Which Bond Types Provide the Most Diversification for Stock Investors?

Stock and bond correlations have risen recently amid interest-rate changes and inflation.

For the past few decades, bonds have reliably diversified investors’ equity exposure. But will they continue to do so, especially in a rising-interest-rate environment that affects both bond and stock prices?

Exploring trends in stock/bond correlations was a key topic in our recently published Diversification Landscape Report. We assessed how effectively taxable and municipal bonds have served as ballast for investors' equity exposure, both in the very short term as well as over the long haul.

High-quality bonds, especially Treasuries, have frequently exhibited negative correlations with stocks. But as inflation and rising interest rates have roiled both the stock and bond markets in recent months, high-quality bonds didn’t diversify equity exposure as consistently as in the past. We also observed that many fixed-income types that investors use to populate their bond portfolios--especially intermediate-term core plus and municipal bond funds--tend to be less effective as diversifiers than Treasury bonds or cash.

Correlations Over the Short Term

Despite the global coronavirus pandemic, stock performance was exceptionally strong over the three-year period ended in December 2021. And while bond returns were relatively low in absolute terms, bond prices got a boost from Federal Reserve easing over the period.

As inflation and the prospect of rising interest rates rattled the stock and bond markets in the second half of 2021, though, high-quality bonds didn’t diversify equity exposure as consistently as in the past. (Emory Zink explored stock/bond correlations in rising-rate environments, both in the short term and historically.) Over the six-month period ended Dec. 31, 2021, only cash and short-term Treasuries managed to exhibit a decent negative correlation with equities. (Short-term bond funds’ correlation with stocks was negative over that stretch, too, but just barely.) Longer- and intermediate-term government bonds were less effective as diversifiers over that period. Over the whole of 2021, cash and most short-term Treasuries had modest negative correlations with stocks; other bond categories were positively correlated.

