Vanguard Dividend Growth: A Great Stock Fund for Uncertain Times

Down markets often bring out this fund's strengths.

When stock market uncertainty abounds, Vanguard Dividend Growth’s VDIGX steady profile breeds confidence.

This fund has held a Morningstar Analyst Rating of Gold for more than a decade not only because it has repeatedly proved itself in turbulent times, as in 2022 thus far, but also because it is well positioned for the future. As we did a year ago, here we dig deep into its management team, process, and portfolio. One difference between then and now, though, is the fund is no longer in a slump and its strengths are once again evident.

A Veteran Manager Adds Talent

Wellington Management’s Donald Kilbride has distinguished himself since taking over here in early 2006, but that hasn’t kept him in recent years from recruiting younger talent to his now four-person dedicated team. Kilbride and longtime collaborator Peter Fisher added Ashley Carew, an experienced forensic accountant, in July 2020, and then veteran Wellington analyst Silas Brown at the start of 2022.

Carew and Brown have both made an impact already. Carew’s fundamental research into 3M MMM shortly after she started raised questions about the firm’s key business drivers and ultimately prompted Kilbride to sell the stock in third-quarter 2020. That sale proved timely as 3M shares have since lost money and would have been a drag on the fund had they remained in the portfolio.

Brown, on the other hand, influenced the purchase of analog semiconductor chipmaker Texas Instruments TXN in 2021’s second half, shortly before he formally joined Kilbride and company after seven years on Wellington’s U.S. Growth team. Brown’s penchant for long-duration growth businesses and knowledge of Texas Instruments' 80,000-strong product lineup helped him convince Kilbride that Texas Instruments could continue to grow its dividend, which it’s done at a 21% annualized rate over the past decade.

Adapting His Approach Without Losing Focus

Buying Texas Instruments for the first time in his career represents an evolution, though not revolution, in Kilbride’s approach to stock-picking. Within tech, Kilbride still eschews capital-intensive businesses that rely on one or two products with short life cycles, but he now appreciates how Texas Instruments’ embedded competitive advantages can fuel long-term dividend growth. He has also sought to learn from missing out on dividend stalwart Apple AAPL, which he calls the biggest mistake of his career. Although iPhone sales account for around half of Apple’s revenue, the company’s iOS ecosystem and growing services business distinguish it from mere product-oriented companies, and Kilbride is open to buying the stock for the right price.

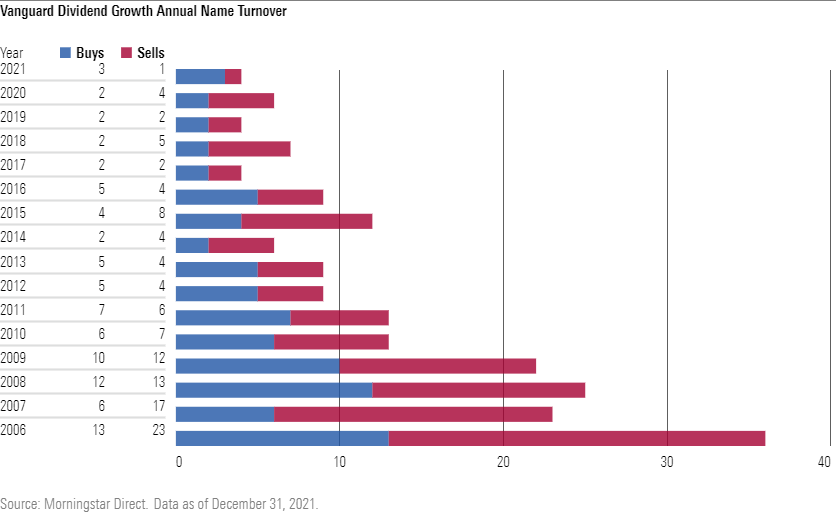

Kilbride’s willingness to adapt while staying focused on dividend growth potential is also evident from a close look at the fund’s portfolio over the years. Although its 11% to 41% annual turnover has been 12 to 37 percentage points less than the large-blend Morningstar Category median each year since he took over, Kilbride is less prone to trade in and out of names than in the past. In 2021, he bought two other stocks besides Texas Instruments (Stryker SYK and Mastercard MA) and sold one (Amgen AMGN) for a total of four name changes, the same number he made in the rallies of 2017 and 2019 and well below the double-digit annual totals that were typical in his first decade running the fund.

