When the Stock Market Is Openly Inefficient

The curious case of Digital World Acquisition Corporation's warrants.

Separate Ways (Worlds Apart)

On Jan 20, 2022, I published “How to Lose Money: Buy Digital World Acquisition Corp.” That column was misnamed. It should have been entitled, “How Not to Make Money: Listen to Rekenthaler.” When the stock markets closed on Jan. 19, Digital World Acquisition Corporation’s (hereafter just DWAC) stock cost $77.45. It closed this past Friday at $97.54.

Guilty as charged. But here's the thing. Although my forecast was wrong about DWAC's stock, it has been correct about the company's warrants. That should not have occurred. Either my prediction should have been wrong about both DWAC's common stock and its warrants, or it should have been right about both. There is no defense for a split decision.

Basic Math

To explain: When DWAC issued its equity, it distributed one warrant for every two stock shares to its IPO buyers (which consisted of various hedge funds). Each warrant permits its owner to buy a share of the company's stock at a price of $11.50. The warrants may be exercised starting on Sept. 3 of this year, or 30 days after the company’s scheduled merger with Trump Media & Technology Group, whichever date comes first. The warrants will expire in 2028.

As with other forms of options, warrants carry two sources of value: 1) intrinsic value, being the difference between a warrant's exercise price and the cost of the company's stock; and 2) time value, which recognizes that, unlike owners of common stock, warrant investors have a choice to either convert their warrants or abstain. Having that choice is a benefit, which is why time values are almost always positive. (This, allegedly, is a rare counterexample.)

Determining the intrinsic value of DWAC’s warrants is straightforward. That amount is $86.04, obtained by subtracting the $11.50 exercise price from the stock price of $97.54. Typically, calculating the time value of the warrant is tricky, as it involves estimating the stock’s future volatility. In this case, though, the computation is simple. Because the stock’s price is so far above the warrant’s exercise price, the time value is negligible. Possessing the right to abstain means little when one will almost certainly not abstain.

Thus, DWAC’s warrants should be worth about $87. Their actual value: $23.76. That was the cost to purchase a warrant on Friday afternoon.

Left Arm, Right Arm

Well, you might say, Rekenthaler botched that evaluation, too. Fair enough. One should distrust arguments by researchers who claim to have spotted what the marketplace missed. Usually, the opposite is true. But in this case, I am the consensus. Last month, The Wall Street Journal talked to several investment professionals, each of whom also believed that DWAC's warrants should trade at roughly their intrinsic value. (It would be difficult to conclude otherwise.)

The clinching argument, however, derives not from the disparity itself, but instead from its inconsistency. Maybe the investment professionals who were contacted for the article overlooked a critical reason why DWAC's warrants should trade at a large discount to the company's stock. But even if that criticism is true, it does not explain why the two securities don't trade in tandem. After all, each was issued by the same company. Whatever price difference exists between the two should therefore be relatively constant.

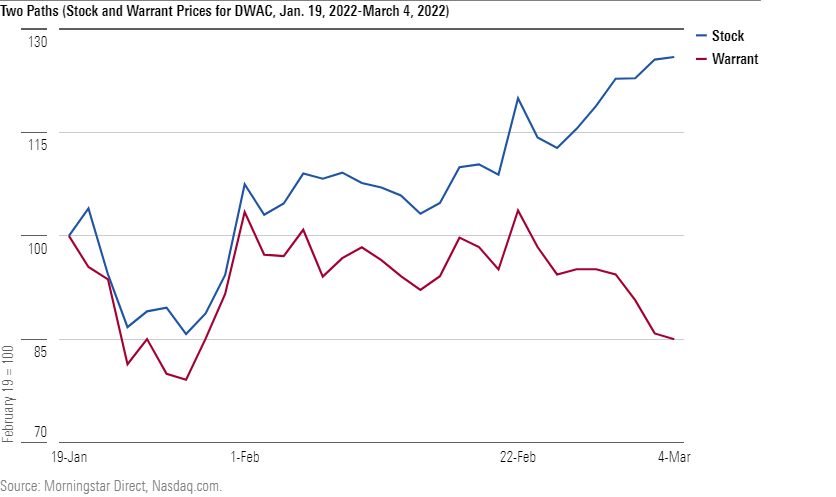

And yet it has not been constant. The following chart shows the relative performance for each investment since Jan. 19.

The relationship between DWAC’s stock and warrant prices is battier than Bruce Wayne’s lair. Consequently, when investigating that issue, we needn’t worry about finding evidence that squares the circle. The task cannot be accomplished. Either: 1) DWAC’s stock price is wrong, 2) DWAC’s warrant price is wrong, or 3) both prices are wrong. The one interpretation that cannot hold is that both prices are correct.

Assessing the Possibilities

My analysis can go no further. None of the three narratives above adequately explains the behavior of DWAC’s equity investments.

If the company’s stock price is accurate, why haven’t its investors--who were by that account highly astute in recognizing the opportunity--seized the lowest-hanging fruit that ever hung on an investment tree? Sell 1,000 shares of DWAC stock, buy 2,500 shares of DWAC warrants, pay the $11.50 conversion fee for each warrant when September arrives, and DWAC supporters will own 2.5 times as many equity shares as they own today, with $9,390 in cash left over.

If, on the other hand, the company’s warrant price is accurate--meaning that DWAC’s common-stock holders are deceived rather than astute--why has this error persisted? Is the equity marketplace so inefficient that a relatively large stock can trade for months at several multiples of its openly signaled true worth without any correction occurring? Perhaps … but if so, business schools ought to revise how they teach investment theory.

The final explanation--that both the stock and warrant prices are wrong--strikes me as the likeliest of the three possibilities. Assessing DWAC’s prospects is difficult, as its fortunes depend entirely upon that of Trump Media & Technology Group, which has barely begun operations. One should therefore expect confusion in determining the company’s value. What’s more, special-purpose acquisition companies often perform erratically before (and shortly after) their mergers, because they have a bifurcated shareholder base: Their institutional owners are seeking to exit, or at the least to hedge their exposures, while their retail investors are bullish.

Final Note

In hindsight, I erred when I said DWAC was a sure loser. The company’s investment terms are deeply unfriendly to the stock’s retail shareholders; should Trump Media & Technology Group disappoint, they will be left holding the bag while the institutions reap profits. That is a fact that no DWAC supporter can successfully deny. I, personally, would not be interested in buying into a startup media business that is valued at more than $15 billion while possessing $1.25 billion in capital.

But, as this column has demonstrated, there is nothing “sure” about DWAC. The performance of its securities has defied analysis. I was mistaken to believe I could solve that mystery. Back to the Batcave.

Note: So much for planning ahead! I wrote the bulk of this column over the weekend. On Monday, after I'd finished, DWAC's stock dropped 14.6% because ... well, who am I kidding? I have no idea why. At any rate, the key points of this article still stand: DWAC's stock remains above its Jan. 19 level; its warrants have declined even further; and the performance of both investments continues to baffle.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JUWC2VJUKBCG5P3KVQJCHL5QSQ.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JD5KSEJFLNFLJA5XRS6YK2O24Q.jpg)