Why High-Yield Bonds Should Outperform in 2022

In an environment of rising interest rates and healthy economic growth, we continue to favor high-yield corporate bonds.

There’s been virtually nowhere for investors to hide in 2022, with losses across the board in both bond and stock markets. But we think high-yield bonds--aka junk bonds--should provide a haven for investors as the year progresses.

Factors favoring high-yield bonds should be an economy that remains strong even as it cools off from last year’s post-pandemic surge, high yield’s lower sensitivity to rising interest rates, and of course, their yield advantage over higher-quality corporate and government bonds.

As we noted in our 2022 Outlook, stocks were overvalued coming into the year and interest rates were poised to rise with inflation running hot. Each of these headwinds will continue to play out across the markets, but the impact of rising rates has led to significant losses across the fixed-income universe.

Robust Economic Growth Will Support High Yield

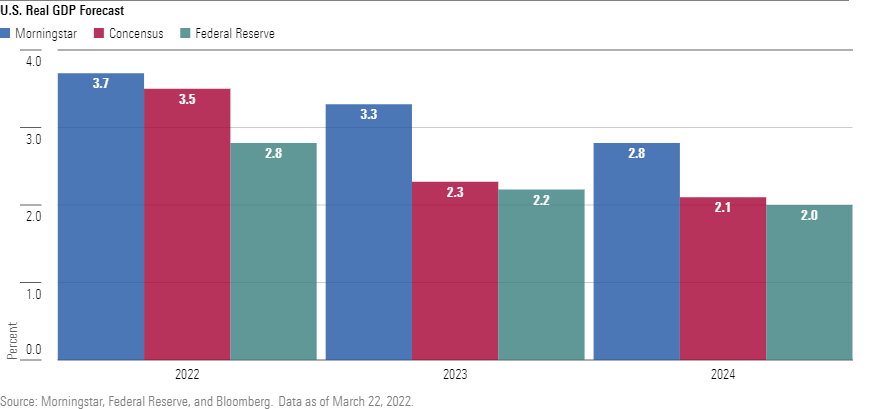

Looking forward, we continue to think there is value in corporate bonds, especially high yield. The main reason is that our U.S. economics team continues to forecast relatively robust economic growth in the United States over the next three years. Our forecast for real U.S. gross domestic product in 2022 is 3.7%, which is then projected to step down to 3.3% in 2023 and 2.8% in 2024, each of which is higher than both street consensus and the Federal Reserve’s projections.

We have incorporated the Fed’s tightening monetary policy and inflationary pressures into our economic outlook and have slightly revised our GDP projections down from the end of last year.

However, we continue project that the combination of economic normalization, shift in consumer spending back to services from goods, and a rising job participation rate will continue to propel robust economic activity this year, and that momentum will continue into next year. As the economy expands, it will help to limit defaults, result in fewer ratings downgrades, and should lead to a greater amount of rating upgrades.

What Are High-Yield Bonds?

A high-yield bond is one that is rated below-investment-grade by the ratings agencies. Bonds that are rated BBB- or higher are considered investment-grade and have lower default probabilities; whereas bonds rated BB+ or lower are considered high-yield and are colloquially known as “junk bonds” because of their higher default risk.

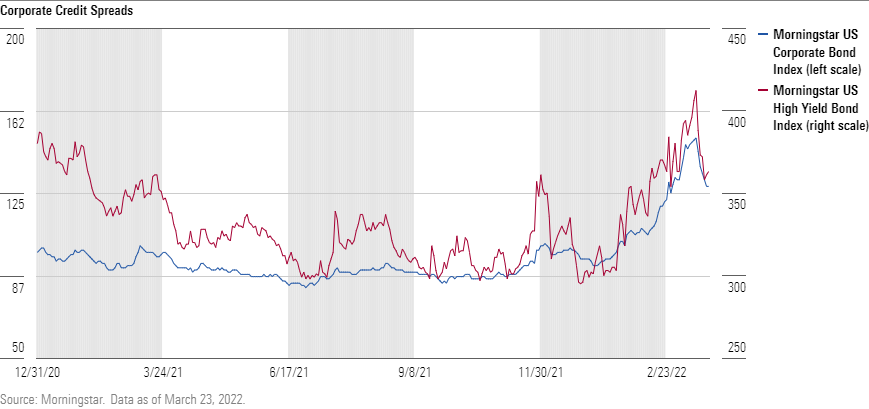

The corporate credit spread is the amount of extra yield over equivalent maturity U.S. Treasuries that investors earn to compensate them for the risk of weakening credit strength and defaults. In our investment-grade index, the average credit spread has widened 33 basis points thus far this year. In our high-yield index, the average credit spread has widened 60 basis points. The widening credit spreads have contributed to the losses in corporate bond indexes this year. Yet the amount that credit spreads would widen from here should be mitigated by our expectation for robust economic growth over the next three years. In fact, assuming our economic projections come to fruition, we would expect credit spreads to tighten back to the levels that we saw at the end of 2021.

