A Flurry of New ETFs Have Launched in 2022

The latest offerings range from sensible to speculative.

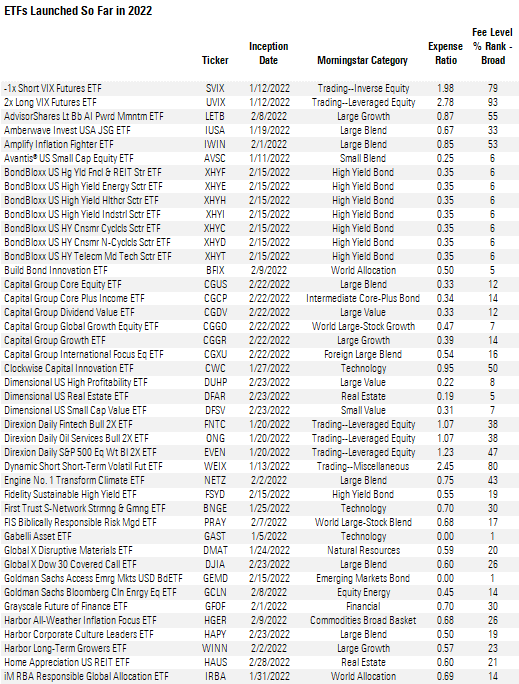

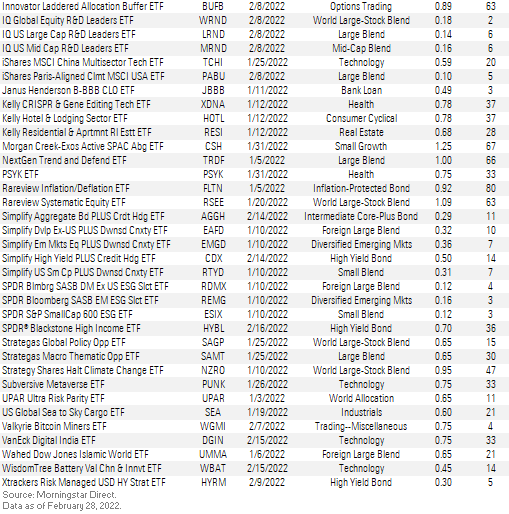

Keeping up the pace set in 2021, there were 78 new exchange-traded funds launched in the first two months of 2022. Of those, 34 came from firms making their ETF debut. That number includes six ETFs offered by the venerable Capital Group, parent of American Funds.

Capital Group is late to the ETF race but a strong entrant. In an article ahead of the firm’s ETF launches, Morningstar associate director of manager research Tom Nations says, “While other active management mutual fund giants like Fidelity and T. Rowe Price moved first, Capital Group will now bring its characteristic scale and low-cost leadership to bear on ETFs.”

Though they are similar to existing American Fund mutual funds, these offerings are unique strategies. Nations says, “Like the American Funds, the Capital Group ETFs also will have analyst-led research portfolios that gobble up a portion of assets. And while Capital's robust bottom-up capabilities are one of its key strengths, it also means that stock picks will bubble up from mostly the same analyst teams that support the American Funds.”

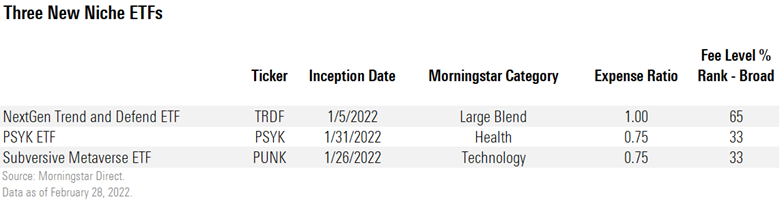

Capital Group’s new funds stand in contrast to a number of niche offerings narrowly focused on a variety of themes, as well as ETFs aiming to feed a growing demand for alternative investments. Some of these new options are eye-catching, but they aren’t necessarily good investments. We single out three below and suggest Morningstar Medalist funds that aren’t as trendy but that have long track records of success.

