Is International Diversification Necessary?

The diversification benefits haven’t been obvious in recent years, but there’s still a case to be made.

Adding international exposure is one of the first steps toward a diversified portfolio. Even minimalist investors usually carve out a portion of their portfolios for non-U.S. stocks as a supplement to domestic stocks and bonds. International stocks are subject to many factors that can lead to divergent performance, including local market conditions, currency movements, exposure to different sectors and industries, and political and economic factors. These traits mean they often show different performance patterns, both relative to the U.S. market and versus other international markets.

In our recently published 2022 Diversification Landscape Report, we looked at how different asset classes performed in the past couple of years, how correlations between them have changed, and what those changes mean for investors and financial advisors trying to build well-diversified portfolios. One key finding: While there's still a case for including international stocks in a diversified portfolio, the diversification benefits haven't been as obvious over the past several years.

Recent Performance Trends

In recent years, international diversification has detracted from performance. The Morningstar Global Markets xUS Index has lagged its domestic counterpart in each of the past four calendar years. Aside from a brief resurgence in the fourth quarter of 2020--when international stocks briefly pulled ahead partly because of weakness in the U.S. dollar--most markets outside the United States have fallen behind.

With the novel coronavirus pandemic affecting economies, companies, industries, and people on a global scale, most major international markets dropped at least as much as the U.S. market in early 2020. Japan was the only major regional market to maintain a lower correlation with the U.S. It also suffered lighter losses than most other global markets. For 2020 overall, the Asia-Pacific ex Japan region posted better gains than any other major geographic area, driven by a strong economic recovery in many markets, as well as the perception that government lockdown measures were effectively containing coronavirus infection rates.

Some of the previous year’s momentum carried over into the first part of 2021, but returns flagged in the second half of the year thanks to concerns about worsening pandemic trends and inflation rates. For 2021 overall, the Morningstar Global Markets xUS Index gained about 8.9% versus a 25.8% return for the Morningstar US Market Index. Developed markets fared far better than emerging markets: While the Morningstar Developed Markets xUS Index rose 12.2% for the year, the Morningstar Emerging Markets Index was down 0.3%.

