Markets Review/Preview: Yields March Higher, Oil Slides

Chinese ADRs bounce back, Nvidia and Moderna rise, and energy stocks slump.

With the constant rumble of the Ukraine war continuing in the background and the Federal Reserve’s inaugural rate increase in the rearview mirror, the focus remains on ripples from both across markets, especially in the oil and the bond markets.

Oil price volatility remains in the spotlight after sanctions were imposed on Russia, one of the world's biggest exporters of the commodity. Oil prices fell this past week after rising to about $130 per barrel earlier this month. That earlier spike in energy prices, combined with surges in other commodities, has been fueling concerns that inflation pressures will remain higher, longer. The International Energy Agency, which works with countries to help shape energy policy, will hold a meeting for energy and climate ministers in Paris on March 23 and 24. In the bond market, yields have continued their upward march, with inflation pressures pushing them to higher levels than many in the market had been expecting just a few months ago. The U.S. Treasury 10-year note finished Friday at 2.15%, up from 1.71% at the beginning of March and 1.63% at the start of the year. Short-term yields have had an even more dramatic move, reflecting the expectations for a stepped-up pace of Fed rate increases in 2022. The yield on the U.S. Treasury two-year closed out Friday's session at 1.96%, up from 1.3% at the beginning of March and 0.79% at the start of 2022.

Many in the markets will be keeping a close eye on the gap between the yields on the two-year and 10-year note. That difference has been narrowing – a trend known as a flattening yield curve. Should short-term yields move above long-term yields – known as an inverted yield curve – that could trigger alarm bells. An inverted yield curve is often seen as a precursor to a recession.

President Joe Biden will travel to meet with members of NATO in Europe to discuss the military alliance’s response to the war in Ukraine, and what steps may be taken next. Those talks are scheduled for March 24. While on his trip Biden is also expected to attend a European Union meeting.

Among the events scheduled for next week:

- Monday: Nike NKE Earnings

- Tuesday: Adobe ADBE Earnings; Carnival Cruise Line CCL Earnings; Nvidia NVDA Investor Day

- Wednesday: General Mills GIS Earnings

- Thursday: Moderna MRNA Investor Day

For the trading week ending March 18:

- The Morningstar US Market Index was up 6.4%.

- The best-performing sectors were consumer cyclical 9.2% and technology 8.3%.

- The worst-performing sectors was energy, down 3.1%.

- Yields on the U.S. 10-year Treasury note rose to 2.15% from 2%.

- Oil ended the week down 4.2% to $104.70 per barrel.

- Of the 863 U.S.-listed companies covered by Morningstar 767, or 89%, rose, and 96, or 11%, fell.

What Stocks are Up?

