What’s Really Inside Equity ESG Portfolios?

Any stock you can think of is on the menu.

You can find virtually any developed-markets stock in a fund that claims to invest according to environmental, social, and governance mandates. Outside of just a handful of small industries, there are few businesses that ESG managers seem to agree to not own. For investors, this means their money can flow into almost any stock imaginable, so investors with specific ESG preferences need to dig into the portfolios of ESG-labeled funds, as they likely contain stocks they wouldn’t expect.

This fact by itself is not a condemnation of ESG investing, but it instead reflects the reality that ESG is far from a settled discipline. Ratings providers frequently disagree on the level of ESG risk for a particular stock, while ESG investors disagree on the best way to use investing to spur societal change. Some believe in divesting from companies that score poorly, while others believe in actively owning the worst stocks to improve them from within.

This range of approaches opens the door for almost any stock to get into an ESG portfolio.

What Isn't an ESG Stock?

U.S.-based investors looking for sustainable funds still have limited options. Most intentional ESG offerings are in the blend Morningstar Categories, with large-blend and foreign large-blend the two most popular.

We aggregated the holdings of all the ESG and non-ESG portfolios in those two peer groups to see to what extent the two broad approaches differed.

As shown in Exhibit 1, almost every stock in the Russell 1000 Index, the most common large-blend fund benchmark, is held by at least one large-blend fund marketed as an intentional ESG offering. Only 21 of the index's 1,013 companies as of February 2022 were not in at least one large-blend ESG strategy. That means 98% of the index's constituents, equaling 99.7% of the benchmark's market capitalization, qualifies as ESG according to at least one asset manager.