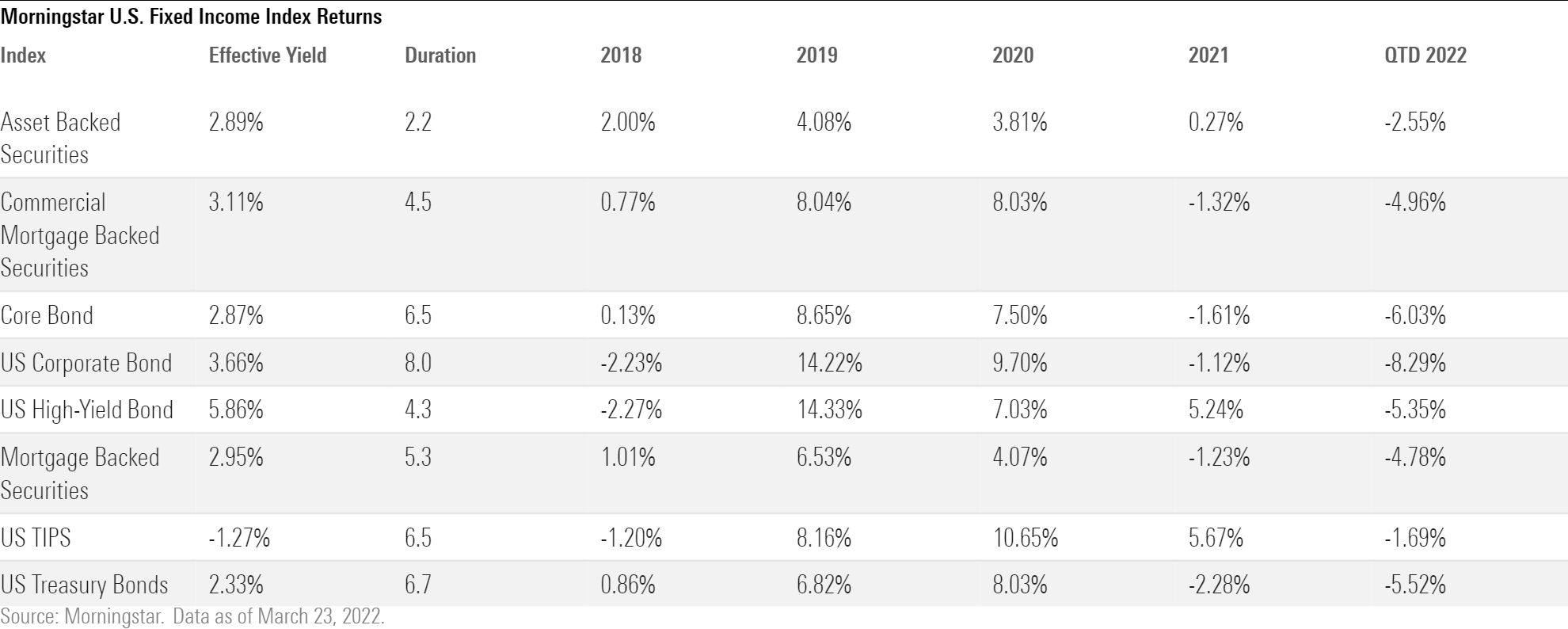

Currently, the effective yield of our high-yield bond index is 5.86%, much higher than the 3.66% yield of our investment index, or the 2.33% of our U.S. Treasury index. The higher yield carry of junk bonds will help to offset principal losses in a rising rate environment.

In an environment where we expect interest rates to continue rising, investors should focus their allocations within medium-term durations, such as those bonds with 5.0-year maturities. The credit spread for investment-grade bonds is less than for high yield, and investment-grade bonds often have longer maturities. As such, investment-grade bonds have longer duration and are more sensitive to underlying interest rates. High-yield bonds generally have shorter duration owing to the combination of their higher yield and shorter maturities. As such, high-yield bonds are less sensitive to interest-rate risk.

Why Are Interest Rates Rising?

