A New Day Is Dawning at Dodge & Cox

The historic fund company tries to keep up with the times--on its own terms.

The article was published in the March 2022 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

Throughout its 92-year history, Dodge & Cox has prided itself on stability. In 2022, however, the storied firm is undertaking some significant--albeit gradual--changes. In some ways, the firm is evolving along well-established lines; in others, it's trying to catch up with peers.

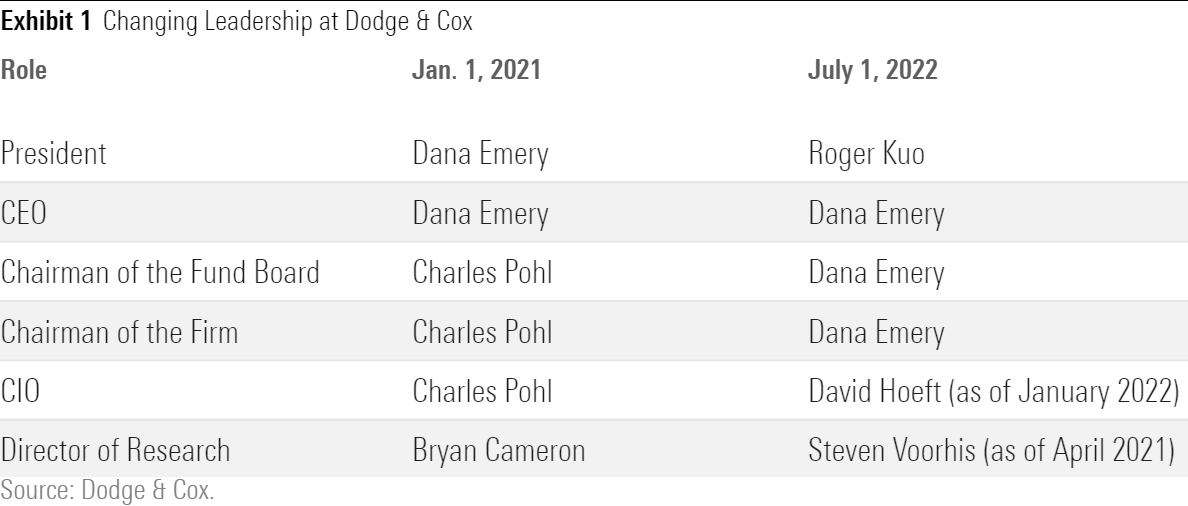

Dodge & Cox's transparent succession planning is exemplary. The firm's ownership structure makes many retirements relatively predictable. Partners must be active employees but must begin selling their stakes at age 65 and fully exit them by 70. This often allows Dodge & Cox to announce retirements well in advance, and for key leadership positions it typically puts successors in supporting roles early so they can learn the ropes.

All of this has been on display in recent years. Consider the planning around chairman and former chief investment officer Charles Pohl's pending retirement in June 2022. Dodge & Cox announced Pohl's timeline in January 2021, but preparations began at least two years earlier when David Hoeft became associate CIO. Hoeft assumed full CIO duties from Pohl at the start of 2022. The firm also said in early 2021 that at his retirement Pohl would cede chairmanship of the funds and the firm to president and CEO Dana Emery. These plans remain on track.

Pohl's departure is part of a gradual, generational leadership change at Dodge & Cox. Steven Voorhis replaced firm veteran Bryan Cameron as director of research in 2021 (Cameron retired at year's end); another influential leader, international-equity investor Diana Strandberg, will step down at the end of 2022. Emery, who is in her early 60s, hasn't announced her own plans yet, but clients should expect plenty of warning. As a possible sign of things to come, in June 2022 she will hand the presidency to Roger Kuo, a close collaborator and longtime member of the firm's international- and global-equity investment committees, to make room for what she's picking up from Pohl.