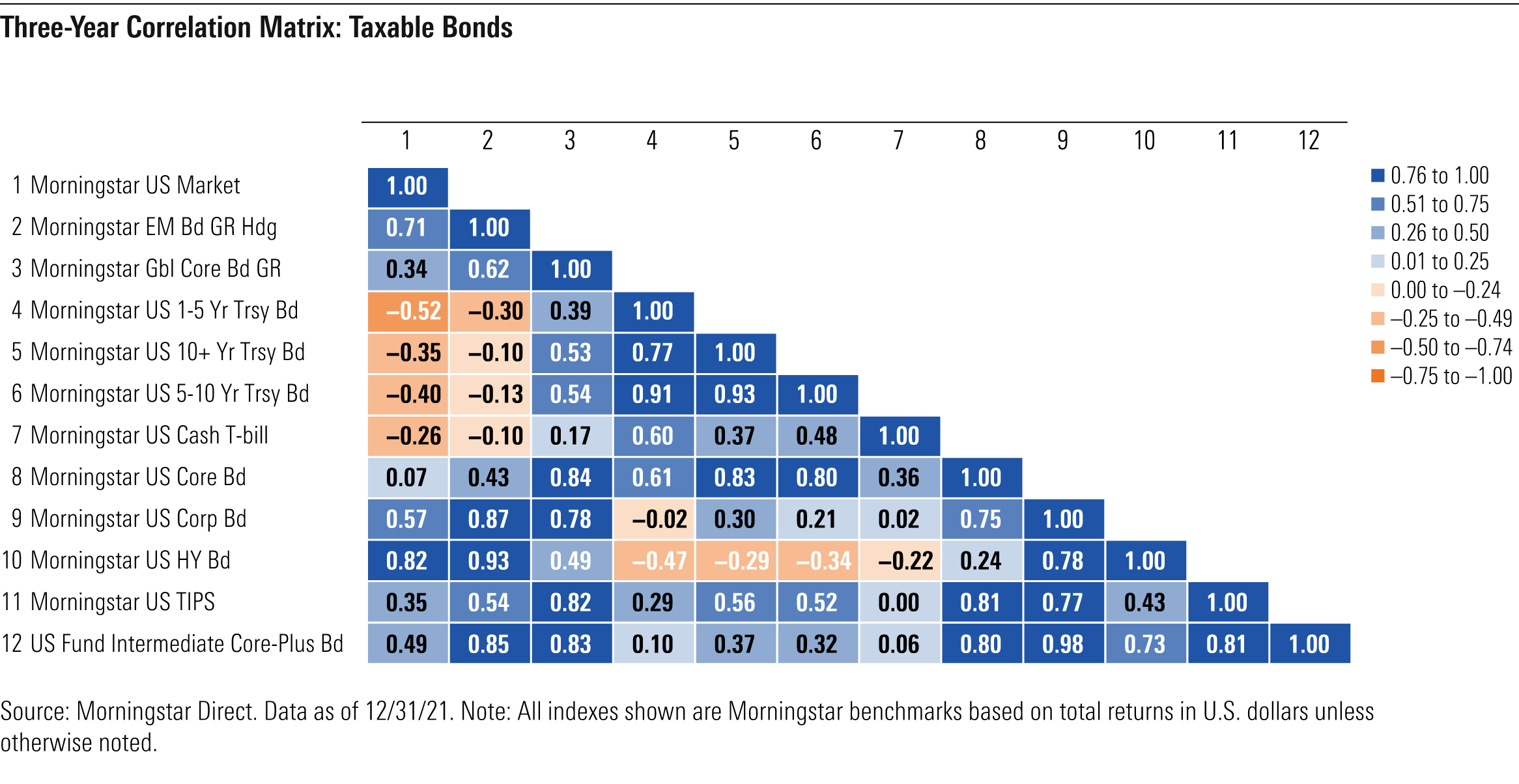

Over the three-year period from 2019 through 2021, Treasury bonds were the best diversifiers for equities, exhibiting a solidly negative correlation with the Morningstar US Market Index. Short-term Treasuries had the lowest correlation, but intermediate- and long-term Treasuries were decent as well. Cash also exhibited a negative correlation with stocks, but not as low as Treasuries did.

Meanwhile, a broad range of fixed-income types were less effective as diversifiers over the three-year period. The Morningstar US Core Bond Index and funds in the intermediate-term core bond category, another popular area, exhibited a modest positive correlation with stocks. Funds in the intermediate-term core-plus and short-term bond categories, which also house a lot of investors’ fixed-income assets, demonstrated a much higher correlation with equities. High-yield bond funds, which often move in sympathy with stocks, had the highest correlation with equities of any of the fixed-income indexes or categories we examined.

