Markets Review/Preview: Fed Rate Liftoff Ahead

Volatility continues to dominate markets.

It is finally here.

The Federal Reserve is set to meet Tuesday and Wednesday and is poised to kick off what is expected to be the first in a series of interest-rate hikes as it tries to bring inflation under control.

Bond markets are priced for the Fed to announce a 0.25% increase in the federal-funds rate. The move follows on the heels of the release of February's consumer price index report showing inflation rose at a 7.9% rate from a year earlier.

“The bond market is expecting six to seven fed-fund rate hikes through the end of 2022, about in line with our expectation of six,” Morningstar analyst Preston Caldwell says.

In addition to the news from the Fed on rates, investors will also be looking for clues as to the Fed’s plans for reducing its holding of bonds purchased as a way to pump money into the economy during the pandemic.

Events scheduled for the coming week include:

- Tuesday: Federal Reserve meeting begins; Producer Price Index data for February; Volkswagen VWAPY earnings

- Wednesday: Federal Reserve meeting concludes; U.S. retail sales; Starbucks annual meeting

- Thursday: FedEx FDX earnings

For the trading week ending March 11:

- The Morningstar US Market Index was down 2.9%

- Oil ended the week down 5.5% at $119 per barrel.

- Buoyed by commodity prices, Energy stocks rose 1.6%, continuing to outperform the market.

- The worst-performing sectors were consumer defensive down 5.6% and technology 4%.

- Yields on the U.S. 10-year Treasury note rose 15.6 to 2% from 1.73%.

- Of the 859 U.S.-listed companies covered by Morningstar 228, or 27%, rose, and 631, or 73%, fell.

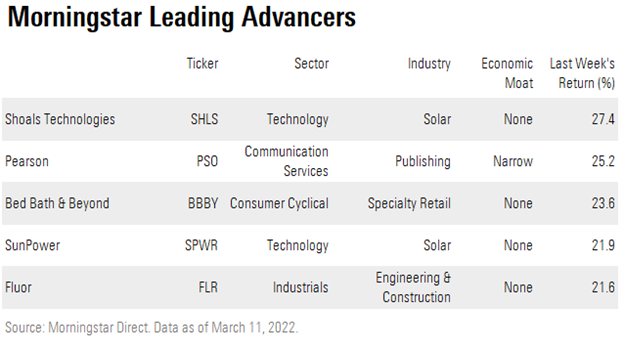

What Stocks Are Up?

The best performers on Morningstar’s coverage list this week were Shoals Technologies SHLS, Pearson PSO, Bed, Bath & Beyond BBBY, SunPower SPWR, and Fluor FLR.