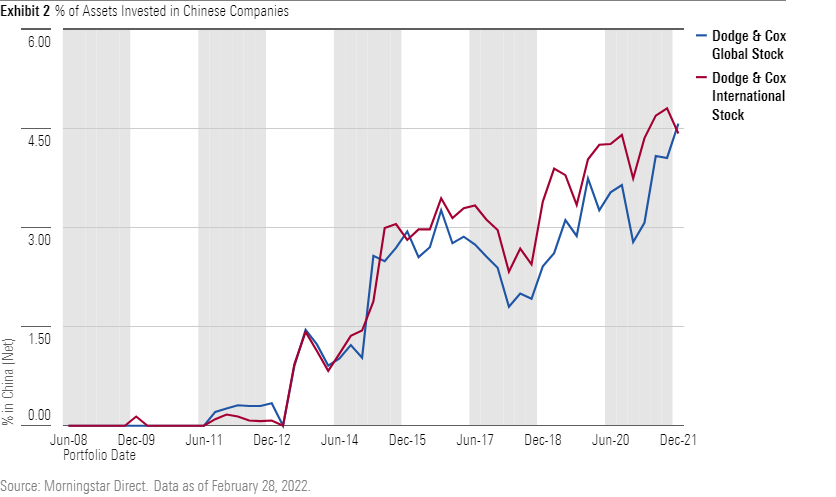

Such clear, smooth transitions are essential as Dodge & Cox is taking some ambitious steps by its own standards. In 2021, it opened its first investment office outside San Francisco--in Shanghai. The small office has only one analyst and is restricted to Chinese nationals, but it's a toehold in the world's second-largest economy. As CIO, Pohl was adamant about getting and maintaining access to companies in China, and Chinese stocks have been minor but growing portions of Dodge & Cox International Stock DODFX and Dodge & Cox Global Stock DODWX.

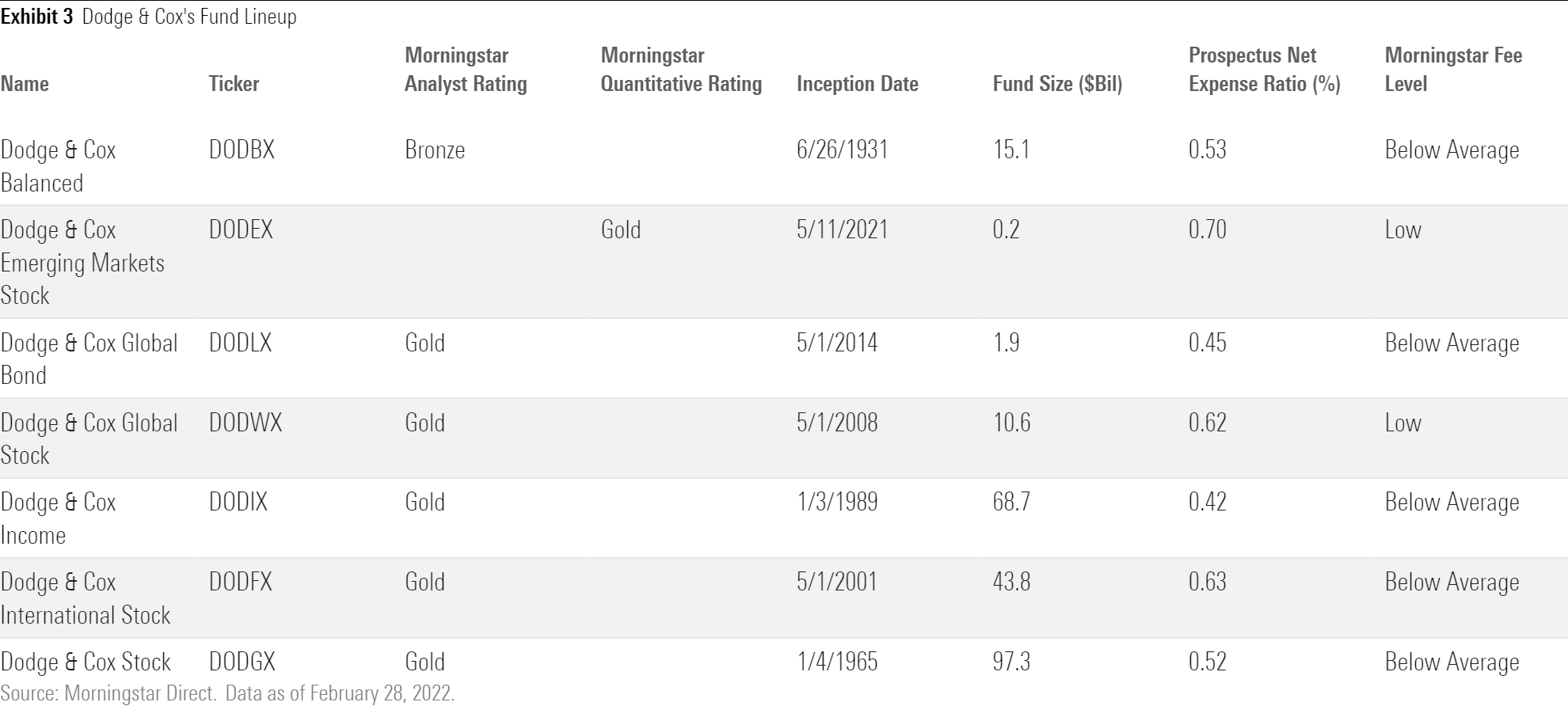

China is even more central to the firm's seventh--and newest--mutual fund, Dodge & Cox Emerging Markets Stock DODEX. Launched in May 2021, the fund had roughly one fourth of its assets in Chinese companies at year's end. The fund is also unique at Dodge & Cox in that it relies in part on quantitative research tools to find opportunities; the firm's other offerings depend almost entirely on its strong fundamental analyst corps. Dodge & Cox has gotten serious about quantitative research only in the past decade. It started with the 2013 hiring of Robert Turley, who holds a doctorate in business economics and serves on the emerging-markets fund's investment committee.

