Thematic Funds Continue to Capture Investors’ Imagination—and Their Money

Investors should think twice before chasing the next hot theme.

In recent years, the global menu of thematic funds has expanded in number and breadth like never before. These funds attempt to harness secular growth themes, such as technology themes like artificial intelligence, social themes like Generation Z, and physical world themes like renewable energy or climate change.

The result has been a steady supply of ever more niche and complex investment strategies from asset managers and increased demand from investors for greater clarity with respect to how these funds are built and how they might (or might not) fit within their portfolios.

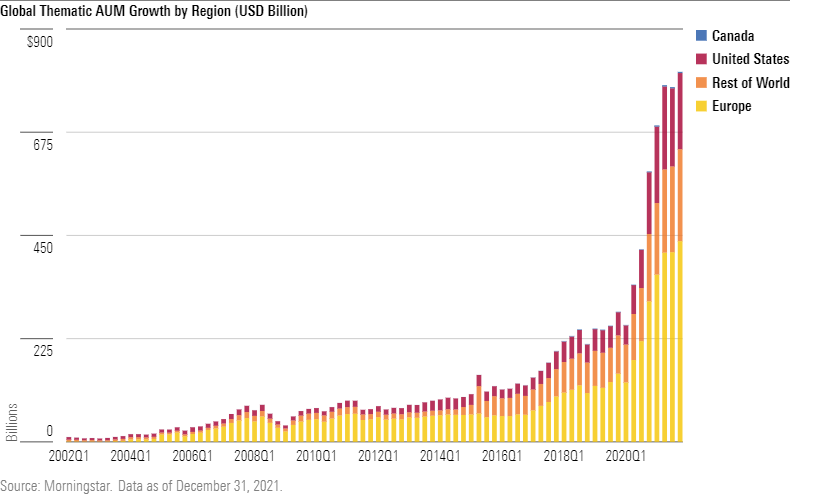

At the end of December 2021, there were 1,952 surviving funds in Morningstar's global database that fit our definition of thematic. In the trailing three years to the end of 2021, these funds' assets under management grew nearly threefold to $806 billion from $255 billion worldwide. At the end of 2021, global thematic fund assets represented 2.7% of all assets invested in equity funds globally, up from 0.8% 10 years ago.

As assets have poured into thematic funds, the menu has broadened. A record 589 new thematic funds debuted globally in 2021, more than double the previous record of 271 funds launched in 2020.

We detail these findings in our latest Global Thematic Funds Landscape. Below, we explore some key findings from the report.

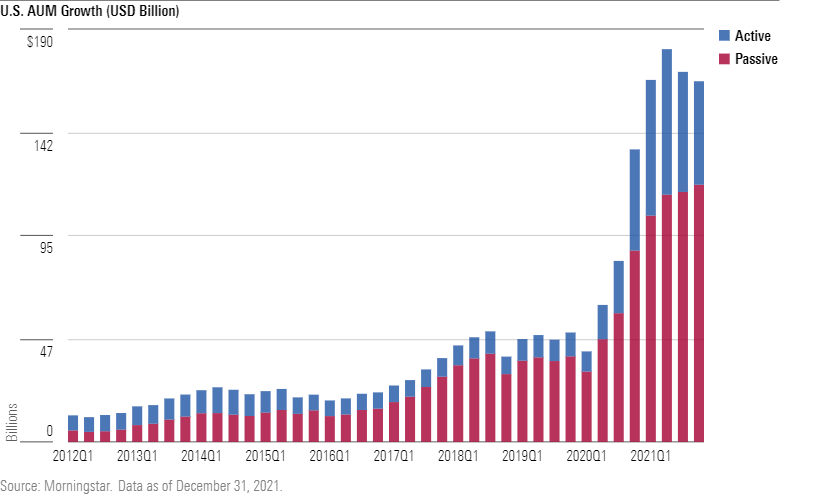

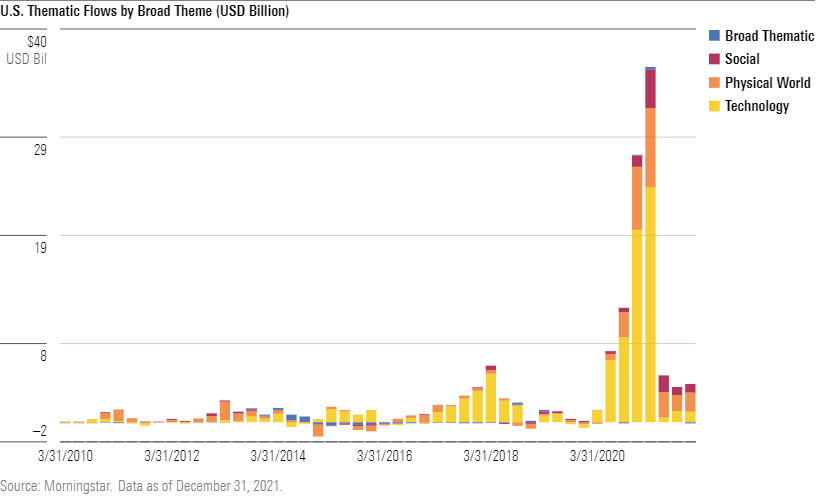

The U.S. Thematic Fund Market

After an explosive 2020, assets in U.S. thematic funds stabilized in 2021 despite a record-breaking number of launches. In mid-2021, total AUM topped out at more than $180 billion, but inflows had already begun to slow. Assets flowing into U.S. thematic funds increased dramatically throughout 2020 and peaked in the first quarter of 2021 at around $36 billion. Net inflows were below $5 billion in each of the remaining three quarters of 2021. At the end of 2021, U.S.-domiciled thematic funds held a combined $165 billion.

