iShares and American Funds Seeing Inflows Diverge

February flows for these behemoths reflect broader trends.

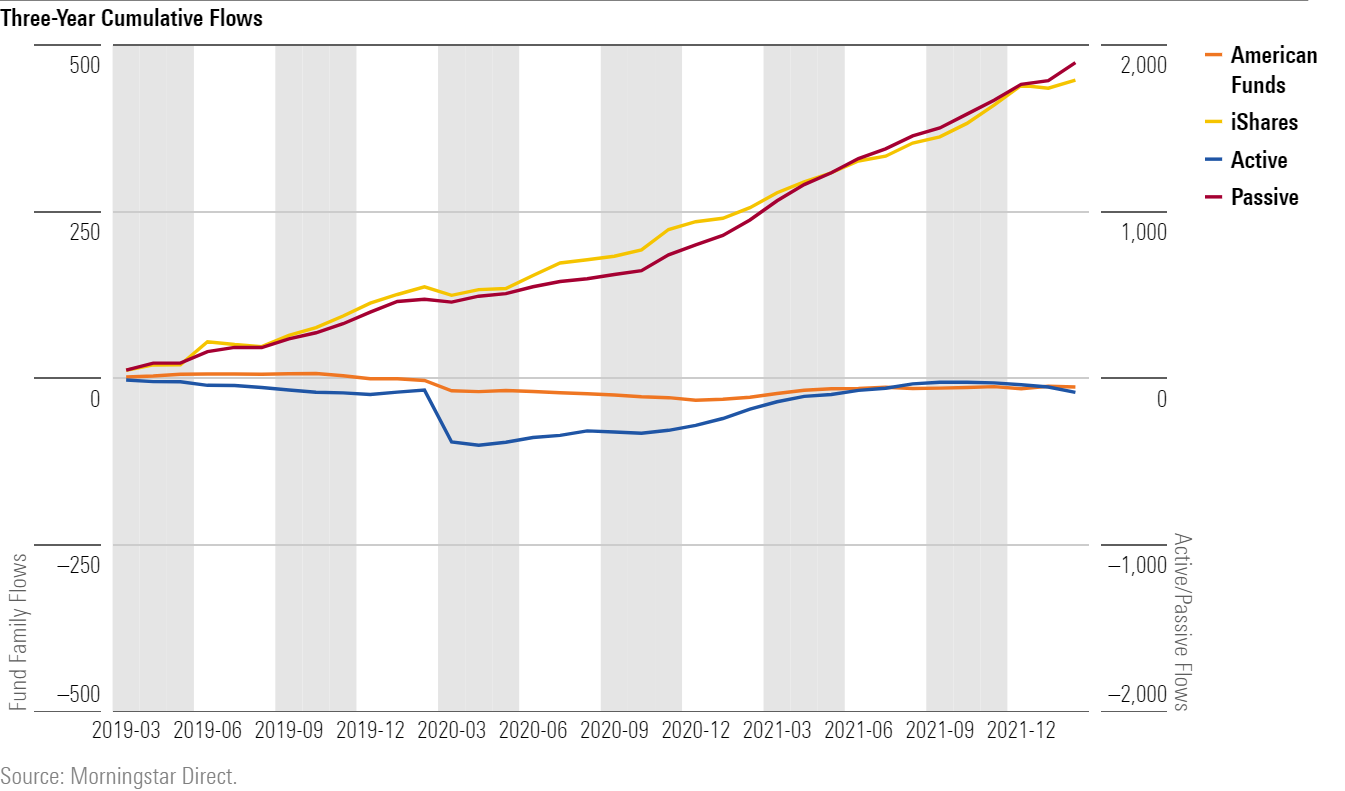

American Funds and iShares are emblematic of increasing investor preferences for passive and ETF vehicles. They both have over $2 trillion under management today, and while iShares has had heavy inflows in recent years investor interest in American Funds’ active offerings has stagnated.