Interest rates have risen from a confluence of several factors. First, the Federal Reserve has begun to tighten monetary policy. At its March meeting, it not only raised the federal-funds rate to a range of 0.25% to 0.50%--its first interest-rate hike since December 2015--but also forecast that it will continually raise rates through the end of 2023. According to the Fed's Summary of Economic Projections, it forecasts that it will raise rates to almost 2% by the end of this year and up to almost 3% by the end of next year. Second, the Fed has concluded its asset purchase program, thus lowering the amount of total demand for U.S. Treasuries. Further, the Fed will likely look to begin selling bonds off of its balance sheet as soon as this summer, which will increase supply for U.S. Treasuries over the amount needed to fund the U.S. government.

In addition, the market continues to price in ever higher near-term inflation expectations. Inflation had already been on the upswing, but Russia’s invasion of Ukraine has led to a spike in commodity prices, especially in oil, agricultural products, and industrial metals. The inflationary impacts of the higher commodity prices will be felt in the months to come as those prices flow through the supply chain.

In the shorter end of the curve, the 5-Year Breakeven Inflation Rate has risen to 3.57% from 2.87% at the end of last year, its highest level since this data series began in 2003. This rate measures the market implied average inflation rate for the next five years.

In the longer end of the yield curve, the 5-Year, 5-Year Forward Inflation Expectation Rate has been on an upward trend, hitting 2.31%. This places future inflation expectations near the top end of the range it has traded within since 2014. This rate is the market implied average inflation rate over the five-year period that begins five years from today.

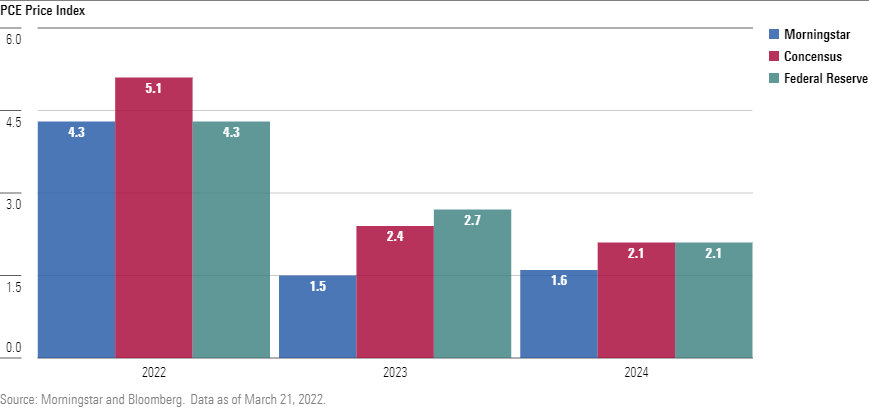

While inflation is running hot right now, we note that according to our forecasts, we project inflation will begin to decrease in the second half of this year and drop to as low as 1.5% in 2023.

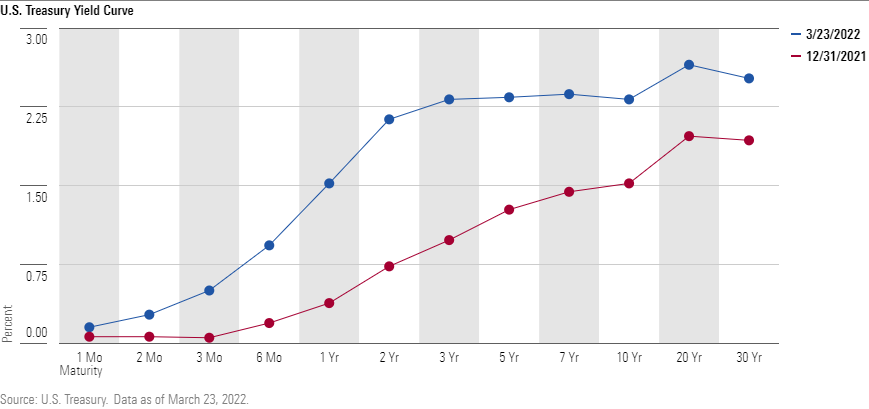

Rates have risen across the yield curve, but the greatest amount of increase has occurred in the shorter end of the curve. For example, the yield on the 2-year Treasury has risen 140 basis points to 2.13% since the end of 2021, whereas the 10-year Treasury has risen 80 basis points to 2.32%. This is known as a flattening yield curve.

There are several reasons for this. The impact of tightening monetary policy has a greater influence on short-term rates. Considering the Fed expects the federal-funds rate to be 2% by the end of this year and 3% next year, investors have incorporated that into their return requirement for 2-year Treasuries. Longer-term rates, however, are more closely correlated with the market's long-term economic outlook, which has been on a downward trajectory. This market consensus expectation for slowing economic growth, or even a potential recession on the horizon, has kept a lid on the amount that longer-term rates have risen.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)