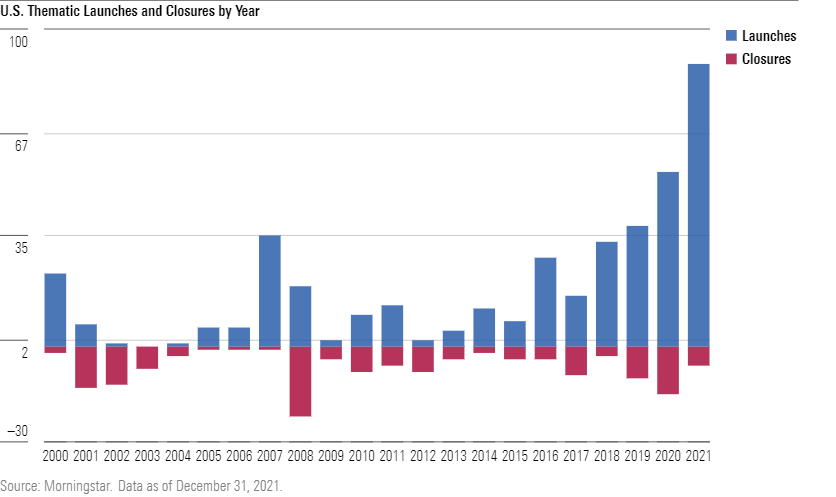

Historically, thematic fund launches have tended to move in cycles. New strategies are often introduced during periods of strong performance, like the new millennium and the mid-2000s. But they tend to wane during downturns. Those trends indicate that investors' appetites for these strategies and the desire for providers to offer them typically move in sync with the broader market.

Thematic fund launches are a bull-market phenomenon. The hoard of new thematic funds introduced over the past several years further supports this connection. The second half of 2020 witnessed nearly as many launches as the entirety of 2019, and 2021 was another record year with 90 new launches. Nearly half of these new launches came to market in the fourth quarter of 2021.

Overall, the U.S. thematic fund landscape is still dominated by a handful of very large funds. The 10 largest accounted for nearly 44% of all U.S. thematic fund assets as of Dec. 31, 2021. At the end of 2021, ARK Innovation ETF ARKK was still the largest U.S. thematic fund, maintaining a large lead over its next largest competitor. However, ARKK shrank over the course of 2021, owing to a combination of disappointing performance and investor withdrawals. While the fund experienced net inflows for the whole year, the fund suffered significant outflows during the second half of 2021. All three ARK funds that were on the top-10 list in 2020 saw their assets shrivel in 2021.

In 2021, more than two thirds of thematic funds underperformed the Morningstar Global Markets Index. This is a sharp reversal from their stellar showing in 2020, highlighting the volatility that goes hand in hand with thematic investing.

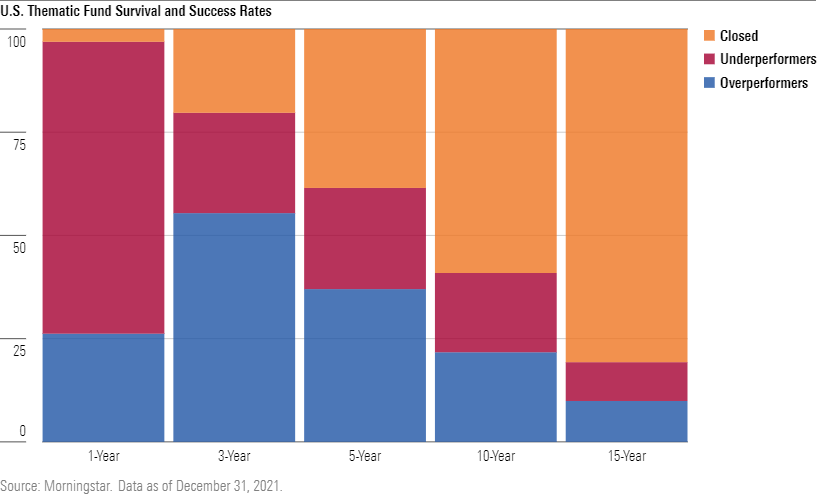

Over longer periods, these funds have generally performed poorly versus broad market indexes. A supportive market for growth strategies has seen thematic funds generally perform well over the trailing three years, but their success rate tumbles as we go further back in time. Over the 10 years through the end of 2021, nearly 60% of U.S. thematic funds shuttered, and just 22% both survived and outperformed the Morningstar Global Markets Index. The exhibit below details the dismal odds facing investors in selecting a thematic fund that will succeed.

Chasing Shiny Objects

Thematic funds have captured investors' imagination, but buyers should beware. These funds are often designed more with salability in mind than investment suitability. Many cross the border into gimmick territory. Examples abound. Whiskey ETF, The Kids Fund, and StockJungle.com Pure Play Internet are just a few that have come and gone over the years. Investors have often piled into these funds at precisely the wrong time, only to be disappointed. Investors mulling thematic ETFs should think long and hard about whether a particular theme has long-term investment merit or if it is a mirage.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/93a178f7-9fba-48fa-b146-9b56e127ae6c.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)