Airline Stocks Encounter Some Turbulence

Demand headwinds may be ahead.

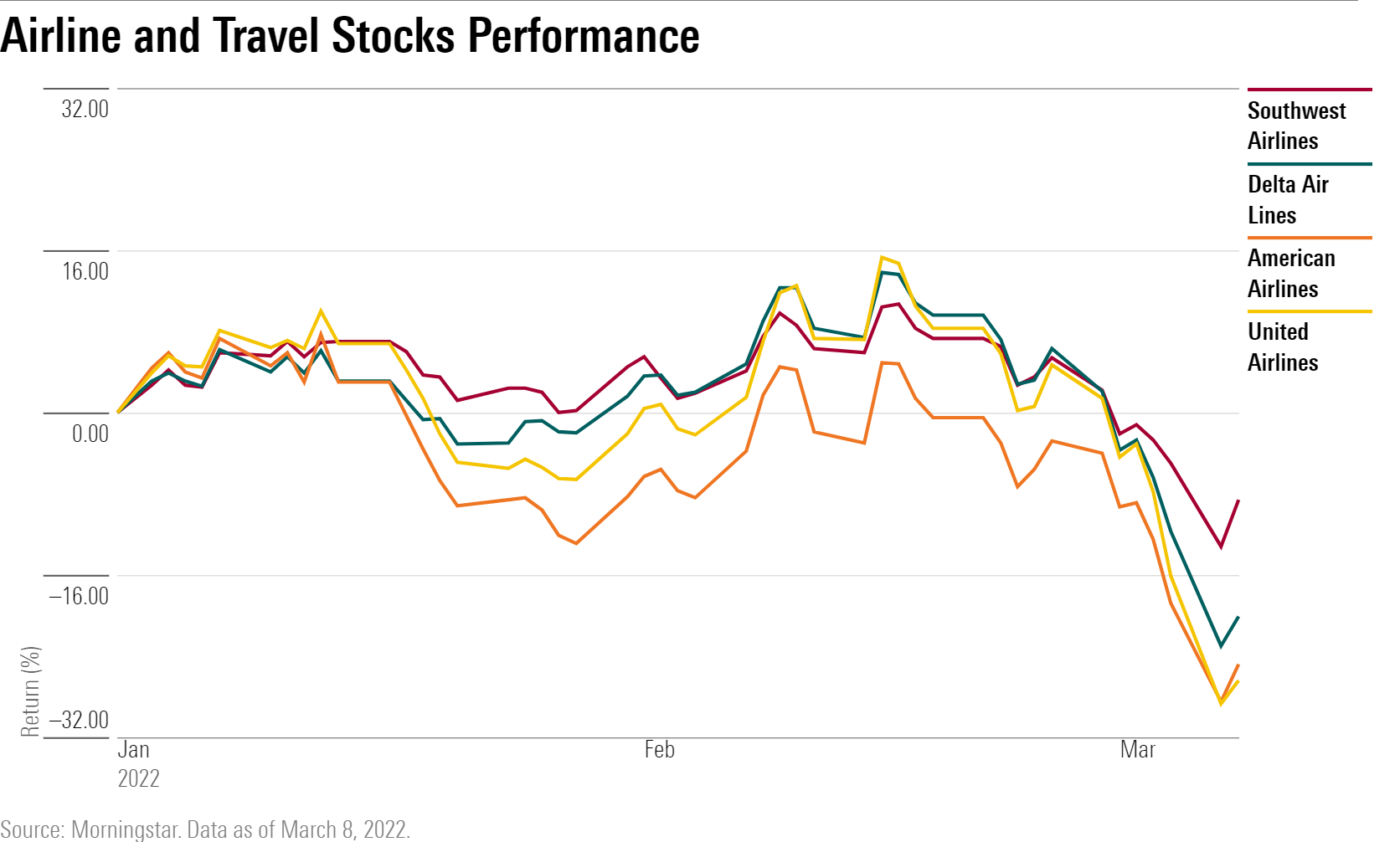

Airline stocks bounced back on March 8 after falling as much as 15% and hitting new 52-week lows in the past week, highlighting the immense volatility the industry is contending with as investors try to account for rising fuel costs following Russia’s attack on Ukraine.

Southwest Airlines LUV rose 5.3%, American Airlines AAL was up 5.2%, Delta Air Lines DAL rose 3.7%, and United Airlines UAL rose 3.3% during Tuesday’s trading session. American, Delta, and United are still down by 20% or more for the year to date.

Exhibit 1

The volatility for the industry is be expected, according to Morningstar analyst Burkett Huey.

“Even small changes in their operating performance can produce outsize impacts on their operating results,” Huey says. Airlines are capital-intensive and have high financial leverage--especially after taking on debt to survive the coronavirus pandemic.

“The big story right now for airlines is that oil prices are climbing higher, that is going to be a large expense increase,” says Huey. He sees higher ticket prices soon as companies seek to offset rising expenses. “Airline ticket price changes are really a big function of oil--that’s the most volatile input.”

