How Advisors Can Bring Focus to Client Conversations

Using these financial life stages can help you understand your clients' finances in a more flexible way.

Advisors are commonly taught the Financial Life Cycle model that describes a path from zero to intergenerational wealth by way of several consecutive stages: Accumulation, Decumulation, and Legacy. This may well be the path that some follow, but for most of us, our financial lives go through many different stages--or modes--as we experience setbacks, shocks, windfalls, and major expenses. While the Life Cycle model is useful, it may be even more useful to think about the journey in a more flexible way.

What Are Financial Life Modes?

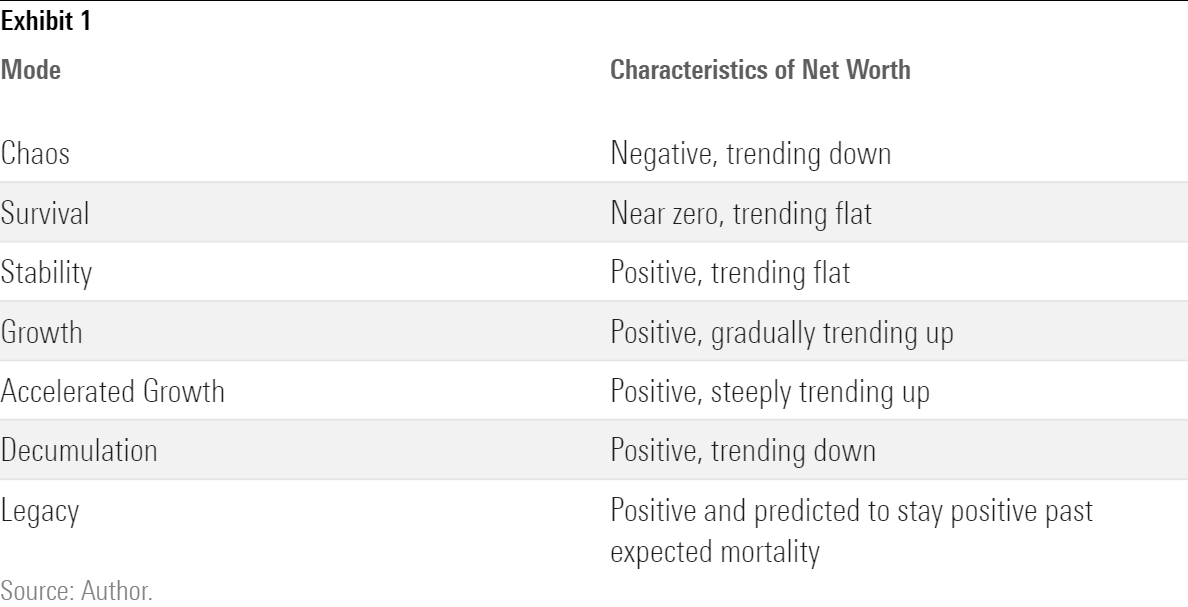

The Financial Life Modes model defines seven distinct modes that one’s finances can be in at any given time. Each mode is characterized by the behavior of one’s net worth over time.

Moving Through the Modes

A person may start or end life in any one of the seven modes, and there is no guarantee that one will move through them in the sequence listed above. Many people will spend their entire lives in Chaos or Survival mode. Some are fortunate enough to start out in Legacy mode but even they could devolve into Chaos if they do not master the skills necessary to maintain Stability or generate Growth.

