What Happens to Your ETFs if Chinese Stocks Delist?

The SEC has singled out Yum China, four others for potential delisting in 2024 over accounting standards.

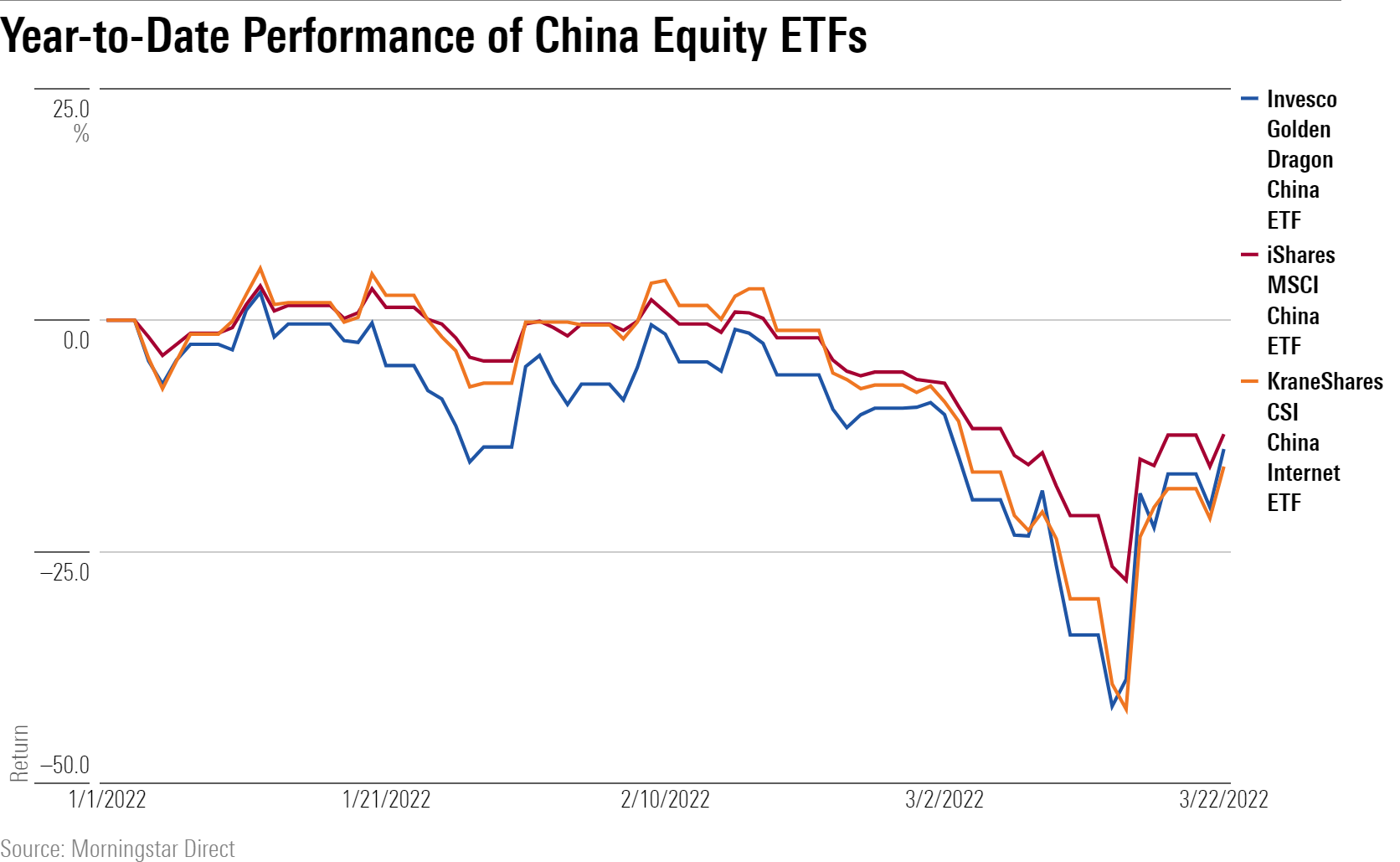

Chinese stocks have been on a roller coaster ride, taking exchange-traded funds with big holdings of those names along with them.

Earlier in March, the Hang Seng Index plunged more than 20% from where it started 2022, hitting a six-year low, and the Hang Seng Tech Index collapsed by as much as 40%. The broad-based Morningstar China Index fell 28.5% over the same period.

Worries about the impact of coronavirus lockdowns in China were one major reason behind the selloff. Another was a growing conflict between U.S. and Chinese regulators, as the Securities and Exchange Commission warned it was closer to ordering the delisting of shares in five China-based companies that trade on the New York Stock Exchange and Nasdaq, if those companies don’t meet tougher accounting and disclosure rules. These listings are known as American depository receipts, or ADRs.

