Fund Lineup Turnover in 6 Charts

These factors help explain the changes to the fund offerings of a market or firm.

Funds come, and funds go. This lineup turnover within fund-family product sets can be disruptive to investors and their carefully planned portfolios, as investors consider new marketed offerings or are forced to find alternatives when fund companies merge or liquidate funds.

In our inaugural study on fund lineup turnover, "As the Fund World Turns," we examined product-development practices across the globe through a new metric that we call lineup turnover.

This metric considers both fund and exchange-traded fund launches and obsoletions (mergers or liquidations) as a percentage of the number of funds at the beginning of the period examined. We considered fund lineup turnover through multiple lenses: globally and within domiciles, from an active/passive perspective, at super-category levels, and at firm level for the largest fund companies worldwide.

Below, explore six key charts and tables from the report.

Fund Launches Have Exceeded Closures Over the Past Decade

Over the past 10 years, fund and ETF launches have exceeded obsoletions, helping the fund universe grow.

Our global fund lineup turnover figure, depicted below, shows that change among investment firms’ fund lineups has trended down since 2016.

This indicates some overall improvement in fund-firm product-development behavior: A steadier launch rate and a falling obsoletion rate mean more-enduring funds and less investor disruption.

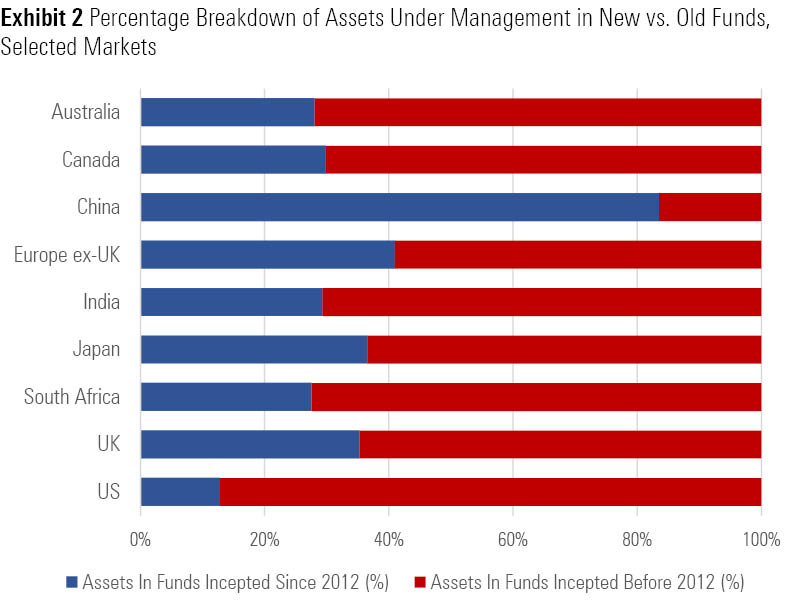

New Funds Comprise a Significant Portion of the Fund Universe Assets Under Management

New funds, here defined as those launched in 2012 and since, have grown to be a considerable portion of some fund markets, though the specific percentage varies significantly.

China’s fund market, for example, is growing by leaps and bounds from a low base as investor interest increases rapidly. As shown below, new funds in China now make up 84% of total fund and ETF assets under management.

New funds offered in Europe ex-UK, which includes investment hubs Ireland and Luxembourg, are also a large portion, at 41% of AUM. (Irish and Luxembourg vehicles can be sold to investors in Europe, as well as Asia and other parts of the world.)

Meanwhile, new funds in the United States have had less asset-gathering success; they represent just 13% of total AUM. This is likely a function of the U.S. market’s large size and maturity.