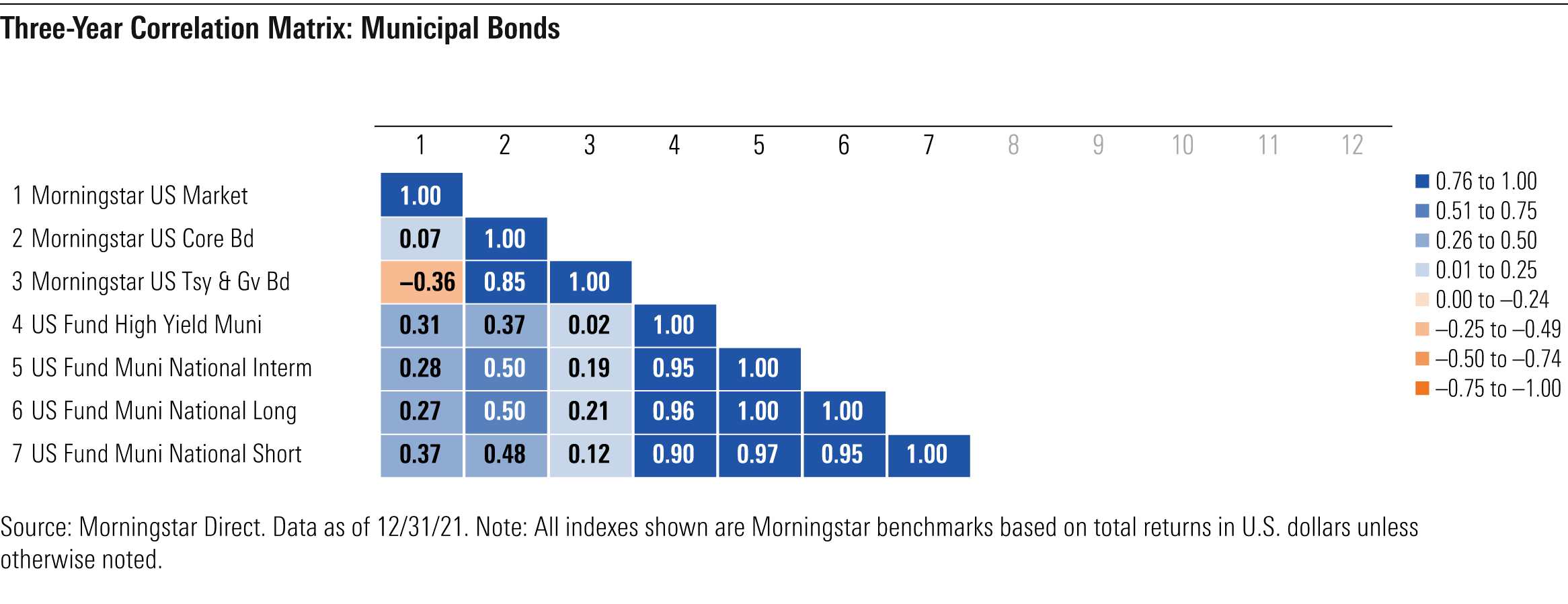

As with taxable bonds, municipal bonds have benefited from Fed easing during the pandemic period and over the past three years. Lower-quality and longer-duration munis generally notched better returns than their short-term, higher-quality counterparts. Over the three-year period through 2021, short-, intermediate-, and long-term munis showed similar correlation levels versus stocks, with correlations roughly in line with those of intermediate core bond funds. Treasury bonds and cash (including municipal money market funds) looked better from a diversification standpoint than munis during the period.