The ride wasn't over, however. As opportunistic investors started to bottom-fish among beaten-up shares, Chinese state media hinted at government support in progressing toward a cooperation plan with U.S. regulators. That sparked a sharp rebound with major Chinese tech firms in Hong Kong markets recording gains of as much as 30% in a single day.

Even after the rebound, investors in many China-heavy ETFs are still facing big losses. The ADR-heavy, $212 million Invesco Golden Dragon China ETF PGJ is down 9.4% for the year to date, after plunging 42.8% in 2021. The $6.3 billion KraneShares CSI China Internet ETF KWEB, which mimics an index focused on Chinese tech firms listed overseas, also delivered a similar return profile, falling 8.0% so far in 2022 and near 50% in 2021. The broad-based iShares MSCI China ETF MCHI has registered a 6.4% drop.

At the same time, the delisting threat lingers. The first batch of five firms cited by the SEC will have until the end of March to show proof of audit compliance, or else they will have to delist from the New York bourse by 2024. The stocks in the spotlight: fast-food chain operator Yum China YUMC, wafer processing solution provider ACM Research ACMR, and bio-pharma firms BeiGene BGNE, Zai Lab ZLAB, and HutchMed HCM, which is a biopharmaceutical producing arm under Hong Kong's CK Hutchison CKHUF.

"We expect more Chinese ADRs to be included in the Provisional List over the next few weeks," says Ivan Su, senior equity analyst at Morningstar. As the companies publish their annual reports, the SEC will be scrutinizing the company filing for compliance with the new results.

Which ETFs Hold the Most Stocks at Risk?