- source: Morningstar Analysts

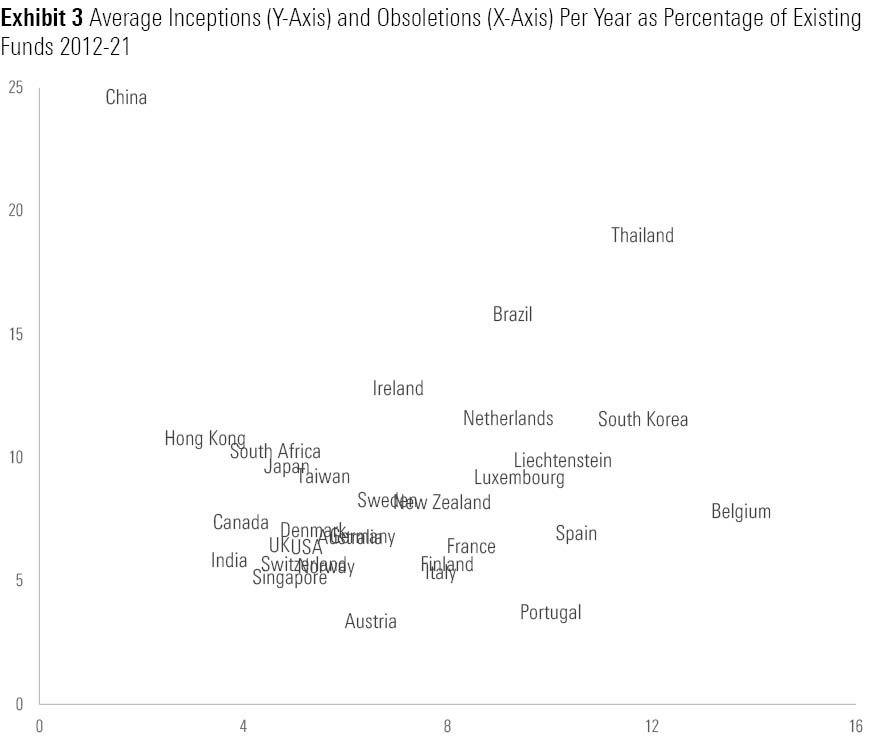

Different Domiciles Show a Range of Trends in Fund Lineup Turnover

This chart below maps a domicile’s 10-year average inception rate (fund launches/beginning of period funds) against its 10-year average obsoletion rate (fund mergers and liquidations/beginning of period funds), illustrating how the markets’ lineup turnover rates compare with one another.

Note that China stands alone in the upper left corner of the chart, indicating that it has by far the largest average inception rate and the lowest obsoletion rate. Again, this reflects fast growth in China, as well as product proliferation.

Meanwhile, as the outliers on the right side of the chart, Thailand and South Korea have inception rates well above the global average--but also the highest obsoletion rates.

A cluster of countries are much more stable in terms of fund and ETF lineup turnover. The U.S. is the largest and most-mature market, and so it makes sense that its lineup turnover falls below the global average. But overall, Singapore is one of the world’s most-stable markets, as is India, thanks in part to a regulatory rule that limits fund families’ practice to offer just one fund per category.

- source: Morningstar Analysts

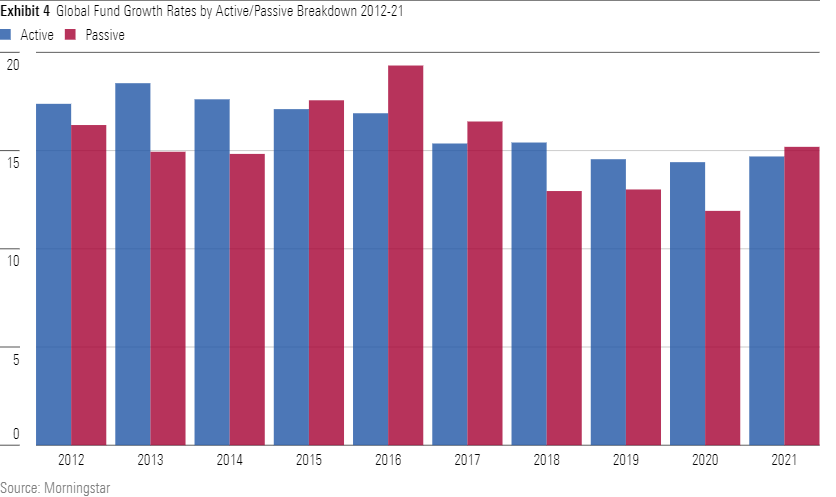

Active Funds Overall Experienced More Lineup Turnover Than Passive Funds

Considering the rising investor interest in passive funds over the past decade, one might have expected passive funds in aggregate to have seen higher lineup turnover figures than those of active funds.