Longer-Term Trends

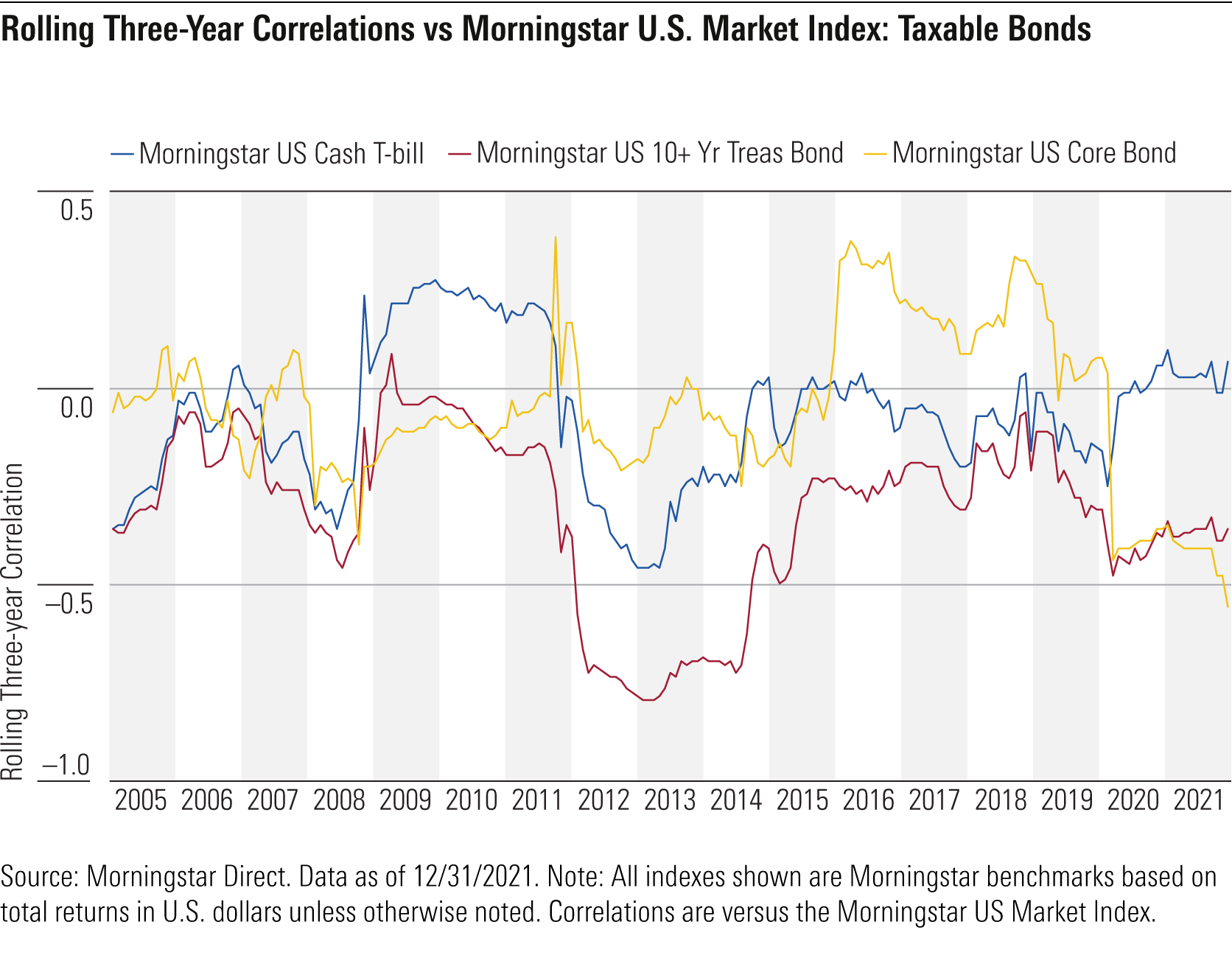

Over the past two decades, Treasury bonds have provided the best diversification of any bond type--and indeed of any asset class--for investors with equity exposure in their portfolios. The correlation benefit was similar for Treasuries across the duration spectrum. Cash has been the next most attractive diversifier for stocks. The Morningstar US Core Bond Index, which is dominated by high-quality U.S. bonds, has also delivered a negative correlation with the equity market.