Correlation Between U.S. and International Stocks

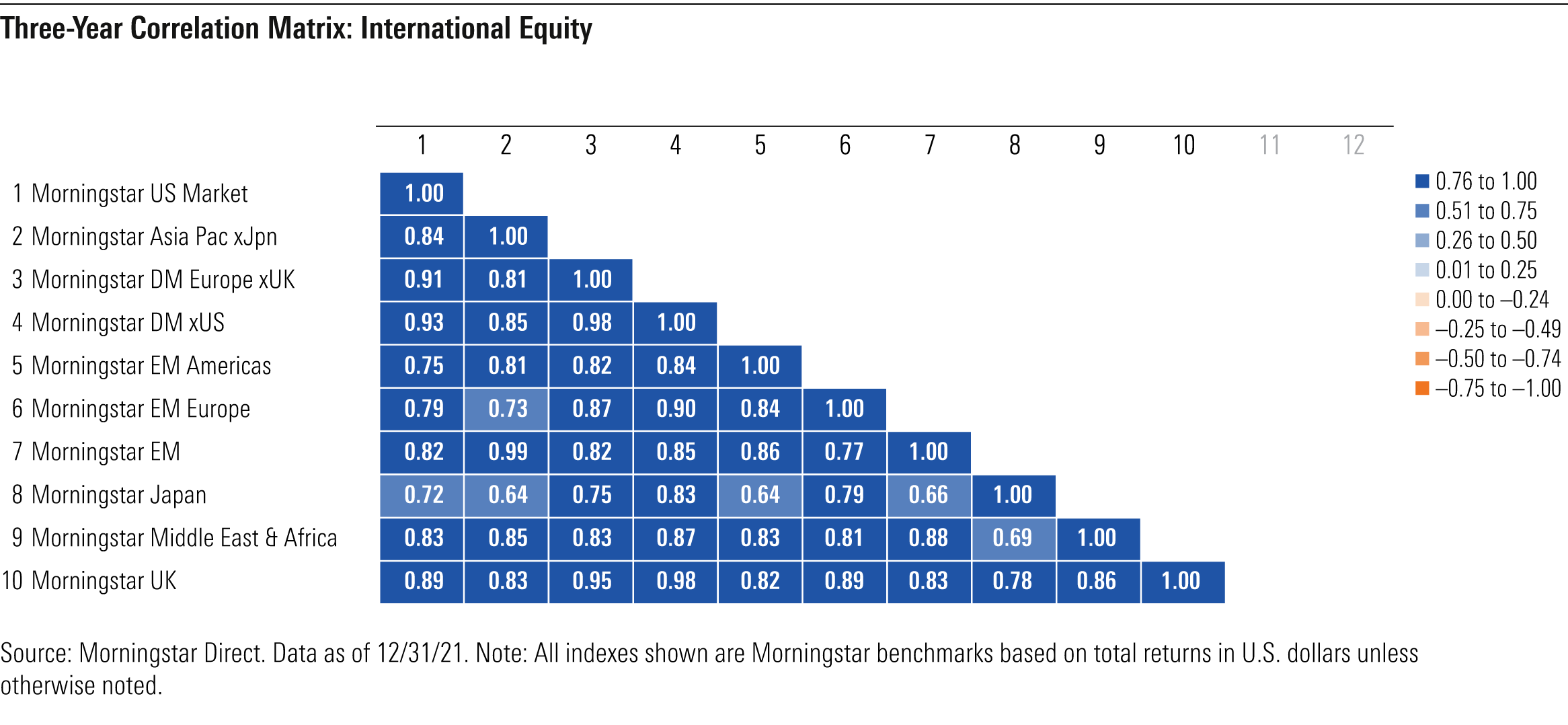

From a diversification perspective, most international markets have been closely tied to the U.S. market over the past three years, as shown in the table below.

The Morningstar Developed Markets xUS Index showed the closest link with the domestic equity market, followed by Europe and the United Kingdom. Japan and Latin America continued to show some of the lowest correlations with the U.S. market. The latter region’s correlation with the U.S. equity market has trended down to 0.58 over the past five years, compared with as high as 0.80 in some previous periods. This probably reflects the impact of tighter trade policy on the region, as well as style and sector differences. While growth sectors such as technology have increasingly dominated the U.S. market, value-oriented sectors such as basic materials and financials have played a bigger role in Latin America. Across different international markets, cross-correlations between Japan and the rest of Asia were among the lowest, as were correlations between Japan and Latin America.

Because correlations between the U.S. and other developed markets around the world have been so high in recent years, international diversification hasn’t improved portfolio performance. Adding international stocks to a portfolio of U.S. stocks has reduced risk slightly (as measured by standard deviation) but has also detracted from returns. The net result has been lower risk-adjusted returns, which might call into question whether international diversification is fundamentally broken.