But as shown below, while there were a couple of years in which passive funds did show higher lineup turnover, active funds exhibited higher lineup turnover otherwise. Correspondingly, active funds’ 10-year lineup turnover ratio was 16.2% compared with passive funds’ 15.3%.

And while the number of passive funds has grown faster than that of active funds over every single calendar year, active funds are seeing higher obsoletion rates. Just under 40,000 active funds merged or liquidated in the domiciles included in this study over the past decade.

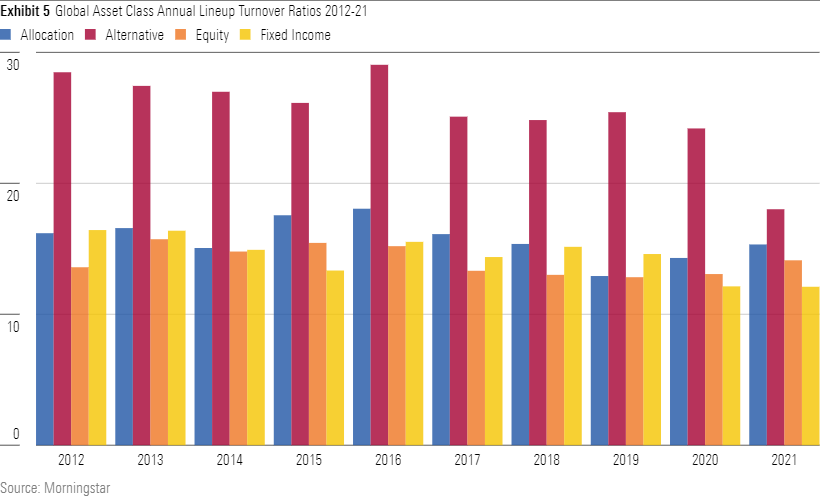

Alternatives Funds Show the Highest Lineup Turnover

The alternatives asset class hosts investment strategies that attempt to expand, diversify, or eliminate dominant risk factors contained in traditional equity and bond indexes. As shown on the chart below, the speed of change in this group has been on a level of its own.

Early in the decade, many asset managers renewed their alternatives lineups. They cut strategies that had disappointed during and after the global financial crisis and that had lost assets, while introducing new types of funds, such as quantitative strategies.

In Europe, excluding the United Kingdom, the UCITS market provided a growing channel for hedge fund houses to market their products in a liquid version to a broader audience. However, in the latter part of the decade, alternatives’ popularity waned, and there were only two years (2016 and 2017) when the global fund count shrunk. Especially in Europe (excluding the U.K.), the alternative industry has experienced many fund closures in a prolonged period of outflows, with the number of funds shrinking by 7% over the period. On the other hand, although the alternatives fund set shrank in the U.S. from 2016 through 2019, product development has been robust overall and the market grew by 53% over the trailing decade.

Among the Largest Global Firms, Higher-Rated Parents Show Better Lineup Turnover Numbers