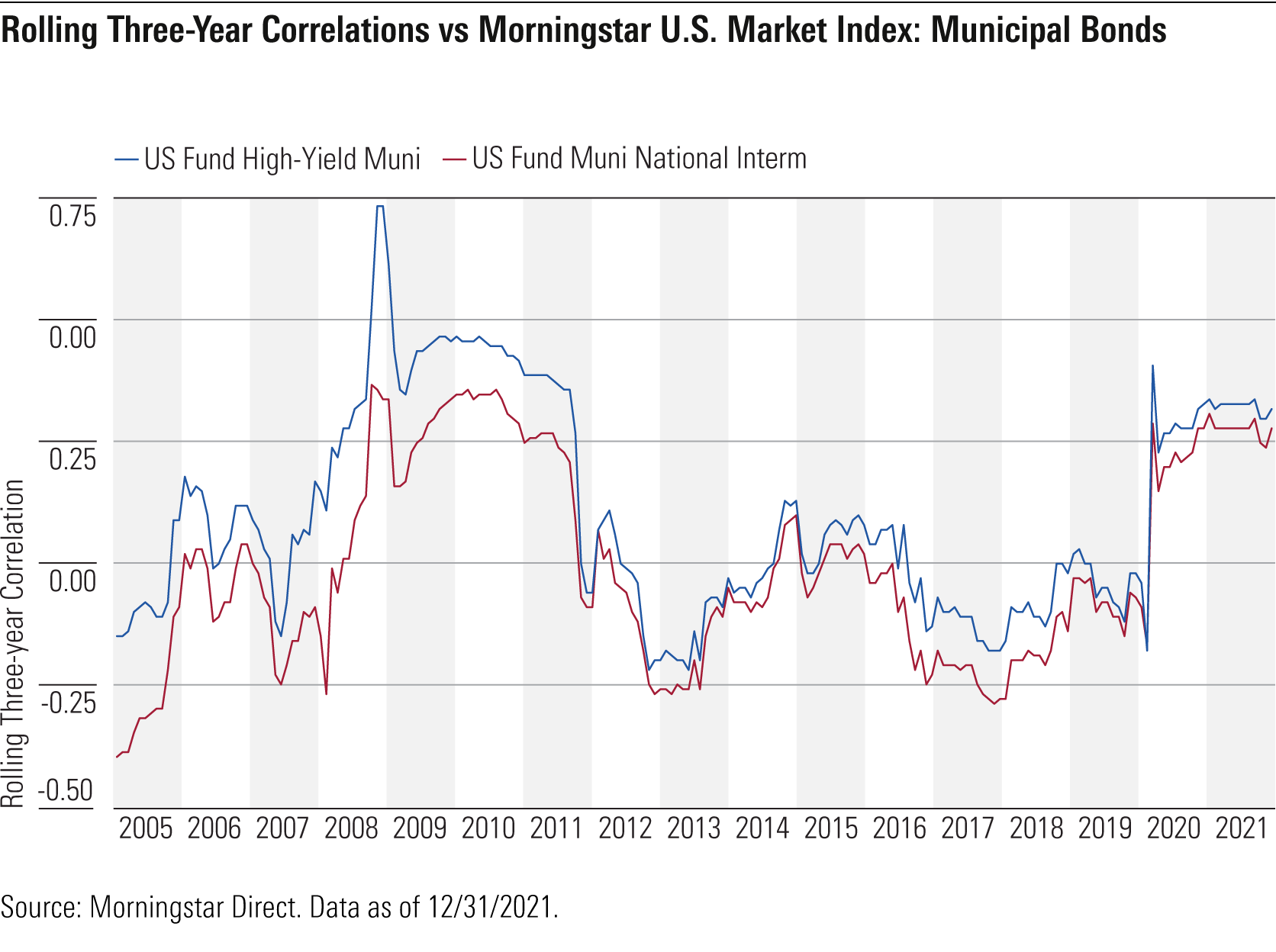

Municipal bonds’ correlation with equities has risen a bit over the past decade. The muni market is less liquid than that of Treasuries, and it has often seized up in periods of economic and equity market stress. Across all longer-term time frames, high-yield muni funds were the least-effective diversifiers for equities of any muni fund group. That is similar to the trend for high-yield taxable bonds; they are much less defensive and more sensitive to economic stress than high-quality bonds.

Over the past 20 years, most muni bond indexes and fund categories have shown similar correlation trends--higher than those of Treasury bonds and the Morningstar US Core Bond Index. In periods of equity-market weakness driven by a weakening economy, such as 2008, municipal bonds have decoupled from Treasuries and other U.S. government bonds, likely on concerns that higher unemployment and weak business conditions would hurt tax receipts. Among the muni subgroups, the short-term muni group was the only one with a consistently negative correlation with equities over the past two decades.

Portfolio Implications

While high-quality bond types display varying degrees of effectiveness as diversifiers and some have experienced small losses when stocks have fallen, it’s worth keeping the big picture in mind. Specifically, during extended periods of equity-market weakness, high-quality bonds will usually hold up much better than stocks, posting smaller losses or even gains. That’s true of both taxable and municipal bonds.

The good news for investors is that they don’t need to venture into volatile long-term Treasuries to obtain diversification: Short- and intermediate-term government bonds have been as effective as long, and cash has recently been almost as effective a diversifier as Treasuries. That’s an important finding because long-term Treasuries are substantially more volatile than short- and intermediate-term bonds, while their yield advantage is fairly modest.

It is also notable that cash has recently looked a bit better than Treasuries from the standpoint of diversification. That may owe to the fact that as yields have declined across the board for several decades, high-quality bond yields have edged toward zero, so bond prices simply don’t have a lot of room to move up. It may also be that, with yields on cash and Treasuries so tightly aligned, investors do not view bonds as worth their risks in a flight to quality.

Even as Treasuries and cash have provided a consistent diversification benefit, it’s striking that many of the core fixed-income fund types that investors use to populate their portfolios have substantially higher correlations with stocks--for example, short-term bond funds and those in the intermediate-term core and core-plus categories. Those correlations have generally been trending up over the past several decades, likely an outgrowth of declining yields and the need for funds to venture into corporates and away from Treasuries to plump up their payouts and offset their expenses.

Of course, moving in sympathy with stocks doesn’t mean similar performance. Even in terrible periods for stocks, such as 2008 and the first quarter of 2020, most short-term, intermediate core, and intermediate core-plus funds have exhibited small losses or even gained value. Not surprisingly, all manner of lower-quality bond types are exceptionally poor diversifiers for stocks. That demonstrates that they are best used as supplemental holdings alongside high-quality fixed-income investments or, perhaps better yet, as equity alternatives.

And while demand for TIPS has recently surged with inflation, inflation-protected bonds have exhibited much weaker diversifying abilities than have nominal Treasuries over the past few decades. That pattern makes intuitive sense, too, in that demand for TIPS’ inflation protection is likely to stall out when worries about the economy are running high and equities are dropping. TIPS are also much less liquid than nominal Treasuries. In short, while TIPS play a role for inflation protection, investors have not been able to rely on them to diversify their equity exposure. On the other hand, inflation has kept a low profile for the past decade. If stocks were to experience weakness related to inflation, TIPS may confer a greater diversification benefit.

Over longer periods, municipal bonds have exhibited a higher correlation with equities than high-quality taxable bond indexes, especially Treasury bonds. That suggests that even investors who put a high value on the tax-saving features of muni bonds should consider augmenting them with U.S. government bonds for diversification and ballast during equity market shocks. It also underscores the importance of not using a muni fund as a source of liquid reserves; any bout of illiquidity in the muni market would be an inopportune time to sell. (Investors in high tax brackets can use municipal money market funds in that role.) High-yield munis' higher correlation with equities, meanwhile, indicates that such bonds are best used alongside higher-quality bonds. Could Your Portfolio Use a Makeover? Submit your information for a chance to have Christine Benz review your portfolio and provide improvement suggestions based on your needs.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)