8 Stocks That Are High in Quality, Cheap in Price

As the market stays in correction territory, high-quality undervalued stocks including Biogen and Salesforce look poised to gain.

Broad-based stock market losses in 2022 have opened opportunities for investors to scoop up stocks of high-quality companies at discount prices.

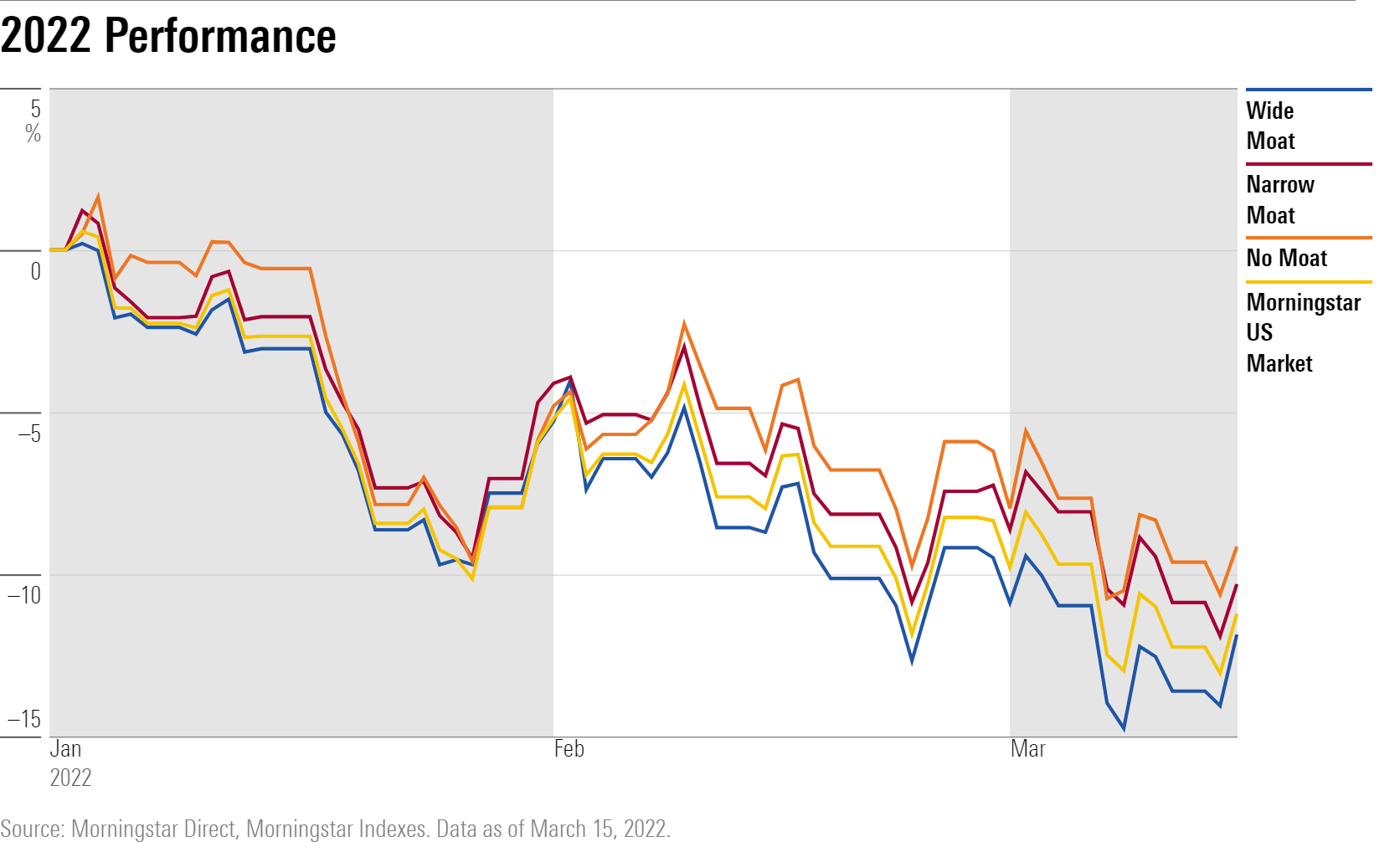

Stocks that earn Morningstar's wide moat designation--companies with strong competitive advantages that should help them outperform their peers over the next 20-plus years--have fared worse this year than the overall market.

