18 Top Dividend-Stock Funds for 2022

These mutual funds and ETFs pursue various dividend strategies and earn Morningstar Analyst Ratings of Silver or Gold.

Dividend-paying stocks are the Tom Hanks of investing: Everyone seems to like them.

Many retirees rely (at least in part) on the regular income that dividend stocks throw off. Nonretirees, meanwhile, enjoy "getting paid to wait"--or the idea of collecting quarterly income from stocks while holding on for stock price appreciation. Historically, dividends have been a key component of total returns, though that impact has been muted during the past several years as low- and no-dividend-growth stocks have driven a large portion of market return.

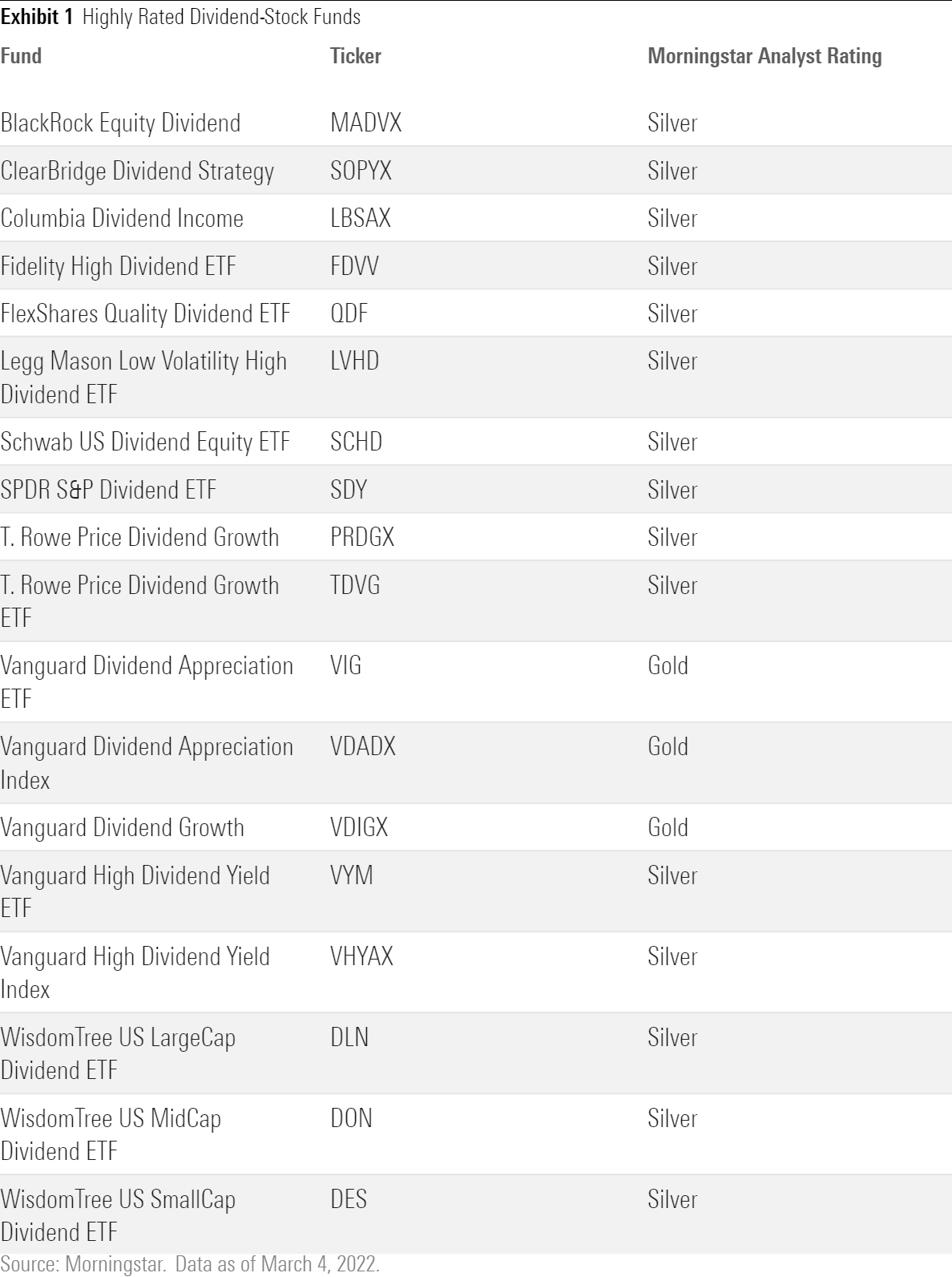

There are many fine dividend-focused mutual funds and exchange-traded funds to choose from. Exhibit 1 below features 18 funds that focus on U.S. dividend-paying stocks and that have at least one share class that earns a Morningstar Analyst Rating of Silver or better. (We expect such highly rated funds to outperform over a full market cycle.)

- source: Morningstar Analysts

Not all dividend funds are alike. Most of the funds on this list pursue one of two approaches to dividend-paying stocks.

The first group favors what Morningstar's global director of passive strategies research Ben Johnson has called "yielders"--stocks whose yields are high in absolute terms. Such companies are usually more mature businesses that choose to pay out profits rather than reinvest them. You'll find these yielders largely in the financials, energy, utilities, and industrials sectors. Such stocks come with tantalizing yields but carry some risk. For starters, yielders in economically sensitive sectors may be vulnerable during an economic slowdown. Moreover, yielders face some interest-rate risk: When rates trend up, investors may swap high-income-producing stocks, especially in sectors like REITs and utilities, for bonds.

The second group of funds focuses on what Johnson calls the "growers"--companies that have increased their dividends over time. Growers typically don't boast burly yields like yielders do, though they have their advantages. Notably, companies that regularly boost their dividends are usually profitable and financially healthy. As such, these companies generally show some resilience during market downturns. Further, dividend-growth stocks can provide some inflation protection. "Income-focused investors receive a little 'raise' when a company increases its dividend," reminds Morningstar's director of personal finance Christine Benz.

Deep dive: What's the Difference Between Dividend Yield and Dividend Growth Stocks?

Of course, neither dividend-oriented strategy excels in every market climate. "Overall, though, they tend to hold up a bit better than average during times of market turbulence and have generated attractive risk-adjusted returns over longer periods," notes Morningstar portfolio strategist Amy Arnott.

Start your free 14-day trial of Morningstar Premium. Rely on the gold standard for mutual fund and ETF research. Unlock our analysts’ ratings to see which funds we think will outperform.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)