The strategy’s now massive asset base, which peaked at $68.7 billion in late 2021, has likely contributed to the name change reduction, but size alone doesn’t explain it. In running Wellington Select Quality Equity, a more concentrated and smaller $6 billion separate account sibling of Vanguard Dividend Growth and the strategy behind Kilbride’s newly launched Vanguard Advice Select Dividend Growth VADGX, he has shown the same tendency to trade less. Even though Kilbride is intentionally more opportunistic with Select Quality Equity’s 26- to 29-stock portfolio, its total number of name changes since 2014 (when data is first available) has trended down from double digits to six and four in 2020 and 2021, respectively, the same number as Vanguard Dividend Growth.

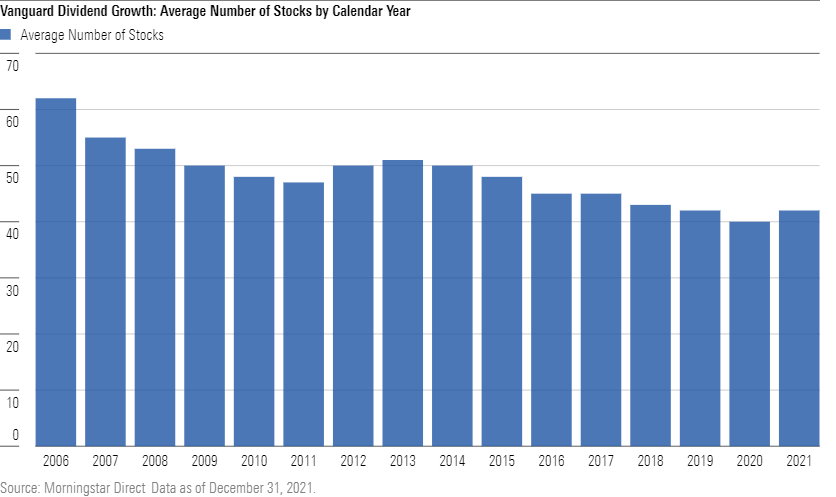

Other signs of strained capacity are lacking. Relative to the universe of U.S. dividend growth stocks, the strategy is considerably smaller now than in early 2017, when the mutual fund was closed to new investors. It hasn’t moved up the market-cap ladder from smaller, less-liquid names. Moreover, rather than increasing the name count to accommodate asset growth, Kilbride has instead become more selective in his search for large- and mega-cap companies able to grow their dividend around 10% each year. Whereas the portfolio held 57 stocks on average in his first three years on the job from 2006-08, it averaged 41 from 2019-21.

Kilbride’s buy-and-hold philosophy shows from the 11 stocks he has held for 15 years, but even among this select group he aims to trim positions on relative strength and add on relative weakness. Over the past five years through year-end 2021, for example, he altered by more than 10% the fund’s McDonald’s MCD share ownership 4 times, including an increase of 38% in 2018’s third quarter when the market priced the stock between $155 and $167, and a decrease of 14% in 2021’s third quarter when stock sold for $229 to $248. Morningstar analysis suggests these moves added value versus the benchmark, as have Kilbride’s trades generally since he started on the fund.

