Airline Stocks Stage a Rally as Oil Prices Fall

Shares of the carriers often rise when the price of oil—their most volatile input—falls in price.

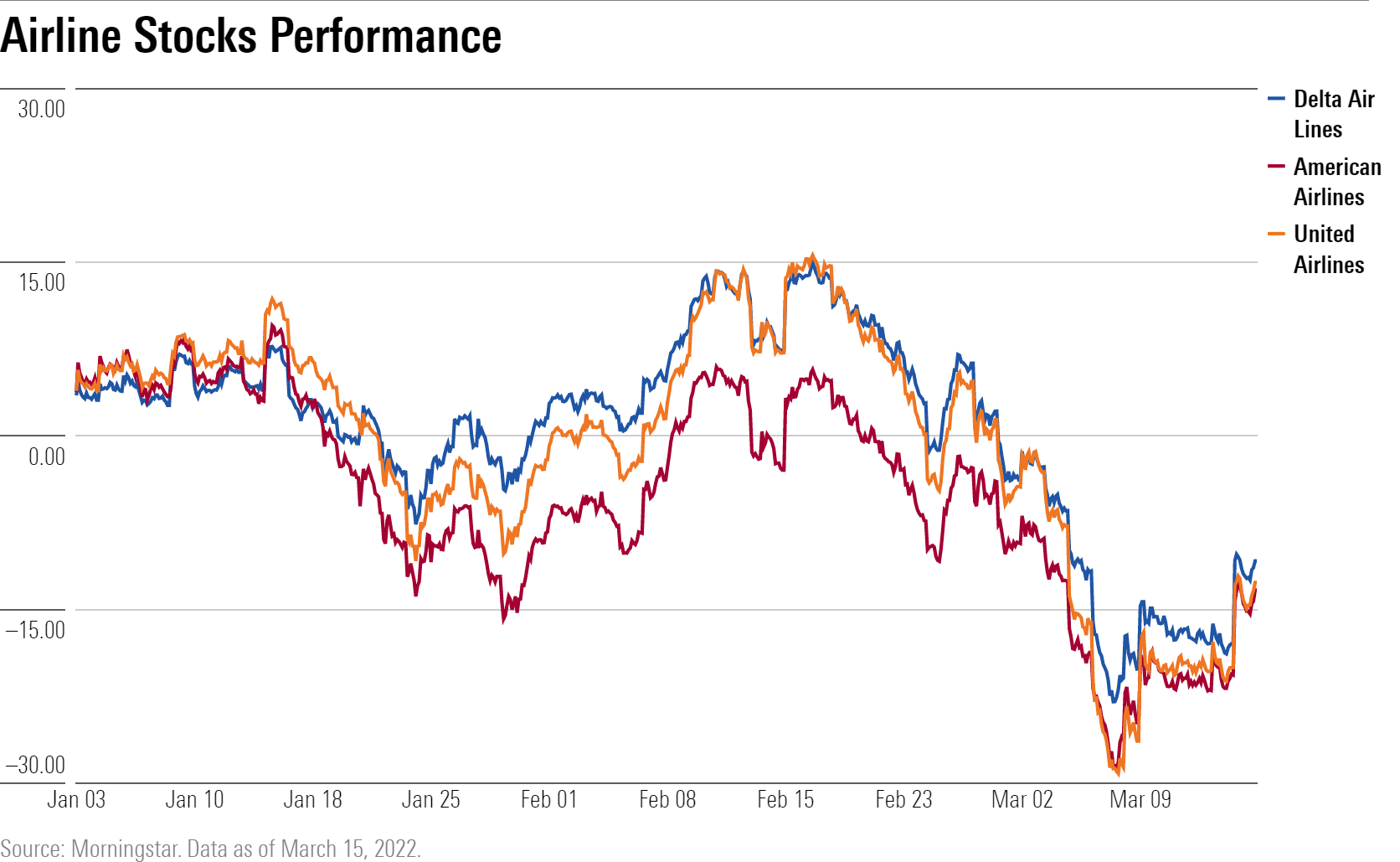

Shares of domestic carriers rose with Delta Air Lines DAL, United Airlines UAL, and American Airlines AAL each rising by 8% or more in trading on March 15.