Turley's work has also brought new rigor to the firm's investment process. He and a small team have crafted tools to monitor portfolio risk exposures. Gone are the days when the firm might have measured its exposure to oil-price movements simply by tallying its energy-sector holdings. Quant-driven risk tools, such as BlackRock's Aladdin system, abound in the asset-management industry, but Pohl and his colleagues felt that Dodge & Cox had enough trading and portfolio data to tailor risk tools to its own needs.

Turley's quant and risk-monitoring efforts are also bearing fruit at Dodge & Cox Balanced DODBX, the firm's first mutual fund. (It launched in June 1931.) For decades, it has had a surprisingly simple structure. It essentially married the portfolios of the firm's two main strategies: Dodge & Cox Stock DODGX and Dodge & Cox Income DODIX. Both use Dodge & Cox's contrarian, valuation-focused philosophy, and as such may invest in unloved companies or securities if the research team sees unrealized value in them.

Yet, investors in a balanced fund often want a so-called "smoother ride" produced by its bonds serving as effective counterweights to its stocks. Dodge & Cox Balanced, by contrast, hasn't always provided such comfort. The fund dropped 46% from June 2007 through February 2009, worse than 95% of its peers. One source of pain: Wachovia. The fund held Wachovia's common stock and a few of its corporate credits. It took hits on both fronts when mortgage-related losses in 2008 pummeled Wachovia. A similar situation occurred in early 2020. As the coronavirus pandemic took hold, the Balanced fund fell a sharp 31% in less than five weeks in late February and March. Again, the fund suffered from stock and bond exposure to hard-hit companies such as Occidental Petroleum OXY.

The troubles spurred some soul searching and changes to Dodge & Cox Balanced are underway. In early 2021, the firm formed a working group of top equity and fixed-income investors and added Turley to bring his risk-management tools to bear. In May 2022, the seven-member working group will become the firm's seventh investment committee and take charge of the Balanced fund. It is already having an effect, as Turley's tools have sharpened management's awareness of correlations between certain stocks and bonds and have supported the occasional use of options, preferred stock, and international equities to modify the fund's risk profile. Fundholders can expect to see a more nuanced approach to portfolio construction and risk management going forward.

Dodge & Cox is also wading into the environmental, social, and governance area. Like many firms, it argues that it had already included ESG factors in its evaluation of the risks facing companies. But ESG data is evolving, and some of it--such as metrics related to climate change or carbon emissions--hasn't been accounted for in traditional fundamental analysis. Dodge & Cox now has an ESG checklist to guide its analysts. This is a reasonable first step, but Dodge & Cox is still early in its ESG journey. A company's valuation (whether ESG factors influence it or not) remains Dodge & Cox's guiding light.

Most recently, Dodge & Cox moved to keep its funds attractive from a pricing standpoint. It has long targeted cheapest-quartile expense ratios for its single, no-commission share class--a boon for retail investors. Over time, however, the fee structure became tough to swallow for defined-contribution retirement plans. Dodge & Cox had paid fees for defined-contribution plan recordkeeping, and those plans had to report such payments to clients. Dodge & Cox removed this administrative hassle by creating a so-called "clean" share class that avoids such arrangements. The new X share class will debut in May 2022 on all but the emerging-markets fund. Designed specifically for defined-contribution plans, it will have an even lower management fee than the legacy shares (which will be called I shares).

For a firm lauded for its stability and consistency, Dodge & Cox isn't sleepy. It has handled leadership changes admirably in the past and is doing so now. Its foray into China follows its investment interests in the region. It has tailored its relatively nascent quant and risk-management efforts to its capabilities and investment style. ESG takes a back seat to valuation but isn't ignored. Finally, the launch of a new share class serves clients and maintains the funds' long-standing low-fee advantage. Overall, the firm is adapting to changes and trends in asset management on its own terms, and that's likely to help Dodge & Cox stay true to what has made its reputation.

/s3.amazonaws.com/arc-authors/morningstar/a25c5a3e-6a5c-495e-9278-eb867855f392.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RZEYRM7QNVE63FSD5LZOBHHTTQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a25c5a3e-6a5c-495e-9278-eb867855f392.jpg)