As a group, wide moat companies have lost 14.1% for the year, nearly 1% more than the Morningstar U.S. Market index losses of 13.3%. The underperforming wide-moat stocks group includes Biogen BIIB, down 19% so far this year, and cloud-based CMS provider Salesforce CRM, where shares are down 24%. Both are now trading in undervalued territory and are considered five-star stocks by Morningstar analysts.

Historically, it's unusual for wide moat companies to underperform the broader market. For seven of the past 10 calendar years, the Morningstar Wide Moat Index and the Morningstar Narrow Moat Index both outperformed the companies without economic moats of any kind in the U.S. market overall.

It’s especially notable that wide moat stocks are lagging in the current economic environment of high inflation and rising interest rates, where companies with the strongest competitive advantages ought to be able to shine.

But many wide moat stocks were also particularly overvalued coming into 2022, and expensive names have been at the epicenter of the market's declines so far this year.

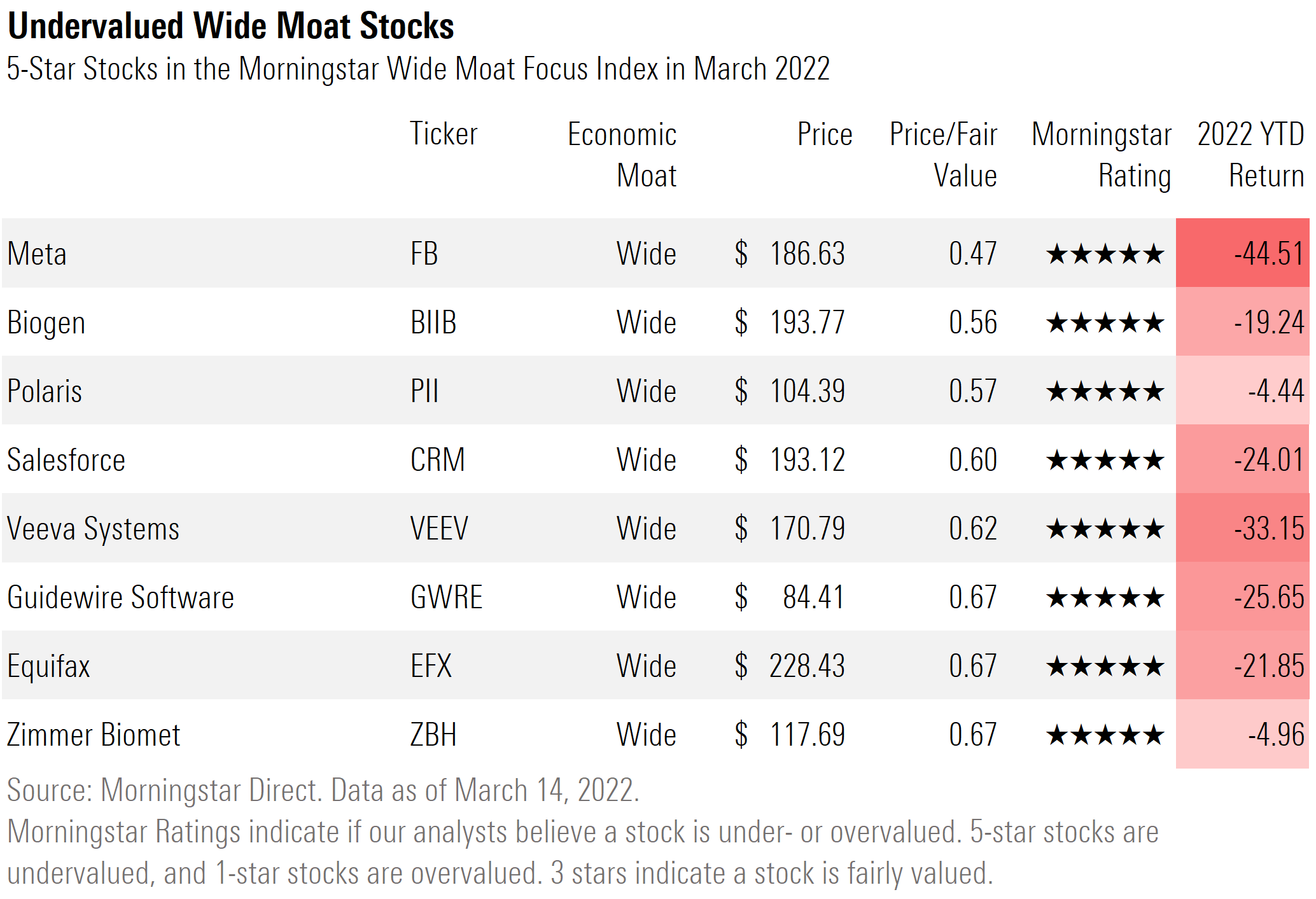

Now, however, many wide moat stocks have fallen far enough in price that they’re undervalued when compared against the fair value estimates set by Morningstar analysts.

We screened the Morningstar Wide Moat Focus Index to find wide moat companies with Morningstar’s 5-star rating that are currently trading at discount prices. Here are the eight most undervalued names in the index:

Meta FB

“Meta’s large and growing user base and the rich data that it generates help advertisers post more effective ads, in terms of brand awareness, resulting in high return on investment. With higher ROI, more advertisers jump on board, allowing Meta to further monetize the network.

“Antitrust enforcement and further regulations pose a threat to Meta's intangible assets, data. However, increased restrictions on data access and usage would apply to all firms, not just Meta. The firm’s large audiences and the continuous consumer engagement are likely to continue to drive demand for Meta ad inventories, although possibly at lower prices.”

--Ali Mogharabi, senior analyst

Biogen BIIB

“Biogen has achieved strong profitability based on its Roche collaboration in oncology and Biogen's diversified MS franchise, and has the intangible assets to support a wide moat. We think the firm does face environmental, social, and governance risks, particularly related to potential U.S. drug price-related policy reform (Biogen sees roughly 60% of its sales from the U.S. market) and ongoing potential for product governance issues (including litigation). While we have factored these threats into our analysis, we don't see them as material to our valuation or moat rating.