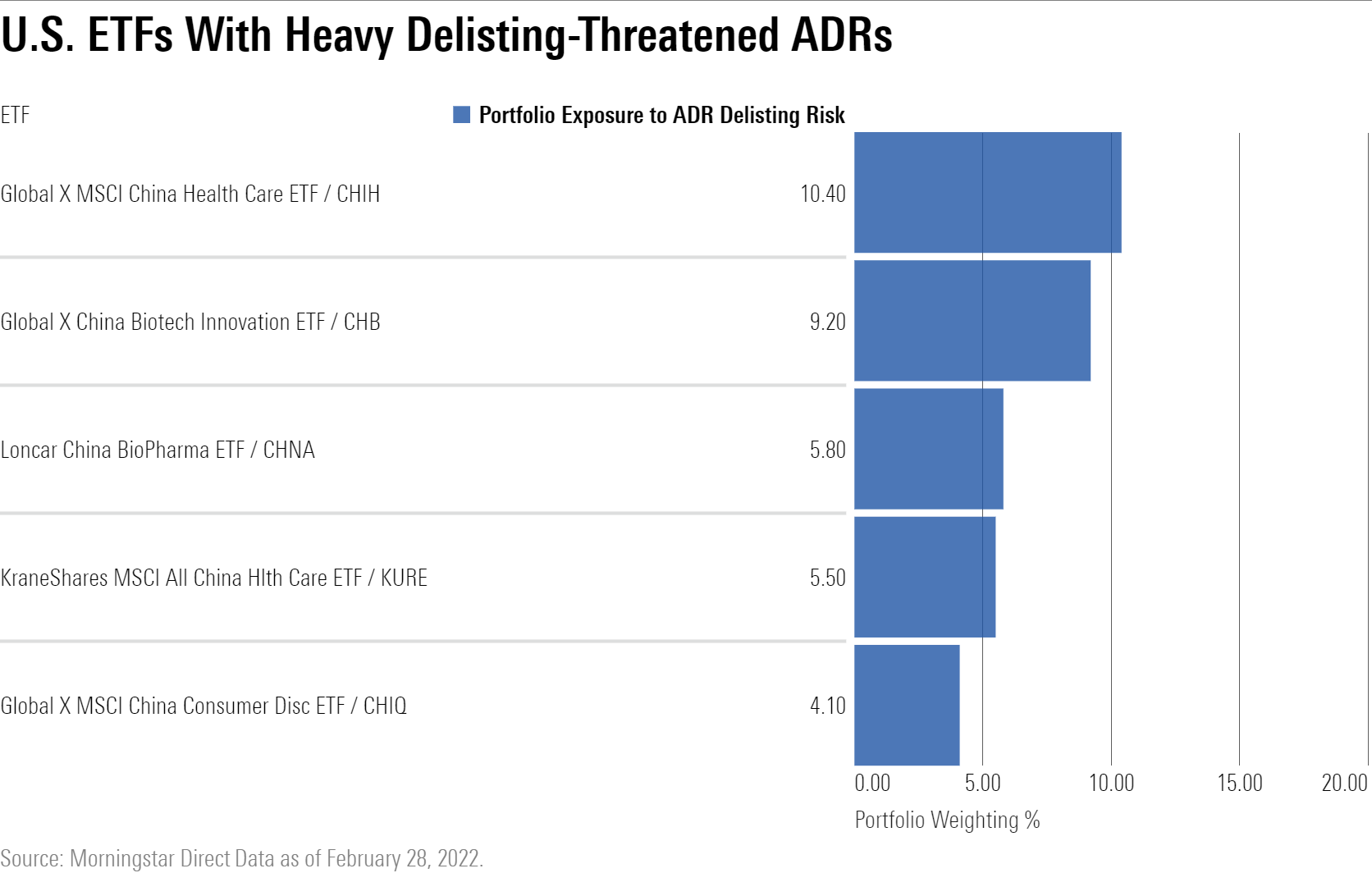

According to Morningstar Direct data, in the $37 billion China equity ETF market in the United States, 16% of assets are ADRs and 5% of those assets buy into Chinese names that are currently listed on U.S. bourses only.

Across global ETF products, PGJ is a Chinese ADR-focused portfolio, and the $6.3 billion KWEB has held 50% of its assets in Chinese ADRs.

In terms of the five stocks highlighted by the SEC as already at risk of delisting, MCHI, which has $6.4 billion under management, is the largest holder of the batch in dollar terms as of Feb. 28. Chinese ADRs owned by MCHI totaled $76.4 million but only account for about 1.6% of its assets.

When it comes to impact by portfolio weighting, since BeiGene, HutchMed, and Zai Lab land in the healthcare sector, the largest owners tilt toward thematic funds. For example, Global X MSCI China Health Care ETF CHIH is among the top owners of BeiGene (a 5.9% weight), HutchMed (1.8%), and Zai Lab (2.7%) out of its assets under management. For Yum China, Global X MSCI China Consumer Disc ETF CHIQ and KraneShares MSCI China ESG Leaders ETF KESG top all other ETFs by owning 4.1% and 2.6% of the fast-food chain's shares in their portfolios, respectively.

Among other widely held China ADRs is search engine provider Baidu BIDU, owned by ETFs with more than $750 million in total assets. E-commerce platforms Alibaba Group BABA, JD.com JD, and Pinduoduo PDD also are common holdings.

Delisting Implications for Stock Investors

What would be the implications for investors in these ETFs if delistings do take place?

Aside from the volatility in the market, there shouldn’t be significant implications for ETF shareholders, says Lorraine Tan, Morningstar's director of equity research, Asia. Tan points to the delisting of CNOOC, the China National Offshore Oil Corporation 00883, in December 2001 as an example.

“There is a set process that funds will have to refer to if this should happen,” Tan says. For companies that have a listing elsewhere, most commonly in Hong Kong, even if delisting occurs, funds can convert U.S. shares into Hong Kong shares. The delisting procedure itself would pass on no fundamental implications, thus their valuations should remain the same.

Tan notes that there is a fee to the funds involved, but it is not one that poses a significant cost to shareholders. In CNOOC’s case, the conversion into shares listed in Hong Kong cost funds $5 per 100 ADRs.

Tan continues: “The alternative is to sell [the ADRs] and buy the Hong Kong shares if the investor wants to retain their holdings and prefers not to wait for the mandatory conversion period. In the meantime, we should expect more notices from the SEC to the companies with China businesses listed in the U.S.”

Jackie Choy, Morningstar's director of ETF research, Asia, says an ETF would simply mirror changes in the indexes that result from the delisting: “In the case that a company only has an ADR listing, closer to the delisting date, such delisting would be reflected in the index. Hence, the ETF would be selling out the positions.’’

Some fund companies are getting ahead of any potential delisting.

KWEB's manager KraneShares, which has $6.9 billion under management, announced March 11 it would progress to a full transition of holding the Hong Kong listings. "We believe a compromise between the U.S. and Chinese regulators is still attainable, but we are converting our ADR holdings to Hong Kong shares because we believe doing so is in the best interest of our clients," the firm said. KraneShares expects the portfolio to be composed of solely Hong Kong listings by the end of 2022, driven by continued U.S. ADR conversion and relistings in Hong Kong.

Still, investors should keep an eye on developments around the delisting threat, says Choy: “In ETF investments, it is important to understand what the index consists of. This drives the portfolio itself, which in turn drives the performance profile of the ETF.”

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)