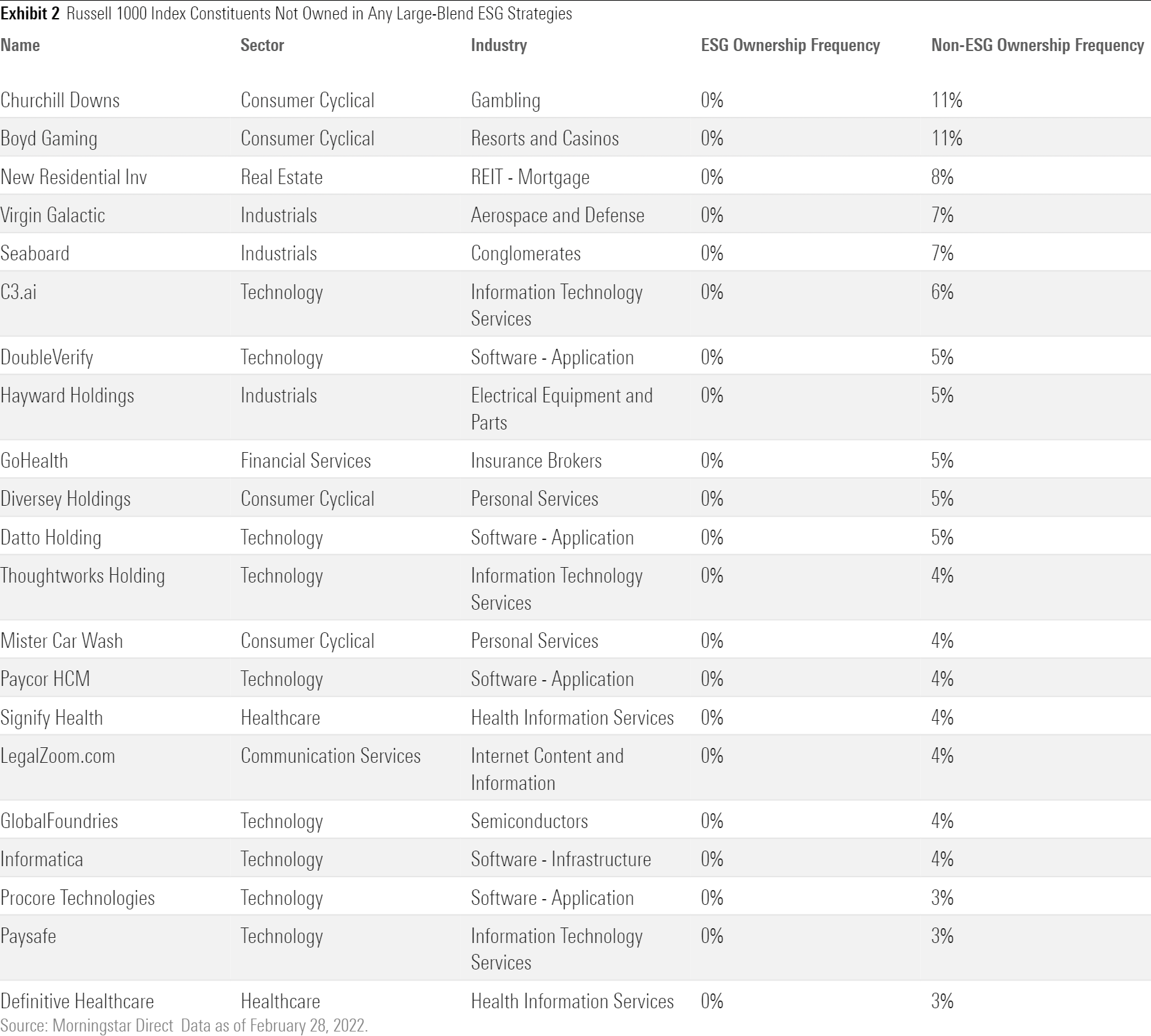

Most of those 21 companies (listed in Exhibit 2) are among the smallest 25 stocks in the index; the largest completely shunned stock, Churchill Downs CHDN, is the benchmark's 616th-largest stock.

There are only 97 ESG-intentional strategies in the large-blend category, so the broad ownership is not because of the sheer number of funds trying to fill their portfolios. It also is not the result of sprawling, passive ESG strategies; more than 92% of the Russell 1000 Index's stocks show up in at least one active ESG fund. Furthermore, the median number of holdings in the ESG portfolios is considerably lower than the median of their non-ESG active peers, which makes the breadth of ownership more surprising.

Granted, the active ESG set includes DFA U.S. Sustainability Core 1 DFSIX, which holds more than 2,000 stocks; it is effectively a passive strategy with some factor tilts and ESG exclusions. Even if that fund is reclassified as passive, 84% of the Russell 1000 Index's stocks, or 96.6% of the index's market cap, still appear in at least one active ESG strategy.

