Could Group Savings Work for My Family?

You don’t have to amass savings and assets alone.

Saving money is often treated as an individual responsibility. But, based on what we’ve seen around the world, group savings can also be an effective method of building wealth.

Because I come from a large international family, I've long been aware that many people save as part of a group instead of on their own. I've even tried it myself. For years now, some of my relatives from Trinidad & Tobago have taken part in what we call a sou-sou. Around the world, there is the tanda in Mexico, self-help groups in India, and harambee in Kenya.

As commonplace as group savings is in other communities, the practice isn’t as well-known in the United States. To see how Americans feel about the idea, Morningstar’s behavioral science team asked a representative sample of them to share their thoughts on group savings and its possible pros and cons.

How Do I Start a Group Savings Plan?

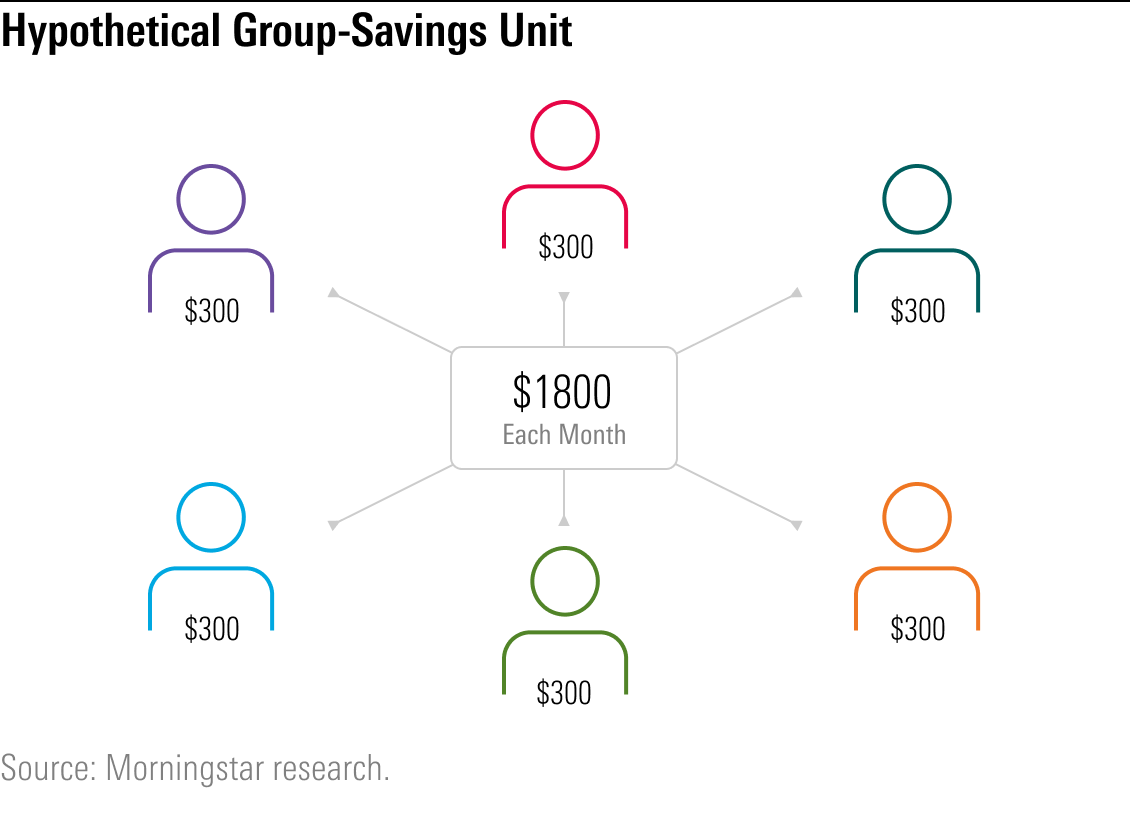

In group savings, a group of people--often a group of relatives, friends, or even coworkers--pool their money on a predefined schedule and time frame to achieve individual or collective financial goals.

Let’s say six people get together and each contributes $300 every month for six months. Each member, in turn, may take the entirety of the group's fund each month ($1,800), or they may all wait until the end of the six-month period to distribute or use the money jointly ($10,800, not counting interest).

