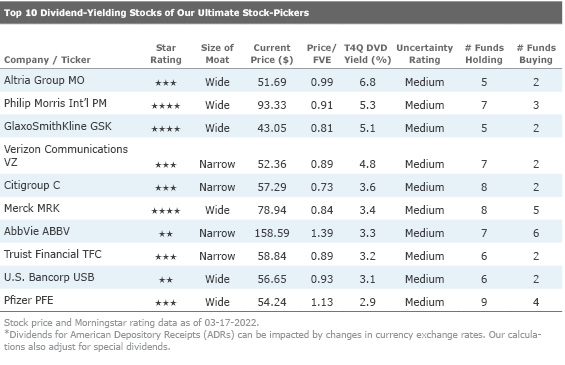

Our Ultimate Stock-Pickers' Top 10 Dividend-Yielding Stocks

Half of the top 10 dividend-yielding names are undervalued.

As you may recall from our previous dividend-themed articles, when we screen for top dividend-paying stocks among the holdings of our Ultimate Stock-Pickers we try to find the highest-quality names that are currently held with conviction by our top managers. We do this by taking an initial list of the dividend-paying stocks held in the portfolios of our Ultimate Stock-Pickers and then narrow it down by concentrating on firms that we believe have durable competitive advantages that should allow them to generate the excess returns necessary to maintain their dividends over the longer term. We also look for firms where there is lower uncertainty on our analysts’ part regarding their future cash flows. We accomplish this by screening for holdings that are widely held (by five or more of our top managers), are yielding more than the S&P 500, have wide or narrow economic moats, and have uncertainty ratings of either low or medium.

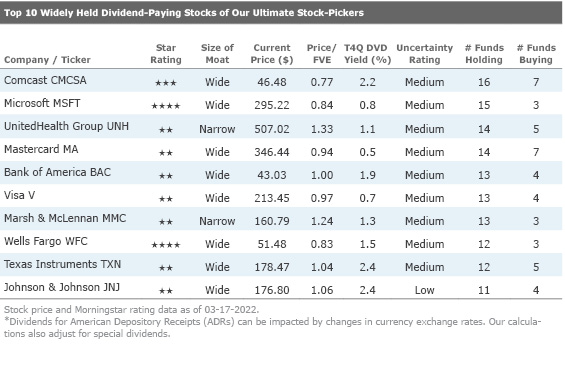

Once our filtering process is complete, we create two different tables--one that reflects the top 10 stocks with the highest dividend yields and another that lists stocks that are widely held by our Ultimate Stock-Pickers and pay dividends in excess of the S&P 500, which is currently yielding 1.56% as of February 2022. We note that the dividend yield calculations in each of our two tables are based on regular dividends that have been declared during the past 12 months and do not include the impact of any special (or supplemental) dividends that may have been paid out (or declared) during that time.

Looking back to our list of top 10 dividend-yielding stocks from last time around, we note that the majority of the new list is composed of names that were also present on the list we published in September 2021. These names include Philip Morris International PM, GlaxoSmithKline GSK, Verizon VZ, Merck & Co MRK, AbbVie ABBV, and Pfizer PFE. Similarly, the top 10 widely held dividend-paying stocks also remained largely the same. We saw a shift in the ordering of this list. Some notable mentions were Bank of America BAC dropping three spots to number five and Comcast CMCSA remaining at the top of the list to finish the fourth quarter.

In the last edition of the Ultimate Stock-Pickers article discussing dividend yielding stocks, we highlighted the recovery of the global economy from the COVID-19-induced demand slowdowns. This recovery continued through 2021 as positive vaccine news, better-than-expected unemployment data, and a widespread lifting of lockdowns buoyed the economy. Most of the companies on our lists of top 10 dividend-yielding and widely held stocks by our Ultimate Stock Pickers come from the financial services, healthcare, and technology sectors.

