX. The strategy, which boasts a strong team and a deep, multifaceted approach, placed in the category’s bottom quintile with a loss of 17.3%. In the small/mid-cap growth space, Bronze-rated Wasatch International Opportunities WAIOX was one of the worst performers after declining 22.3%. The strategy pursues strong and steady growers with high returns on capital and low debt levels, but the valuations of its typical portfolio holding often far exceed those of the category, which courts risk. Technology picks Esker ESKEF, Rakus, and dotDigital Group DOTDF all fell more than 40%.

As growth sold off in the first quarter, commodity prices surged. After rising by more than 50% in 2021, Brent crude oil prices climbed a further 39%, to $107.91 per barrel on March 31. That fueled several commodity-intensive markets within Latin America, including Peru, Brazil, and Chile. Latin America-focused funds benefitted as a result, including Silver-rated T. Rowe Price Latin America PRLAX and Neutral-rated BlackRock Latin America MDLTX, both of which rose more than 20%.

The commodity boom also helped value-oriented funds hold up better than their growth counterparts. The typical foreign large value and foreign small/mid value funds fell just 2.3% and 3.9%, respectively. Gold-rated Dodge & Cox International Stock DODFX lost just 0.6% in the quarter, better than most of its peers. The team follows a thoroughly contrarian approach, and it benefitted from strong stock selection in energy, namely Ovintiv OVV, Suncor Energy SU, Equinor EQNR, and Schlumberger SLB, all of which rose more than 30%. Meanwhile, Bronze-rated DFA International Value DFIVX gained 2.0%, and Gold-rated DFA International Small Cap Value DISVX lost 2.6%, placing toward the top of their respective foreign large value and foreign small/mid value peer groups. Compared with peers, the DFA strategies have deeper value orientations. Their energy overweightings and technology underweightings buoyed returns.

A couple notable exceptions to the strong performance amongst value funds were Gold-rated Oakmark International Small Cap OAKEX and Oakmark International OAKIX. While their respective 11.3% and 8.7% losses were still much better than most growth-oriented offerings, they still underperformed more than 90% of their foreign small/mid value and foreign large value peers. Contrary to many value-oriented non-U.S. equity funds, these don’t have any energy exposure, which was a headwind during the quarter. The Ukraine invasion also sparked a flight to bonds, pushing interest rates lower and negatively affecting Oakmark International’s European financial holdings such as Credit Suisse CS and BNP Paribas BNPQY. Meanwhile, industrials picks like Finland’s Konecranes and Metso Outotec hurt Oakmark International Small Cap. David Herro and team have faced similar bouts of underperformance over the years, but their unwavering commitment to their bold approach has paid off time and time again; both funds remain excellent offerings.

/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)