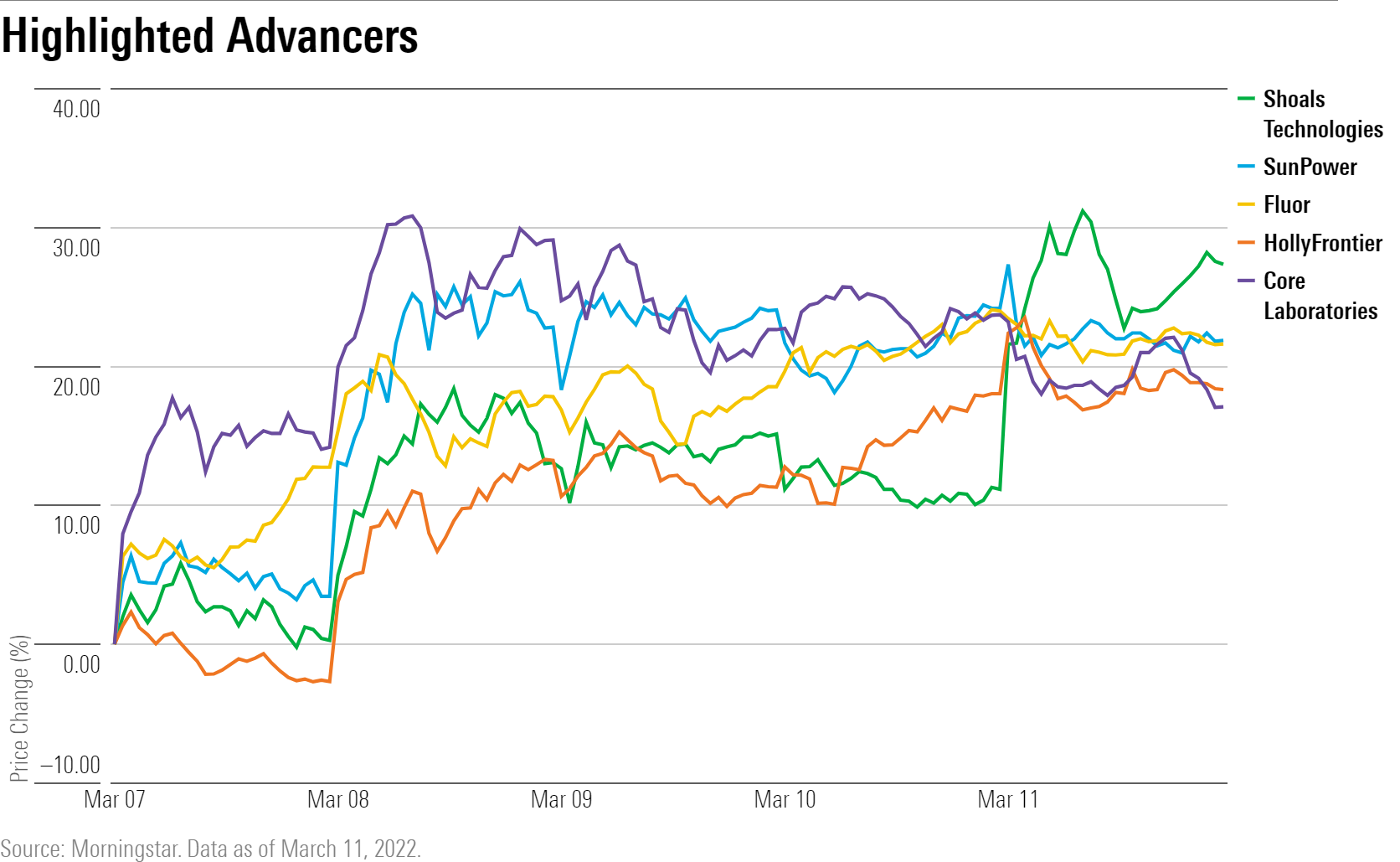

Companies in the renewable energy side of the sector rose, with Shoals Technologies up 27.4%, SunPower SPWR 21.9%, and SunRun RUN 14.8%. Ormat Technologies ORA and Enphase Energy ENPH also closed higher.

The oil-services and equipment industry also rallied, with Fluor up 21.6%, Core Laboratories CLB 17.1%, and NOV NOV 15.5%. Oil stocks HollyFrontier HFC, Baker Hughes BKR, and Weatherford International WFRD also ended the week higher.

Other notable moves are Mandiant MNDT up 12.4%, following confirmation that Google’s parent company, Alphabet GOOGL, would be purchasing the cybersecurity firm for $5.4 billion.

What Stocks Are Down?

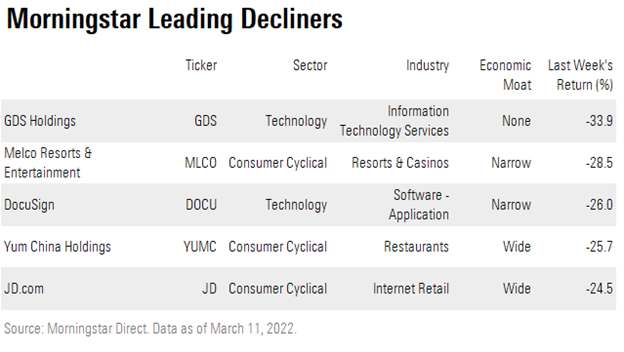

The worst performers last week were GDS Holdings GDS, Melco Resorts and Entertainment MLCO, DocuSign DOCU, Yum China Holdings YUMC, and JD.com JD.