Searching for yield in this type of environment can be risky. Price risk remains elevated as does the risk that companies may not be able to sustainably maintain current dividends due to economic strain. To alleviate some of these risks, we eliminate high uncertainty rated stocks from our screening process. Although the market has recovered, four stocks on our dividend-yielding list remain undervalued. Wide-moat rated GlaxoSmithKline and Merck, as well as narrow-moat rated Verizon and Citigroup C are all trading at or over an 11% discount to fair value. The average price to fair value estimate for the top dividend-yielding stocks was 0.95, indicating that we view these high-yielding stocks as fairly priced. The top 10 dividend-yielding stocks remain heavily overweight in the healthcare sector, which contributed four names to the top 10 list. The mix is different for our top 10 widely held dividend-paying stocks list, where half the companies are coming from the financial services sector followed by healthcare and technology.

A closer look reveals there was no crossover of companies that appeared on the lists of top 10 dividend-yielding and top 10 widely held dividend-paying stocks.

Interestingly, all the top 10 widely held securities were held by 11 or more funds. This period's list of widely held dividend-paying stocks was less undervalued than the top dividend-paying stocks. Three of the 10 stocks were materially undervalued, averaging a price to fair value of approximately 100% compared with an average of 95% for our top 10 highest dividend-yielding stocks.

We continue to believe that the best way for investors to protect their capital is to invest in quality businesses that are trading at attractive prices. Our valuation shows that wide-moat rated GlaxoSmithKline is trading at a significant discount to fair value, so we will focus on it in this piece. We also highlight narrow-moat Verizon and wide-moat Johnson & Johnson.

GlaxoSmithKline GSK

Wide-moat GlaxoSmithKline currently trades at a 19% discount to Morningstar analyst Damien Conover’s $53 fair value estimate. GlaxoSmithKline is one of the largest firms in the pharmaceutical industry. The company is involved in several therapeutic classes, including respiratory, cancer, and antiviral, as well as vaccines and consumer healthcare products. The diverse platform insulates the company from problems with any single product. Additionally, the company has developed next-generation drugs in respiratory and HIV areas that should help mitigate both branded and generic competition.

We believe Glaxo’s shift from its historical strategy of targeting slight enhancements toward true innovation and branching out from developed markets into emerging markets positions the company well. These initiatives improve Glaxo’s pricing power and help support long-term growth by diversifying cash flows beyond developed markets.

We anticipate an acceleration of growth over the next five years as vaccine utilization normalizes after the pandemic--in addition to long-acting HIV drugs gaining share and new products launching. Conover highlights that with no major patent losses until 2028, Glaxo is approaching a period of steady growth. We expect shingles vaccine Shingrix to rebound robustly over the next several years as COVID-19 vaccinations will likely cause less disruption to this important vaccine. While the HIV drug franchise was up only 3%, we expect strong growth from long-acting drug Cabenuva (treatment) and Apretude (prevention).

Glaxo’s diversity in products and strategy plays into our moat rating. We believe the business merits a wide moat rating, supported by its patents, economies of scale, consumer brands, and a powerful distribution network. Its patent-protected drugs carry strong pricing power, enabling the firm to generate returns on invested capital over its cost of capital.

Further, the patents give the company time to develop the next generation of drugs before generic competition arises. While Glaxo holds a diversified product portfolio, there is some product concentration with its largest drug, Triumeq (for HIV), representing close to 7% of total sales, but we expect new products will mitigate the generic competition that likely won't emerge until 2027 or later. Glaxo’s operating structure also allows for cost-cutting following patent losses to reduce the margin pressure from lost high-margin drug sales. Overall, Glaxo's established product line creates the enormous cash flows needed to fund the average $800 million in development costs per new drug. A powerful distribution network sets up the company as a strong partner for smaller drug companies that lack Glaxo’s resources. Glaxo's entrenched vaccines and consumer healthcare franchises create an added layer of competitive advantage stemming from cost advantages in creating vaccines and strong brand power in the consumer group.

We think the firm does face environmental, social, and governmental (ESG) risks, particularly related to potential U.S. drug price-related policy reform to increase access by lowering drug prices. Ongoing product governance issues (including litigation about side effects and patents) also weigh on the company. While we have factored these threats into our analysis, we don't see them as material to our moat rating.

Verizon VZ

Narrow-moat Verizon currently trades at a 14% discount to Morningstar analyst Michael Hodel’s $59 fair value estimate. Verizon is primarily a wireless business that serves about 91 million postpaid and 4 million prepaid phone customers and connects another 25 million data devices, like tablets, via its nationwide network, making it the largest U.S. wireless carrier.