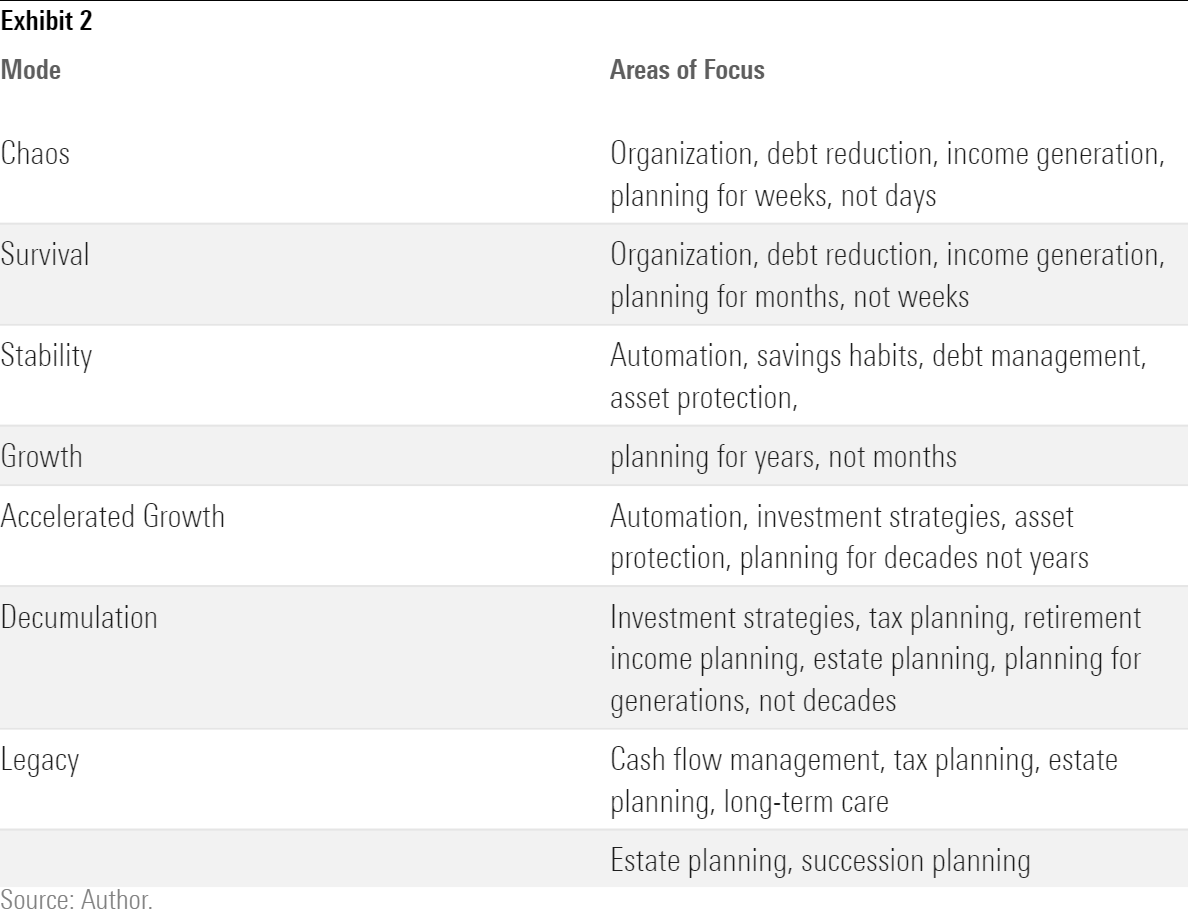

To this point, each mode also corresponds to specific areas of focus and skills to master in order to advance to a higher mode. These focus areas can help advisors coach clients on specific areas of thought and behavior that can help them gain financial mastery. The effect on net worth is a natural byproduct of mastering these habits of mind and behavior, as well as managing the inevitable shocks and setbacks that we all face.

The usefulness of the Financial Life Modes comes in several forms. First, most people will know which mode they are in even if they are not financially savvy. Are they just trying to keep their head above water? Survival. Are they comfortable but not saving enough? Stability. Getting a client to identify which mode they most identify with can help you to quickly zero in on the skills and goals that will advance them to the higher modes. A person in Chaos doesn’t need investment advice; they need credit counseling. A person in Stability mode who strives for accelerated growth too quickly risks losing their assets because of short-term thinking.

Another way to use these concepts with clients is to ask them about their financial journey from childhood to present day. What mode were they in when they were kids? What modes have they been through since? What were the major events or decisions that led to these changes? What skills and habits have they already mastered in their current mode, and which would they like to work on?

As George Box said, “All models are wrong, but some are useful.” Some are more useful than others. The Life Modes model is flexible in that it can describe any number of paths through wealth, poverty, and in between. It can also serve as a powerful conversation aid to help you understand your clients’ strengths, weaknesses, skills, and knowledge gaps, and quickly determine which ones are most relevant to focus on in the short, medium, and long term.

/s3.amazonaws.com/arc-authors/morningstar/6c608d29-bb89-4580-943a-7819645ad538.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6c608d29-bb89-4580-943a-7819645ad538.jpg)