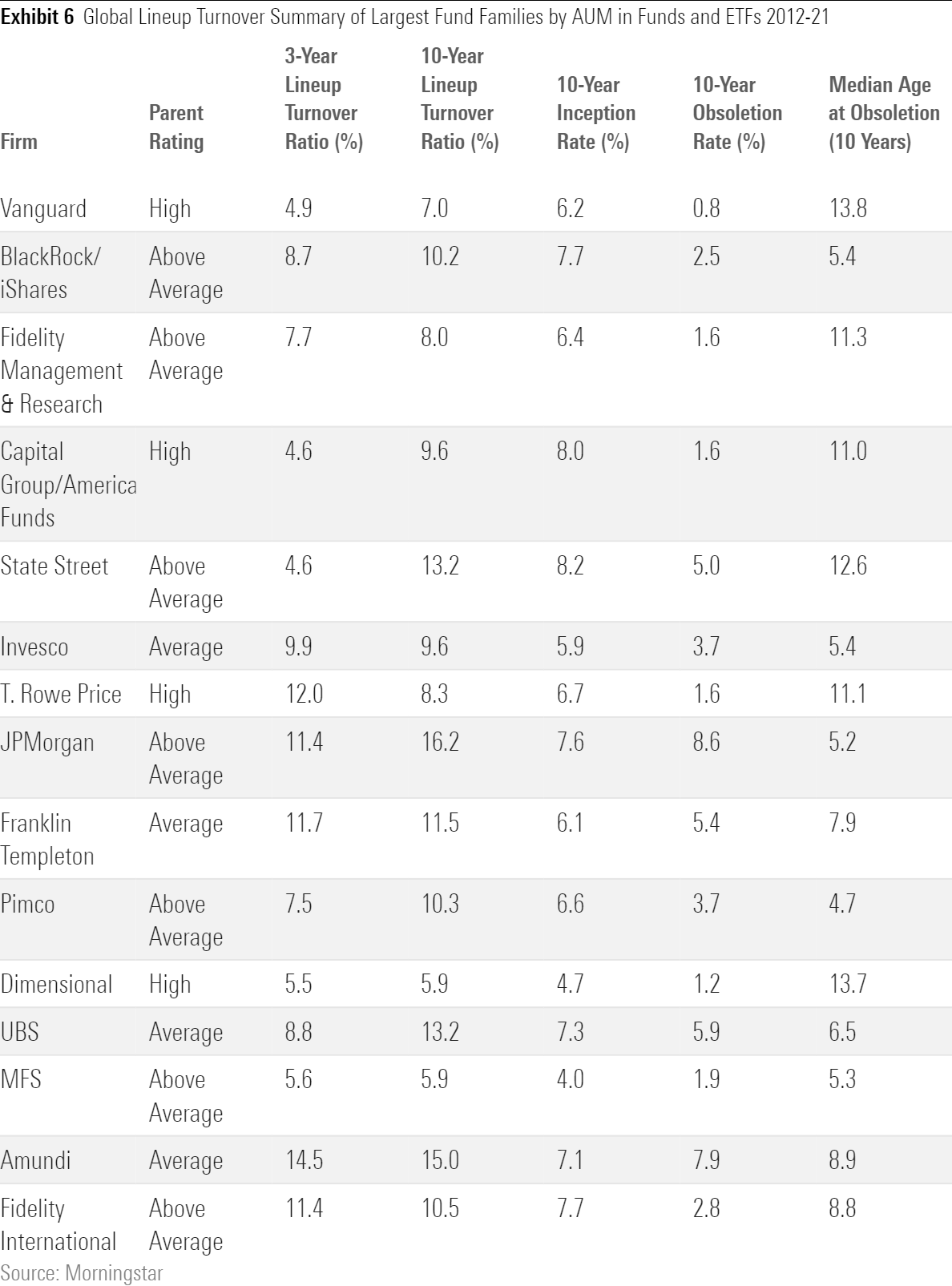

Our study examined the world’s largest fund families, considering AUM in funds and ETFs globally. Here, we show the largest 15.

Most of these global firms show smaller three-year lineup turnover numbers than their 10-year rates. Asset-management mergers and acquisitions have had a notable impact for some firms, including Paris-based Amundi and Invesco; time will tell what Franklin Templeton’s mid-2020 acquisition of Legg Mason and its collection of investment boutiques will bring.

Overall, firms with High Parent ratings on this list--Vanguard, Capital Group/American Funds, T. Rowe Price, and Dimensional--boast smaller 10-year obsoletion rates and longer median ages at obsoletion, indicating a more careful approach to product development.

Good stewards of capital are thoughtful about their launches and ability to support their funds from an investment, distribution, and operational perspective. While growth and evolution in firms’ investment offerings are to be expected, evidence of product development conscientiousness includes lower inception rates, lower obsoletion rates, and lower lineup turnover figures at the parent level, all other things equal.

Investors would also expect to see higher median ages of funds at obsoletion. While any single decision to launch, merge, or liquidate a fund might be the right decision and in investors’ best interests, a pattern of consistently high lineup turnover or regular lineup turnover that suggests churn in a firm's investment lineup are warning flags.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)