Verizon has long prided itself on network quality, investing consistently in both wireless and fixed-line technology. The firm has built its marketing reputation around these networks, attracting a large and loyal customer base. In the wireless business, the firm holds roughly 40% of the postpaid phone market, about one third greater than either AT&T T or T-Mobile TMUS. Leading scale enables Verizon to generate the highest margins and returns on capital in the industry.

The company has taken steps to ensure that it remains well positioned in the traditional wireless market, building fiber deeper into major metro areas, acquiring a large spectrum in 2021, and ramping up spending to put that spectrum to use. With all this at play, we believe the firm will deliver consistent results over the long term.

On the economic moat front, we believe Verizon merits a narrow economic moat with a stable trend. Verizon, AT&T, and T-Mobile dominate the U.S. wireless market, claiming more than 90% of the retail postpaid phone market. Providing solid nationwide coverage requires heavy fixed investments in wireless spectrum and network infrastructure. While a larger customer base does require incremental investment in network capacity, a significant portion of costs is either fixed or more efficiently absorbed as network utilization reaches optimal levels in more locations. In addition, Verizon’s relatively straightforward corporate history and consistently strong financial position have enabled it to deploy its network in a highly coordinated manner, warranting a narrow

We believe Verizon’s moat trend is stable. Though Verizon has started to expand the Fios fiber network again, the heaviest spending on Fios is in the past. In Fios areas, we expect Verizon will remain in a rational duopoly with its cable rivals, likely enabling Verizon to slowly gain share and improve ROICs as industrywide prices increase. Outside of Fios territories, however, Verizon’s fixed-line business is an albatross, with low and declining market share punishing profitability. We expect Verizon will need to explore opportunities with regulators to shut down these networks at some point, either moving to wireless technologies or simply ceding markets to cable.

Johnson & Johnson JNJ

Wide-moat Johnson & Johnson currently trades within a range we consider fairly valued to Morningstar analyst Damien Conover’s fair value estimate of $167. Johnson & Johnson is the world's largest and most diverse healthcare firm. Three divisions make up the firm: pharmaceutical, medical devices and diagnostics, and consumer. The drug and device groups represent 80% of sales and drive the majority of its cash flows. The drug division focuses on the following therapeutic areas: immunology, oncology, neurology, pulmonary, cardiology, and metabolic diseases. The device segment focuses on orthopedics, surgery tools, vision care, and a few smaller areas. The consumers segment focuses on baby care, beauty, oral care, over-the-counter drugs, and women’s health. Geographically, just over half of total sales are generated in the United States.

We view Johnson & Johnson as a stand-alone leader across the major healthcare industries. However, relative to the company's size, J&J needs to increase the number of meaningful drugs in late-stage development to support long-term growth. The company has also created new medical devices, including innovative contact lenses, minimally invasive surgical tools, and robotic instruments. These multiple businesses generate substantial cash flow. J&J's healthy free cash flow (operating cash flow less capital expenditures) is over 20% of sales. Strong cash generation has enabled the firm to increase its dividend over the past half-century, and we expect this to continue. It also allows J&J to take advantage of acquisition opportunities that will augment growth. Diverse operating segments coupled with expected new products insulate the company more from patent losses relative to other Big Pharma firms.

Concerning the economic moat, J&J carries one of the widest moats in the healthcare sector, supported by intellectual property in the drug group, switching costs in the device segment, and strong brand power from the consumer group. The company's diverse revenue base, strong pipeline, and robust cash flow generation create a wide economic moat.

At the same time, we believe J&J holds a stable moat trend. The company faces manageable patent losses over the next few years, and pricing power in the core franchises is relatively stable. On the other hand, the company encounters headwinds in the macro-environment corresponding with the risk-sensitive U.S. Food and Drug Administration. While Johnson & Johnson manages these headwinds, its pipeline is focused on more innovative treatments in areas of unmet medical areas such as oncology and immunology, where payer coverage and pricing power remain strong. Outside the pipeline, strong entrenchment in medical devices and consumer goods gives the company some relief from the pressures in the drug group.

Disclosure: Eden Alemayehu, Justin Pan, and Eric Compton have no ownership interest in any of the securities mentioned here. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)