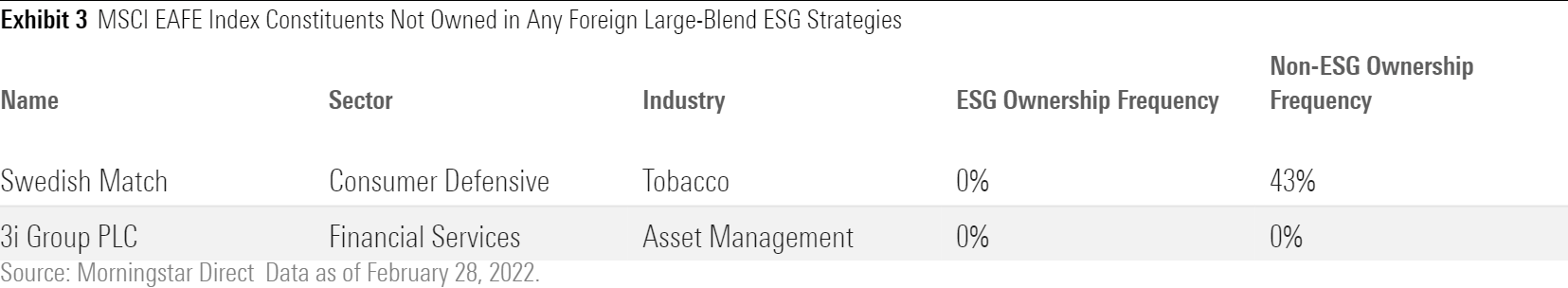

This is not a U.S.-only phenomenon. At least one intentional ESG foreign large-blend fund owns all but two of the MSCI EAFE Index's 807 constituents (see Exhibit 3). That means at least one sustainable fund considers a staggering 99.8% of the companies in the popular foreign large-blend fund benchmark to meet some ESG criteria. Again, this isn't the result of a massive sample set or broad passive strategies. There are only 34 ESG strategies in the foreign large-blend category, and 96% of the stocks in the MSCI EAFE Index appear in at least one of the 19 active ones. Similar to the large-blend category, the foreign large-blend group includes a sprawling DFA fund. The 4,000 stock DFA International Sustainability Core 1 DFSPX is technically an active fund. Even if it is reclassified it as a passive strategy, though, 89% of the MSCI EAFE Index's stocks, or 94% of its market cap, still reside in at least one active ESG foreign large-blend strategy.

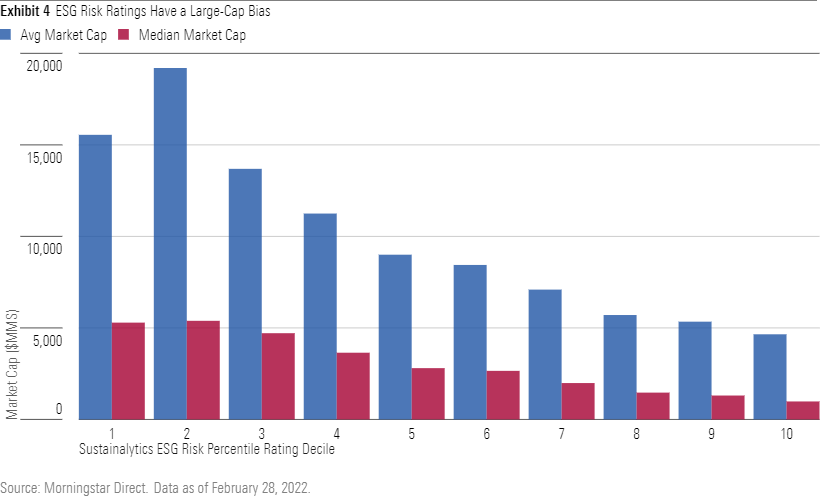

This willingness of ESG managers to hold almost any stock is not a necessarily an indictment of ESG investing. Investing is a forward-looking, opinion-based business; there should be disagreements. However, one likely contributing factor to the wide ownership is that current ESG rating systems tend to favor larger companies over smaller ones. Exhibit 4 breaks out the Sustainalytics ESG Risk Ratings by decile for all U.S.-based companies. The risk rating percentile is based on Sustainalytics' (a Morningstar company) percentile rating across its entire coverage universe. There is a clear connection between market cap and ESG rating: The larger the company, the better the ESG ratings (lower deciles are better). For ESG managers that run exclusionary screens based on ESG ratings, this market cap bias in the ratings themselves could be pushing them toward the biggest names in the index.