An individual may decide to use a payout for a major expense, such as debt repayment, savings, or investment. Alternatively, the group may use the accumulated $10,800 for a combined expense like a cultural event, international trip, or a shared asset like agricultural equipment.

Personally, I’m currently using this strategy with siblings and cousins who wanted to save money to help our grandmother pay for future house repairs. We believe group savings helps us do this equally and fairly, given our different financial circumstances and busy lives in locations across the U.S.

We started small with each of us giving $20 per month for 10 months while I took on the responsibility of sending reminders and collecting the money in an FDIC-insured savings account. However, as we increased our monthly contributions and extended the time frame to several years, we became more efficient and opened a jointly owned brokerage account. That way, our savings could be invested to achieve long-term interest following a simple, yet balanced approach. We’ve even simplified the collection process with automatic bank deposits and are thrilled our teamwork is steadily bringing us toward our goal.

From my own personal experience, group savings can be highly effective when done correctly. But what about Americans who may not have heard of this strategy?

Could Saving Money as a Group Work for Most Americans?

Many Americans struggle to save money, yet saving is important for major purchases, dealing with emergencies, and having a secure retirement. This problem is often structural--if you barely have enough money for everyday expenses, then it may be impossible to put some aside. However, the difficulty can also be psychological in our consumer-driven economy with relatively easy access to credit. Group savings may offer people an environment with mutual support and accountability to help with meeting difficult financial goals. However, there may be harmful consequences if members of a group-savings unit do not honor their commitments.

In our research, we find that only 10% of respondents had tried group savings. Compared with Americans who have not tried this strategy, those respondents are more likely to be younger, male, employed full-time, members of a racial minority group, and to consider themselves investors. Experienced group savers were also less likely to have incomes below $25,000 and were slightly less likely to have retirement accounts. Interestingly, experienced group savers were no more or less likely to have been born outside of the U.S. than people who had not tried group savings.

Among the majority of respondents who had not tried group savings, a sizable portion thought it could be just as effective or better than saving on their own. In short, we identified three categories of group savers for comparison:

- Experienced Group Savers (10% of respondents): These respondents have tried group savings.

- Potential Group Savers (36%): These respondents have not tried group savings but perceive it as being equal to or better than saving on their own.

- Averse Group Savers (54%): These respondents have not tried group savings but do not perceive it as potentially equal to or better than saving individually.

Overall, the type of relationships respondents found appropriate for group savings were close family members (62%) and friends (44%), but 17% of respondents did not think any relationships outside of immediate family could be appropriate. Experienced group savers selected the widest variety of relationships and were more likely to select coworkers and religious-group members than people who had not tried group savings.

The most popular advantages cited among respondents were receiving support (54%), personal accountability (45%), and the opportunity to help others (45%). Almost all respondents identified at least one potential disadvantage to group savings. The biggest concern among 59% of respondents was a lack of privacy. This was a worry shared by all categories, but experienced group savers did not cite disadvantages as frequently as the other groups. Only 39% of experienced group savers were concerned with pressuring others, and just 39% cited personal stress, 35% cited more financial risk, and 30% worried about weakening relationships.

Should You Try Group Savings?

Group savings might be worth considering for short-term goals after careful examination of whether:

- You would benefit from additional support and accountability in your saving efforts

- You have relationships with the appropriate amount of mutual trust for financial collaboration

- Potential members of your group-savings unit can candidly set expectations and implement ways to minimize risk

- You have clearly defined goals for how you will spend or invest the money you save

If the above criteria apply to you, group savings may serve as a commitment device to help overcome obstacles like procrastination and lack of confidence. However, it is crucial to formalize agreements for contributions and payouts through verifiable documents and secure financial accounts.

Even before beginning a group-savings cycle, individuals should have meaningful objectives for what they will do with the money saved. If the goal is longer-term wealth creation, then after initial success, consider making the switch from careful saving to responsible investing, which may be better at achieving returns.

/s3.amazonaws.com/arc-authors/morningstar/ff370d56-5946-45e8-a1ea-5e50301bc997.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ff370d56-5946-45e8-a1ea-5e50301bc997.jpg)