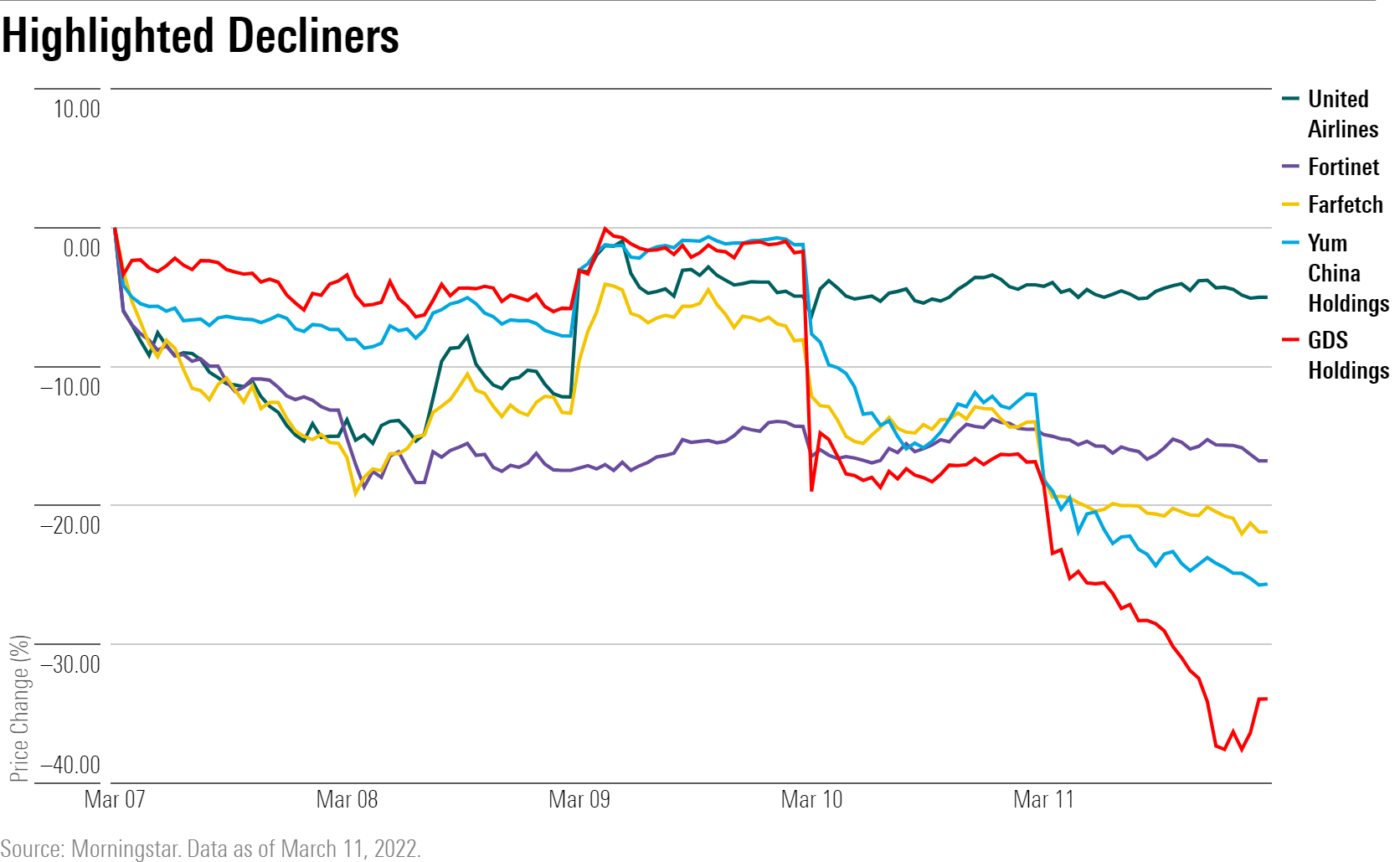

Regulatory concerns knocked down several Chinese ADR-listed companies in the last few days. Among the companies to trade down on the news were GDS Holdings, which plunged 33.9%, Melco Resorts and Entertainment tumbled 28.5%, and Yum China was down 25.7%. On Thursday, U.S. regulators called out five companies at risk of being delisted from exchanges, including Yum China, due to accounting disputes. Chinese ADR-listed companies JD.com, Trip.com TCOM, and Baidu BIDU were also caught in the sell off.

Companies in the e-commerce space also sold off to end the week lower. Farfetch FTCH fell 21.9%, Etsy ETSY slid 20%, and Mercadolibre MELI was down 15.5%.

A handful of tech company shares slumped. Cybersecurity company Fortinet FTNT fell 16.8%, data storage company Seagate STX 15.4%, and Micron Technology MU 11.1%.

Airline stocks encountered turbulence, with United Airlines UAL, Delta Air Lines DAL, and American Airlines AAL falling 10% or more last Tuesday. Shares rose sharply as oil prices declined but still finished the week lower.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)