“We think barriers to entry are high for potential biosimilars to Biogen's products, and Biogen has a strong R&D strategy for maintaining its leadership in MS and neurodegenerative diseases, where pricing power is strong, patient need for novel therapies is high, and Biogen has been building a solid pipeline. Returns on invested capital, historically north of 20%, are likely to bottom out over the next couple of years due to generic pressure on Tecfidera sales and biosimilar pressure on Rituxan. However, we expect ROICs to continue to exceed our 7.2% cost of capital estimate and to rebound into the mid-teens in the long run.”

--Karen Andersen, strategist

Polaris PII

“We believe Polaris has established a wide economic moat, delivering healthy adjusted returns on invested capital (averaging 21%, including goodwill, during the past five years). We believe innovative product offerings and growth of adjacent categories through acquisitions (and organically) have positioned the business to continue to capture increasing volume and profits as it reaches new end users. However, nonexistent switching costs could weigh on pricing power intermittently. Our concern in previous periods has been that hiccups in the quality of innovation along with an increasingly competitive environment could have put the company's wide moat at risk. We perpetually consider the company's ability to protect (and gain) market share and maintain brand goodwill in the key ORV and snowmobile segments to determine whether or not the brand equity remains at risk from prior recalls and the competitive landscape. In our opinion, Polaris has taken the right steps to protect its wide moat rating, with disciplined quality assurance protocols and well-developed manufacturing processes to prevent pervasive product recalls.”

--Jaime M. Katz, senior analyst

Salesforce.com CRM

“For Salesforce.com overall, we assign a wide moat rating arising primarily from switching costs, with support from a network effect as well.

“Salesforce.com remains the clear leader in salesforce automation (Sales Cloud). The company has gone from no product to 33% market share over the last 20 years. Customers and industry observers alike view Salesforce.com as the clear front-runner in a category that increases the productivity of sales representatives. In other words, this is mission-critical software that helps drive revenue for users. We believe this segment enjoys a wide moat--indeed the widest moat as a stand-alone product among Salesforce.com’s four cloud solutions. A variety of industry data points clearly indicate the Sales Cloud SFA solution is a best-of-breed solution, which by itself creates a certain amount of organizational inertia, as IT managers and executives engage in self-serving behavior. That is, they can jeopardize their own careers by pushing to switch from a leading solution that is functioning well and meeting their corporate needs. We believe customers are also reluctant to switch away from Sales Cloud because of the time, expense, and risk of implementing new applications and migrating data and the time, expense, and lost productivity of retraining the workforce on a new platform. SFA is a revenue-driving initiative and therefore is critical to users. The organizational risk of making a change is high, in our view.”