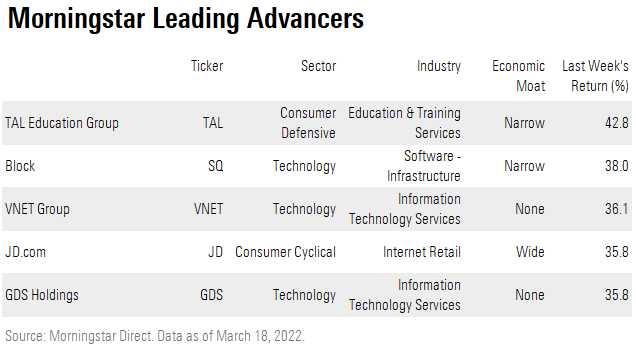

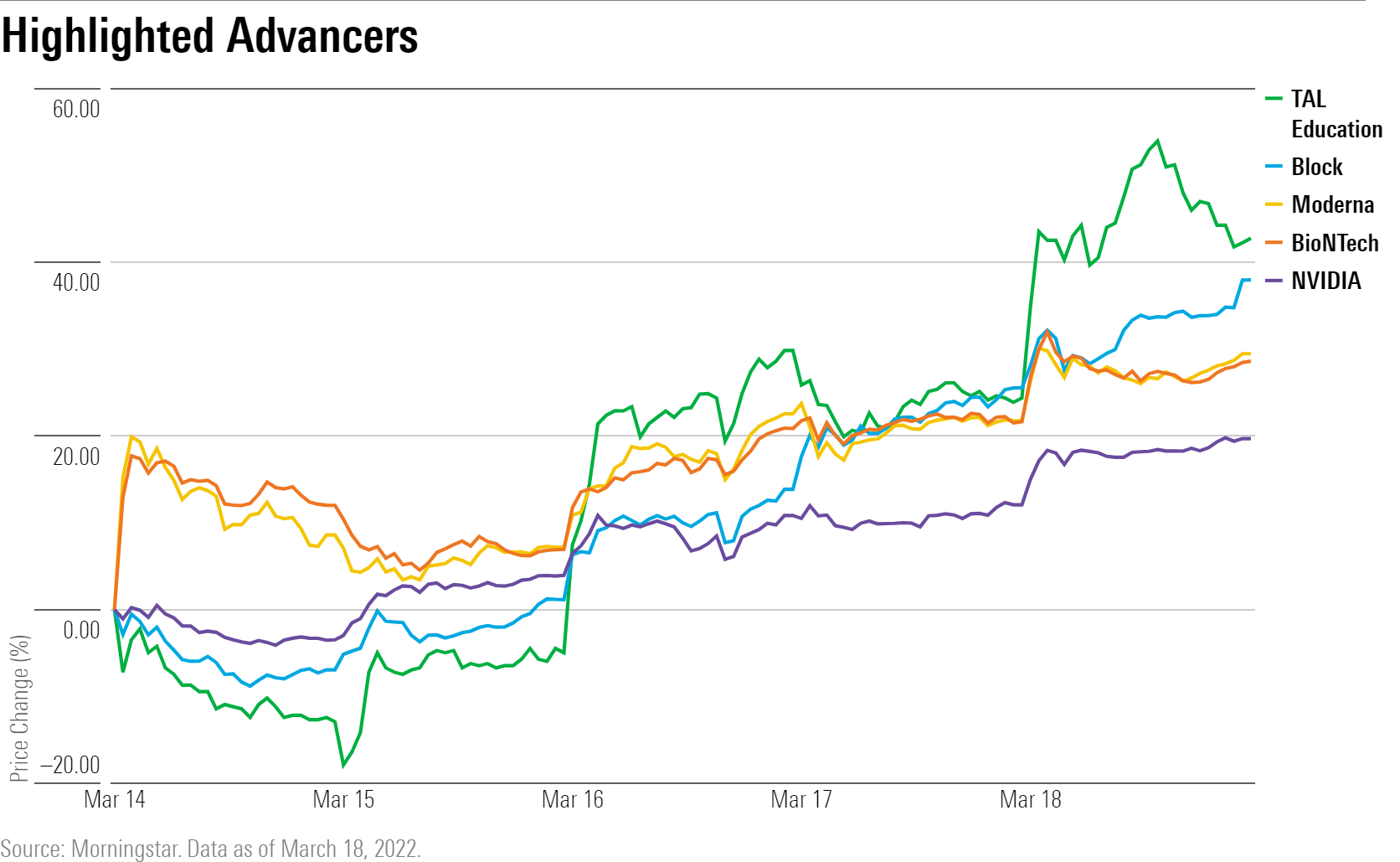

The best performers in the past week were TAL Education Group TAL, Block SQ, VNET Group VNET, JD.com JD, and GDS Holdings GDS.

Chinese ADR-listed companies gained, recouping losses from the earlier sell off. The move came after China announced they would work to keep their stock market stable and support listing shares overseas.

Stocks in the technology and consumer cyclical sectors were also higher. DocuSign DOCU, Nvidia NVDA, Roku ROKU, and Zoom ZM all rallied.

Stocks in the travel industry gained as declining oil prices eased concerns about cost pressures for carriers. United Airlines UAL, American Airlines AAL, and Delta Air Lines DAL soared. Retailers such as Farfetch FTCH, Kohl’s KSS, Macy’s M also rose higher.

Other notable movers were BioNTech BNTX and Moderna MRNA, both of which closed up after the companies filed for approval of a second coronavirus booster shot.

What Stocks Are Down?