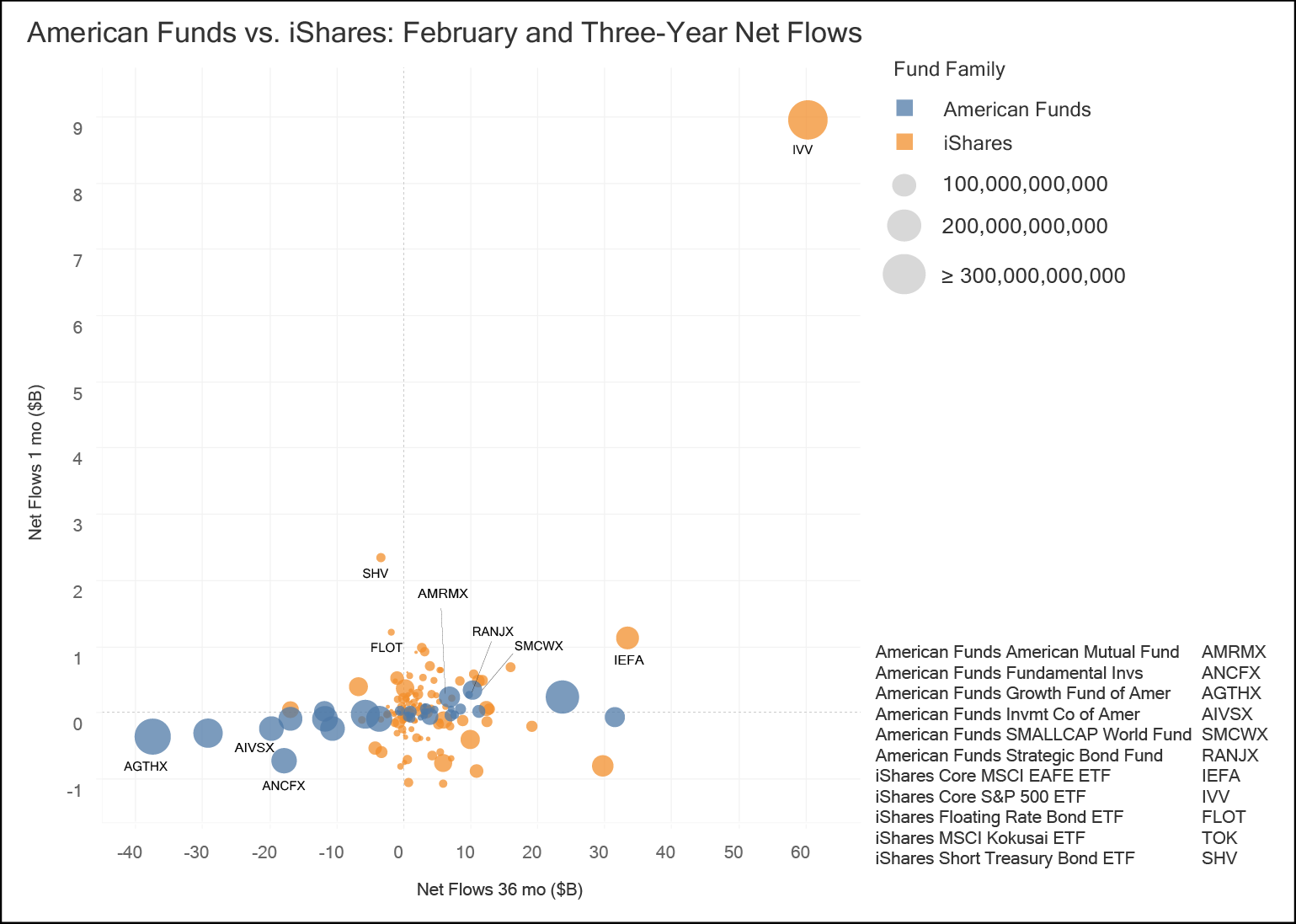

Fund flows in February also illustrate the larger active/passive trends at play. iShares had inflows of over $12.3 billion, while American funds saw outflows of $1.1 billion. Underneath the larger trends, each fund company had a few outliers.

American Funds

Active world small-mid stock funds had $460.5 million in net inflows in February, and American Funds SMALLCAP World Fund SMCWX took in $348.2 million--more inflows than any other American Fund. The strategy’s cheapest share classes earn a Morningstar Analyst Rating of Silver, while pricier ones land at Bronze.

American Funds Strategic Bond RANJX, which is not rated by Morningstar’s manager research analysts, saw the second-highest amount of inflows last month. It took in $283.5 million, bucking a trend. Overall, active intermediate core plus bond funds had more outflows, $6.9 billion, than those in any other category. Passive instruments on the other hand took in just under $1 billion.

American Funds American Mutual AMRMX, which is in the large value category, was another notable exception, with inflows of $246.3 million: active large value funds as a whole had outflows in February. This was in stark contrast to passive offerings, which received $16.3 billion.

Overall, American Funds had almost $1 billion in outflows from its large-blend funds. American Funds Fundamental Fund ANCFX had the largest outflow at $723.3 million. The strategy has a Morningstar Analyst Rating range of Silver to Bronze, depending on share class fees. American Funds Investment Company of America AIVSX, another large-blend fund, had outflows of $245.3 million in February. It has Analyst Ratings ranging from Silver to Neutral.

It was these two behemoths that dominated category flows in February. Without them large-blend active funds would have had net inflows last month. With them included, the category saw outflows of $641 million.

American Funds Growth Fund of America AGTHX, which has Morningstar Analyst Ratings ranging from Silver to Bronze, had outflows of $359.9 million. This was in line with the category trend; $6.2 billion left active large-growth funds. This money did not flow to passive instruments. Passive large-growth funds received only $231.9 million of inflows.

iShares

Similar to American Funds, iShares often mimicked the larger trends in flows, but deviated in some instances.

Its most popular fund by far was the Gold-rated iShares Core S&P 500 ETF IVV, which took in just under $9 billion. This was nearly a quarter of the $39.2 billion of inflows into passive large-blend funds in February. The majority of these inflows were into other funds tracking the S&P 500. Vanguard 500 Index VOO had inflows of $17.1 billion, and the Fidelity 500 Index FXAIX took in $5.2 billion.

The next two largest receivers of inflows were ultrashort bond funds, Neutral-rated iShares Short Treasury Bond ETF SHV and iShares Floating Rate Bond ETF FLOT. The two funds took in a combined $3.5 billion, accounting for most of the $4.7 billion of inflows to ultrashort passive funds last month. Active instruments, on the other hand, had outflows of $3.2 billion.

Foreign large-blend fund iShares Core MSCI EAFE ETF IEFA also took in $1.1 billion in February. The Silver-rated fund was an outlier. Overall, passive offerings in the category saw outflows of $488.1 million last month. Active funds received $1.8 billion.

In contrast, iShares’ 18 high-yield bond ETFs had outflows of $2.2 billion. This accounts for the bulk of the $2.7 billion of outflows from the passive funds category. Active funds in the category saw outflows of $6.9 billion.

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)