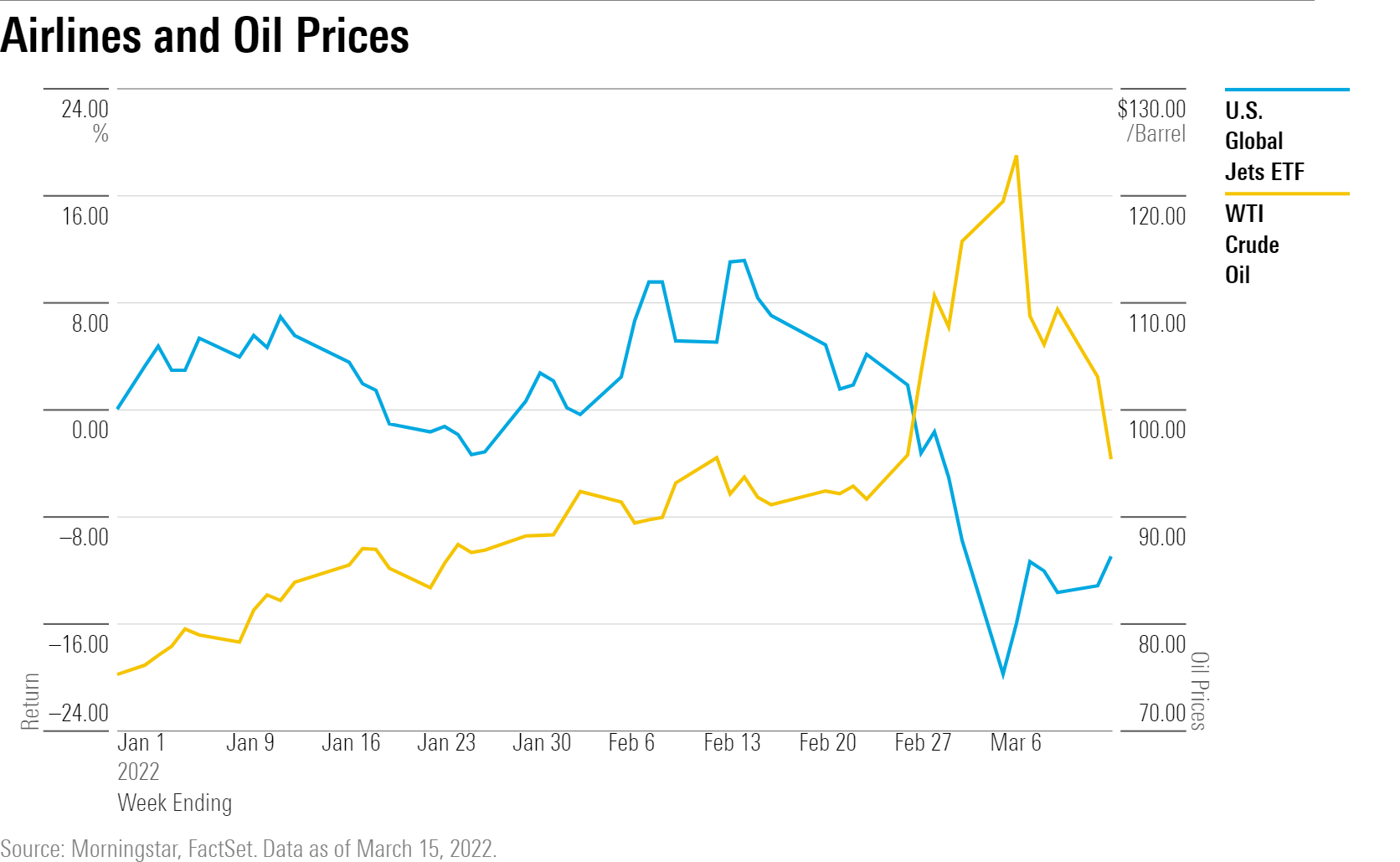

The move in shares came after oil prices fell on concerns about demand following a resurgence in coronavirus cases led to a lockdown of two cities in China by authorities. Oil and airline stock prices share an inverse relationship, with the value of carriers rising as the commodity's price falls. The price of oil is an airlines most volatile input, according to Morningstar analyst Burkett Huey.

“Even small changes in their operating performance can produce outsize impacts on their operating results,” Huey says. Airlines are capital-intensive and have high financial leverage--especially after taking on debt to survive the coronavirus pandemic, he notes.

Airlines have been hit with turbulence in the past few weeks as oil prices reached over $130 a barrel for the first time since 2008 last week. Oil fell below $100 on March 15.

American Airlines rose 9.3%, with United Airlines up 9.2% and Delta Air Lines 8.7%. All three airlines hit new 52-week lows on March 8.

“If an airline sells tickets assuming oil is going to be at one price and it goes higher, that can lead to mispriced tickets and potentially gross margin losses on flights,” Huey says.

In the short-term, airlines will face losses for tickets purchased when prices for oil were lower for flights that have yet to take place. In the long run, if oil climbs higher, then subsequent higher ticket prices may stifle demand for air travel.

Airlines operating between Europe and Asia face other pressures as well. In some cases, they are being required to go out of their way to avoid Russian airspace, leading to longer flights that use more fuel, increasing their costs.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T3GL43HDAFE4XKUGIENW4D5DDI.jpg)