A Resilient Portfolio and Excellent Long-Term Record

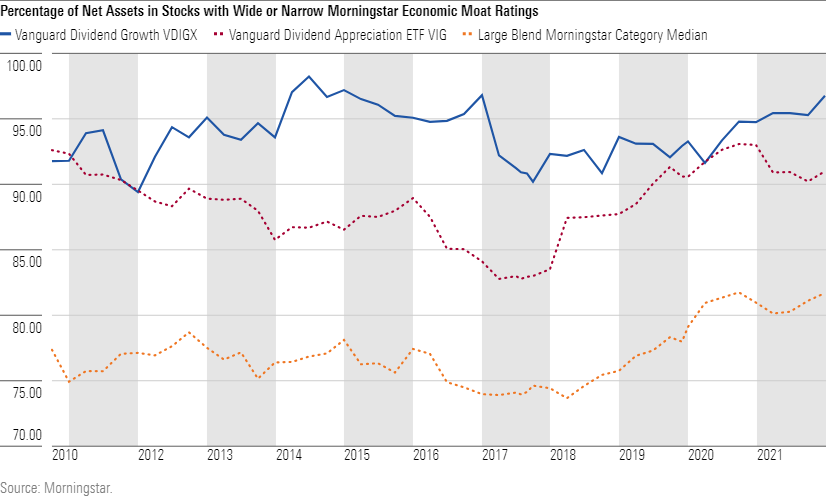

Investors shouldn’t choose this fund for Kilbride’s trading acumen, however. Rather, it is his ability to root the portfolio in reasonably priced, competitively advantaged dividend growers that stands out. Indeed, the portfolio’s 90%-98% combined stake in companies with either wide or narrow Morningstar Economic Moat ratings has consistently been 10 to 20 percentage points higher than most large-blend rivals’ and 5 to 10 percentage points more than Vanguard Dividend Appreciation ETF VIG, which tracked the fund’s former primary prospectus benchmark--the Nasdaq U.S. Dividend Achievers Select Index--until Sept. 20, 2021, when both it and the fund switched to the S&P U.S. Dividend Growers Index.

Holding such companies has led to a more resilient portfolio than broad equity benchmarks, like the Russell 1000 Index, in every major downturn on Kilbride’s watch. Except for modest underperformance during early 2020, the fund has also lost less than its former and current dividend growth benchmarks in market drops of 10% or more dating to 2006.

In the still unfolding downturn, which began with worries over inflation and accelerated when Russia invaded Ukraine, the fund’s 9.1% peak-to-trough (Jan. 5 to March 8) loss was 2.2 and 3.1 percentage points better than the S&P U.S. Dividend Growers and large-blend peer norm, respectively. Entering 2022, the fund’s 7.2-percentage-point overweight in aerospace and defense stocks, like top-10 holding Northrop Grumman NOC, has added most to the fund’s resiliency, and helped catapult it from the peer group’s bottom third in calendar-year 2021 to its top decile over the trailing year through March 15.

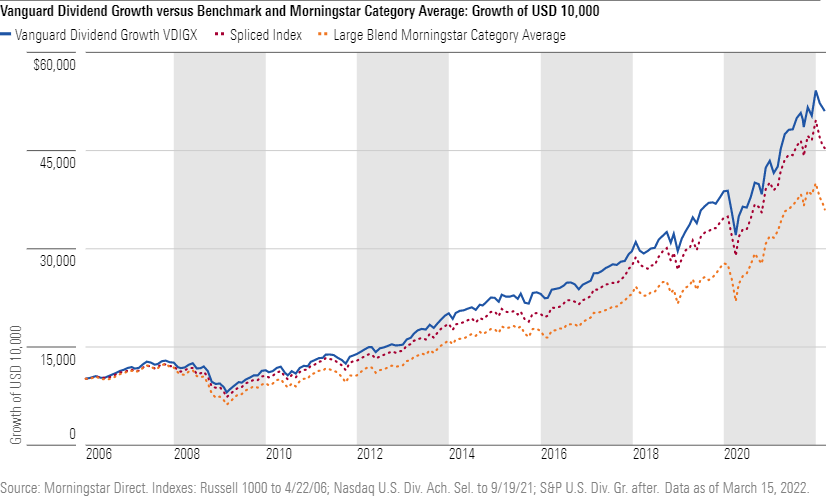

The fund’s recent performance versus its peer group is in line with its record over Kilbride’s 15-plus year tenure. Comparing results to the index is more difficult because neither the fund’s current nor its former benchmark existed when he took over in February 2006. Splicing together the three indexes he has faced over that span (Russell 1000 prior to April 22, 2006; Nasdaq U.S. Dividend Achievers Select through Sept. 19, 2021; S&P U.S. Dividend Growers thereafter), a $10,000 investment in the fund at the beginning of Kilbride’s tenure would have grown to $50,870 through March 15, versus $45,234 and $35,856 in the spliced index and typical category peer, respectively.

An Excellent Choice for Tax-Sheltered Accounts

The one long-standing advantage its passive exchange-traded fund rival has over the fund is in tax efficiency. Kilbride’s penchant for shifting assets to the most attractive stocks within the portfolio has led to long-term capital gains distributions in nine of the past 10 years and short-term capital gains distributions in seven of the past 10. Vanguard Dividend Appreciation ETF, on the other hand, didn’t make a single capital gains distribution over that period.

For those with money to invest in tax-sheltered retirement accounts, however, it is hard to do better than Vanguard Dividend Growth. With a conservative posture and reliable results, it is an excellent building block if not a cornerstone for a fund portfolio.

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)