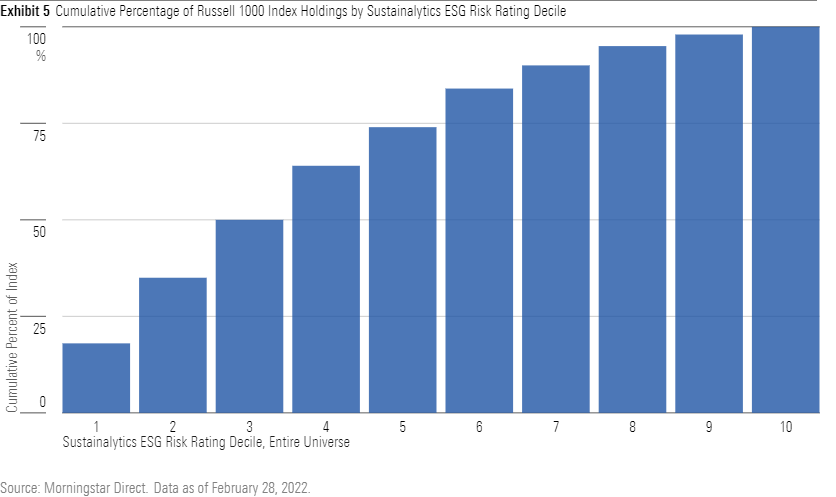

The data seems to support that thesis. Exhibit 5 shows the distribution of Sustainalytics ESG Risk Scores for the Russell 1000 Index. The y-axis represents the cumulative percentage of index holdings ranked in each decile or lower. More than 75% of the index’s constituents rank in the lower half of ESG risk scores for Sustainalytics’ total universe, while just 4% of the Russell 1000 Index ranks in the highest three deciles. This is not a problem unique to Sustainalytics; other ratings providers show similar patterns. Given this bias, large-cap ESG managers should have no problem finding companies they can justify holding based on a third-party rating. So maybe it is not so curious that almost every large-cap stock is owned by an ESG manager. It seems ESG managers are eating up every large-cap name in sight because ESG rating companies are putting most of them on the menu. Whether or not large-cap stocks deserve higher rankings than smaller ones is a different debate, but there is evidence that ESG ratings make a huge swath of the index eligible for ESG fund ownership.

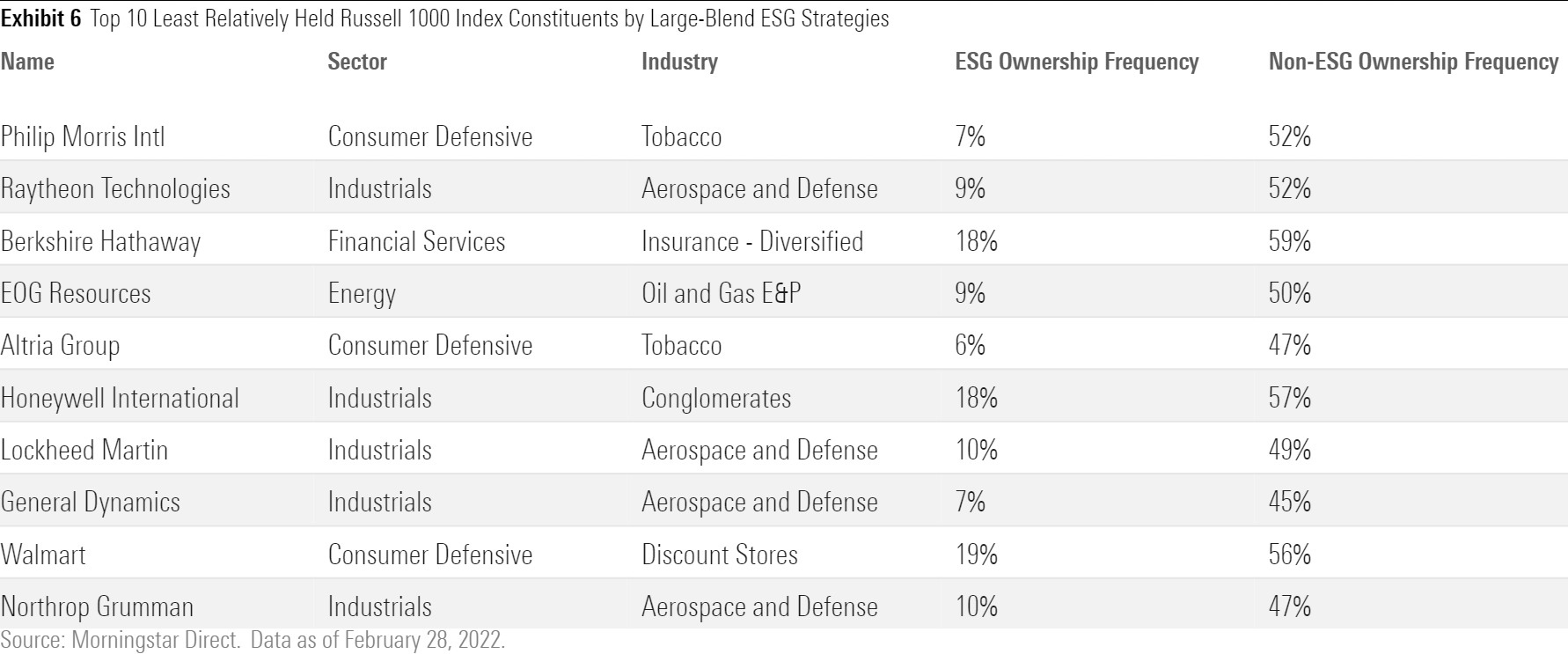

Where Are the Differences?