Longer-Term Trends

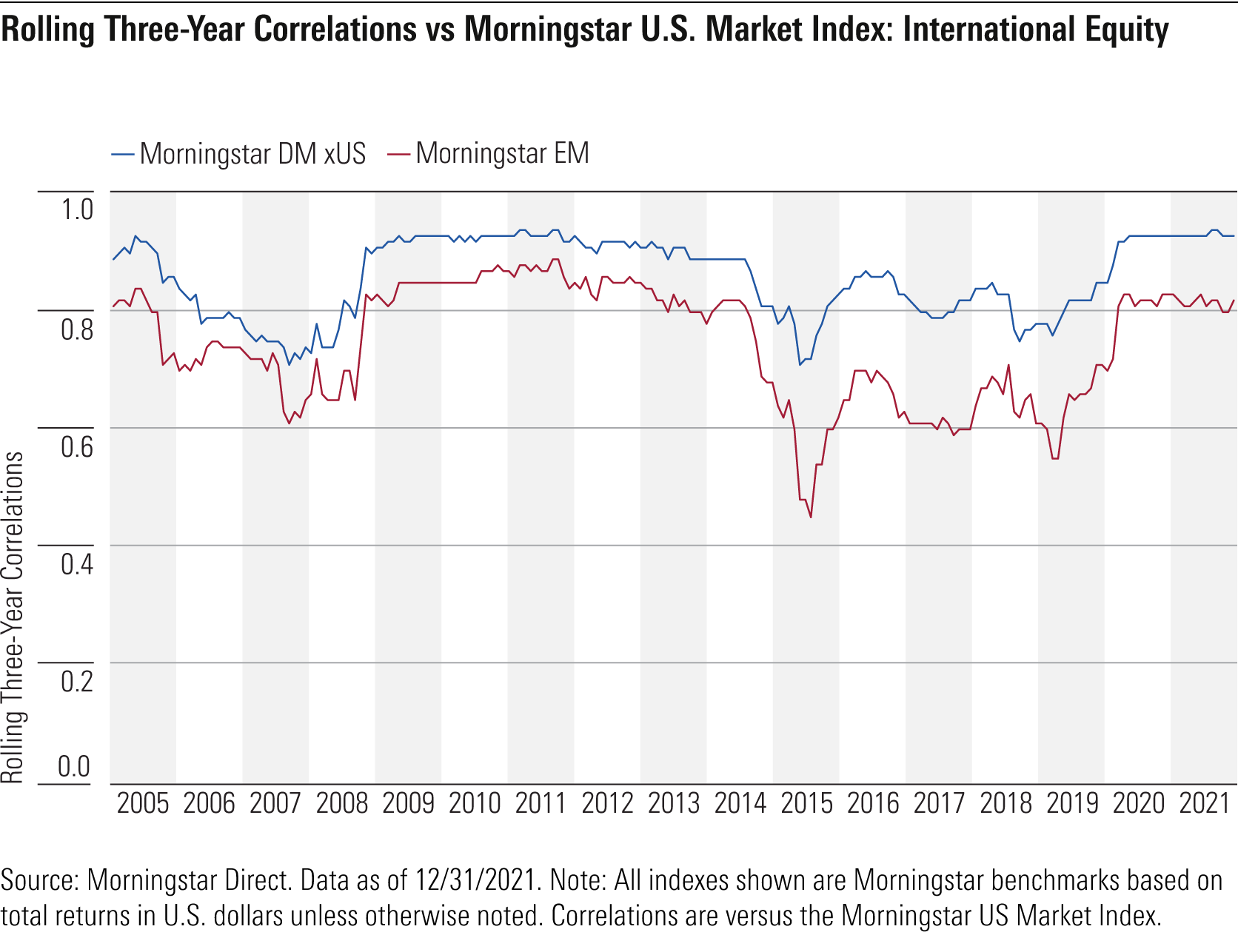

This pattern hasn’t always been the case. As shown in the table below, correlations between the U.S. and international markets have been lower in some previous periods, such as from 2004 through 2008, when the U.S. dollar was generally on the decline. If the greenback goes into another longer-term slump, it’s conceivable that correlations between U.S. and international markets could again drift lower.

In addition, correlations were much lower in earlier decades. For example, correlations between U.S. and non-U.S. stocks were as low as 0.12 during the 1970s, 0.29 in the 1980s, and 0.54 in the 1990s, making them much more effective for portfolio diversification during those periods. But because international correlations have increased by such a significant amount since then, it’s not clear whether they’ll ever return to their previously low levels.

Relative correlations across different international markets have generally stayed in the same range, with developed markets showing the strongest correlation with the U.S. equity market and emerging markets showing the weakest.

Portfolio Implications

Because emerging markets have generally had a lower correlation with the U.S. equity market, most investors will probably want to make sure their foreign-stock allocation includes at least some exposure to less-developed markets. And while some specific regions have been better portfolio diversifiers than others, most investors will probably want to shy away from investment vehicles that focus on a particular geographic region.

As mentioned above, the steady increase in international correlations might raise questions about whether international diversification is still worthwhile. In an increasingly global economy, geographic boundaries aren’t as clear-cut as they used to be. Most larger companies earn at least a portion of their revenue from non-U.S. markets, and the fact that investors can easily find stock and fund opportunities across borders makes the U.S./non-U.S. distinction less important than it used to be. Even so, there’s no guarantee that international stocks will always move in lockstep with the U.S. market. And even with higher correlation levels, international stocks still provide some diversification benefits, particularly as it relates to currency exposure. In a period of U.S. dollar weakness, international diversification could become increasingly important.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)