--Dan Romanoff, senior analyst

Veeva Systems VEEV

“We assign a wide moat rating to Veeva, stemming from switching costs and to a lesser extent intangible assets. The company provides mission-critical software for the life sciences industry. The high degree of specification behind Veeva’s software is an asset to its clients (in improving workflow and ease of adherence to regulations) and Veeva itself (clients have their complex workflow entrenched in its software). Once integrated into a company’s operating activities, the direct time and expense of switching to a competing software solution is high and comes with substantial operating risks. The downside operational risk of switching is expansive and could result in loss of data in the migration process, temporary disruption to sales activities, or even ultimately delay product launches and put the company at risk of exposure to unnecessary regulatory risk.”

--Dylan Finley, analyst

Guidewire Software GWRE

“Our wide moat rating for Guidewire Software is driven by higher customer switching costs and, to a lesser extent, intangible assets. Our position is that switching costs for software are driven by several factors. The most obvious would be the direct time and expense of implementing a new software platform. Additionally, there are indirect costs along those same lines, mainly lost productivity as employees move up a learning curve on the new system and the distraction of employees involved with the function where the change is occurring. Perhaps most important, there is operational risk, including loss of data during the changeover, project execution, and potential business disruption. The more critical the function and the more touch points across an organization a software vendor has, the higher the switching costs will be.”

--Dan Romanoff, senior analyst

Equifax EFX

“Overall, we believe Equifax merits a wide moat rating based on intangible assets.

“Equifax’s data is critical to its customers’ (often banks) underwriting decisions, and the price of its services is negligible relative to the loan amounts at risk. We estimate that North American credit bureaus’ revenue represents about 1-2 basis points of total household debt. Because the accuracy and completeness of data is critical to credit decision-making, lenders often pull from more than one credit bureau, and we do not believe pricing is the primary factor for choosing a credit bureau. We believe the barriers to entering the credit bureau business are high, as replicating a database of millions of customers would be incredibly difficult. Because the credit bureaus’ data is based on the voluntary reporting of thousands of financial institutions, it’s unlikely that a startup, particularly with heightened data security concerns, could convince banks to share consumer information.”

--Rajiv Bhatia, analyst

Zimmer Biomet ZBH

“Zimmer's wide economic moat stems from two major sources: switching costs and intangible assets.

“First, there are substantial switching costs for orthopedic surgeons. The extensive instrumentation, or tool sets, used to prepare bones and install implants are specific to each company. The learning curve to become proficient in using one company's instrumentation is significant. Additionally, relative to other specialists, orthopedic surgeon skill and experience play an outsize role in the clinical outcome for the patient. These issues all leave surgeons reluctant to train and master multiple instrumentation systems, especially if procedure volume is too low to maintain high surgical facility with more than one system. Research has found surgeons stick with their preferred vendor and sales rep for 5-15 years and use that vendor for approximately 95% of their orthopedic procedures during that time.

“Zimmer's moat also involves intangible assets, including intellectual property that protects the product portfolio, which is characterized by evolutionary changes to technology, because new generations of products rely on intellectual property established by earlier iterations of those devices. Following changes to patent law introduced in 2012, the U.S. has switched to a first-inventor-to-file system, which had previously been a first-to-invent system. We think this change favors the moats of the larger orthopedic players like Zimmer. The new system encourages inventors to file an application as soon as possible. Inventors will also need to provide more detailed applications in order to head off competitors that may block improvement patents in future generations of products. The new law also mandates an opposition review after the patent has been granted. This will result in more challenges to patents. We think firms like Zimmer, which can support an extensive legal team, will be in a better position to take advantage of the new law by filing comprehensive patent applications on an accelerated timeline and mounting complex and time-consuming challenges to patents granted to competitors.”

--Debbie S. Wang, senior analyst

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)