PSYK ETF PSYK

Elemental Advisors launched its first fund, PSYK ETF PSYK. The ETF tracks the Enhanced Consciousness Index, maintained by index provider Solactive, which is composed of companies “involved in the legal research, development, and production of psychedelics to address medical conditions.”

The ETF has some red flags. An expense ratio of 0.75% is high for an index strategy. Furthermore, sector strategies have proven difficult to use in a portfolio, and narrowly focused strategies like this one bring additional risks.

While this fund’s unique focus has niche appeal, investors who want exposure to cutting-edge healthcare might be better served by more-diversified offerings in the specialty health Morningstar Category that have established track records--and lower costs.

Fidelity Select Health Care FSPHX has a Morningstar Analyst Rating of Gold. In his July 2021 report, strategist Robby Greengold cites skilled leadership and a strong supporting team as the strategy’s greatest asset. This expertise is vital, as the strategy “often invests in early-stage small caps--profitless biotechs, for example--whose futures are far from certain but more discernible for those with a solid grip of the science underlying their worth.”

Another alternative is Vanguard Health Care VGHAX, which earns a Silver rating for both its share classes.

In his October report, senior analyst William Samuel Rocco says that manager Jean Hynes looks “for innovative firms with differentiated products or services and attractive valuations relative to their growth prospects.” As it generally holds between 20% and 30% of its assets in non-U.S. equities, the fund is also a strong offering for those looking for international healthcare exposure.

Subversive Metaverse ETF PUNK

The Subversive Metaverse ETF PUNK is the first offering from fund company Subversive Capital. The ETF invests in companies that provide services and products that support the infrastructure and applications of the metaverse. Of course, “metaverse” means different things to different people. Subversive Capital defines the metaverse as “the next generation of the Internet, which has the potential to allow creators to build the next chapter of human interaction through immersive experiences in three-dimensional virtual spaces.”

The fund’s 0.75% expense ratio isn’t high relative to other actively managed funds in the specialty technology category. However, the fund and firm have no track record.

An alternative offering broader exposure to the tech sector is Silver-rated T. Rowe Price Global Technology PRGTX. The fund has the flexibility to invest outside of its benchmark, the MSCI ACWI/Information Technology Index, which is an advantage according to director Katie Rushkewicz Reichart. In her June 2021 report, she notes that the strategy has benefitted from T. Rowe’s impressive analytical resources in tech-related communications and consumer discretionary companies, such as Amazon.com AMZN.

BlackRock Technology Opportunities BTEKX, which earns ratings of Gold or Silver depending on the share class, is another strong choice. Lead manager Tony Kim has been analyzing tech firms for over two decades and has led the fund since 2013. Associate director Tom Nations observes that “in a sector that rapidly produces new, dominant players, few investors have the skill, experience, and system that Kim does to identify the underlying shifts.”

NextGen Trend and Defend ETF TRDF

NextGen ETFs bills its first offering as “the first active long-short S&P 500 ETF.” NextGen Trend and Defend ETF TRDF invests in other ETFs, and at any given time has just one holding: Vanguard S&P 500 ETF VOO, Direxion Daily S&P 500 Bear 1X ETF SPDN, or SPDR Bloomberg 1-3 Month T-Bill ETF BIL. A “rules-based, quantitative methodology” signals whether the fund should track the S&P 500, rotate into an ETF that provides the daily inverse return of the S&P 500, or retreat into cash. The fund has switched positions four times since its Jan. 5, 2022, inception.

Market-timing, especially between options with extremely different return profiles, is very challenging, says analyst Bobby Blue: “If they mistime a regime, there’s potential for the strategy to be wildly out of step with the rest of the market.” Another concern is its 1% expense ratio on top of the fees charged by the underlying ETFs, which is a high hurdle. Long-term investors will rightly question whether this strategy might enhance their portfolio.

The list below includes all ETFs launched in January and February.

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)