“But if an airline sells tickets assuming oil is going to be at one price and it goes higher, that can lead to mispriced tickets and potentially gross margin losses on flights.”

In the short term, airlines are already facing a loss for tickets purchased prior to the oil rally by passengers that have yet to take flight. In the long run, higher ticket prices may stifle demand for air travel.

Airlines operating between Europe and Asia are facing other pressures as well. In some cases, they are being required to go out of their way to avoid Russian airspace, leading to longer flights that use more fuel and increase their costs.

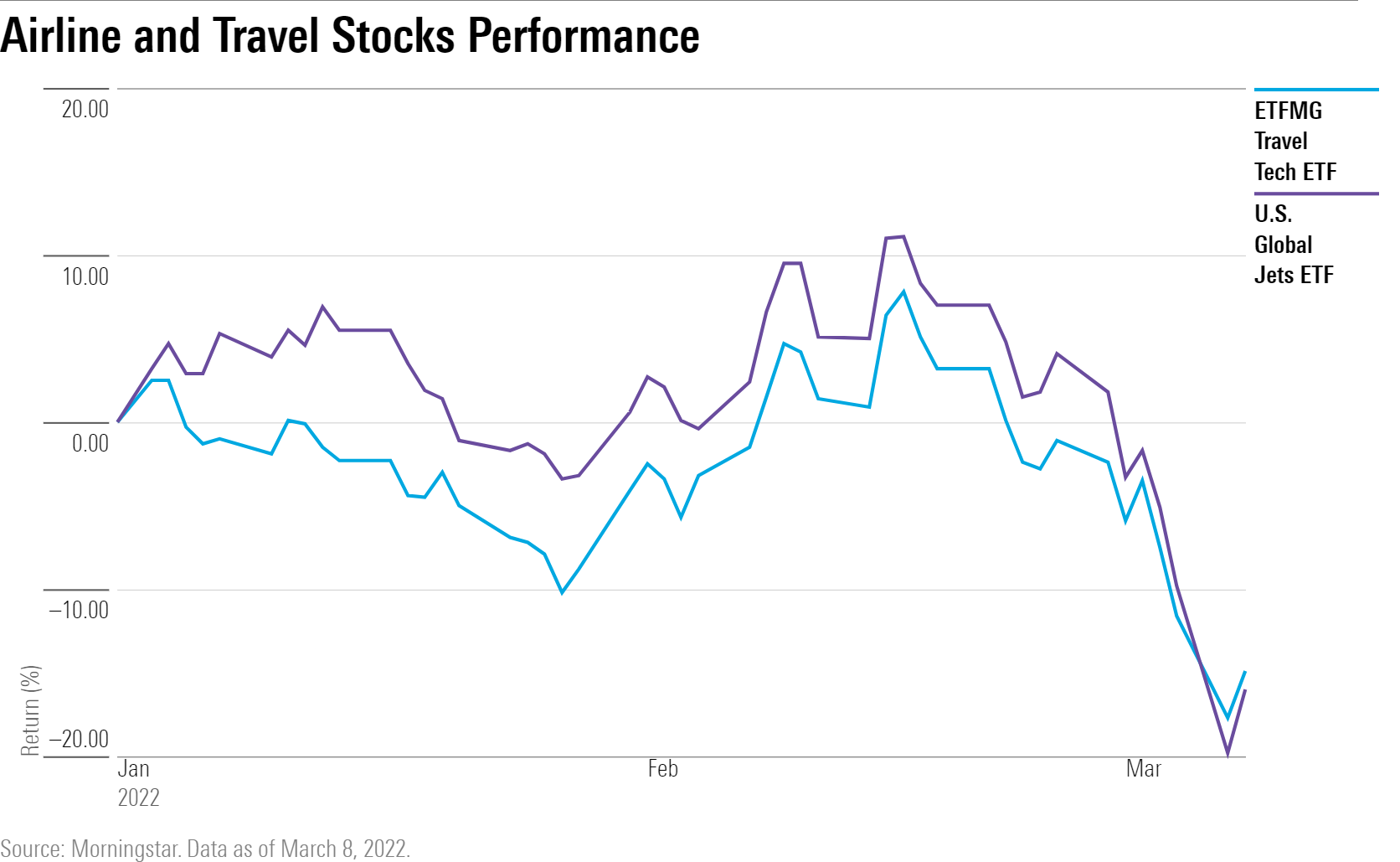

Stocks in other travel-related industries have also been hit as investors sold off shares. Aircraft manufacturers Airbus EADSY is down 17.8% and Boeing BA is down 13.7% for the year. Booking BKNG is down 20.8%, TripAdvisor TRIP is down 15.3%, and Expedia EXPE is down 8.3% for the year to date.

Exhibit 2

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T3GL43HDAFE4XKUGIENW4D5DDI.jpg)