ESG investors do tend to own far less of some kinds of stocks. Very few of them own the classic "sin stocks," such as tobacco, alcohol, weapons, and gambling firms, among others, as shown in Exhibit 4. Among U.S.-focused strategies, tobacco companies, such as Philip Morris PM and Altria MO, don't appear in many ESG portfolios, while they show up in roughly half of non-ESG funds. ESG funds also mostly ignore weapons and defense contractors like Raytheon Technologies RTX, Lockheed Martin LMT, and General Dynamics GD, which are common among traditional managers. And the two Russell 1000 Index constituents most shunned by ESG funds are gambling-related: Churchill Downs and Boyd Gaming BYD.

Exhibit 7 shows the same trends in international funds. Tobacco companies account for four of the top 10 avoided stocks in ESG funds compared with their non-ESG peers. Fewer ESG portfolios own the MSCI EAFE's gambling-related stocks, and they also eschew the brewers, including Heineken HEINY, Carlsberg CABGY, and Anheuser-Busch InBev BUD. Sustainable funds have been excluding these types of businesses for decades, though, since ESG approaches were known as "Socially Responsible Investing" strategies. Besides the sin stocks, however, it does not appear that any new consensus has emerged about the ESG merits of other industries or companies.

What About Energy?

Energy is often cited as a key differentiator between ESG and non-ESG strategies, but energy is a small sliver of the market, and ESG funds' energy allocations can vary wildly. It is not unreasonable for ESG managers to be on both sides of the energy fence. An exclusionary manager can refuse to own oil and gas stocks, while a more active manager might buy energy shares in order to push those firms to adopt more-sustainable business models. Among large-blend ESG managers, there is a clear split. While 37 of the 97 intentional ESG strategies in the large-blend category carry zero energy exposure, 24 of them own more energy than their average non-ESG peer. This is almost exclusively oil and gas exposure, as Morningstar classifies most alternative energy stocks--including wind and solar--in sectors like industrials or technology.

The wide range of oil and gas ownership carries over to the international funds, too. The average energy allocation for intentional ESG foreign large-blend funds is 2.3%, almost half the average non-ESG peer's 4.2% stake. Again, even though 12 of the 34 ESG foreign large-blend funds avoid the sector completely, 10 (roughly a third) own more energy than the typical traditional peer.