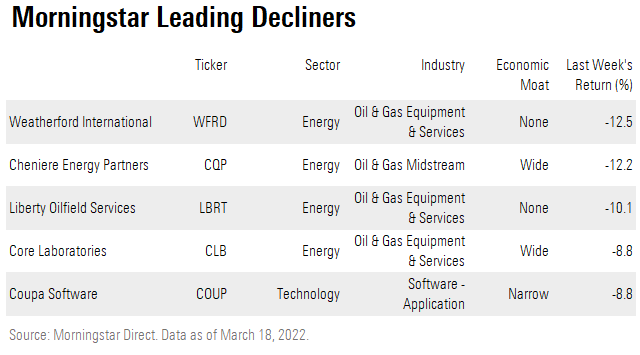

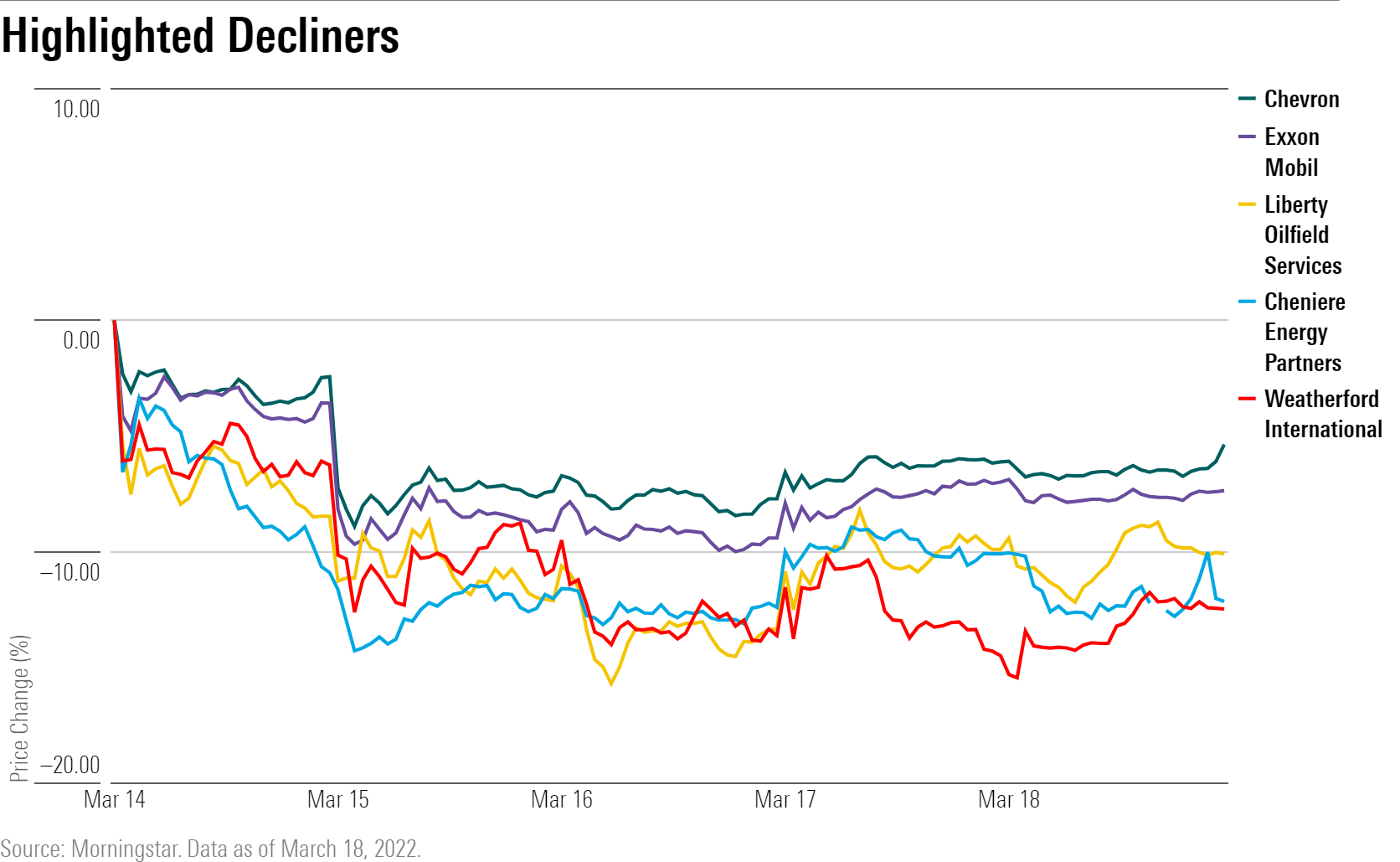

The worst performers in the past week were Weatherford WFRD, Cheniere Energy Partners CQP, Liberty Oilfield Services LBRT, Coupa Software COUP, and Core Laboratories CLB.

Oil stocks faced the largest losses in the past few days with various parts of the industry simultaneously falling. Oil prices fell as low as $94, and large oil companies such as Exxon Mobil XOM and Chevron CVX fell.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/237L6UCCT5DIJOTXSUHF5NKFYM.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/R7HDJUUCAVCXZH56GSOH6M55CU.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)