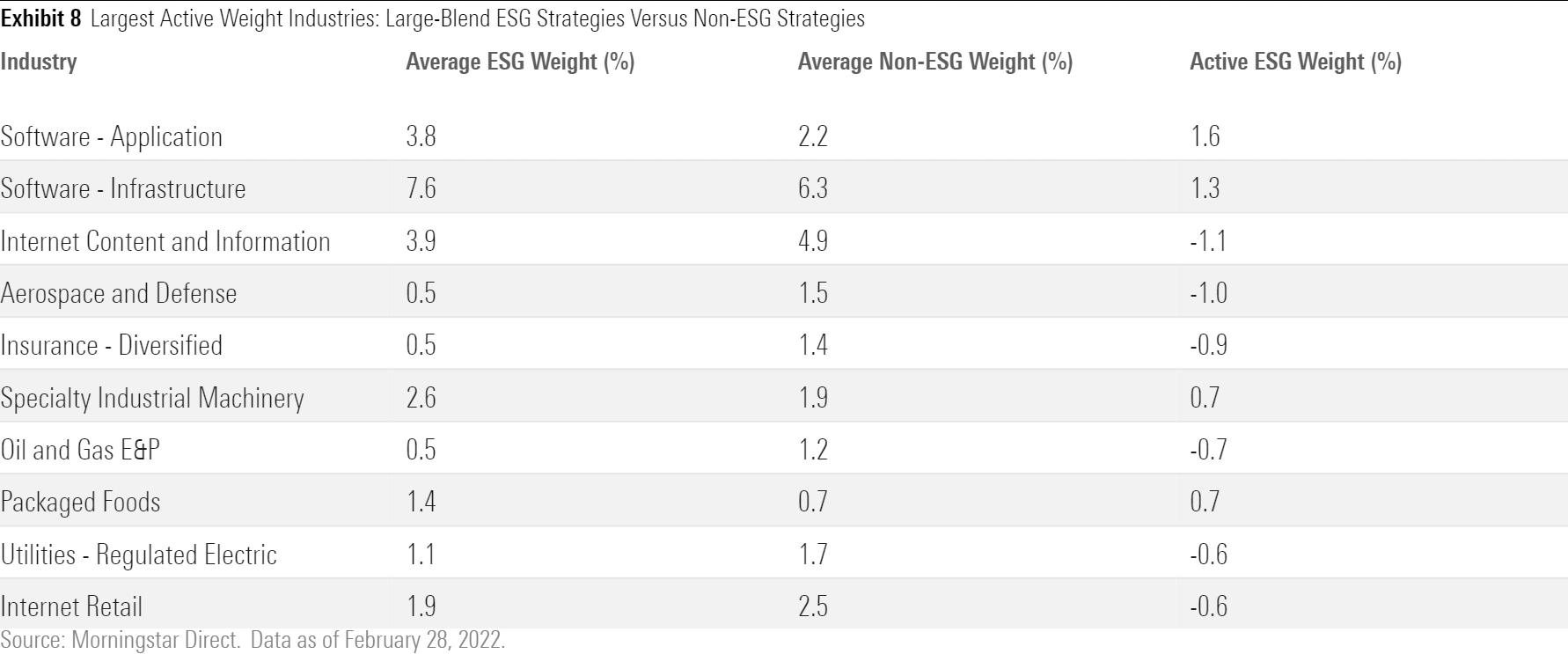

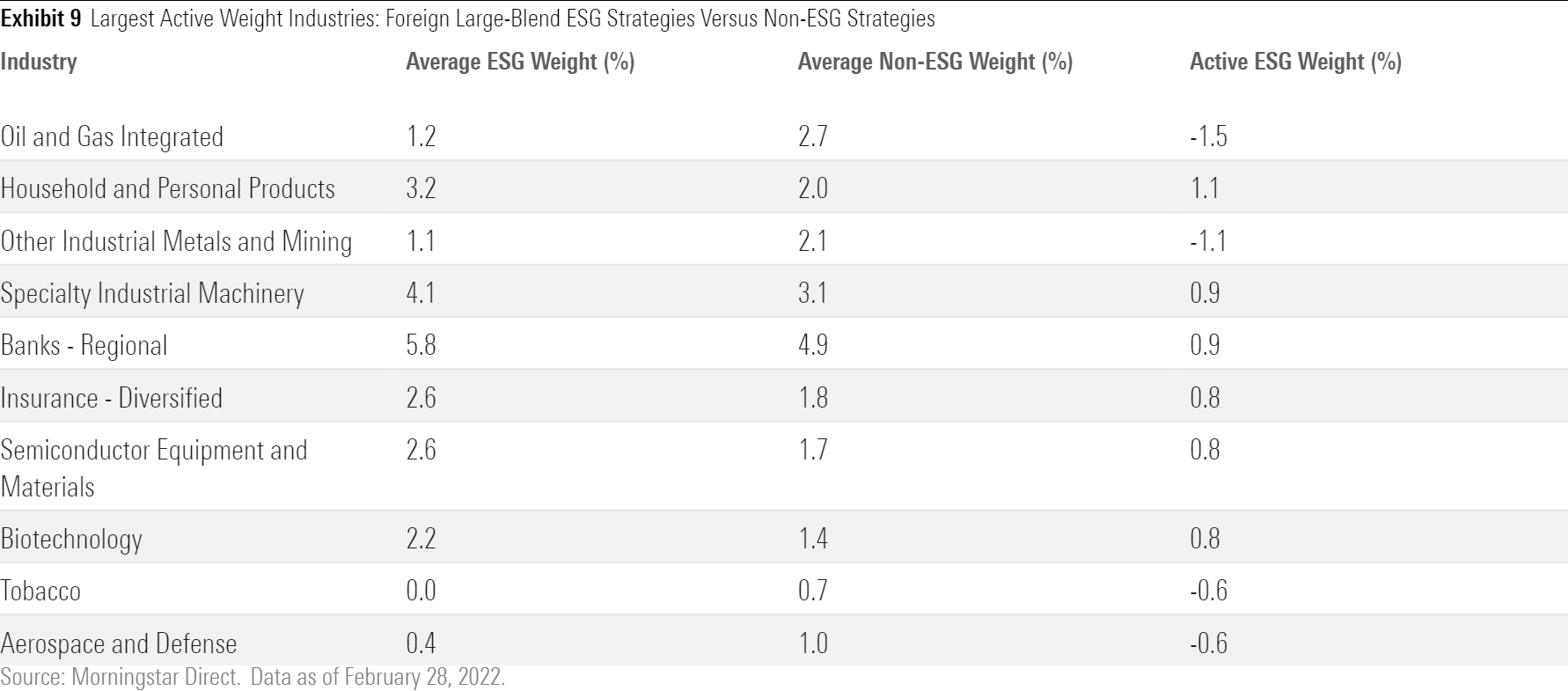

Outside of the sin stocks and energy, it is hard to identify clear opinions on single industries. Individual companies, rather than sentiments on wider industries, often drive allocations. For instance, U.S. managers tend to dodge Berkshire Hathaway BRK.A--possibly because Warren Buffett's lukewarm view of ESG--which creates an apparent underweighting in diversified insurers (Exhibit 8). Non-U.S. ESG funds, as shown in Exhibit 9, are overweight in that industry relative to non-ESG peers, since Berkshire is not in their index.

Great, Now What?

This shows it still pays to know what you own. Do not assume an ESG-labeled portfolio will reflect your conception of ESG. Ambiguity is not a new investment management dilemma. Plenty of funds, for instance, market themselves as "quality"-oriented strategies, yet there is no single definition of a quality business. Yet if any and every stock can be construed or rated as ESG-friendly, what do ESG portfolios offer that investors could not get from a passive broad-market index fund?

One could argue that widespread ESG fund stock ownership is a good thing because it could put more pressure on more company management teams to prioritize sustainability. In that case, then, the real key seems to be finding ESG managers that are differentiated stock-pickers and skilled at convincing management teams to adopt more sustainable policies. In practice, a "buy-and-hope" ESG strategy in which a manager buys a stock passively hoping for its ESG profile to improve is no different than a non-ESG-intentional strategy.

There is no shortage of opinions in the burgeoning ESG field. It means very different things to different investors and managers. It remains to be seen whether any consensus views, apart from the historically avoided sin stocks, will emerge on the ESG merits of individual companies or industries. Ultimately, asset managers will struggle to sell nondifferentiated strategies, which gives them incentives to develop their own approaches to ESG. Investors should continue to expect wide variance in terms of portfolio holdings among ESG funds and would be well-served to do their homework on strategies before investing.

Investors looking to filter through the noise can use Morningstar’s ESG Commitment Level Rating as a starting point. The rating, applied at the firm and fund level, is a qualitative assessment of how much ESG truly plays a role in an investment strategy. This data point can help investors find strategies that are ESG in more than just name. It is not a lenient system, and only those funds which our ESG team feels are truly advanced in their approach to ESG investing earn scores above a “Basic” level. A sampling of those funds can be found here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b0c51583-b9a2-49eb-9a8f-5f25a8bda4a3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b0c51583-b9a2-49eb-9a8f-5f25a8bda4a3.jpg)